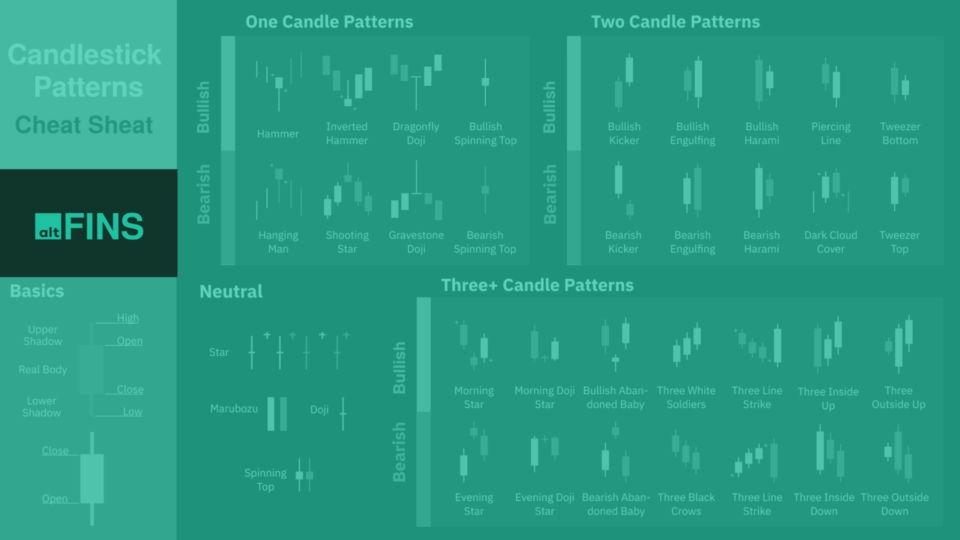

Candlestick Patterns Now Available on Crypto Screener Preset Filters and Signals Summary!

We are excited to announce a significant enhancement to our altFINS platform: Candlestick patterns are now accessible in the Crypto Screener Preset Filters and Signals Summary! What Are Candlestick Patterns? Candlestick patterns serve as visual representations of price movements...

Read moreEducation Bundle plan is live!

Take advantage of a newly launched Education Bundle plan which grants you access to our new Crypto Trading Course, Premium Plan, and VIP Telegram channel. Why you should get access to Education Bundle 1. VIP Telegram channel: gain trade...

Read moreCoin Picks Portfolio

Dear Investors, We are pleased to provide you with the latest update on the performance of our Coin Picks portfolio as of June 24th, 2024. The calculation of the portfolio performance assumes hypothetical investments of $1000 in each project...

Read moreCrypto News and Events Integration on Charts

📢 Exciting News for Our Registered Users! 🎉 We’re thrilled to introduce a new feature to enhance your trading experience: Crypto News and Events Integration directly on your charts! 📈 Now, you can seamlessly correlate price movements with relevant...

Read moreIntroducing Watchlist and Portfolio Alerts

📣 Exciting News from altFINS: Introducing Enhanced Alert Functionality! We’re thrilled to announce a game-changing feature on altFINS: Watchlist and Portfolio Alerts! Now, traders can experience a new level of customized alerts tailored precisely to their watchlist or portfolio...

Read moreNew Crypto Trading Course Is Live!

We’re absolutely thrilled to share some fantastic news – our brand new Crypto Trading Course is officially live! 🌟 It’s been quite the journey, but after pouring our hearts and knowledge into it, we’re confident it’s going to be...

Read moreTrade & Earn Program Is Officially Launched!

Trade and Earn: Starting today, you can turn every trade on altfINS DEX into opportunity to unlock Premium membership. For every $400 in trading volume, you’ll get a whole day of Premium access. Yep, you heard it right! By...

Read moreBitcoin Fees Hit 20-Month High

Over the last few days Bitcoin fees hit 20-month high as miners’ revenues match almost $70k BTC price because of another spike in Ordinals inscriptions. This is good for miners but bad for end users as they pay too...

Read more🤑 Huge Coin Breakouts

Massive Breakouts…Are You In? Strike While The Market is HOT! Crypto market is in an Uptrend again and our trade setups have captured some massive breakouts! These are times when traders make most of their profits for the year…in...

Read moreChart Pattern Alerts Are Now Available on altFINS!

We are thrilled to announce the launch of our latest feature, Alerts on Chart Patterns! Now, you can stay informed and seize opportunities with ease as you receive timely notifications whenever new chart patterns are identified. Read this step-by-step...

Read morealtFINS Black Friday Special Offer

altFINS is offering impressive discounts of up to 63% on annual and lifetime plans! Let’s take a closer look at the details and find out how you can take advantage of this special offer! Get 60% off on altFINS...

Read moreMassive Breakouts…Are You In?

Crypto market is in an Uptrend again and our trade setups have captured some massive breakouts! These are times when traders make most of their profits for the year…in uptrends. Strike while the iron market is hot! Breakouts happen...

Read more10 Tips for Maximizing Your Profits with altFINS Crypto Screener

Hey there, fellow crypto traders! If you’re looking for an edge in the cryptocurrency trading, we’ve got a tool you need to know about – the altFINS Crypto Screener. In this article, we’ll break down why you should give...

Read more📢 Introducing Data API & Widgets on altFINS! 🚀

We’re thrilled to announce the addition of a NEW section called Data API & Widgets to our platform. Let’s dive into the details! Analytical Data API: Your All-In-One Market Data Solution altFINS’ Analytical Data API service is a game-changer...

Read moreTechnical Analysis: A Powerful Tool for Traders

Use Technical Analysis. It works! First and foremost, it’s important to clarify that Technical Analysis is not a mystical practice or a crystal ball that predicts the future. It’s a systematic approach to analyzing crypto markets, grounded in the...

Read moreCrypto Market Review Week 43 – 2023: Cryptocurrency vs. Traditional Markets

Cryptocurrencies continue to captivate the financial world, with Bitcoin (BTC) and Ether (ETH) taking center stage. BTC was trading at around $34,345 on Monday, marking an impressive 14.4% increase compared to the previous week. ETH saw a robust surge,...

Read moreAre crypto markets overbougth? Due for a pullback?

Crypto markets have rallied hard! Are crypto markets overbought? Over-extended? Our trade setups have generated nice gains for our members, especially the top 10 trade setups we issued on Oct 15th (see here). That included winners like SOL +37%,...

Read moreSpooktacular Halloween Flash Sale! Get 50% Off Annual Plans

Halloween is creeping up, and we’ve got a wickedly good treat just for you. Introducing our “Spooktacular Halloween Flash Sale,” where you can save a terrifyingly fantastic 50% on our annual plans. 🎃 With altFINS, you won’t miss out...

Read moreAlert for the 200-Day Moving Average Breakout

Today, we’re diving into a trade setup for Helium (HNT) and exploring how to set up alerts for a price breakout above the 200-day moving average. But before we do that, let’s take a moment to celebrate some recent...

Read moreTop Coins to Watch in the Next Months

The cryptocurrency realm is a constantly evolving environment, presenting investors with exceptional prospects for remarkable gains. Within this multifaceted landscape, even seasoned investors may find it challenging to navigate. Despite the recent market downturn in the past year, fresh...

Read moreDay Trading vs. Swing Trading: What Is The Difference?

When it comes to trading in crypto markets, two popular strategies stand out: day trading and swing trading. These approaches vary significantly in terms of time frames, trading styles, and risk levels, making it essential for traders to understand...

Read moreMastering Support and Resistance for Trading Success

Understanding key concepts like Support and Resistance can be the difference between success and disappointment. These fundamental tools are essential for any trader looking to navigate the volatile crypto markets effectively. Watch this Tutorial Video and learn about Support...

Read moreCrypto Market Review Week 40 – 2023: Markets React to Job Data and Inflation Concerns

Welcome to our weekly macro review for the 40th week of 2023. The global financial markets witnessed significant developments. Bitcoin and Ether (ETH) continued to hold their ground as leading cryptocurrencies, outperforming traditional equity markets. The US job market...

Read moreTrading Strategy: Profiting from Pullbacks in Uptrends

In the world of cryptocurrency trading, seasoned traders know that catching a trend in its early stages can be challenging. That’s where the pullback in uptrend strategy comes into play. In this blog post, we will delve into this...

Read moreCrypto Market Review Week 39 – 2023: Fed’s Monetary Policy and ETF Expectations

Welcome to our weekly macro review for the 39th week of 2023. In this update, we’ll delve into the performance of key financial markets, the latest on inflation, and the cryptocurrency landscape. As the world continues to navigate economic...

Read more10 Promising Trade Setups

In this article, we’ll explore ten intriguing trade setups in the crypto market, along with their profit potential. These setups have been identified by Richard Fetyko, CEO of altFINS in his trading video. 10 Profitable Trading Opportunities Richard in...

Read moreCrypto Market Review Week 38 – 2023: Fed’s Monetary Policy and ETF Expectations

In this week’s macro review for Week 38 of 2023, we’ll delve into the performance of key assets like Bitcoin and Ether, the Federal Reserve’s monetary policy decisions, and the eagerly anticipated approval of Bitcoin ETF applications. Additionally, we’ll...

Read moreAltcoins Breaking Out!

Seizing Profitable Opportunities in Channel Down and Falling Wedge Patterns Recent market movements have brought exciting opportunities for traders as Bitcoin (BTC) surges and altcoins show signs of breaking out from their downtrends. This blog post will explore the...

Read moreRelative Strength Index (RSI) Indicator Explained

Cryptocurrency trading is a dynamic and high-stakes endeavor, and having a robust strategy is vital for success. Among the many tools available to traders, the Relative Strength Index (RSI) stands out as a versatile indicator. In this article, we...

Read moreCrypto Market Review: week 37 | CPI,Bitcoin ETFs, and Market Sentiment

Welcome to our weekly macro review of the crypto and financial markets, where we delve into the latest developments in the cryptocurrency space and traditional financial markets. Here’s a snapshot of what’s been happening in Week 37 of 2023....

Read moreBullish Breakouts: Channel Down and Falling Wedge Patterns

In the ever-evolving world of cryptocurrencies, where prices can swing dramatically in a matter of hours, it’s essential for traders and investors to stay ahead of the game. Cryptocurrency markets have recently witnessed a correction, with many altcoins experiencing...

Read moreHow To Trade Using Ultimate Oscillator (UO)?

In the fast-paced world of cryptocurrency trading, finding the right indicators can make all the difference. It’s used by traders identify overbought and oversold conditions. In this article, we’ll delve into how the Ultimate Oscillator works and how it...

Read moreHow Do Traders Use Candlestick Patters?

If you’re a crypto trader looking to level up your game, you’ve probably heard about candlestick patterns. These quirky-named patterns are not only fascinating but also incredibly valuable tools for traders. In this blog post, we’ll explore how candlestick...

Read moreThere Is Always a Bull Market Somewhere | Coins in Uptrend!

Coins in Uptrend It feels like forever since June’s big rally in crypto following a favorable legal ruling in SEC vs. Ripple case. Markets have given up most if not all of those gains and many coins are at...

Read moreNavigate Crypto’s Near-Term Opportunities

How to prepare for potential “white swan” events that could have a massive near-term positive impact on crypto valuations? On any given day, various macro and micro factors influence the risk assets valuation, including crypto market. What are crypto’s...

Read moreDiscover the New Features of altFINS Platform!

We are thrilled to unveil the latest advancements that have been brewing behind the scenes at altFINS over the last several months. Here are the exciting new features of the altFINS platform: Sleek New Design: Experience a modern and...

Read morealtFINS Launches DEX Aggregator and Complete Platform Redesign

“We are thrilled to deliver new and improved features to our users,” said Richard Fetyko, CEO of altFINS. “DEX aggregator and the new design are a testament to our commitment to providing crypto traders with the best analytics and...

Read moreRelief Rally or Trend Reversal?

Last week, we published blogs (here and here) and trading videos about how extremely oversold crypto markets were and that we’re likely to get a bounce or even a substantial relief rally. Well, we got one!! BTC is up...

Read moreHow To Profit Or Hedge Risk In a Downtrend?

After a huge first half of 2023, when altcoins rallied 100%+, the market has given up most of those gains and is firmly in a downtrend. Traders have to adjust their strategies based on market conditions (“market structure”). In...

Read moreCrypto Rally IS ON

These Are Potential Macro Catalysts When there’s chaos and blood in the streets, there are opportunities. In today’s video, we provide an update on this ongoing relief rally, how far it could go and which coins are still looking...

Read morealtFINS Launched DEX Aggregator

Dear altFINS members, At altFINS, we understand the struggle of navigating the complex world of cryptocurrency trading. That’s why we created an altFINS platform for traders and investors to access a wealth of valuable data, insights, and analytics. With...

Read moreBear vs Bull Markets

Navigating the Bear Market: Opportunities and Reasons for Optimism In a recent video, altFINS CEO Richard Fetyko shares his insights on trading the current bear market while highlighting the potential for a relief rally and the emergence of a...

Read moreNew Partnership with Coinchange

🔥Earn Passive Yield On Your Crypto. Strong historical APY of 8.1%! We are thrilled to announce a new strategic partnership between altFINS and Coinchange! As we continuously strive to provide you with the best in the digital asset management space, this...

Read moreHelium (HNT) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Helium (HNT) Trends Helium...

Read moreRipple (XRP) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Ripple (XRP) Trends Ripple...

Read moreSolana (SOL) Analysis

Updated: In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Solana (SOL)...

Read moreChainLink (LINK) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 50 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Read technical analysis of...

Read moreLitecoin (LTC) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Litecoin (LTC) Trends Litecoin...

Read morePolygon (MATIC) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Polygon (MATIC) Trends Polygon...

Read morePolkadot (DOT) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Polkadot (DOT) Trends Polkadot...

Read moreDogeCoin (DOGE) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. DogeCoin (DOGE) technical...

Read moreFilecoin (FIL) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Filecoin (FIL) technical...

Read more