Day Trading vs. Swing Trading: What Is The Difference?

When it comes to trading in crypto markets, two popular strategies stand out: day trading and swing trading. These approaches vary significantly in terms of time frames, trading styles, and risk levels, making it essential for traders to understand the differences to choose the one that best aligns with their goals and resources.

In this blog, we’ll explore the key distinctions between day trading and swing trading.

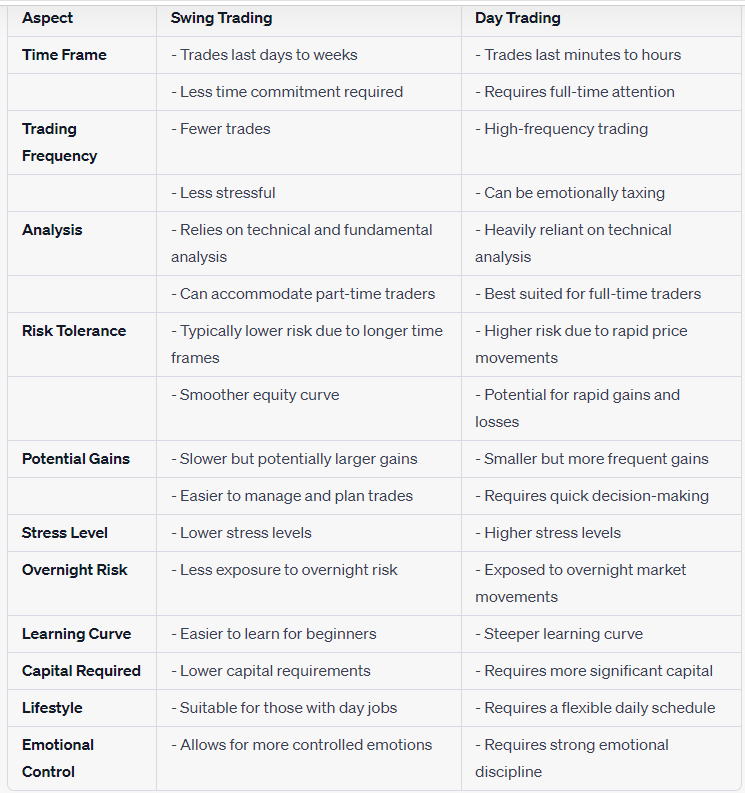

1. Time Frame

One of the most apparent differences between day trading and swing trading is the time frame over which trades are executed:

Day Trading:

- Time Frame: Day traders open and close positions within the same trading day.

- Duration: Trades typically last minutes to hours.

- Overnight Positions: Day traders do not hold positions overnight.

Day Traders can use 15 min or 1 hour price data on: crypto screener, chart patterns, crypto signals summary.

Swing Trading:

- Time Frame: Swing traders aim to capture price swings or trends over a more extended period.

- Duration: Trades may last from a few days to several weeks.

- Overnight Positions: Swing traders often hold positions overnight and over weekends.

Swing Traders can use all time intervals from 15 min to 1 day on: crypto screener, chart patterns, crypto signal summary, market highlights and technical analysis section.

2. Trading Frequency

Trading frequency is another significant distinction between these two approaches:

Day Trading:

- Day traders execute a high number of trades within a single day.

- They aim to profit from small intraday price movements.

- It’s not uncommon for day traders to execute dozens or even hundreds of trades in a single day.

Swing Trading:

- Swing traders make fewer trades compared to day traders.

- They focus on identifying and capitalizing on more substantial price movements.

- Swing traders execute fewer, but potentially more profitable, trades.

Learn more about Time Frames in our Knowlede base article.

3. Trading Strategies

Trading strategies also differ between day trading and swing trading:

Day Trading:

- Day traders frequently employ technical analysis, charts, and short-term indicators.

- They make quick, intraday decisions based on these analyses.

- Strategies often include scalping (very short-term trading) or momentum trading to profit from small price fluctuations.

Swing Trading:

- Swing traders use a combination of technical and fundamental analysis.

- They seek to identify longer-term trends and potential price reversals.

- Entry and exit points are determined based on these analyses.

4. Risk Tolerance

Risk tolerance is an essential consideration when choosing a trading style:

Day Trading:

- Day trading is known for its high risk due to the fast-paced nature of trades.

- Traders are exposed to intraday price volatility and may experience rapid gains or losses.

- It’s a high-risk, high-potential-reward strategy.

Swing Trading:

- Swing trading tends to be less risky than day trading.

- Traders are exposed to overnight and weekend market gaps, but the risks are generally lower.

- It offers a balanced risk-reward profile.

5. Capital Requirements

The amount of capital required is another factor to take into account:

Day Trading:

- Day traders often need a substantial amount of capital to meet margin requirements.

- High liquidity and a fast internet connection are essential due to frequent trading costs.

Swing Trading:

- Swing traders may require less capital since they hold positions for more extended periods.

- This strategy reduces the need for large margin accounts and constant monitoring.

6. Emotional and Psychological Factors

Emotional and psychological factors play a crucial role in trading success:

Day Trading:

- Day trading can be emotionally demanding due to its fast pace.

- Traders must make quick decisions and manage stress effectively.

- Emotional discipline is crucial for day traders.

Swing Trading:

- Swing trading is generally considered less stressful.

- Traders have more time to analyze and plan their trades.

- It may be a better fit for those who cannot commit full-time to trading.

What Kind of Trader Are you?

The choice between day trading and swing trading ultimately depends on your risk tolerance, time availability, trading style, and overall trading strategy. Both approaches have their advantages and disadvantages. Some traders may even combine elements of both in their overall trading strategy to achieve a balanced and diversified portfolio.

This article may help you to decide.

0 Comments

Leave a comment