Search Knowledge Base by Keyword

-

Overview

-

Crypto Analytics

-

- Why use it?

- Overview > Charts > Scorecards > Performance > Trend > Oscillators

- Add table columns

- Detail view

- Charts

- Create a Trading Signal or Filter

- Find SMA crossover signals

- Crypto Time Intervals

- Create an alert

- Extreme Overbought coins Due for a Pullback

- Early momentum detection

- Crypto Trend Changes

- Why use it-coins screener

- Mastering Candlestick Patterns for Successful Crypto Trading

- What Are Fibonacci Retracement Levels?

- Essential Candlestick Patterns for Crypto Traders

- Using Local High to Spot Breakouts

- Oversold in Uptrend

- Strong Uptrend

- The Hammer Candlestick Pattern

- The Inverted Hammer Candlestick Pattern

- The Hanging Man Candlestick Pattern

- The Spinning Top Candlestick Pattern

- The Dragonfly Doji Candlestick Pattern

- What is "My Data" Option on altFINS?

- The Relative Volume (RVOL) Indicator

- New Local High

- New Local Low

- Buying Coins at an All-Time-High (ATH)

- Bullish Engulfing Candlestick Pattern: A Comprehensive Guide

- The Gravestone and Perfect Gravestone Doji Candlestick Patterns

- Support and Resistance

- What Makes altFINS One of the Best Crypto Screeners?

- Crypto Volume Tracker: Spot Unusual Volume and Momentum with altFINS

- Show all articles ( 19 ) Collapse Articles

-

- Overview

- Emerging v. Complete

- Mastering Key Levels in Crypto Trading: The Ultimate Guide

- Consecutive Candles

- Big Movement in Trading: Understanding and Trading the Volatility

- Fibonacci Patterns

- 10 steps for how to trade crypto using Crypto Chart Patterns

- How to trade Channel Down? | Crypto Chart Pattern

- Tutorial: Using Custom Chart Pattern Filters

- How To Set Up Chart Patterns Alerts?

- How To Trade Channel Up Pattern? | Crypto Chart Pattern

- How To Trade Ascending Triangles? | Crypto Chart Pattern

- How To Trade Bullish Flag Pattern? | Crypto Chart Pattern

- How To Trade Sideways Channel pattern? | Crypto Chart Pattern

- How To Trade Rising Wedge pattern? | Crypto Chart Pattern

- How To Trade Falling Wedge pattern? | Crypto Chart Pattern

- How To Trade Descending Triangle pattern? | Crypto Chart Pattern

- How To Trade Inverse Head and Shoulders pattern? | Crypto Chart Pattern

- What is "My Data" Option on altFINS?

- How To Trade Symmetrical Triangle Pattern? | Crypto Chart Pattern

- Crypto Chart Patterns Cheat Sheet

- How Does AI Help with Crypto Trading?

- Crypto Chart Patterns

- Show all articles ( 8 ) Collapse Articles

-

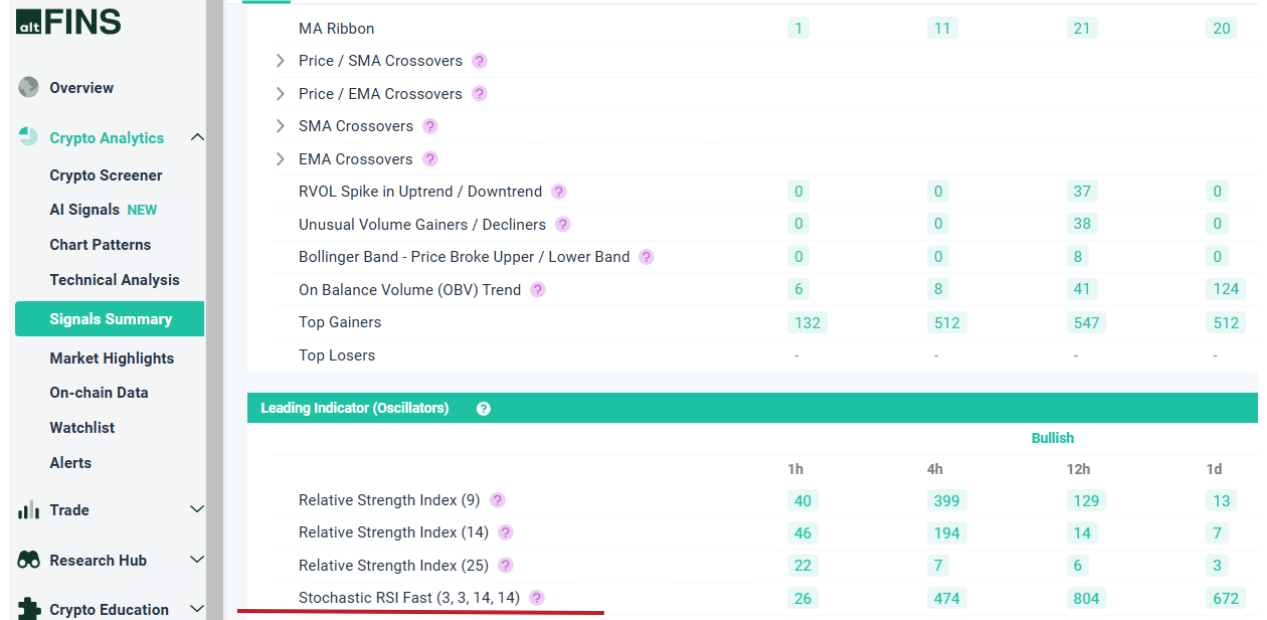

- Signals Summary Overview

- How To Find And Trade Crypto Pullbacks In Uptrend (Buying Dips)?

- Momentum & Up / Down Trend

- Range in Up/Down Trend

- Momentum

- How to trade EMA 12 / 50 crossovers?

- Moving Average Ribbons

- Strong Up / Down Trend

- Strong Up / Down Trend (Short Term)

- Strong Up / Down Trend (Medium Term)

- Strong Up / Down Trend (Long Term)

- Price / SMA Crossovers In Crypto

- What are Price / EMA Crossovers in crypto?

- SMA Crossovers

- EMA Crossovers

- Crypto Unusual Volume Gainers / Decliners

- New Up/Down trend (ADX)

- Bollinger Band - Price Broke Upper / Lower Band

- Strong Up / Down Trend and Oversold / Overbought

- Strong Up / Down Trend and Strong / Weak Ultimate Oscillator

- MACD (12,27,9) Signal Line cross

- MACD (12,27,9) Center Line cross

- Commodity Channel Index cross

- Overall Score of Oscillators (Oversold / Overbought)

- Relative Strength Index (9)

- Relative Strength Index (14)

- Relative Strength Index (25)

- Stochastic RSI (3, 3, 14, 14)

- Williams Percent Range (14)

- Bull Power

- MACD line

- Relative Strength Index (RSI) Divergence: Explained

- How to Trend Trade Crypto

- Early momentum detection

- Short-Medium-Long-Term Trend

- Relative Strength Index

- Uptrend and Fresh Bullish Momentum Inflection

- Using Local High to Spot Breakouts

- Oversold in Uptrend

- Strong Uptrend

- The Hammer Candlestick Pattern

- The Inverted Hammer Candlestick Pattern

- The Hanging Man Candlestick Pattern

- The Spinning Top Candlestick Pattern

- The Dragonfly Doji Candlestick Pattern

- What is "My Data" Option on altFINS?

- The Relative Volume (RVOL) Indicator

- New Local High

- New Local Low

- Bullish Engulfing Candlestick Pattern: A Comprehensive Guide

- The Gravestone and Perfect Gravestone Doji Candlestick Patterns

- Three White Soldiers Candlestick Pattern: A Comprehensive Guide

- How Does AI Help with Crypto Trading?

- What Kind Of Crypto Trading Signals Are on altFINS?

- Show all articles ( 39 ) Collapse Articles

-

- Volume

- OBV Divergence Indicator

- SMA vs. EMA

- RSI Divergence and Trading RSI

- Stochastic (14, 3, 3) (STOCH)

- What is CCI 20? (Commodity Channel Index 20)

- ADX

- MACD Line and MACD Signal Line

- Williams %R

- Stochastic RSI Fast

- Bull / Bear Power

- What is the UO: Ultimate Oscillator (7, 14, 28)

- Short Term Trend

- Medium Term Trend

- Long Term Trend

- Oscillator Rating

- Trading Multiple Time Frames

- Support and Resistance

- Polarity principle

- Early momentum detection

- Crypto Trend Changes

- MACD Histogram (H1, H2)

- What Are Fibonacci Retracement Levels?

- Using Local High to Spot Breakouts

- Oversold in Uptrend

- Strong Uptrend

- The Relative Volume (RVOL) Indicator

- New Local High

- Buying Coins at an All-Time-High (ATH)

- Crypto Volume Tracker: Spot Unusual Volume and Momentum with altFINS

- Show all articles ( 15 ) Collapse Articles

-

-

Trade Crypto

-

- Initiating a trade

- Market vs. Limit order

- Refreshing tables

- Are derivatives such as futures, options and perpetual swaps supported?

- Does altFINS charge trading fees?

- Balances

- Open Orders

- Transaction History

- Order book & Trades

- Connecting to exchanges

- How to trade cryptocurrencies?

- Trading Risk Management

- Crypto Portfolio Tracker

- Connect To Bitget

- Connect to Coinbase

-

-

Research Hub

-

Crypto Education

-

- Where To Buy And Sell Cryptocurrency?

- When Is The Best Time To Buy And Sell Cryptocurrency?

- Crypto Profits: Full Guide How to Take Profits In Cryptocurrency

- What Is Crypto Copy Trading?

- What Is Leverage Trading Cryptocurrency?

- Crypto Arbitrage Trading: Meaning, Signals And Opportunities

- Crypto Hot Wallet vs. Cold Wallet: What is the Difference

- Crypto Trading Strategies

- Difference Between Crypto Fundamental and Technical Analysis

- List of TOP Decentralized Exchanges 2025

- What is a Crypto Prop Trading? A Complete Guide to Crypto Proprietary Trading Firms

- The Best Crypto Prop Trading Firms

- Altrady Review: How To Achieve Optimal Trade Execution

- Crypto AI Agents Explained: Top 10 AI Agent Cryptos by Market Cap to Watch in 2025

- The Ultimate Guide to Smart Money Whales in Crypto

- The Ultimate Guide to Cryptocurrency ETFs in 2025

- How to Control Your Emotions While Trading Crypto (and How altFINS Can Help)

- HyroTrader Review: A Comprehensive Analysis

- Best Crypto Trading Bots in 2025: Coinrule vs Cryptohopper vs 3Commas

- How to Automate Your Crypto Trading with Coinrule

- Show all articles ( 5 ) Collapse Articles

-

-

About

-

AI Features

Stochastic (14, 3, 3) (STOCH)

Stochastic Oscillator 14 3 3 (STOCH) is a range bound momentum oscillator. The Stochastic 14 3 3 indicator is designed to display the location of the close compared to the high/low range over a user defined number of periods.

Stochastic Oscillator 14 3 3 is used to:

(1) Identify overbought and oversold levels

(2) find divergences and

(3) identify bull and bear set ups or crypto signals.

Meaning of Stochastic 14 3 3 indicator

Stochastic 14 3 3 meaning: STOCH 14 3 3 is a range-bound oscillator consisting of two lines that move between 0 and 100. The first line (known as %K) displays the current close in relation to a user-defined period’s high/low range. The second line (known as %D) is a simple moving average of the %K line. Now, as with most indicators, all of the periods used within Stochastic 14 3 3 can be user defined. That being said, the most common choices are a 14 period %K and a 3 period SMA for %D.

The basic understanding is that Stochastic 14 3 3 uses closing prices to determine momentum. When prices close in the upper half of the look-back period’s high/low range, then the Stochastic Oscillator 14 3 3 (%K) rises also indicating an increase in momentum or buying/selling pressure. When prices close in the lower half of the period’s high/low range, %K falls, indicating weakening momentum or buying/selling pressure.

Much like with any range-bound indicator, Overbought/Oversold conditions are a primary signal generated by the Stochastic Oscillator 14 3 3. The default thresholds are 20 for oversold and 80 for overbought.

It is typically best to trade along with the trend when using Stochastic 14 3 3 to identify overbought/oversold levels. The reason is that overbought does not always mean a bearish move just like oversold does not always mean a bullish move. Many times overbought (oversold) conditions can be a sign of a strengthening trend and not necessarily an impending reversal.

The Stochastic Oscillator 14 3 3 is usually plotted with a 3-day simple moving average that acts as the trigger line. When the Stochastic Oscillator 14 3 3 crosses above the trigger line it is a bullish moving average crossover, and when it crosses below it is bearish.

How to Find Stochastic Oscillator 14 3 3 on altFINS?

You can easily find Stochastic RSI FAST Indicator within few clicks:

-

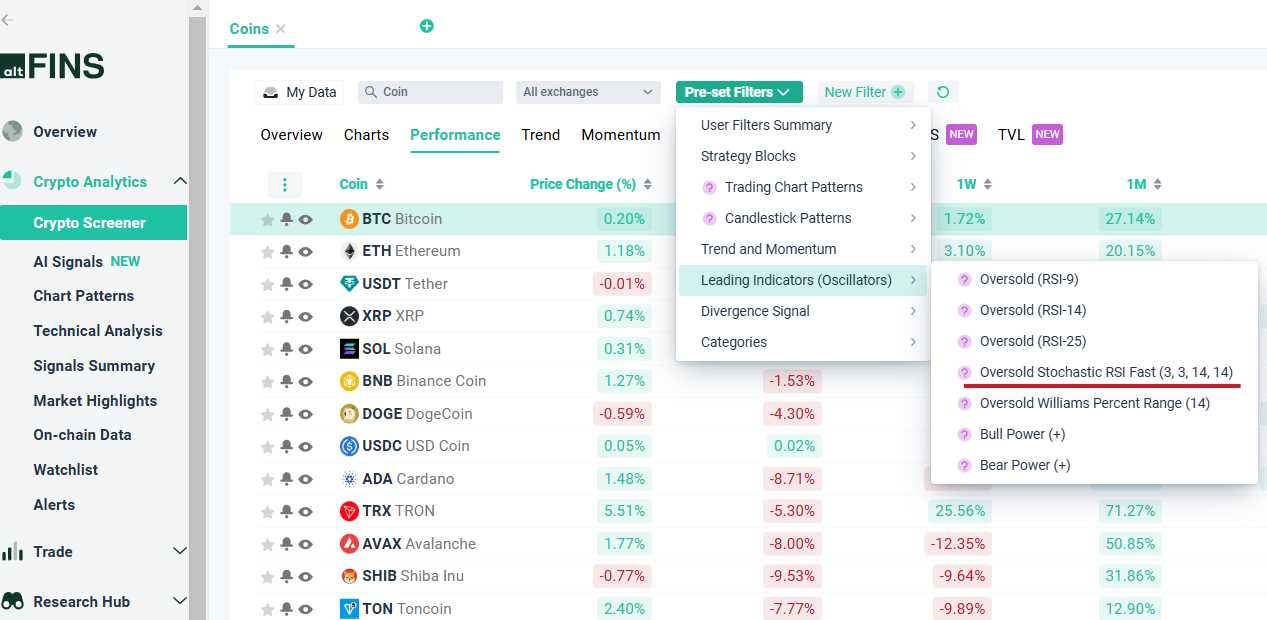

On Crypto Screener: Pre-set Filters

-

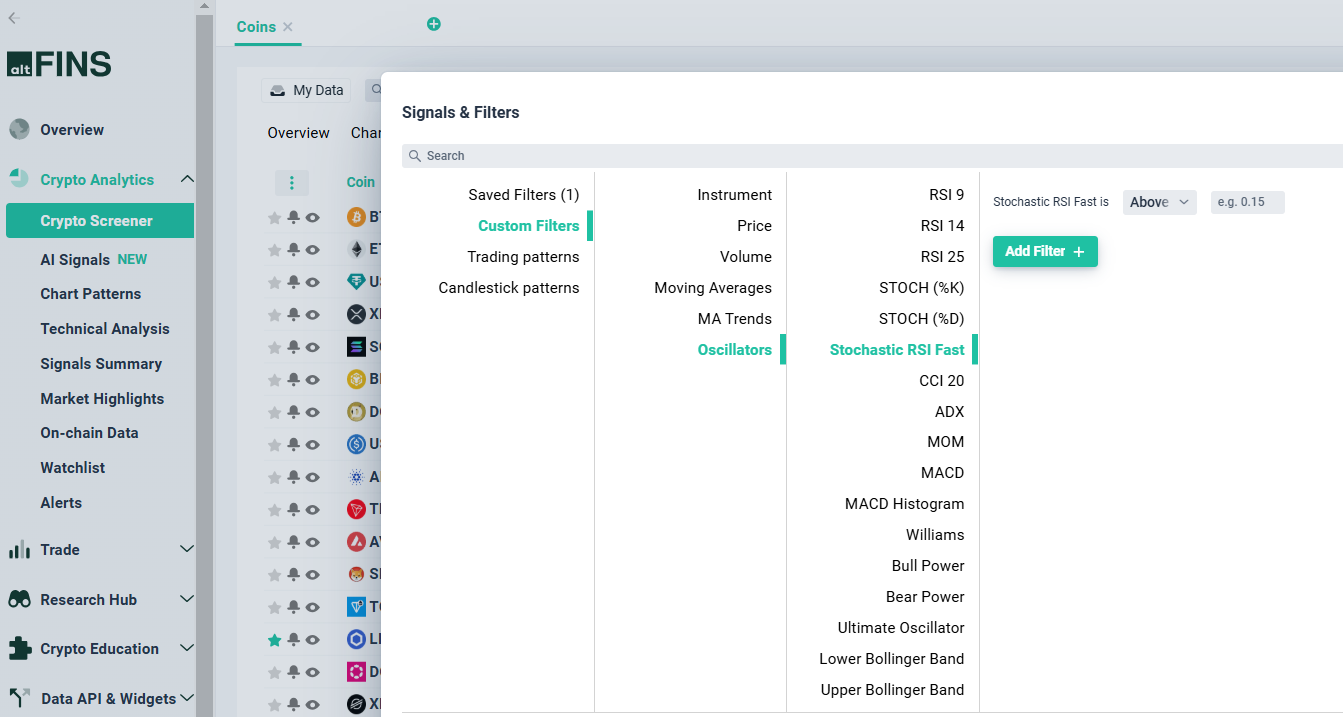

On Crypto Screener: Custom Filters