Search Knowledge Base by Keyword

When Is The Best Time To Buy And Sell Cryptocurrency?

How to know when is the right time to buy and sell crypto? There are individuals who claim they know the market, are brave enough and buy or sell cryptocurrency when they think the time is right. Despite the fact that most people think HODLING is the ideal strategy for investing in the cryptocurrency market. But how can you decide when to actively buy and sell cryptocurrency when you are new to the market?

Crypto market is highly volatile, no doubt about that. It is new and rapidly growing market. It’s not like the traditional stock market, where, if you make an investment in a solid company, your portfolio is likely to grow over time. The stock market may experience brief ups and downs. But a good company with strong fundamentals survives and has a tendency to rise over long periods of time (years).

The case with cryptocurrency is different. With a new asset class that is still in its infancy, it’s more difficult to make such statements. The price of cryptocurrency may decrease significantly over the course of a few hours or days. The opposite is also true, where we can see the price of the same cryptocurrency to double in value in the same amount of time. This kind of volatile environment makes investing and actively buying and selling cryptocurrency a challenge for less experienced investors.

What To Consider Before Even Buying Cryptocurrency?

First, let’s look at what is important before you start buying cryptocurrency. It’s simple to get carried away by the excitement surrounding a well-known cryptocurrency or a particular crypto project. Analyze your cryptocurrency investment by using technical and fundamental analysis.

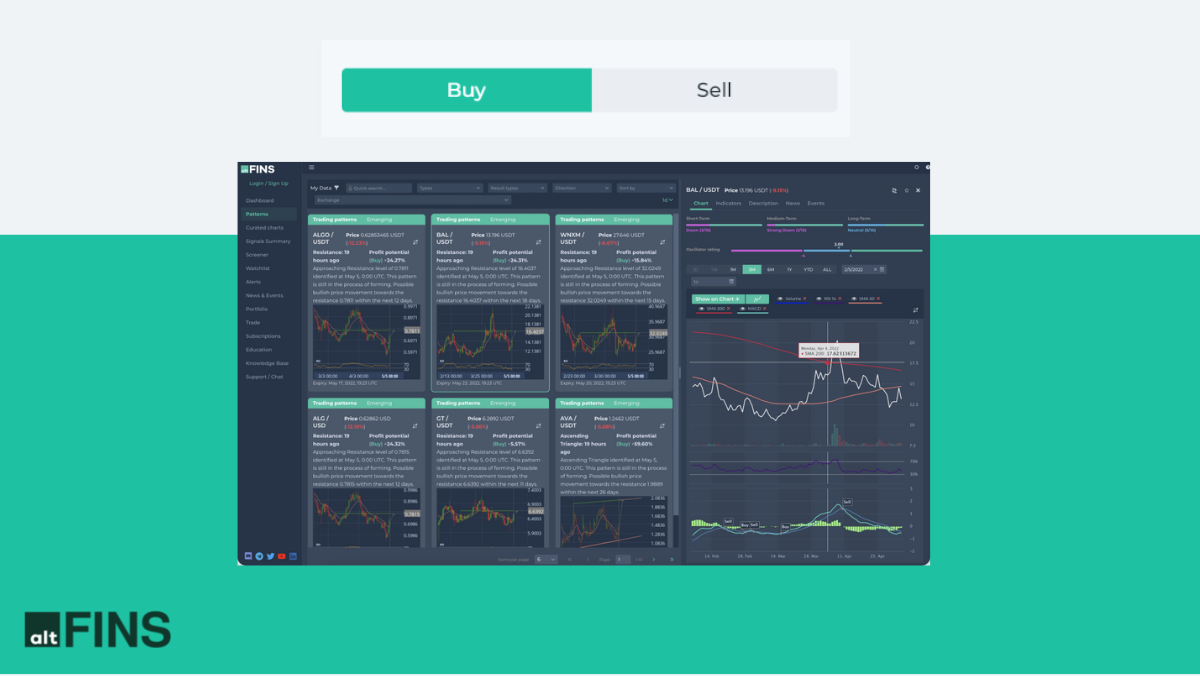

The latter can give you a better idea and a reasonable fundamental justification. Of why you are buying cryptocurrency of your choice, while the former will allow you to judge the best timing of your buy execution. In addition, do not forget about the global picture and look at the markets from the macroeconomic point of view. You can use tools offered by altFINS to help you with technical and fundamental analysis.

Next, how much money will you put in? It’s a mistake to invest your entire life savings on cryptocurrencies. Or any other single investment. Having no more than 10% of your investing portfolio in the crypto market is a reasonable rule of thumb. And within that allocation, you should diversify your risk by making many small trades or investments into cryptocurrencies. Good diversification starts around 20-30 different coins in the portfolio.

What To Consider Before Selling Cryptocurrency?

Before you get your cryptocurrency, consider when you want to exit and what would be the implications of your exit. Will you sell the entire position, or will you exit partially?

Even if your investment value has improved, you don’t have to sell it completely. If you still believe that the cryptocurrency will be successful in the future. You could sell only a portion of your holdings and keep the remainder.

Consider reading our article on how to take profits. What effect does selling your cryptocurrency have on taxes? You must pay cryptocurrency capital gain taxes if the value of your cryptocurrency has increased. If you held the cryptocurrency for longer than 1 year, it is taxed as long-term profits compared to short-term gains. Which are taxed as ordinary income.

The instances in which you might desire to buy and sell cryptocurrency are covered in the sections that follow. However, it is highly recommended that you always conduct your own research and use caution when buying and selling cryptocurrency as your capital is at risk. And you may lose your invested capital.

Setting Purchase target – Buy Point

How To Know When To Buy Cryptocurrency?

First, look at the global macroeconomic picture, does it make sense to buy now? Is cryptocurrency affected by major macroeconomic events. If yes, how much affected it is? Is crypto market in an uptrend? These questions are crucial to answer before you even consider investing your capital into risky assets, such as cryptocurrency.

You should also note that markets tend to be always a step ahead of what the macroeconomic indicators point to. They typically follow various forecasts and if a particular forecast does not hold, markets immediately reprice to reality. Analysing the macro picture of global markets will be the first step to identify when to buy cryptocurrency.

Furthermore, when buying cryptocurrency make sure you understand what it is. Learn about the technology behind the cryptocurrency . You can study the project’s fundamentals. Its website and white paper. If a particular project does not have a white paper, it should to be a major red flag and such project may be not trustworthy at all.

Why Is Fundamental Analysis Important?

The fundamental analysis of cryptocurrency projects is the best way to understand the project thoroughly. It gives you an idea about the cryptocurrency adoption and its tokenomics, which includes information about the coin’s supply restrictions and how it will be divided among management team, investors and other coin holders. It also contains information on coin burning as well as fresh coin creation.

For some projects (DeFi, L1, L2, DEX), altFINS also tracks their revenues and Total Value Locked (TVL), which can be great indicators of user adoption and value creation to token holders.

A good fundamental analysis also scrutinizes the project’s team, investors, and project’s partnerships, which are vital for a credible and reputed functioning of project’s business model. It also includes various market metrics like market capitalization, trading volume, supply metrics. The number that is currently being traded or kept in a wallet is known as the circulating supply. This statistic can be used to determine a coin’s prospective scarcity, which can have a positive and negative impact on its price. You can make wise purchasing judgments if you are aware of the differences between maximum, circulating, and total supplies.

For examples of quality fundamental analysis, read altFINS’ Research reports on some major and some less know crypto projects.

Finally, every cryptocurrency projects have its own specific risks and challenges. As well as growth prospects. Study those and determine whether the cryptocurrency has future and whether it has a utility. Because not every cryptocurrency has a useful function.

Look for coins in the blockchain ecosystem that have practical uses. For example, Ethereum (ETH) know that many smart contracts, DeFi platforms, NFT initiatives, and businesses depend on it to function. This value should endure and accurate to token holders over time. On the other hand, some meme digital currencies, like Bitcoin (BTC),Shiba (SHIB) have no utility whatsoever are simply pure speculative coins for traders.

Why To Use altFINS Platform?

You may access both fundamental and technical analysis of various cryptocurrencies on altFINS platform. The platform screens projects and looks at projects’ market metrics, tokenomics, token adoption, market size, risks and challenges, growth prospects, team, investors, as well as competitor landscape.

altFINS seeks to bring efficiency into the investment process in the digital assets space by covering the entire workflow from 1) pre-trade analysis (investment idea generation, technical indicators, fundamental data, screening, charting, alerts, news, research), to 2) trade execution across exchanges, and 3) post-trade analysis (asset tracking, P&L, NAV, risk analysis). In addition, altFINS also offers investors and novice traders trading courses, available for all subscribers that have a strong desire to learn technical analysis and trading strategies for cryptocurrencies.

Setting Sale target – Sell Point

So, now that you know when to buy cryptocurrency, how to know when to sell your cryptocurrency?

Start by setting a reasonable target, a point where you say it’s enough and you exit the investment by selling your cryptocurrency. Say, the asset has doubled in value since its purchase price. Then this may also be a good time to sell your cryptocurrency. Remember, a professional trader could desire to take advantage of price increase even though the cryptocurrency may very well continue to rise with excellent growth and development forecasts.

So, that choice is ultimately up to you, but it may be a wise choice to sell your cryptocurrency if you wish to reinvest your capital somewhere else, or just simply to cash out. Otherwise, if you believe the cryptocurrency or a crypto project in which you invested has solid foundations, you may just keep your position for a long-term investment horizon.

Crypto market is at most of the times somewhat correlated with traditional stock market and value of your cryptocurrency may be therefore affected by major macroeconomic events. You may occasionally notice a run of unfavorable macro news about central banks and their monetary policy decision, followed by a collapse in the value the entire crypto market.

Maintaining an eye on the market’s macro pulse is crucial since doing so can help you predict the direction the entire crypto market will take. You may follow major market highlights on altFINS platform where we publish a weekly summary of macro highlights for your convenience to keep you up to date.

In What Cases You Should Not Buy Or Sell Cryptocurrency?

Less experienced investors traders sometimes fall victim to emotional trading. In which decisions about whether to purchase and sell are influenced by emotions like fear or enthusiasm. Investors may handle their investments ineffectively as a result of these and can exit too early or too late.

You should not get distracted when there is a panic selling and sell all your invested assets as it may end up in price getting back. Likewise, beginner investors sometimes over bet due to fear of missing out (FOMO) and buy when price is already too high.

10 Tips On What To Look Out For When Buying and Selling Crypto:

- Make your own research and learn what fundamental and technical analysis is.

- Plan your market entry and exit points from the macroeconomic point of view.

- Use professional platforms like altFINS to screen the market for top coins. Learn about them by accessing their fundamental and technical analysis.

- Set your specific purchase and sale targets when to buy and sell the selected cryptocurrency.

- Only invest capital that you can afford to lose.

- Diversify your capital – make sure you don’t invest all your investment capital into 1 asset.

- Make sure you understand the risks associated with cryptocurrency market. Always verify that your investment it’s not a scam or misinformation.

- Choose verified and well-known crypto brokers or exchanges to execute your trades.

- Always keep your wallet credentials safe, preferably use Cold Digital Wallet.

- Beware of emotional trading mistakes and avoid FOMO – fear of missing out.

FAQ