Search Knowledge Base by Keyword

Crypto Profits: Full Guide How to Take Profits In Cryptocurrency

What Does It Mean To Take Profits In Crypto?

Selling a cryptocurrency to lock in profits after it has increased significantly is known as crypto profit-taking. Crypto profit-taking strategies may have an impact on a single cryptocurrency, or even the entire crypto market. If a cryptocurrency, for example Bitcoin (BTC), or Ethereum (ETH), unexpectedly declines after rapidly increasing and there are no external events or news to cause a sudden sell-off, many investors may be taking profits, pushing the price lower.

Cryptocurrency profit-taking is frequently initiated by a specific catalyst, such as a cryptocurrency’s price moving above a predetermined price goal. But it can also be initiated by the simple fact that the price of a cryptocurrency has increased significantly over a short period of time because of a major event.

From a macroeconomic point of view, when FED announces hike in fed fund rates and a quantitate tightening plan for the next 6 to 9 months, it can immediately trigger profit-taking across wider market. Which can easily affect cryptocurrencies, too. It is crucial to remember that profit-taking is frequently a transitory phenomenon. Once profit-taking has peaked, the cryptocurrency price may restart its ascent. However, a coordinated push of profit-taking that drives a cryptocurrency down by a significant amount could indicate a fundamental shift in investor opinion. And foreshadow further drops to the price.

You Need to Set a Goal Of How Much You Want To Earn

First, go back and revisit your exit strategy for your cryptocurrency investment. Find out what you wanted to achieve when you bought your cryptocurrency in the first place. If you’ve come to the realization that you bought a fancy new coin only because someone had recommended the coin. Or was fashionable at the time, it may be time to reconsider your entire investment approach. If you have made a sizeable profit so far but don’t see any long-term potential or value in the coin anymore, you might want to think about withdrawing your earnings and reinvesting them elsewhere. If it is the case that you have bought cryptocurrency without any goal, set a goal. And assess the situation every moment the cryptocurrency price is closer to your goal.

Your goal should clearly reflect the outcome you set when you bought the cryptocurrency. The secret is to pay attention to your current profit margin. We are all different and it really depends on the magnitude of loss each person is ready to accept. Most experienced crypto traders aim for at least 50% profit margin. You can aim for 100% profit margin, or even higher.

If, for instance, your investment increases by 100%, it would be alluring to see where it goes. However, be aware that crypto market is volatile and if price climbs to new highs fast. You could easily jeopardize your investment, as it can retrace back even faster.

Taking Crypto Profits vs Holding Crypto – Differences Between Them

While holding crypto as a long-term investment may be the best strategy for a new investor, going all in at the top the market. Then holding crypto is one of the worst strategies. The main difference is that holding crypto means no matter what the crypto market is doing, investor keeps the position for a long period of time. Which can be 5 to 10 years, or even more. Taking crypto profits would be to close the position immediately at a pre-defined goal, especially when there is a substantial rise in price.

The reality is that most novice investor will enter the crypto market late in a bull market. Holding crypto bought at the top simply means exposing themselves to the pressure to sell when the market keeps on sliding down for more than several months and entering bear market. Investors should rather consider taking profits on the top and prepare for the next bull market.

When is The Best Time To Sell Cryptocurrency To Take Profits?

As we have already pointed out in our article “WHEN IS THE BEST TIME TO SELL AND BUY CRYPTOCURRENCY?”, start by setting a reasonable target, a point where you say it’s enough and you exit the investment by selling your cryptocurrency. Say, the asset has doubled in value since its purchase price. Then this may also be a good time to sell and take profits. Remember, a professional crypto trader could desire to take advantage of price increase. Even though the cryptocurrency may very well continue to rise with excellent growth and macroeconomic forecasts.

You may decide to sell and take profits if something negative happens to the cryptocurrency project. Or you see the team behind the project will no longer be able to deliver promised development roadmap. You may also decide to sell and take profits if you wish to reinvest your capital somewhere else. Or just simply to cash out and wait for a new investment opportunity to develop. Crypto market is at most of the times somewhat correlated with traditional stock market and value of your cryptocurrency may be therefore affected by major macroeconomic events. You may occasionally notice a run of unfavorable macro news about central banks and their monetary policy decision. Followed by a drop in the value the entire crypto market.

Maintaining an eye on the market’s macro pulse is crucial since doing so can help you predict the direction the entire crypto market will take. You may follow major market highlights on altFINS platform where we publish a weekly summary of macro highlights for your convenience to keep you up to date.

How To Take Profits In Cryptocurrency – The Best Profit Taking Strategies

Now that you know when it is a good time to sell to take profits, it would be essential to list some of the best strategies for profit-taking. We have identified TOP 5 strategies that may be used to take profits effectively:

- Sell your entire position in cryptocurrency and take profit immediately on a significant increase in price

It may come as natural hint that if you start to lose value of your cryptocurrency investment, you may feel under pressure to cut your losses as soon as possible. However, that might not be true with taking crypto profits when the value of your cryptocurrency keeps on going up. If there is a significant jump up in price, not many less experienced cryptocurrency investors may see this as an opportunity to take profits by selling their entire position in cryptocurrency. This may not be really a wise decision as the price can be pushed back down by many other market participants who start to take profits by selling their partial or entire stakes. As a result, it may take another several days or months for the price to come back to the high levels.

- Sell your entire position in cryptocurrency and take crypto profit after the price touches your pre-defined target point

You may take profits after the price touches your strictly pre-defined target point, no matter how long it takes. As we have pointed out earlier in the article, setting a goal of how much you want to earn matters even before you consider buying cryptocurrency.

- Sell only a portion of your total long position and take profit when the price hits your exit target

You may also use strategic trading method to realize and optimize profit for your cryptocurrency that you believe has massive long-term potential. For example, if the price of a particular cryptocurrency is rising, you could consider selling only a small portion, say 30 – 40% of the total long position, and use the proceeds to buy more, again, when the price falls. Alternatively, you can use the proceeds to buy another cryptocurrency or even another type of a financial instrument, where you have done your technical and fundamental analysis and have identified a new buying opportunity.

- Buy the rumour and sell the news to take crypto profit

This is standard term that is well-known among the investing and trading community. It indicates that if positive news is anticipated at some point in the future. The price will frequently increase prior to that time but may not do so afterwards once the news is made public. Typical example in the cryptocurrency world was when the Ethereum (ETH) merge was planned to happen. Investors had been buying the cryptocurrency 6 months ahead, gradually pushing Ethereum’s price up until the Merge execution event. After which the price did not move and even started to decline slightly.

Investors who actively screen the market for opportunities may become aware of major events happening in near future. And buy the cryptocurrency in anticipation of a capital gain in price. They can then take crypto profit by selling their stake slightly before the date of the event.

- Taking profit when short selling cryptocurrency

To briefly explain short selling – it is a sell position that is established by obtaining borrowed cryptocurrency. Say Ethereum (ETH), the value of which the investor anticipates falling. Investor sells borrowed cryptocurrency on the market to buy it back later.

- Use trailing stop-loss orders to secure crypto profits during price surges.

This strategy allows you to capture profits if the price increases while protecting your earnings if the price suddenly drops. Trailing stops are valuable during periods of high volatility in the crypto market.

- Diversify profits into stablecoins to protect your gains

After achieving your target profit margin, converting a portion of your earnings into stablecoins helps shield your portfolio from sudden market downturns. Stablecoins like USDT or USDC are a popular choice among crypto investors.

- Set incremental sell orders (ladder strategy) to take profits in stages

Selling a fixed percentage of your holdings at different price levels ensures you capitalize on price surges while still retaining exposure to potential future gains.

- Reinvest profits into low-market-cap altcoins for potential high returns

High-risk, high-reward strategy where investors use profits from large-cap coins like Bitcoin to buy promising altcoins with growth potential.

- Follow AI-powered crypto trading signals for optimized profit-taking decisions

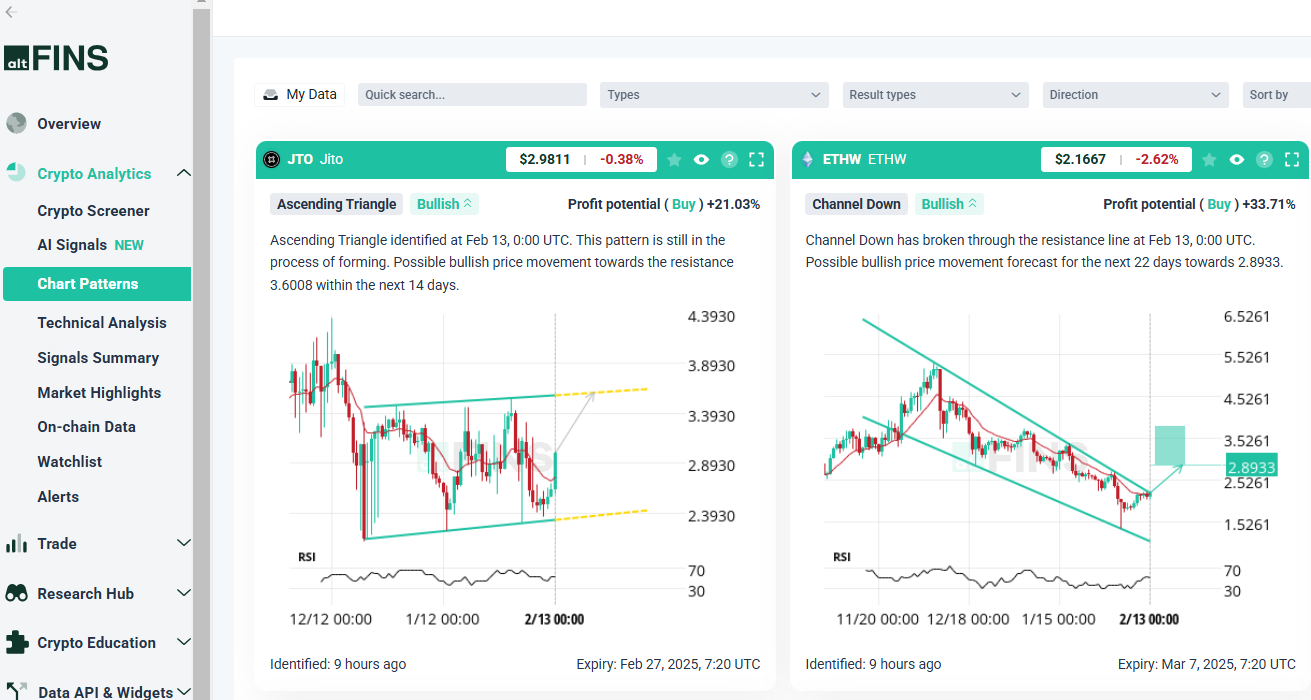

Platforms like altFINS provide AI crypto signals that help traders make informed decisions about when to enter and exit positions based on technical analysis and market sentiment.

Source: altFINS

The investor is hoping that the price will continue to fall so they may buy the borrowed cryptocurrency for less money few days or months later. If the price drops to investor’s target level, they can buy the cryptocurrency at much cheaper levels. And take profits by returning the borrowed cryptocurrency. However, since the price of the cryptocurrency might also increase, the risk of loss on a short position can be substantial as the investor have to then buy the cryptocurrency at higher price and return it back with a loss. Because short selling involves higher risks owing to the usage of margin, it is often done over a shorter period and is therefore more likely to be done for speculative purposes.

Some Advice On What To Watch Out For When You Want To Take Crypto Profit

- It is never bad to reiterate some of the critical points on what to watch out for when you want to sell to take profit on your cryptocurrency investment.

- Always plan your profit taking goal, even before you buy cryptocurrency.

- Regularly follow macroeconomic developments, cryptocurrency’s price development, technical indicators and fundamental metrics using professional crypto platform like altFINS.

- You can access the platform using your desktop, ipad or smart phone by downloading the altFINS app.

FAQ