Search Knowledge Base by Keyword

The Spinning Top Candlestick Pattern

TL;DR: Spinning Top Guide

The Spinning Top is a candlestick with a small body and long shadows, signaling a stalemate between buyers and sellers. It highlights market indecision and often precedes a price reversal or a volatile breakout.

-

Spotting the Pattern: Use altFINS’ Crypto Screener to instantly find Spinning Tops across 3,000+ altcoins using their Pre-set or Custom Filters.

-

Trading Strategy: Don’t trade it alone. Look for confluence with support/resistance levels and wait for the next candle to confirm the new direction.

-

Key Tip: Use altFINS to filter by volume and timeframe to ensure the indecision is happening on a significant scale.

Detailed Characteristics of the Spinning Top Pattern

The Spinning Top candlestick pattern is a crucial indicator in technical analysis, signaling indecision in the market. This pattern, characterized by its small body situated between long upper and lower shadows, suggests that neither buyers nor sellers could gain the upper hand during the trading session. This comprehensive guide delves into the Spinning Top, offering advanced strategies for its application in various trading scenarios.

Understanding the Spinning Top

A Spinning Top is identified by its short body, which appears between long shadows. This structure indicates a balanced conflict between buyers and sellers, with the price moving above and below the opening level but closing near it, reflecting uncertainty.

Spinning Top Candlestick Patterns on altFINS

altFINS crypto screener allows traders to create custom filters based on Candlestick patterns. These patterns include 1-Candle Patterns, 2-Candle Patterns, and patterns involving 3 or more candles.

To access Candlestick patterns on altFINS, go to:

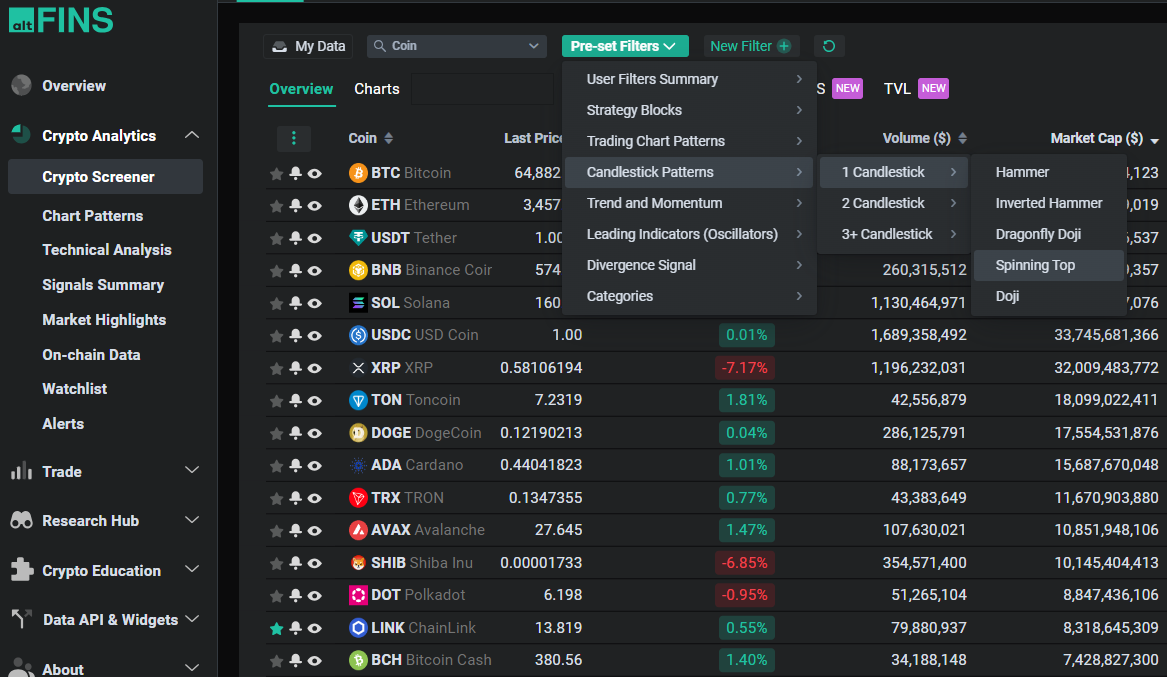

Crypto Screener – Preset Filters

altFINS provides a leading cryptocurrency screening tool capable of analyzing over 3,000 altcoins using 120 different indicators across five time frames. It includes Pre-set Filters, which are predefined and optimized strategies and patterns designed for quick access to the most popular filters, such as the Spinning Top Candlesticks pattern.

Crypto Screener Pre-set Filters

Select Pre-set Filters – Candlestick Patterns – 1 Candlestick – Spinning Top and you will get the results:

Source: altFINS

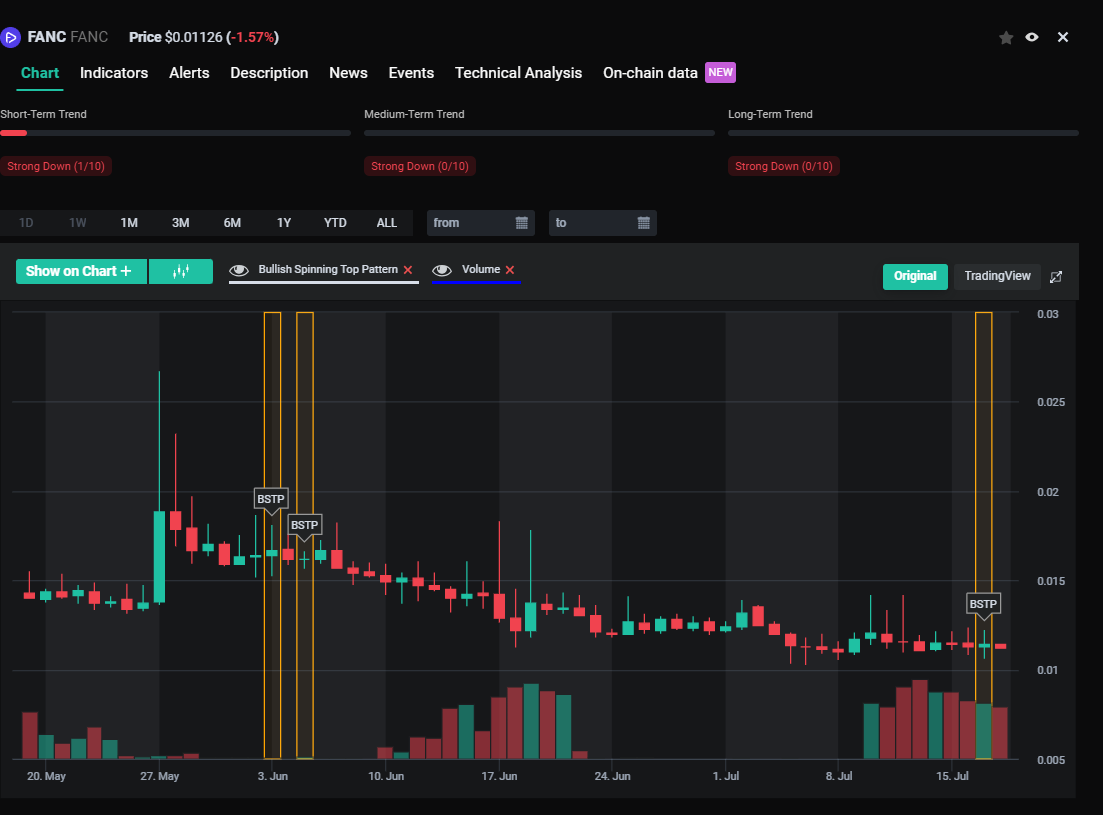

Examples: Spinning Top Candlestick Pattern in Charts

Source: altFINS

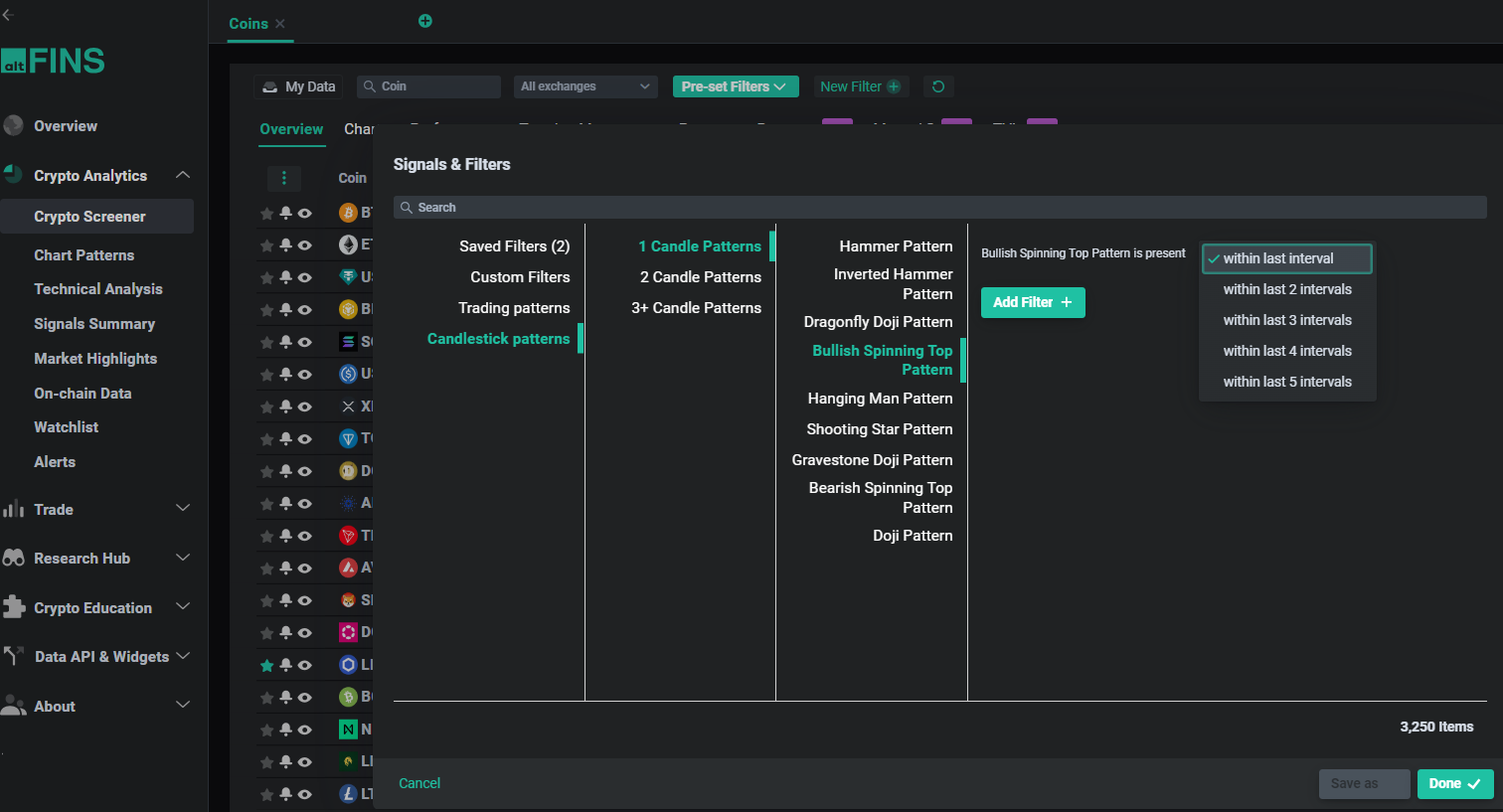

Crypto Screener Custom Filters

Select New Filter- Candlestick Patterns – 1 Candlestick – Spinning Top and select interval.

Source: altFINS

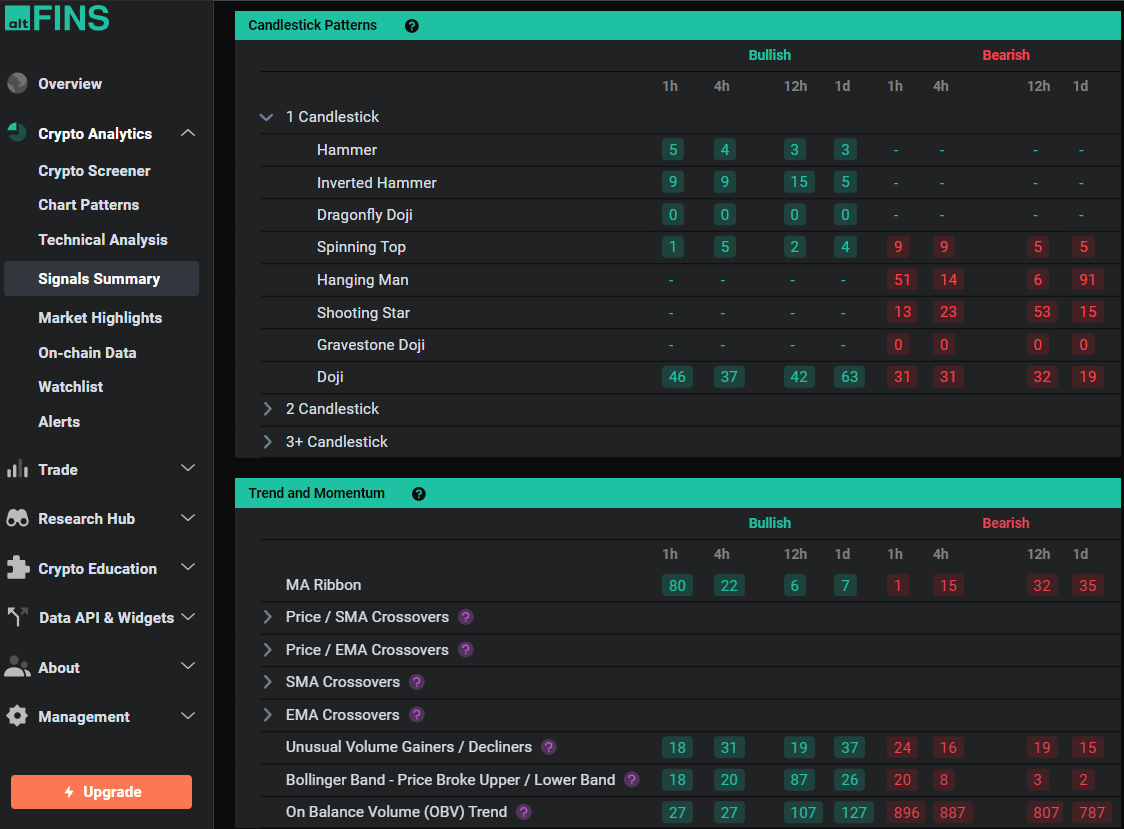

Signals Summary Custom Filters

Source: altFINS

Variations and Similar Patterns

- Doji: A pattern that also indicates market indecision but with an even tighter convergence of opening and closing prices.

- High Wave Candle: Similar to the Spinning Top but with even longer shadows, suggesting greater volatility and indecision.

Recognizing these variations helps traders discern subtle shifts in market sentiment and adjust their strategies to better anticipate potential moves.

Advanced Trading Strategies

Combining with Support and Resistance Levels

When a Spinning Top forms at a key support or resistance level, it can signal a potential reversal or continuation pattern, depending on subsequent price action. This integration of patterns and price levels enhances the predictive reliability.

Using with Trend Lines

A Spinning Top appearing near a trend line, especially one that has been tested multiple times, might indicate a forthcoming breakout or rejection. Confirmation would typically involve a subsequent candle closing clearly above or below the trend line.

Tips and Tricks for Effective Use

Wait for Confirmation

Acting on a Spinning Top without further confirmation can lead to premature and risky decisions. Observing subsequent candles for a decisive move in either direction can help validate the initial signal provided by the Spinning Top.

Check the Historical Context

Analyzing how Spinning Tops have influenced the price action of an asset in the past can offer insights into how similar setups might unfold in the future.

Monitor Market Sentiment

Overall market sentiment and macroeconomic factors should be considered as they can influence the effectiveness of patterns like the Spinning Top.

Use Technical Indicators for Confirmation

- Volume Analysis: Significant volume during or after a Spinning Top can indicate the strength of the upcoming move.

- Moving Averages: A Spinning Top near important moving averages may act as a pivot point, suggesting potential support or resistance.

Psychological Insights

The Spinning Top represents a tug-of-war where neither side gains ground, reflecting market indecision. This can often precede significant shifts in market direction as traders reassess their positions and the market consensus evolves.

Risk Management

Adopting robust risk management strategies is crucial when trading based on the Spinning Top:

- Proper Position Sizing: Based on the asset’s volatility and distance to your stop-loss, adjust your position size accordingly.

- Dynamic Stop-Loss Adjustment: Modify your stop-loss strategy in response to new market information to protect gains or limit losses.

Practical Examples

Presenting historical chart data with Spinning Top patterns can elucidate both successful and less effective trading scenarios. These real-world examples help traders recognize when a Spinning Top might lead to a profitable trade and when it might not.

Conclusion

The Spinning Top candlestick pattern is a valuable tool for gauging market sentiment and impending volatility. By applying advanced strategies, considering the broader market context, and implementing effective risk management, traders can significantly enhance their trading performance. This pattern, when interpreted correctly and used in conjunction with other analysis techniques, forms a vital part of a sophisticated trading strategy.

Read also an article:

Mastering Candlestick Patterns for Successful Crypto Trading

Essential Candlestick Patterns for Crypto Traders

The Dragonfly Doji Candlestick Pattern

The Hammer Candlestick Pattern

The Inverted Hammer Candlestick Pattern

The Hammer Candlestick Pattern

The Gravestone and Perfect Gravestone Doji Candlestick Patterns

Bullish Engulfing Candlestick Pattern

The Hanging Man Candlestick Pattern

What is Candlestick Pattern (source: Investopedia)