This Indicator Warned Us of a Selloff

Yesterday, crypto markets sold off 5-10%.

Could we have expected it? Are assets in your portfolio overbought?

The short answer is YES.

You can get alerted when asset prices are overbought

Don’t bet left holding the bag while everyone else exits!!

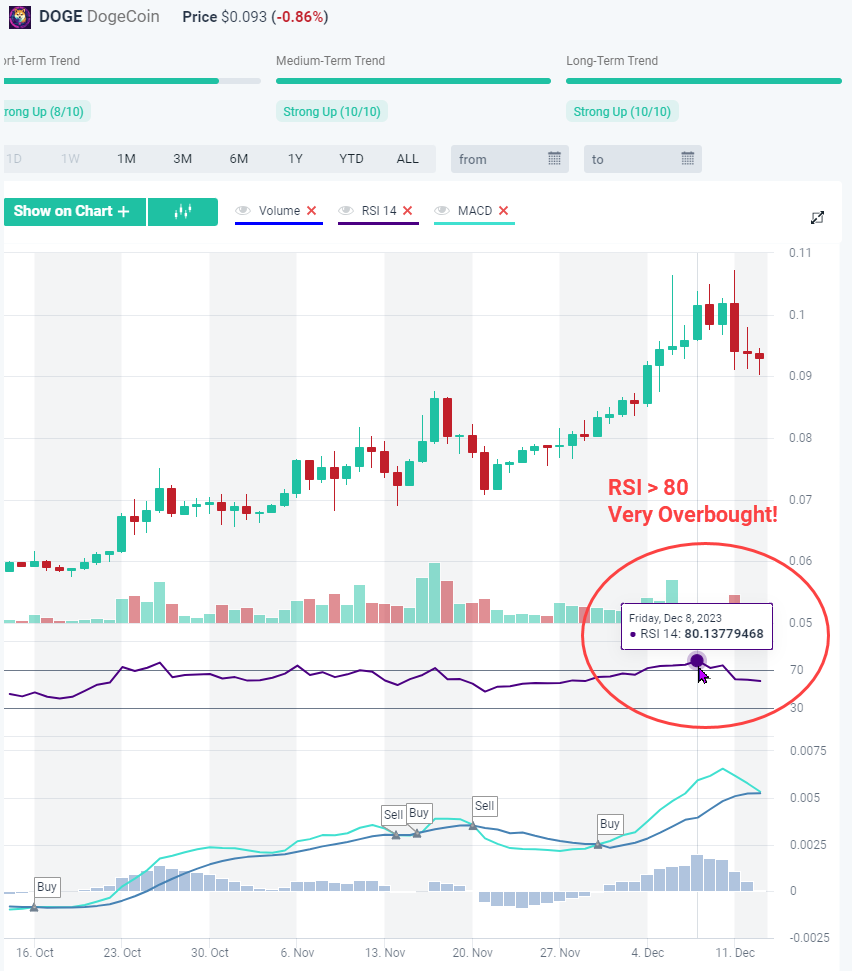

Traders often use RSI indicator as a “canary in a coal mine”, or a warning signal that price of an asset is overbought and due for a correction or temporary pullback before resuming its Uptrend.

This is especially true when price is overbought AND approaching resistance area. More on this later.

RSI or Relative Strength Index compares average gains on UP days versus average gains on DOWN days. RSI ranges in 0-100 but when it gets above 70, it indicates overbought territory.

RSI for Bitcoin (BTC) and Ethereum (ETH) exceeded 70 level this week, which is OVERBOUGHT territory, meaning asset prices rose a bit too far too fast.

Plus, following some big gains last week, asset prices were approaching some major resistance levels and traders decided to take some profits. This selling triggered liquidations of highly leveraged long positions across the altcoins, which is basically forced selling and that compounded the drawdown.

Using altFINS, you can get warned of such Overbought situations

Here are three approaches:

1. Screener and Alerts: find assets that are Overbought (RSI > 70): see live results. Create an Alert for this market scan by clicking on Alert icon.

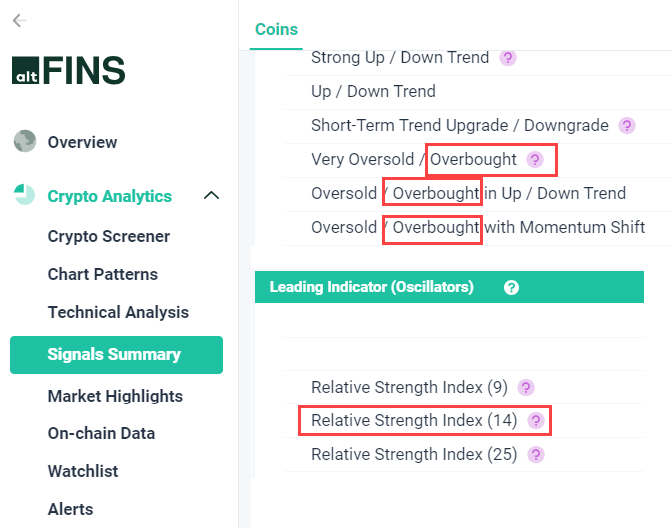

2. Signals Summary section also includes several pre-set filters that you can use to identify assets that are overbought (RSI > 70) or very overbought (RSI > 75):

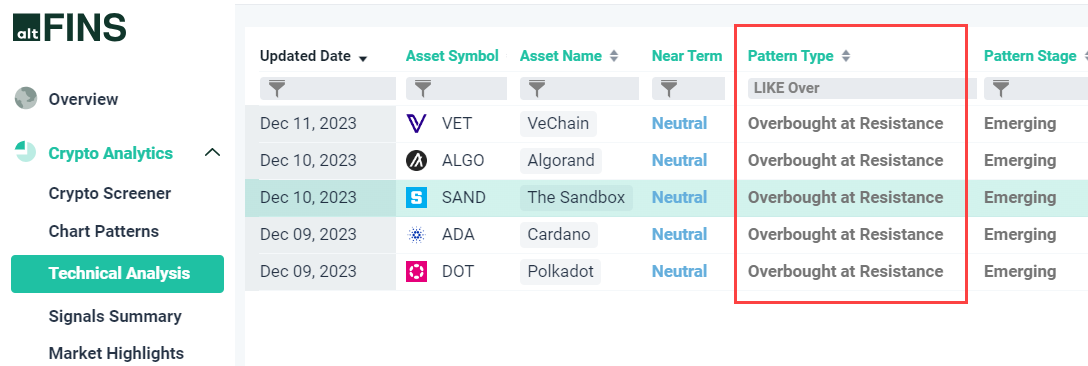

3. Technical Analysis: Overbought at Resistance. Our trade setups have identified many coins that were flashing Overbought (RSI > 70) AND were approaching resistance.

When these two indicators line up, traders beware!! A pullback is likely to occur as traders sell to take profits.

You can find these in our Technical Analysis section where we maintain trade setups for over 60 major altcoins.

Here are recent examples:

In summary, RSI is an extremely useful indicator for identifying Oversold (RSI < 30) and Overbought (RSI > 70) assets.

Use it to your advantage for timely trade entry and exit.

When RSI gets very overbought (above 75 or even 80), there is a very high likelyhood that the price will pull back, correct as traders take profit.

Don’t bet left holding the bag while everyone else exits!!

For more trading ideas, use our automated Chart Patterns, Trading Videos, Signals and Technical Analyses. For longer term investment opporutinities, check out our Coin Picks in Research.

0 Comments

Leave a comment