Search Knowledge Base by Keyword

Oversold in Uptrend

TL;DR: Buying the Dip in an Uptrend

The “Oversold in Uptrend” strategy identifies high-quality assets that are temporarily “on sale” due to short-term profit-taking, even though their primary direction remains bullish.

The Winning Formula

-

Trend: Ensure the asset is in a Medium/Long-term Uptrend.

-

Momentum: Look for an RSI < 40 (Oversold).

-

Location: Price should be near a Key Support Level.

-

Risk Management: Aim for at least a 2:1 Reward-to-Risk Ratio (RRR).

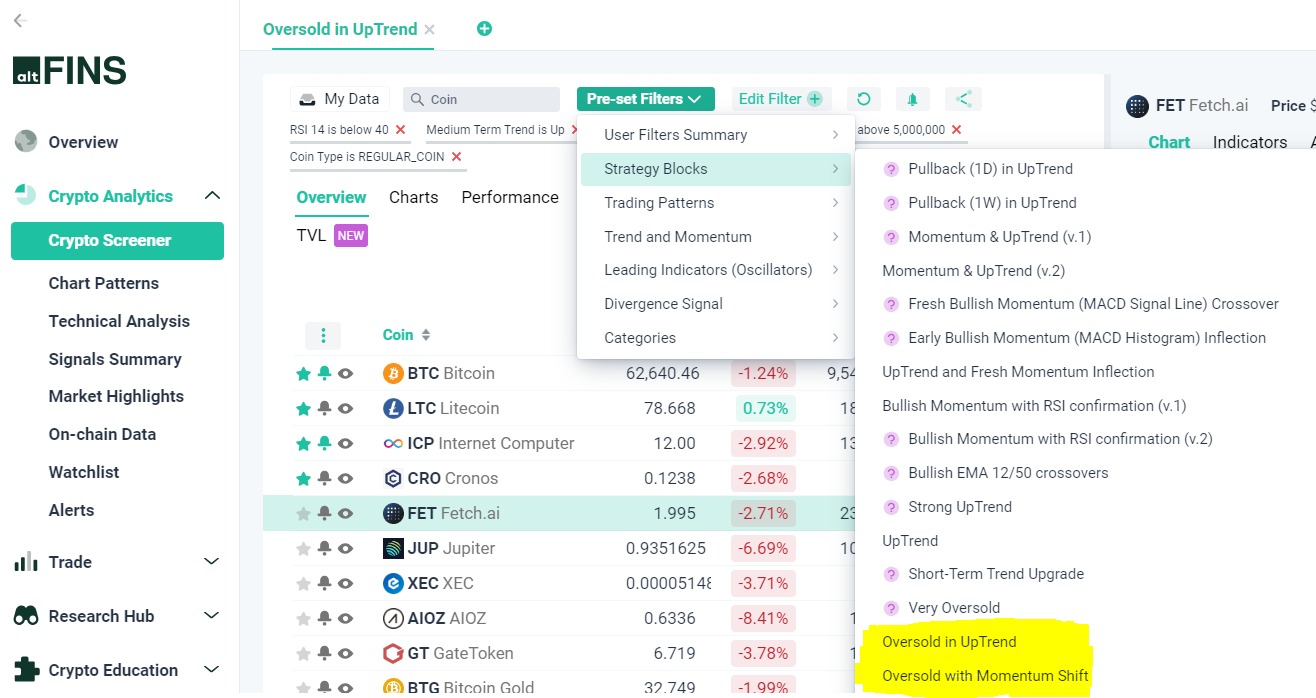

How to Execute on altFINS

-

Step 1: Use the “Oversold in Uptrend” pre-set filter in the Crypto Screener.

-

Step 2: Confirm the RSI and trend rating.

-

Step 3: Identify the nearest resistance (Take Profit) and prior swing low (Stop Loss).

-

Step 4: Set an alert to be notified of fresh pullbacks.

Why it works: It filters out high-risk “falling knives” by ensuring you only buy coins that have a proven upward bias, significantly increasing the probability of a price bounce.

What “Oversold in Uptrend” Mean In Crypto Trading

An “oversold in uptrend” trading strategy involves identifying coins that are temporarily undervalued within an overall uptrend. The idea is to find opportunities to buy when the asset is considered oversold, meaning its price has dropped below its intrinsic value or below what is considered a reasonable level based on technical indicators.

Introduction

In fast-moving crypto markets, prices often swing sharply—even within a strong uptrend. These pullbacks can create some of the best swing trading opportunities, allowing traders to buy quality assets at temporarily discounted prices. One powerful way to spot such setups is the “Oversold in Uptrend” strategy, which combines trend analysis, support levels, and the Relative Strength Index (RSI).

An “oversold in uptrend” trading strategy involves identifying coins that are temporarily undervalued within an overall uptrend. The idea is to find opportunities to buy when the asset is considered oversold, meaning its price has dropped below its intrinsic value or below what is considered a reasonable level based on technical indicators.

In this Trading Video, our CEO and Founder, Richard Fetyko, demonstrates how to find swing trading opportunities in the current market.

Why the Strategy Works

Even strong uptrends experience pullbacks as traders take profits. These dips often push the asset into oversold conditions, while the overall trend remains intact. By focusing on:

-

Trend direction (asset is still trending up),

-

Momentum (RSI < 40), and

-

Support levels (price near prior lows),

…traders can find situations where the downside is limited but the upside potential is attractive.

Check live results for “Oversold in Uptrend” market filter here.

We teach this strategy in Lesson 5 of our new Trading Education Course. It covers 7 trading strategies, risk management and Short Selling.

Here are the video contents:

0:00 Run a Pre-set market filter “Oversold in Uptrend”

2:50 BTC analysis

4:50 LTC analysis

7:00 ICP analysis

9:00 CRO analysis

10:00 FET analysis

Example, Trade Setup: FET (Fetch.ai)

Trade setup: price is in an uptrend on Medium- and Long-term basis. It’s pulled back to $2.00 support and is oversold (RSI < 40).

- Stop Loss (SL) level at $1.55, just below prior swing low.

- Take Profit level at $3.00 (nearest resistance). That also gives us a healthy 2:1 Reward-Risk-Ratio (RRR) of $1.00 (profit) vs. $0.50 (loss).

We teach how to set proper Stop Loss (SL) levels and calculate RRR in our new Crypto Trading Course.

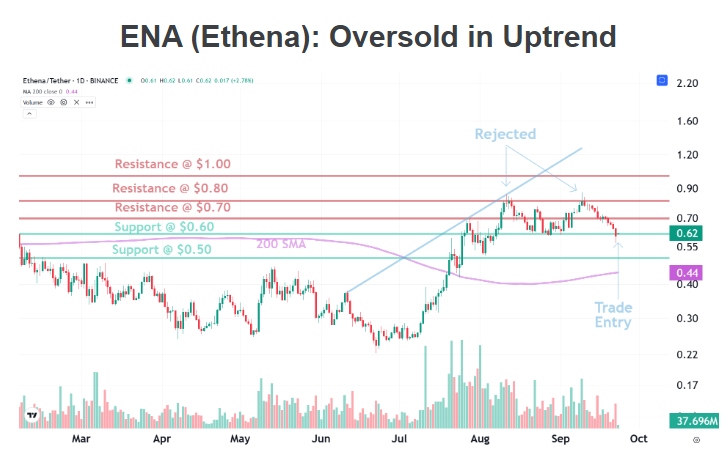

Trade Setup: ENA (Ethena)

Above is an example asset that fits the Oversold in Uptrend strategy: ENA (Ethena).

- It’s in an Uptrend, oversold (RSI < 40) and near $0.60 support.

- Solid entry point with +15% potential upside to $0.70 or higher.

- Stop Loss at $0.55 for a 2:1 Reward-Risk-Ratio (RRR).

Btw we also highlighted ENA in a recent report Top 5 coins with DAT buying pressure.

Step-by-Step Guide

-

Step 1: Open the Crypto Screener → choose “Oversold in Uptrend” filter

-

Step 2: Confirm the coin is in a Medium- and Long-term uptrend

-

Step 3: Check RSI level (<40)

-

Step 4: Verify price is near a key support level

-

Step 5: Plan trade → set Stop Loss and Take Profit with Reward-to-Risk Ratio

Where to Find This Strategy on altFINS?

1. Crypto Screener: Oversold in Uptrend

2. You can find swing trading opportunities in our Technical Analysis section (trade setups)

On the Screener, you find such trading opportunities by using our pre-set market scans:

Simply follow these links. You can even create alerts for them! (follow the link and click on alert icon)

1. Oversold and Uptrend (see results)

2. Coins in Uptrend and Fresh Bullish Momentum Inflection (see results)

3. Oversold and Momentum Shift (see results)

Why the Strategy Works

-

Market psychology: profit-taking causes dips even in strong uptrends

-

Oversold signals (RSI < 40) can highlight short-term undervaluation

-

Combining technicals (trend + support + RSI) increases probability of success

Frequently Asked Questions (FAQ)

What does “oversold” mean in crypto trading?

“Oversold” describes a condition where an asset’s price has fallen too far, too fast, making it undervalued in the short term. Traders often use the Relative Strength Index (RSI) to spot this — values below 40 (or sometimes 30) suggest the asset could be oversold and due for a rebound.

How do you confirm that a coin is in an uptrend?

An uptrend is confirmed when the price makes higher highs and higher lows over time. On altFINS, you can check Medium- and Long-term trend indicators in the Screener to quickly confirm whether an asset is trending up.

Why combine “oversold” with “uptrend”?

Oversold signals alone can be misleading in a downtrend, where prices keep falling. By requiring the coin to also be in an uptrend, traders increase the odds that the pullback is temporary and the asset will bounce back.

What is a good Reward-to-Risk Ratio (RRR)?

Many traders look for setups with at least a 2:1 ratio — meaning the potential profit is twice the possible loss. For example, risking $0.50 per coin for the chance to make $1.00 gives an RRR of 2:1.

How reliable is RSI in crypto trading?

RSI is one of the most popular momentum indicators, but it works best when combined with trend direction and support/resistance levels. On its own, RSI can give false signals, especially in highly volatile crypto markets.

Where can I find oversold-in-uptrend coins?

You can use the altFINS Crypto Screener with the pre-set filter “Oversold in Uptrend”. You can also set alerts, so the platform notifies you whenever new trade opportunities appear.