Why did crypto crash? How to profit from it?

Bitcoin (BTC) and Ethereum (ETH) prices pulled back by -6.32% and -7.99% in the last 7 days, and -11.67% and -22.99% in the last 30 days.

And with that, the whole altcoins market tanked by 20-50% from their highs.

Markets are getting oversold, however, with RSI < 40 and in many casis RSI < 30.

This can present swing trading opportunities. More on this later.What caused the crash?

INFLATION!

U.S. economy is strong, unemployment still very low, consumer and business spending is strong and that is driving prices up again.

In 2023, inflation was declining and markets were expecting the FED to lower interest rates in 2024, which was positive for risk assets like tech stocks and crypto.

Lower Interest Rates = Higher Asset Valuations

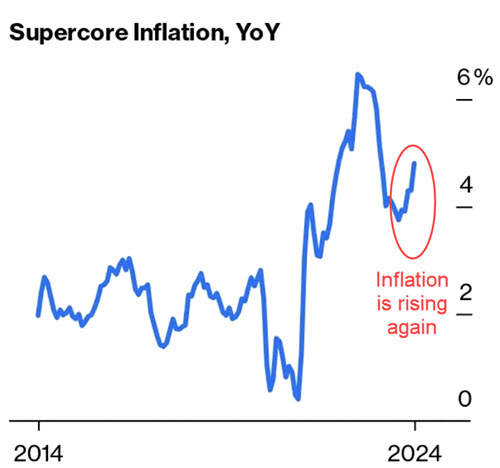

However, March was the third straight month of higher-than-expected services inflation — supercore inflation (which excludes the non-services of energy, food and housing) makes it look like we’ve stopped disinflating and started inflating again:

As a result of inflation rising again, the FED is less likely to cut interest rates, which has a negative impact on valuations of risk assets.

Less than a week ago (April 10), markets were expecting several rate cuts in 2024 and 2025 (blue line). Now, after strong employment numbers and inflation rising, markets do not expect much in rate cuts (black line):

How to profit?

We’re entering a different market regime.

It’s not your strong uptrend anymore but more choppy, up and down swings.

That’s where Swing Trading can profit.

And traders can’t just go long (buy then sell) but they need to Short Sell (sell then buy).

We teach these strategies and skills in our new Trading Education Course. It covers 7 trading strategies, risk management and Short Selling.

Many crypto assets are now oversold.

Some assets are getting oversold (RSI < 40 or even below 30), which is rare in an Uptrend and tends to be a great short-term buying opportunity ahead of a bounce up.

Especially when the price is oversold AND near a support area.

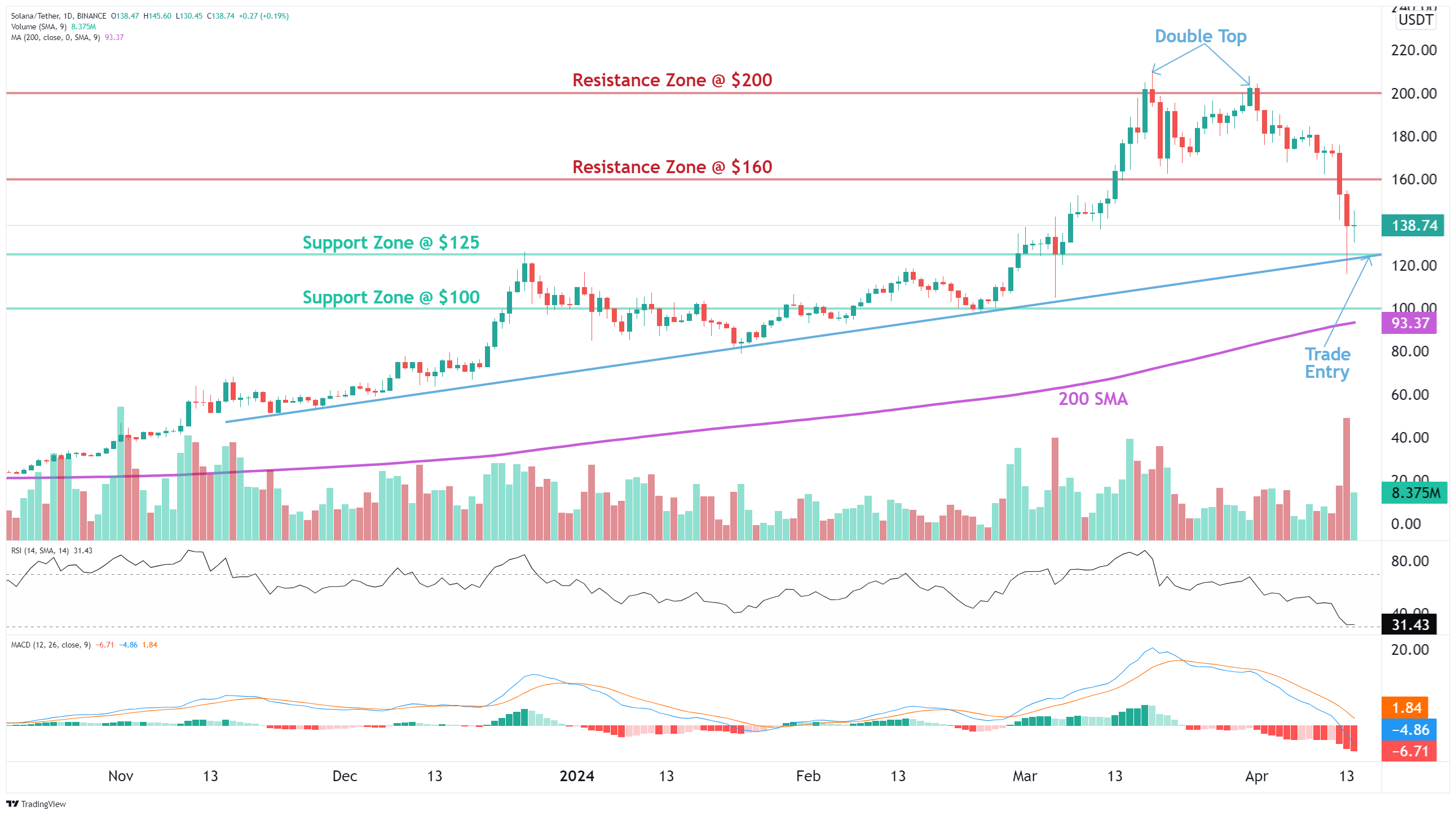

Solana (SOL) is a great example.

Price remains in an Uptrend, it’s approaching $125 support and is oversold (RSI ~ 30). It’s likely to bounce and swing back up to $160 resistance for a +25% potential profit.

Solana (SOL) – Oversold in Uptrend

You can find swing trading opportunities in our Technical Analysis section (trade setups), AI-based Chart Patterns section as well as the Crypto Screener.

On the Screener, you find such trading opportunities by using our pre-set market scans:

Simply follow these links. You can even create alerts for them! (follow the link and click on alert icon)

1. Oversold and Uptrend (see results)

2. Coins in Uptrend and Fresh Bullish Momentum Inflection (see results)

3. Oversold and Momentum Shift (see results)

1. Oversold and Uptrend strategy (see results)

This is a trend trading strategy that finds coins in an Uptrend that are oversold (RSI < 40).

Normally, oversold conditions require RSI to dip below 30, but for coins in an Uptrend, even 40 or less is considered oversold, due for a bounce.

2. Coins in Uptrend and Fresh Bullish Momentum Inflection (see results)

This is a trend trading strategy that uses MACD Histogram indicator to time your entry and exit.

Coins in this trading strategy are in an Uptrend and also early in their upswing (fresh positive momentum).

0 Comments

Leave a comment