Trading Strategy: Profiting from Pullbacks in Uptrends

In the world of cryptocurrency trading, seasoned traders know that catching a trend in its early stages can be challenging. That’s where the pullback in uptrend strategy comes into play. In this blog post, we will delve into this trading strategy that allows traders to seize opportunities within established uptrends by buying the dips. We’ll break down the rules and steps for successfully implementing this strategy and explore how altFINS can help you identify these lucrative trading opportunities. But let’s first watch the Tutorial Video, on how to find and trade Pullback in Uptrend.

Understanding Pullbacks in Uptrends

Before we dive into the strategy, let’s clarify what we mean by a “pullback in uptrend.” In the world of technical analysis, a pullback refers to a temporary reversal in the price of an asset within an overall uptrend. It’s important to note that even in strong uptrends, prices don’t move in a straight line; they often consolidate, pull back, and then resume their upward trajectory.

The Basic Idea Of Pullback in Uptrend

The fundamental concept behind the pullback in uptrend strategy is that markets tend to overreact to short-term price fluctuations, leading to temporary declines in an otherwise bullish market. Traders employing this strategy seek to capitalize on these price dips, anticipating that the asset will eventually continue its upward journey and reach higher price levels.

Implementing the Strategy:

To successfully implement the pullback in uptrend strategy, traders follow a set of rules and steps:

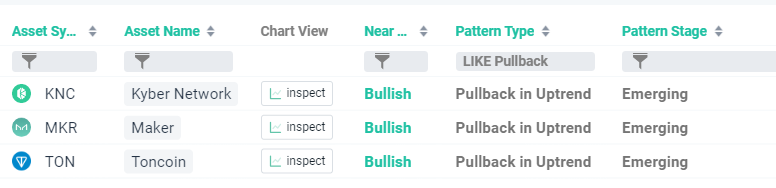

- Identify Coins in Uptrends: Begin by identifying cryptocurrencies that are currently in an uptrend. Look for assets that have experienced recent pullbacks within the last seven days (1W).

- Visual Chart Analysis: Examine the price charts of these coins to identify the nearest support levels. Support levels are price points where the asset has historically found buying interest and reversed its downward movement.

- Buy Near Support: Once you’ve identified a suitable support level, place a buy order near that level. This positions you to enter the market at a lower price during the pullback, with the expectation that the asset will resume its uptrend.

- Risk Management: Implement effective risk management by setting a stop-loss order. This stop-loss level should be strategically chosen to limit potential losses if the market moves against your position.

Leveraging altFINS for Trading Opportunities

altFINS is a valuable tool that can expedite your search for coins with pullbacks in uptrends. Here’s how you can utilize it:

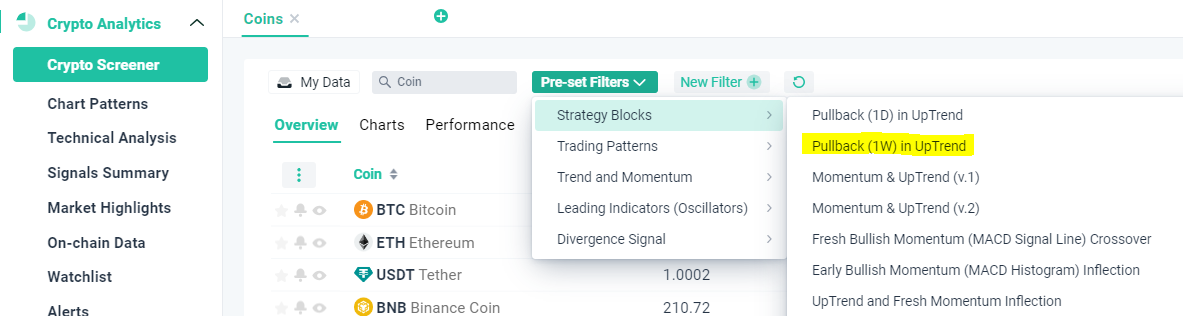

- Crypto Screener: Use the Screener feature on altFINS and select the “Pullback (1W) in Uptrend” pre-set filter. This will instantly display coins that match your criteria.

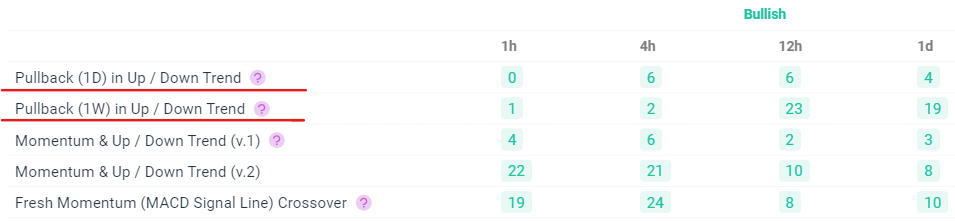

- Signal Summary: Explore the Signal Summary section on altFINS to gain insights into potential trading opportunities. Look for coins that exhibit pullbacks in uptrends.

- Technical Analysis: Leverage the technical analysis tools on altFINS to further confirm your entry points and support levels.

The pullback in uptrend strategy is a valuable tool in a trader’s arsenal, allowing them to profit from temporary reversals within established uptrends. By identifying coins in uptrends, conducting visual chart analysis, and strategically placing buy orders near support levels, traders can optimize their chances of success. Remember that effective risk management is crucial in this strategy, and altFINS can assist you in swiftly identifying these trading opportunities.

So, if you’re looking to enhance your cryptocurrency trading strategy, consider incorporating the pullback in uptrend approach into your repertoire. With the right tools and knowledge, you can capitalize on market fluctuations and boost your trading success.

0 Comments

Leave a comment