How to Profitably Trade Sideways Channel

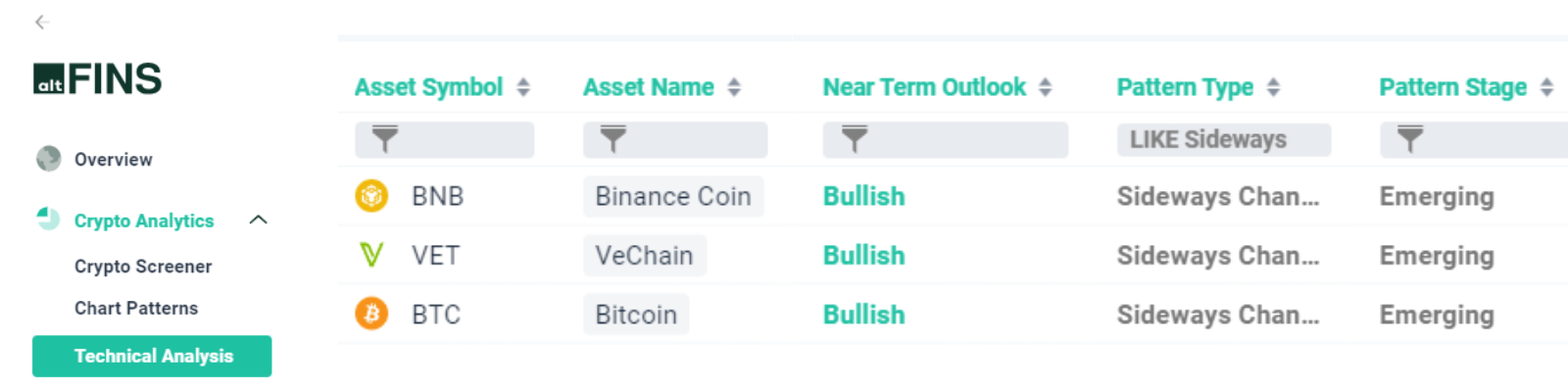

We’re seeing BTC and some altcoins trade in a Sideways Channel, also know as a Trading Range.

These offer nice swing trading opportunities to generate profits even when the overall market is stuck.

Case in point, our trade setup on VeChain (VET) has a potential +25% gain.

Richard has prepared a trading video demonstrating how to trade and profit from Sideways Channels, complete with explanations and several trade setups. Check it out!

VeChain (VET): Sideways Channel

Sideways Channel is one of the easiest patterns to identify and trade for beginner traders.

We teach this strategy in Lesson 6 of our new Trading Education Course. It covers 7 trading strategies, risk management and Short Selling.

Let’s use VeChain (VET) as an example (see chart above).

While the pattern is emerging, before a breakout, swing traders can trade between the support and resistance areas. Enter near $0.038 support and exit near $0.052 resistance for a nice + 25% gain!

Stop Loss (SL) level at $0.035, below prior swing low. That also gives us a healthy 2:1 Reward-Risk-Ratio (RRR) of $0.010 (profit) vs. $0.005 (loss).

We teach how to set proper Stop Loss (SL) levels and calculate RRR in our new Crypto Trading Course.

You can find this and 60 other trade setups with Take Profit and Stop Loss levels in our Technical Analysis section.

Don’t miss these profitable trading opportunities.

Technical Analysis for top 60 altcoins (Sideways Channel patterns)

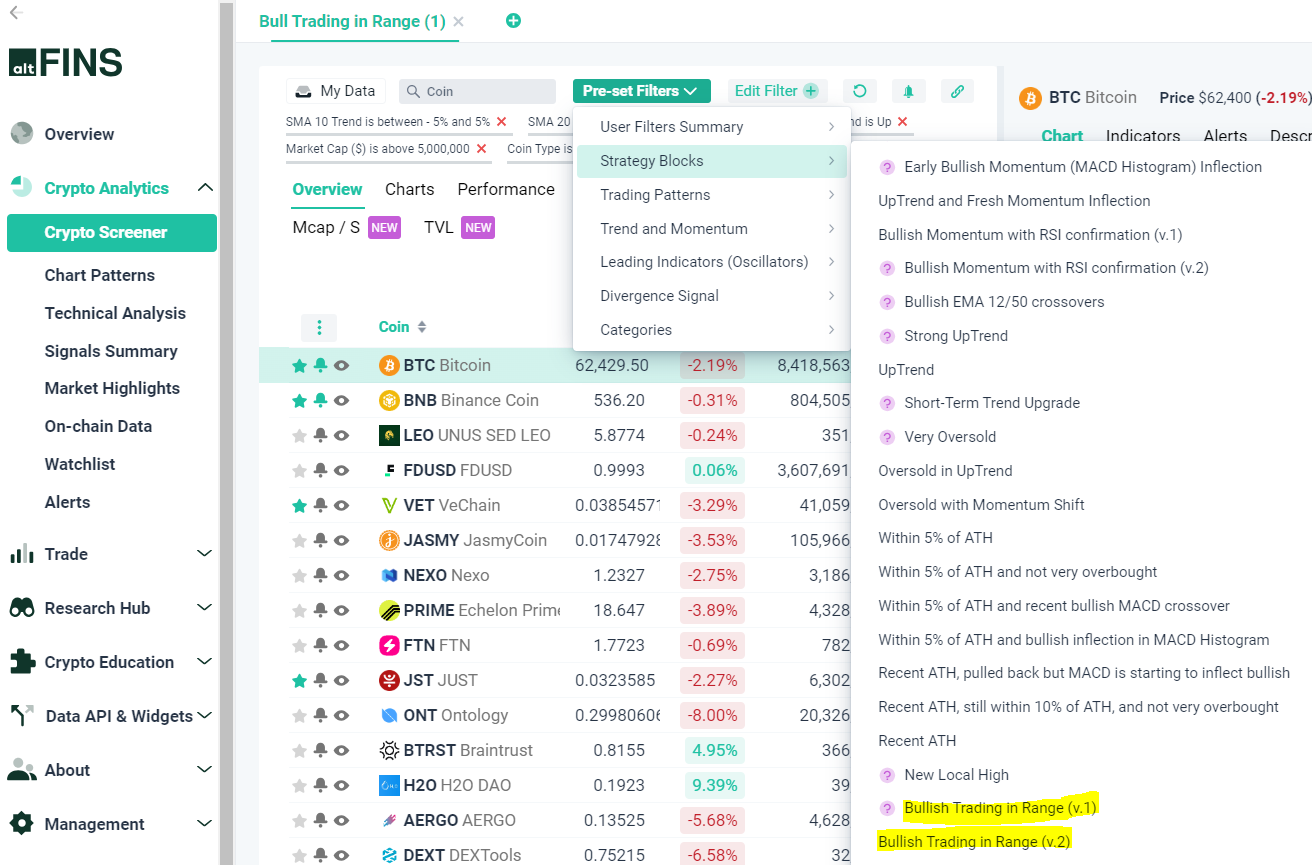

Sideways Channel in Crypto Screener

You can also find assets trading in a Sideways Channel using our Crypto Screener’s two Pre-set filters:

Go to live screener results here.

What is the Sideways Channel?

A Sideways Channel is formed when price moves sideways, trading in a range between a horizontal support and resistance.

It shows that the demand from buyers and supply from sellers are more less in a balance, with some ebbs and flows.

Traders can trade this pattern either when it’s emerging or upon a breakout.

Swing traders can trade the emerging Sideways Channel, between the support and resistance areas. Enter near support and exit near resistance.

Trend traders can wait for a breakout from the pattern to take a position in the direction of the breakout.

If the asset is trading in an Uptrend, then the price is likely just consolidating for a period of time and is likely to break above the channel resistance and continue its uptrend.

0 Comments

Leave a comment