Bullish Breakouts: Channel Down and Falling Wedge Patterns

In the ever-evolving world of cryptocurrencies, where prices can swing dramatically in a matter of hours, it’s essential for traders and investors to stay ahead of the game. Cryptocurrency markets have recently witnessed a correction, with many altcoins experiencing a 10-20% drop in the last 30 days (see Performance tab on Screener). However, amid these challenges, two recurring chart patterns have emerged as potential opportunities for profit: Channel Down and Falling Wedge patterns.

Understanding Channel Down and Falling Wedge Patterns

Channel Down and Falling Wedge patterns are common trend reversal patterns that often appear during downtrends characterized by lower highs and lower lows. These patterns indicate a period of consolidation and uncertainty in the market, as sellers dominate. However, they also signal a potential shift in sentiment.

As the selling pressure subsides, more traders and investors start to see value at these lower price levels. This shift in perception can lead to a bullish breakout, where the price breaks out of the pattern, often resulting in rapid price movements and, consequently, profits.

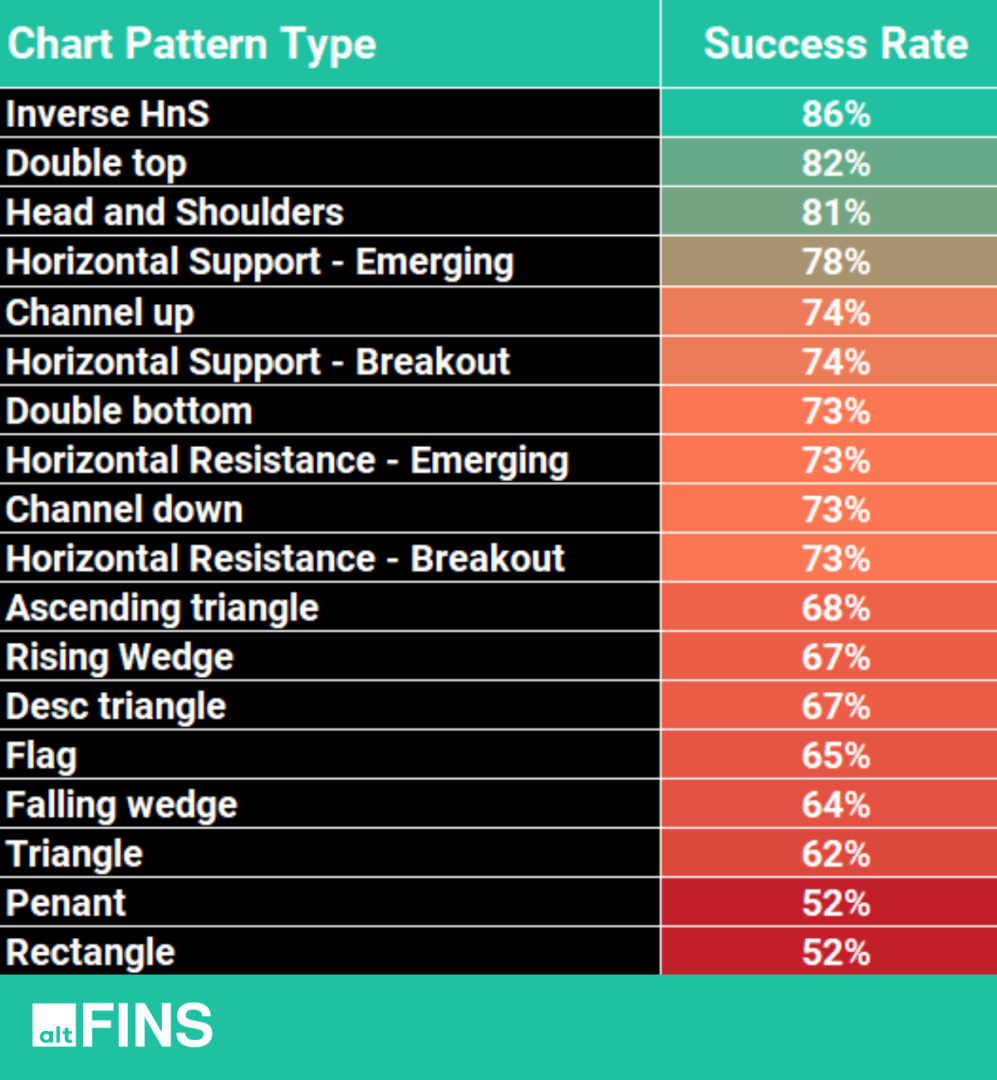

Success Rates of These Patterns

According to historical data provided by altFINS, Channel Down breakouts have a 73% success rate, while Falling Wedge breakouts have a 64% success rate. This suggests that these patterns can be reliable indicators of trend reversals, making them valuable tools for cryptocurrency traders.

Real-Life Example: 1INCH

To illustrate the potential of these patterns, let’s take a look at a recent example: 1INCH. altFINS’ AI-based chart recognition engine identified a bullish breakout from the Channel Down pattern, which led to a quick 10% gain in price. This real-life example showcases how these patterns can be profit opportunities for those who recognize them early.

Identifying Opportunities

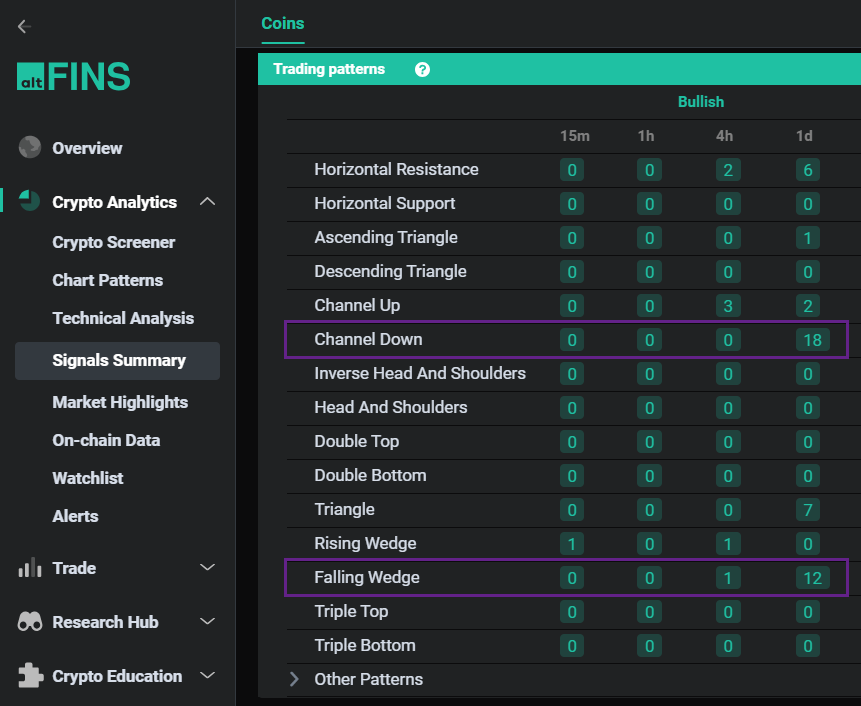

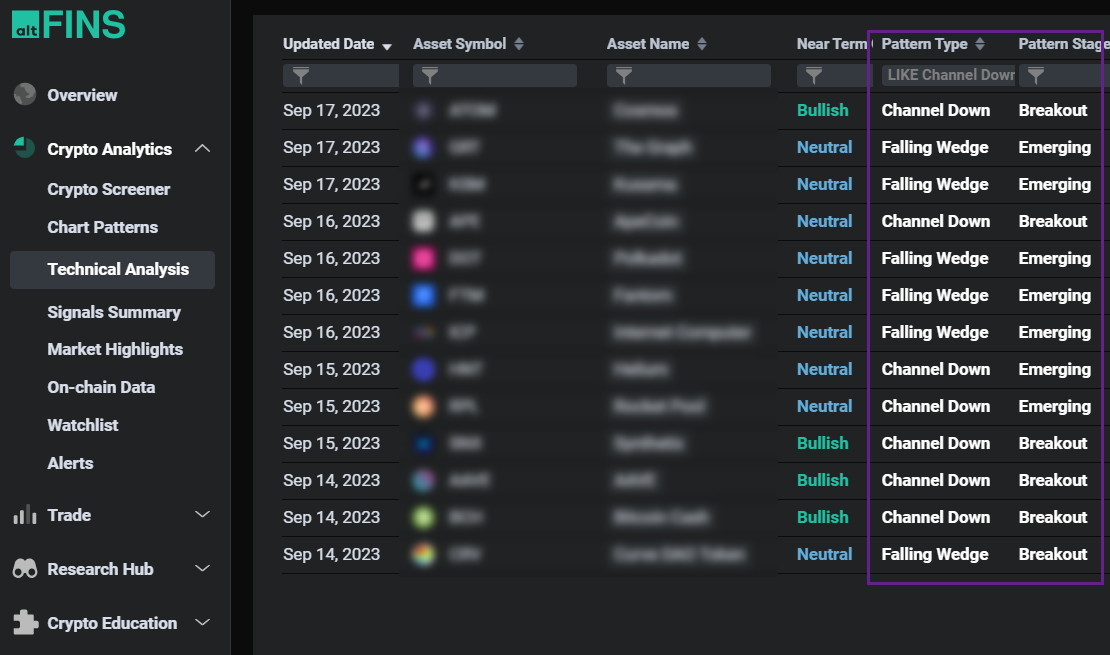

Currently, altFINS’ pattern recognition engine has identified 18 altcoins trading in a Channel Down pattern and 12 altcoins trading in a Falling Wedge pattern. These opportunities can be found on the altFINS platform under the following sections:

- Chart Patterns: Search for Channel Down and Falling Wedge pattern types.

- Technical Analysis: Search for Channel Down and Falling Wedge pattern types.

- Signals Summary – Patterns Section: Explore the Signals Summary section for a comprehensive overview of these patterns.

Signal Summary Section on altFINS

Educational Resources

For those looking to deepen their understanding of trading these patterns, altFINS provides knowledge base articles on Channel Down and Falling Wedge patterns. These resources can be invaluable in improving your trading skills and making informed decisions.

Overall Market Insights

In addition to these pattern-specific opportunities, altFINS offers trade setups and technical analyses for 63 top altcoins. Recent gains for members include impressive returns on assets like Solana (SOL), Maker (MKR), Hellium (HNT), DOGE, and Shiba Inu (SHIB). The Technical Analysis (TA) section on the platform provides detailed insights into more than 60 top altcoins.

Technical Analysis Section on altFINS

In the world of cryptocurrency trading, staying ahead of market trends is crucial for success. Channel Down and Falling Wedge patterns offer a promising avenue for traders and investors to identify potential bullish breakouts in an otherwise bearish market. With success rates of 73% and 64%, respectively, these patterns should not be overlooked. Utilizing altFINS‘ platform and resources can help you navigate these patterns effectively, potentially leading to profitable opportunities in the crypto market’s ever-changing landscape. Don’t miss out on these chances to capitalize on trend reversals and secure your place in the world of crypto trading.

0 Comments

Leave a comment