Fed Leaves Rates Unchanged Impact on Crypto?

Macro events have impact on all asset categories from stocks, bonds to commodities and yes, crypto.

Not sure what to do?

Get access to VIP telegram group and be first to know about these opportunities!! (available to users with Annual, Lifetime and Education plans).

Here’s a snippet of today’s discussion in VIP group:

When the interest rate outlook is stable or declining, crypto does well. That was 2023 and 1Q-2024.

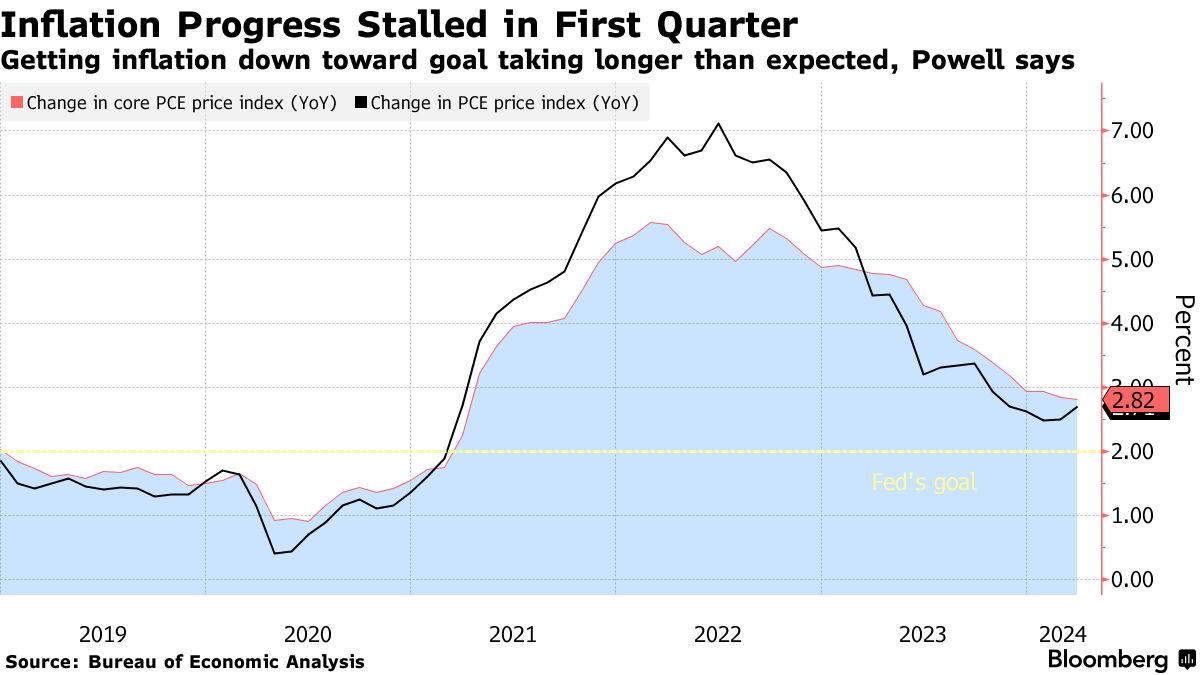

Now, due to inflation perking up, the interest rate outlook is unclear.

At the beginning of the year, traders expected 6 rate cuts in 2024. That was down to expectations of 3 cuts last month and now 0-1 cuts.

That’s had a negative impact on tech stocks and crypto as well (risky assets).

Today, the Fed (U.S. Central Bank) left the benchmark interest rate unchanged at 5.25% to 5.50%.

The bank has signalled that a series of higher-than-expected inflation readings are likely to mean that interest rates will remain higher for longer, but also indicated that it was not yet concerned enough by the recent uptick in inflation to consider rate rises.

They have not even considered to discuss that topic.

That’s a positive!

Seems to us that the market has already priced in this news and could see a relief rally.

But a lot of damage has been done to the trend.

Bitcoin (BTC) broke below the $60K support, dipping as low as $56.7K. It’s a bit in a no man’s land now, with the closest support at $52K.

And with that, the whole altcoins market took it on the chin and is down by 20-50% from their highs in March.

This can present opportunities, if you know how to find them…

Here’s a custom Market Filter that finds assets that are:

1. Still in an Uptrend on Long-term basis.

2. Oversold (RSI < 40)

3. Price is above their 200-day Moving Average.

4. Near their Support levels.

See all results here.

Get access to VIP telegram group and be first to know about these opportunities!! (available to users with Annual, Lifetime and Education plans).

How to profit?

We’re entering a different market regime.

It’s not the strong uptrend anymore but more choppy, up and down swings.

That’s where Swing Trading can profit.

And traders can’t just go long (buy then sell) but they need to Short Sell (sell then buy).

We teach these strategies and skills in our new Trading Education Course. It covers 7 trading strategies, risk management and Short Selling. Get 25% OFF with COURSE25 coupon code!

Many crypto assets are now oversold.

Some assets are getting oversold (RSI < 40 or even below 30), which is rare in an Uptrend and tends to be a great short-term buying opportunity ahead of a bounce up.

Especially when the price is oversold AND near a support area.

Solana (SOL) is a great example.

Price remains in an Uptrend, it’s approaching $125 support and is oversold (RSI ~ 35). It’s likely to bounce and swing back up to $160 resistance for a +25% potential profit.

Solana (SOL) – Oversold in Uptrend

You can find swing trading opportunities in our Technical Analysis section (trade setups), AI-based Chart Patterns section as well as the Crypto Screener.

On the Screener, you find such trading opportunities by using our pre-set market scans:

Simply follow these links. You can even create alerts for them! (follow the link and click on alert icon)

1. Oversold and Uptrend (see results)

2. Coins in Uptrend and Fresh Bullish Momentum Inflection (see results)

3. Oversold and Momentum Shift (see results)

We teach these trading strategies and skills in our new Trading Education Course. It covers 7 trading strategies, risk management and Short Selling. Get 25% OFF with COURSE25 coupon code!

1. Oversold and Uptrend strategy (see results)

This is a trend trading strategy that finds coins in an Uptrend that are oversold (RSI < 40).

Normally, oversold conditions require RSI to dip below 30, but for coins in an Uptrend, even 40 or less is considered oversold, due for a bounce.

2. Coins in Uptrend and Fresh Bullish Momentum Inflection (see results)

This is a trend trading strategy that uses MACD Histogram indicator to time your entry and exit.

Coins in this trading strategy are in an Uptrend and also early in their upswing (fresh positive momentum).

0 Comments

Leave a comment