Search Knowledge Base by Keyword

Support and Resistance

Support and resistance are key concepts used in technical analysis of assets, including crypto assets.

Support is a price level, where a downtrend can be expected to pause due to a concentration of demand or buying interest. This means that traders look at support levels as potential buying opportunities, expecting the price to rebound upward. As the price of a crypto asset drops, demand for the asset increases, thus forming the support zone. And vice versa. Resistance zones arise due to selling interest when prices have increased. Resistance levels indicate a potential selling point, where traders might anticipate a price reversal or a temporary pause in upward movement.

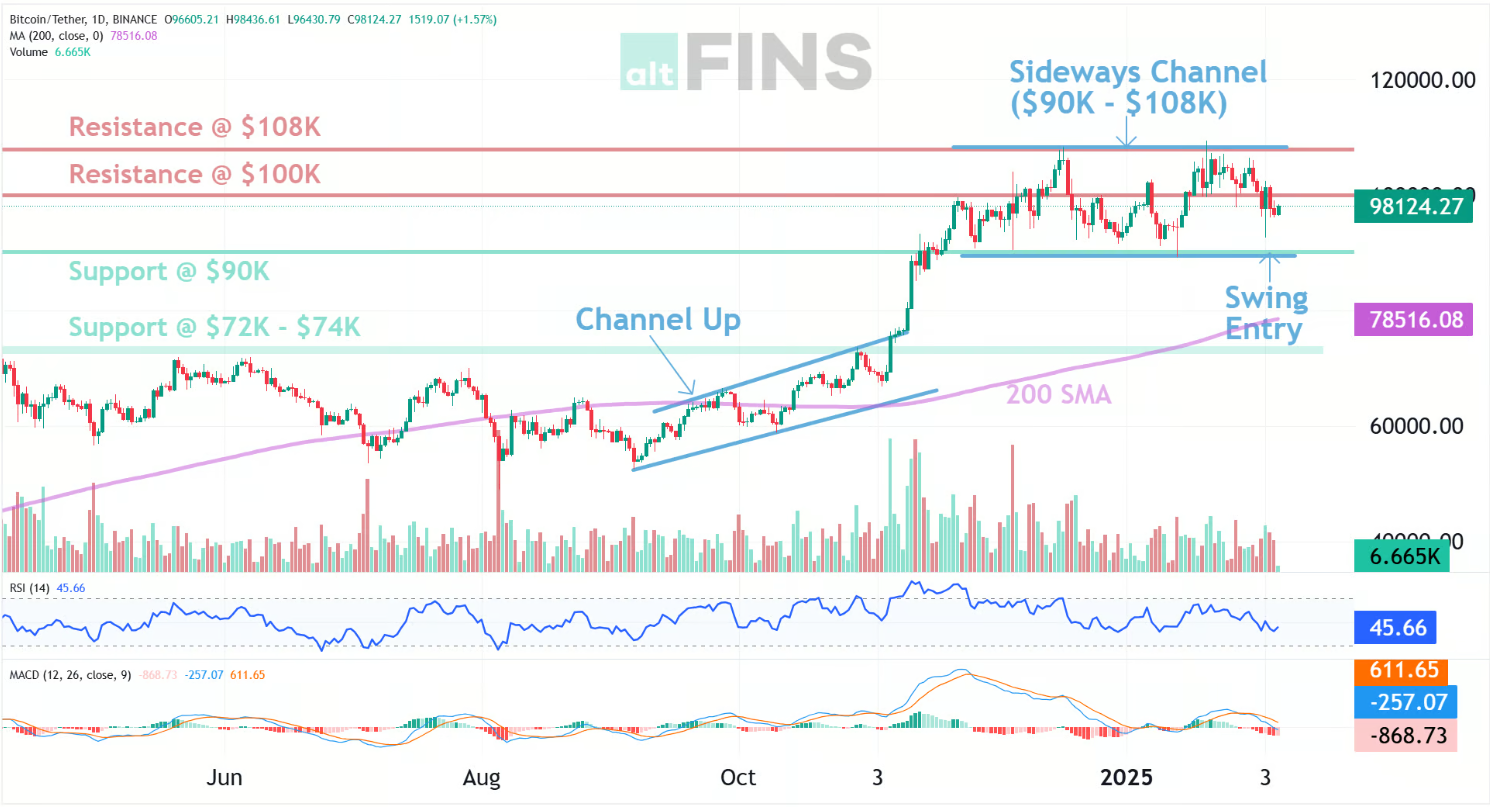

Notice in the Bitcoin cryptocurrency chart below how the price had been rising, reaching the $108K resistance level before reversing downward. This resistance zone acted as a barrier where selling pressure became strong enough to halt further advances. Similarly, the $100K level also presented resistance, preventing the price from maintaining upward momentum.

On the downside, Bitcoin found support at $90K, where buying pressure was strong enough to prevent further decline. If this support fails, the next major support zone lies around $75K, which could act as a strong demand area. The market is currently moving within a sideways channel between $90K and $108K, indicating consolidation. The 200 SMA at around $78.5K serves as an additional support reference, which could act as a swing entry point if the price dips.

Support and Resistance of Bitcoin

Source: altfins.com

A resistance level becomes a resistance zone when more than one resistance level occurs at roughly the same price. Prices rarely rise and stop at the same level, of course. Traders often analyze multiple resistance zones to determine potential price ceilings and breakout points.

A support point is the opposite of a resistance point in that it is a single trough. It is a place where buyers become as powerful or aggressive as the sellers and stop a price decline. Support levels can be tested multiple times, and a stronger support zone is created when prices consistently bounce off the same level.

The concept of support and resistance assumes that, in the future, prices will stop at these levels or zones and that they represent a remembered psychological barrier for prices.

Also, once these levels are broken through, they switch functions (previous resistance becomes support and vice versa) in an important concept known as polarity.

Why do Support and Resistance Occur in the crypto market?

Have you ever bought a coin, watched it decline in price, and hoped to sell out for what you paid for it? Have you ever sold a coin, watched it go up after you sold it, and wished you had the opportunity to buy it again? Well, you are not alone. There are common human reactions, and they show up on the price charts by creating support and resistance. (Jiler, 1962). These psychological tendencies form the backbone of market cycles and are a crucial aspect of technical trading strategies.

What About Round Numbers?

Round numbers often represent support and resistance levels. It is where buying and selling typically increase. Notice Bitcoin at $90K, $100K. The tendency to look for round numbers is part of human psychology. People subconsciously associate with the 19 rather than 20. This also explains why cryptocurrencies like Ethereum or Solana often face resistance at whole number price points such as $300 or $3,000.

How to find Support and Resistance in crypto?

Finding these key levels can be tricky. Generally, a support area forms around the previous price lows, while a resistance area forms around the previous price highs.

Once an area of support or resistance has been identified, those price levels can serve as potential entry or exit points. Here‘s how to trade breakouts and approaches. A price break above the resistance zone implies that sellers are satiated at that level and buyers are anxious. This signals bullish momentum and could indicate further price increases if volume supports the move. See the upward breakout in the Bitcoin chart above.

If another resistance zone exists above the one that was just broken, prices will typically trade up to that next higher zone. Thus, a resistance zone in an advancing market can become a price objective once a lower resistance zone is broken. This logic also works with support zones, in reverse.

How To Find Support And Resistance Levels In Crypto?

Our platform automatically identifies a support or resistance area when there are a minimum of three touching points at a specific price level. These points act as confirmation that the level is significant, increasing its reliability as a trading reference. Key levels can have up to 10 touching points. And the more touching points a price level has, the more significant the level turns out to be. It is how the theory of support and resistance goes, but it also makes logical sense. Every time that a level is tested or touched, but not broken, the market confirms that it is not prepared to go lower than that price. The more often it happens, the more likely it seems that it will happen again.

How are Support and Resistance Zones Drawn in Crypto Trading?

To draw a support and resistance zone, simply draw a horizontal line through each significant trough (support) or peak (resistance).

These lines can be drawn through the bar lows (support) or bar highs (resistance) or using the bar’s close (closing price) since most investors look at closing prices. Extend these lines into the past to see if earlier price declines stopped at the same price level.

The more times the price level has stopped previous advances or supported previous declines, the stronger the resistance or support level will be in the future.

Why Use Support And Resistance In Trading Crypto?

Using Support and Resistance in crypto trading will help you:

- Develop effective risk-reward strategies – By identifying key support and resistance levels, traders can set stop-loss and take-profit levels effectively.

- Enhance technical analysis – These levels act as a roadmap for market movements, providing clear indications of trend strength and reversal zones.

- Improve market timing – Recognizing support and resistance helps traders make better entry and exit decisions, minimizing unnecessary losses.

- Gain confidence in trading decisions – Instead of guessing price directions, traders can rely on historical price action and key levels to make informed choices.

Conclusion By Crypto Trading Expert Richard Fetyko

Support and Resistance levels are critical tools in a trader’s belt. It’s where a lot of crypto signals and trading happens and they tend to be simple trading setups with high win rates. These key levels are often established by behavioral factors (human psychology) and are a clear indicator of the interaction between buyers (demand) and sellers (supply), which ultimately determine the cryptocurrency’s price. By consistently monitoring these levels, traders can gain an edge in predicting price movements and developing a structured trading plan. You can find trade setups for support and resistance levels on altFINS’ platform.