Crypto Market Review Week 38 - 2023: Fed's Monetary Policy and ETF Expectations

In this week’s macro review for Week 38 of 2023, we’ll delve into the performance of key assets like Bitcoin and Ether, the Federal Reserve’s monetary policy decisions, and the eagerly anticipated approval of Bitcoin ETF applications. Additionally, we’ll explore market sentiment and what to watch for in the coming weeks.

Market Performance

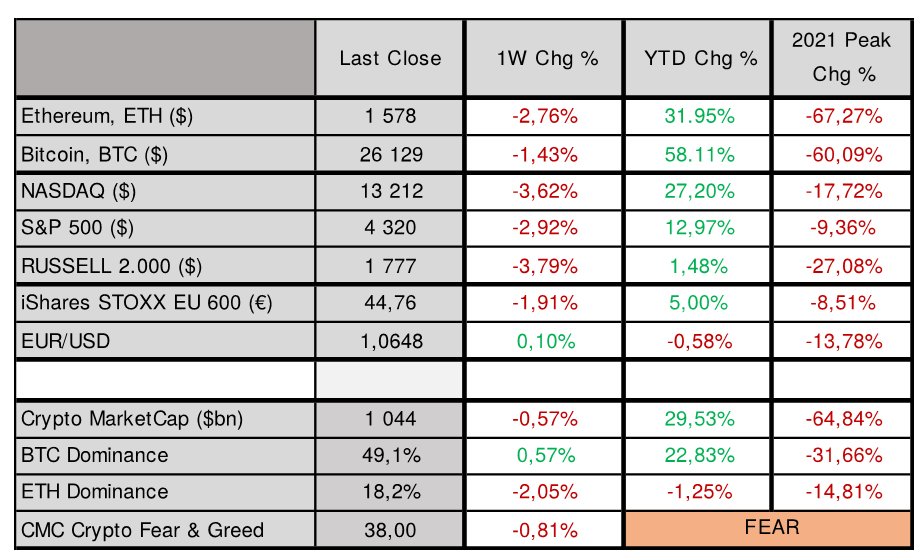

Cryptocurrencies

- Ether (ETH) started the week at approximately $1,578 USDT, down by about 2.8% from the previous week.

- Bitcoin (BTC) was trading at $26,129 USDT, marking a decrease of around 1.4% compared to the prior week.

Both Bitcoin and Ether have outperformed traditional equity markets since the beginning of 2023. BTC has surged by 58% year-to-date, while ETH has seen a remarkable 32% increase. In contrast, the NASDAQ is up by 27%, the S&P 500 by 13%, and the iShares STOXX EU 600 by 5%.

Equity Markets

- The NASDAQ index closed at $13,212, down by 3.6% from the previous week.

- The S&P 500 ended the week at $4,320, marking a decline of almost 3%.

- The European Top 600 stocks index (EXSA) also closed lower, down 1.9% at €44.76.

Currency

- The Eurodollar closed slightly higher at around 1.0648 compared to the previous week.

Federal Reserve’s Monetary Policy

As anticipated, the Federal Reserve opted to maintain its interest rates at a target range of 5.25% – 5.50%. The committee remains vigilant about inflation risks, emphasizing that economic activity is expanding healthily while job gains, although slower, remain robust. The Fed released new fund rate projections, signaling support for another rate hike to reach a target rate of 5.50% – 5.75%. This is a shift from previous projections, which suggested more cuts for 2024 and 2025.

The Fed’s expectations for the core US Consumer Price Index (CPI) have also evolved. They predict a decrease to 3.7% by the end of 2023, lower than their earlier estimate of 3.9%. In 2024, they anticipate further declines, with inflation only returning to the Fed’s 2% target by 2026.

Recent data shows that the core US CPI in August 2023 rose by 4.3%, aligning with market estimates but lower than the Fed of Cleveland’s estimate of 4.46%. This faster-than-expected decline in core CPI suggests a potential adjustment in the Fed’s monetary policy tightening strategy.

Bitcoin ETF Expectations

The cryptocurrency market is abuzz with anticipation for Bitcoin exchange-traded funds (ETFs). The SEC has delayed its decision on six ETF applications, including those from BlackRock and Fidelity, until mid-October 2023. Many analysts, including JP Morgan, believe that the SEC will likely be compelled to approve these applications, citing a recent federal court decision regarding Grayscale’s bid for a spot Bitcoin ETF.

The delay in ETF approval is seen as a strategic move by the SEC to potentially approve multiple spot Bitcoin ETF applications simultaneously, fostering competition and eliminating the first-mover advantage. Once approved, major institutions like Fidelity, BlackRock, and others will have the green light to purchase and hold Bitcoin, reducing its availability on decentralized and centralized exchanges.

Furthermore, history has shown that when Bitcoin’s price rises, the overall altcoin market capitalization increases even more dramatically. If the past is any indicator, we can expect significant growth in the altcoin market when Bitcoin’s price surges.

Market Sentiment and What to Watch For

Market sentiment in the digital asset space has shifted slightly towards fear, with the Digital Asset market sentiment standing at 38.00 compared to the previous week. The Total Cryptocurrency Market Cap experienced a modest 0.6% decline, ending the week at around $1.044 billion. Ethereum’s dominance dipped to 18%, while Bitcoin’s dominance remained just below 50%.

In the coming weeks, investors should keep a close eye on several key events:

- The next monetary policy meeting for the Federal Reserve is scheduled for October 31st to November 1st, 2023.

- The European Central Bank (ECB) will hold its meeting on October 26th, 2023.

- US headline and core CPI figures for September 2023 are set to be released on October 12th, 2023, at 08:30 AM ET.

Conclusion

Week 38 of 2023 has been marked by significant developments in both traditional financial markets and the cryptocurrency space. The Federal Reserve’s stance on interest rates and inflation, along with the impending decision on Bitcoin ETFs, will continue to shape the financial landscape in the weeks ahead. Investors should remain vigilant and adapt their strategies accordingly in this dynamic environment.

0 Comments

Leave a comment