Ripple (XRP) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Let’s explore Ripple XRP price analysis.

Ripple (XRP) Trends

Ripple (XRP) Performance

Ripple (XRP) & MACD

Ripple (XRP) technical analysis:

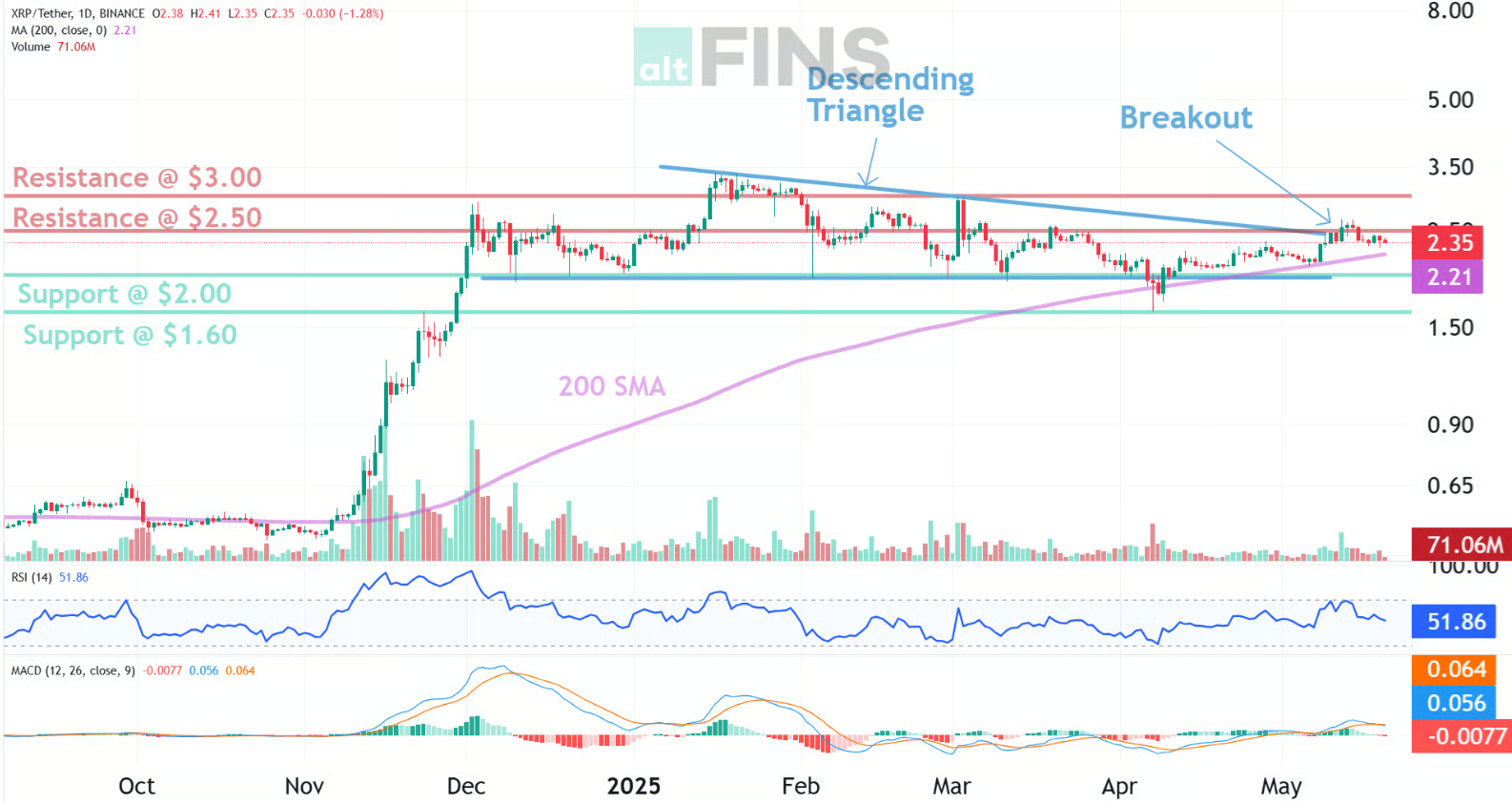

Trade setup: Bullish breakout from Descending Triangle and above $2.50 resistance could signal resumption of Uptrend with +20% potential upside to $3.00 or even $3.40. Stop Loss at $2.25. XRP had been under regulatory pressure from the SEC, which is likely to dissipate under the new White House administration. There’s also a possibility of an XRP Spot ETF launch in 2025. (set a price alert). Learn to trade breakouts in Lesson 7 and Risk Management in Lesson 9.

Pattern: Resistance Breakout. Once a price breaks above a resistance zone, it signals that buyers have absorbed all the supply from sellers at this level and price can resume it’s advance. Following a resistance breakout, the next closest resistance zone becomes a price target. Learn to trade key level breakouts in Lesson 7.

Trend: Short-term trend is Strong Up, Medium-term trend is Strong Up, Long-term trend is Neutral.

Momentum: Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance: Nearest Support Zone is $2.00, then $1.60. Nearest Resistance Zone is $2.50, then $3.00.

See more curated charts for top 65 coins.

Recent news and research:

Ripple v. SEC Lawsuit End Soon? Legal Expert Comments

Ripple’s XRP Price Forecast Sparks Speculation and Concerns

Breaking: SEC Asks Judge Torres for Final Judgment in Ripple XRP Lawsuit

XRP Lawsuit: SEC Files New Demands Against Ripple

Ripple vs SEC Lawsuit: Former SEC Official Argues Potential Success Of Interlocutory Appeal

Ripple News: Top 3 Catalysts That Can Trigger an XRP Price Rally

Ripple eyes US bank partnerships following SEC victory, as XRP volume surpasses Bitcoin

Ripple Labs notches landmark win in SEC case over XRP cryptocurrency

XRP spikes 4% following Ripple’s latest response to SEC

Find more real-time news here.

What is Ripple (XRP)?

Find full description and news on altFINS platform.

Overview

Digital currency Ripple (XRP) and a decentralized payment system were created to make quick and affordable international money transfers possible. Through the use of several fiat currencies and networks, Ripple Labs’ XRP cryptocurrency promises to facilitate quick and straightforward transactions between financial institutions.

At its foundation, the XRP Ledger, a distributed ledger technology used by Ripple, is built on the Ripple Protocol Consensus Algorithm (RPCA), a consensus algorithm. In contrast to conventional banking systems, Ripple uses a network of validating servers to maintain and confirm the ledger’s integrity rather than relying on a single central authority.

Within the Ripple ecosystem, XRP performs a variety of tasks. First off, it serves as a bridge currency, enabling institutions to streamline international trade by first converting fiat money into XRP and then into the desired currency. The expenses and time involved with conventional settlement techniques are decreased by using this process.

Second, within the XRP Ledger, XRP acts as an anti-spam mechanism. The network deters malevolent actors from overwhelming the system with pointless transactions by requiring a tiny quantity of XRP to be destroyed (burned) as a transaction fee.

Additionally, XRP can be used to move money directly between people or held as a speculative investment. Due to its ability to provide quicker transaction settlements compared to conventional banking systems, which may require days to complete foreign transactions, it has grown in popularity.

It’s crucial to remember that Ripple, the firm that created XRP, has encountered regulatory scrutiny and legal issues in several places as a result of XRP being classified as a security by various authorities. In some markets, the perception and uptake of XRP have been impacted by these legal concerns.

Overall, Ripple (XRP) is a digital currency and payment system that uses XRP as a bridge currency and a decentralized network to streamline international transactions, lower costs, and accelerate settlement times.

About altFINS

altFINS is the best crypto analytics platform. The platform will help you find the right crypto trading opportunities. You can search for coin in Uptrend, with Momentum or Breakouts. It’s is great for advanced traders but also for beginners to learn basics of technical analysis in Crypto trading Course or in Curated charts or Chart pattern sections. But also more advanced traders can create their own Screens and Alerts of coins with different trading strategies.

See

See