Search Knowledge Base by Keyword

Using Local High to Spot Breakouts

TL;DR – What’s a Breakout?

A breakout happens when price breaks above a key resistance level, showing strong buying interest. Once sellers are exhausted, buyers push price higher, often quickly. Breakouts work best in uptrending, bullish markets, but they can fail, so risk management matters.

What’s a Breakout?

Breakouts happen when price breaks through a certain resistance area.

It signals that traders and investors are eager to own this asset. Once they have bought up all the supply from sellers, these buyers eventually push the price beyond that resistance area.

And when that happens, price can often move rapidly higher.

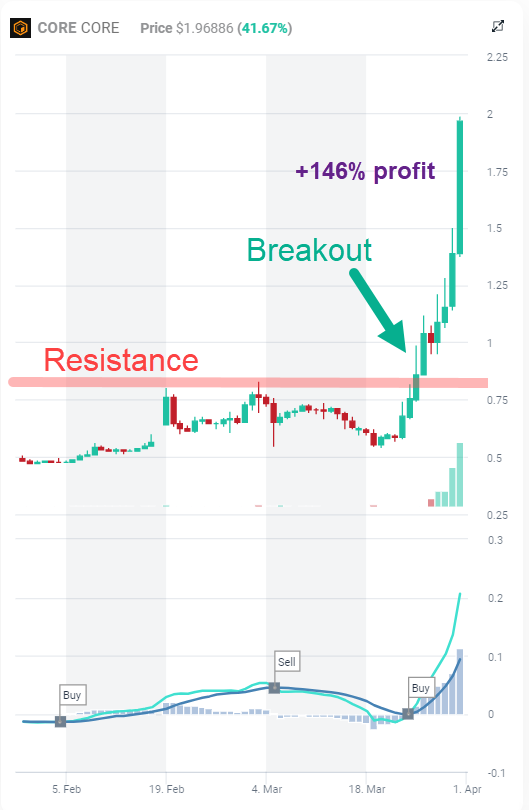

CORE Example

Here’s an example. CORE price got rejected two times around $0.80 where sellers showed up and overwhelmed buyers. Until a week ago when price finally broke above that $0.80 level and quickly gained +146%.

Breakouts don’t always work. There are often failed breakouts when price breaks through a resistance but then pulls back.

However, the current phase of the market cycle is conducive to breakouts because market is in an Uptrend and sentiment is clearly bullish.

Learn How to Trade Key Level Breakouts

We teach trading key level breakouts in our new Crypto Trading Course, which includes 10 lessons, 40 videos, 7 trading strategies, notes, quizzes and risk management techniques to get you to generate consistent trading profits.

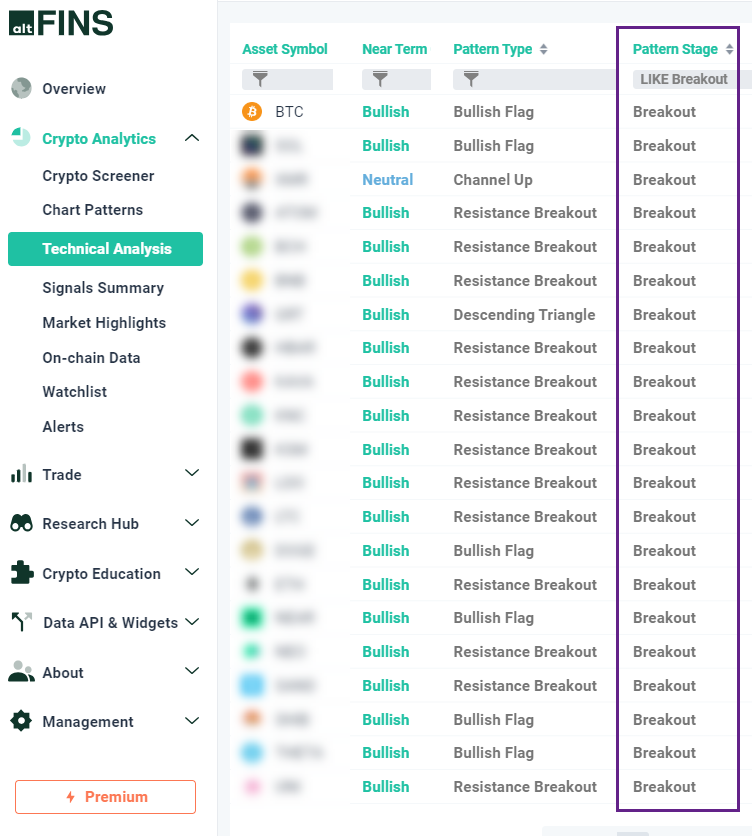

You can find breakouts in our Technical Analysis and automated AI-based Chart Pattern sections.

You can also find breakouts by scanning for assets hitting new local highs (see live results here).

After you run that market scan, look for assets that are just breaking above their prior highs (hence making new local highs).

ETHW Example

Like this one: ETHW. Notice how price reached $5 in early March and pulled back. It got rejected. Traders took profits and sold their positions. Now price is back to that level and breaking above it.

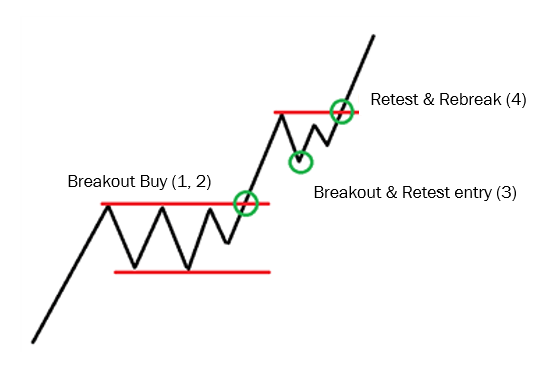

With breakouts, there are several trade entry options (see chart below).

The following four are possible techniques, in the order of risk and reward:

- Intraday breakout.

- Closing candle breakout.

- Breakout and Retest.

- Retest and Rebreak method.

Combination of these trade entry options and gradually scale into their trade position.

This last method offers a good compromise between risk and reward. It also helps with trader psychology because it reduces the fear of missing out.

We teach these four methods in our new Crypto Trading Course available to Annual and Lifetime members.

Trade Setups: Breakouts

FAQ — Breakout Trading

What is resistance?

A resistance level is a price area where selling pressure previously stopped price from moving higher.

Why do breakouts move fast?

Once resistance is broken, there’s less selling supply and more buyers chasing the move.

Do breakouts always work?

No. False/failed breakouts happen when price breaks resistance but quickly falls back below it.

When are breakouts more reliable?

During market uptrends with bullish sentiment.

How can I find breakout opportunities?

- Assets breaking key resistance levels

- Coins hitting new local highs

- Using technical scans or AI-based chart pattern tools

What are common breakout entry methods?

From higher to lower risk:

- Intraday breakout

- Closing candle breakout

- Breakout and retest

- Retest and rebreak (balanced risk/reward, helps reduce FOMO)

What’s the best beginner approach?

The retest and rebreak method or scaling into a position using multiple entry techniques.

Is breakout trading taught in your course?

Yes – our Crypto Trading Course – Lesson Trading ranges – covers key level breakouts, entry methods, strategies, and risk management.