Search Knowledge Base by Keyword

MACD Line and MACD Signal Line

Updated February 2024

Moving Average Convergence/Divergence oscillator (MACD) is a simple and effective momentum indicator. It’s probably the most widely used crypto trading indicator.

MACD turns two trend-following indicators, moving averages (12 and 26 days), into a momentum oscillator by subtracting the longer moving average from the shorter moving average. As a result, the MACD offers the best of both worlds: trend following and momentum.

MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge.

It calculates the difference between a 12 day and 26 day EMA using closing prices. A 9-day EMA of the MACD Line is plotted with the indicator to act as a Signal Line and identify turns. Also, the difference between MACD Line and Signal Line is called Histogram.

How to trade MACD indicator? To generate signals, crypto traders can look for:

1) Signal line crossovers – most used

2) Slope of MACD histogram – earliest signal, most underrated – be sure to use it!!

3) Divergences – good to spot potential reversals

4) Centerline crossovers – least used (belated)

1) Signal line crossovers are the most commonly used MACD trade crypto signals.

The signal line is a 9-day EMA of the MACD Line. As a moving average of the indicator, it trails the MACD and makes it easier to spot MACD turns.

A bullish crossover occurs when the MACD turns up and crosses above the signal line. A bearish crossover occurs when the MACD turns down and crosses below the signal line.

In the chart of ADA (Cardano) above, note that when the MACD line crosses above Signal Line, our system shows a Buy flag, and vice versa for a Sell flag.

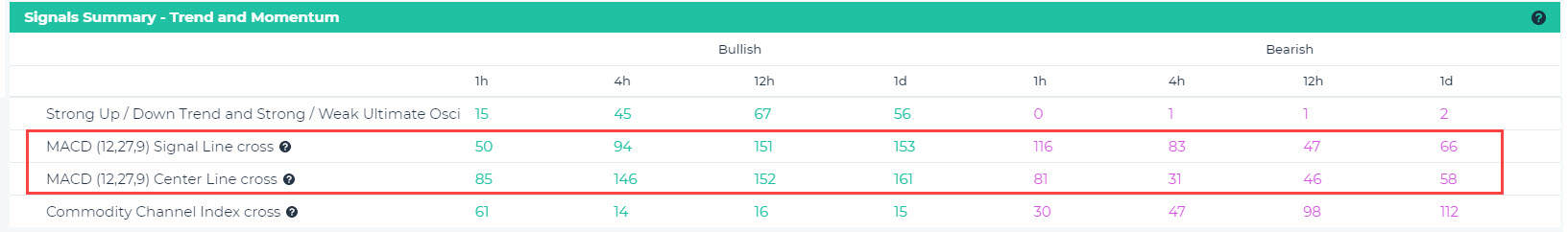

Traders can easily find cryptocurrencies with a bullish or bearish MACD Signal Line crossovers on altFINS.com Signal Summary page:

2) MACD centerline crossovers – least used signal (belated).

MACD above zero for a sustained period of time indicates an uptrend, and below zero, a downtrend. Potential buy crypto signals occur when the MACD moves above zero, and potential sell crypto signals when it crosses below zero.

MACD centerline (0) crossovers happen when the EMA 12 and EMA 26 cross over. So when the faster moving average (EMA 12) crosses above the slower (EMA 26), that’s a Buy signal, and vice versa. Moving average crossovers are commonly used trend indicators but are not good momentum indicators. Consequently, MACD Centerline crossover signal typically lags the MACD Signal Line crossover and is therefore less preferred.

3) MACD divergence – good for spotting potential reversals.

Trend traders also watch for divergences between MACD trends and price trends as a sign of a potential upcoming reversal and end of the current trend.

A bullish MACD divergence happens when cryptocurrency price makes a lower low (downtrend) but MACD makes a higher low. This crypto signals that the downtrend in price is losing momentum as the selling pressure eases with each downswing, which could indicate a reversal.

A bearish MACD divergence happens when cryptocurrency price makes a higher high (uptrend) but MACD makes a lower high. This indicates that while the price is still in an uptrend, the momentum in the upswings has diminished.

Spotting MACD Divergences can be time consuming as it involves visually examining chart after chart. altFINS makes this task easier by enabling traders to review as many as 24 coin charts in a single grid. Just go to Screener, select Charts tab, and change items per page to 6, 12 or 24.

4) Slope of MACD Histogram – earliest signals, most underrated.

As we stated in bullet (1), Signal Line crossovers are the most commonly used MACD for crypto traders. Can we anticipate and get ahead of a MACD Signal Line crossover?

Yes, though not 100% of time.

Here’s a video tutorial on how to detect such early momentum change.

Traders can use MACD Histogram to help anticipate such signals. Recall that a Signal Line crossover happens when a MACD Line crosses over a Signal Line (see “buy” and “sell” flags in Bitcoin chart below). The difference between MACD Line and Signal Line is captured by MACD Histogram bars. In essence, MACD Histogram is an indicator of indicators, and it is a step ahead of Signal Line crossover!

When the slope of the MACD Histogram changes, traders should take notice. When MACD Histogram peaks and begins to decline (blue bars), that’s a potential sell signal to a trader and it would occur sooner than the “Sell” Signal Line crossover (see Bitcoin chart below). And when MACD Histogram troughs and begins to rise (blue bars), that’s a potential buy signal.

In the Bitcoin chart below, notice how the change in the slope (red vertical lines) would give traders an earlier trade signal than a MACD Signal Line crossover (grey vertical lines).

That slight difference in timing could make a huge difference in profits! Try to implement MACD Histogram in your crypto trading strategy.

MACD (12,27,9) Signal Line cross

MACD Signal line is the 9-day EMA of the MACD indicator and is used to identify turns. Signal line crossovers are the most common MACD signals. A bullish crossover occurs when the MACD turns up and crosses above the signal line. A bearish crossover occurs when the MACD turns down and crosses below the signal line.

MACD is a trend following and momentum indicator, calculated by subtracting a longer moving average (26 day EMA) from a shorter moving average (12 day EMA). MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. A 9-day EMA of the MACD Line is plotted with the indicator to act as a signal line and identify turns. Traders can look for signal line crossovers, centerline crossovers and divergences to generate crypto signals. Potential buy signals occur when the MACD moves above zero (center line) or above the signal line, and potential sell signals when it crosses below zero or below the signal line.

MACD (12,27,9) Center Line cross

Centerline crossovers – MACD above zero for a sustained period of time indicates an uptrend, and below zero, a downtrend. Potential buy signals occur when the MACD moves above zero, and potential sell signals when it crosses below zero.

MACD is a trend following and momentum indicator, calculated by subtracting a longer moving average (26 day EMA) from a shorter moving average (12 day EMA). MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. A 9-day EMA of the MACD Line is plotted with the indicator to act as a signal line and identify turns. Traders can look for signal line crossovers, centerline crossovers and divergences to generate crypto signals. Potential buy signals occur when the MACD moves above zero (center line) or above the signal line, and potential sell signals when it crosses below zero or below the signal line.

FAQ