Search Knowledge Base by Keyword

Crypto Arbitrage Trading: Meaning, Signals And Opportunities

Crypto Arbitrage – What It Means And How It Works?

Crypto arbitrage trading is a trading strategy where traders make profits by simultaneously purchasing and selling cryptocurrencies at different trading venues, taking advantage of price discrepancies across crypto exchanges and brokers. The objective is to profit from any price difference between crypto exchanges where a target cryptocurrency is exchanged. For example, if Ethereum (ETH) sells for $1,300 on one exchange and $1,290 on another, a trader can buy Ethereum on the cheaper exchange and sell it on the more expensive exchange, pocketing the $10 difference.

Obviously, opportunities for cryptocurrency arbitrage trading typically arise when there is a significant enough price disparity between exchanges. This might occur when market circumstances suddenly shift (sudden increase in volatility, major announcements, etc.). Or when one exchange’s prices lag those of the others. This tactic of making profits does not come completely risk-free. Arbitrage trading is high-risk crypto trading strategy. It should only be used by experienced who possess sufficient cash for trading activities. And the right trading tools because this technique runs the risk of the asset price fluctuating fast, which might result in a loss on your capital.

Is Crypto Arbitrage Legal?

Crypto arbitrage is legal in majority of countries. Especially those where crypto is not banned. It improves market efficiency so in some countries it is encouraged as the price of the asset will ultimately become more evenly distributed across the global marketplace because more traders will seek to take advantage of the same price differential and thus closing the mispricing gaps between different venues.

Traders must open accounts at centralized crypto exchanges and validate their accounts by passing Know Your Customer (KYC) and Anti-money Laundering (AML) onboarding journeys. This is not the case for decentralized crypto exchanges where traders can execute trades without additional checks and formal validations.

For countries where crypto is banned, or where crypto is a controversial topic, you should first familiarize yourself with local regulations before engaging in any cryptocurrency arbitrage trading. Alternatively, get advice from a local attorney. Or accountant before taking any action if in doubt because sending fiat currency to multiple cryptocurrency exchanges can sometimes be impossible.

Type Of Crypto Arbitrage Trading Strategies

Cross-Exchange Spot Arbitrtage

Let’s take a real example to explain how it works. A cryptocurrency asset, for example, 0.08 Bitcoin (BTC) is purchased by trader on one exchange (e.g., Kraken) for 19,287.2 USDT. And simultaneously sold on another exchange (e.g., Binance) at 19,335.12 USDT. Pocketing the difference as a cross-exchange arbitrage profit, less transaction fees. This is conceivable because the exchanges have different pricing for the same asset.

However, to benefit from the price differential, the trader must have accounts on both exchanges and act quickly, as these arbitrage opportunities appear for a very short time. It would be economically not feasible to buy Bitcoin at one exchange, then send the amount to the other exchange and sell it there. As the opportunity may be gone by the time the trader had sent the Bitcoin over. To capture the below opportunity, trader must have USDT at Kraken and Bitcoin (BTC) at Binance.

Source: altFINS, Kraken, BTC/USDT

Source: altFINS, Binance, BTC/USDT

Arbitrage Using Cryptocurrency Futures

With cryptocurrency futures there is no exchange of ownership of the fiat currency, crypto stable coin, or cryptocurrency on the exchanges. Futures’ liquidity and trading volumes typically exceed that for spot trading. Therefore can offer faster and better execution prices with minimal slippage. For example, using Bitcoin (BTC) futures markets, you can go long Bitcoin futures at one exchange and go short Bitcoin futures on another exchange. In this case, it’s enough you hold only fiat currency at both exchanges in your margin account, to execute the cryptocurrency futures positions.

To explain, a trader would buy Bitcoin (BTC) futures on the exchange with lower Ask price. And simultaneously open a short sell position of Bitcoin (BTC) futures on another exchange with higher Bid price. Once the prices converge to the same price level, the same trader would close both positions and the arbitrage profit that he will make on one exchange will be higher than the loss he will incur at another exchange. Pocketing the difference.

Interest Rate Arbitrage

Furthermore, arbitrage in the crypto market can be found also in other products such as crypto loans. Trader can borrow at a lower rate from one cryptocurrency exchange. And lend at a higher rate on another cryptocurrency exchange. This can be also done between different DeFi Lending & Borrowing platforms and cryptocurrency exchanges. The number of venues and combinations are endless in the crypto space. What is important is that to seize profitable arbitrage opportunities in general, trader must meet certain requirements, skills and possess the right tools.

So, Is It Profitable?

Crypto arbitrage can be potentially profitable trading strategy. Traders must be disciplined, must have enough seed capital to execute trades and must have the technical knowledge and hardware to support their quick buy and sell executions. With the right arbitrage setup, it is indeed a profitable business model.

It is also advisable to execute arbitrage opportunities with higher volume trades, as small volume trades can be charged high transaction fees at crypto exchanges. This fact specifically applies to low market volatility because higher the market volatility, more profitable arbitrage opportunities regardless of the volume being transacted.

Opportunities & Risks

So, when do cryptocurrency arbitrage opportunities appear? What may trigger them?

Cryptocurrencies are in general volatile instruments and financial instruments that are highly volatile are often prone to mispricing at different venues. Because these venues have different levels of liquidity. Respond to the price swings either slower or faster depending on their internal rules or restrictions.

For instance, when the price of a cryptocurrency begins to fall sharply, market orders on an illiquid and less-known crypto exchange would put pressure on the price to fall even more sharply. Which can result in cryptocurrency arbitrage opportunity.

The biggest risk in cryptocurrency arbitrage trading is if the market swings against or the price converges before you manage to execute both buy and sell (in case of not executing the buy and sell trades simultaneously). As a result, the prospect of generating a profit might result in loss instead. However, bear in mind that crypto arbitrage trading looks safer than other outright cryptocurrency trading strategies.

Signals

To quickly identify profitable cryptocurrency arbitrage opportunity, traders often use automated bots. These bots automatically screen prices across different cryptocurrency exchanges and once they identify cryptocurrency arbitrage opportunity, they flash the buy / sell signal to the trader. Crypto Signals are just one part to execute cryptocurrency arbitrage opportunity. Because traders must also have authorized accounts at crypto exchanges, especially, if the automatic bot screens prices across centralized exchanges. Moreover, traders must also have both crypto stable coin currency and cryptocurrency on the exchanges where they want to execute the trades.

Most of the cryptocurrency markets offer historical data for free. Traders can access them via real-time API connections. Traders can generate their API access keys through different types of client packages that exchanges offer. These allow traders to fetch real-time and historical data, send orders, and check account balances by only calling functions from the package. altFINS platform allows traders to track their cryptocurrency portfolio, trade coins across multiple exchanges and create alerts on portfolio positions. For more information how a trader can connect their altFINS account to different exchanges, a full guide can be found at Connecting to Exchanges.

How To Do Crypto Arbitrtage Trading With altFINS – The Case Of Binance & Kraken

Here we explain how to do crypto arbitrage trading between Binance and Kraken crypto exchanges using altFINS platform. Make sure you have some USDT and Bitcoin at both exchanges.

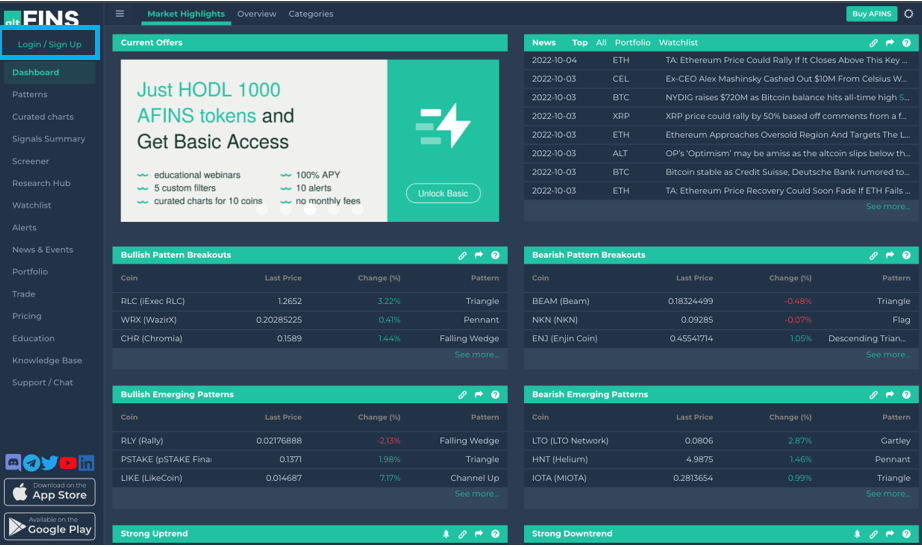

- Visit https://altfins.com/ and sign up or login if you already have an altFINS account:

- Connect to your wallet and add your API connection with Binance and Kraken in your altFINS Account Settings. Follow full guide at: https://altfins.com/knowledge-base/connecting-to-exchanges/

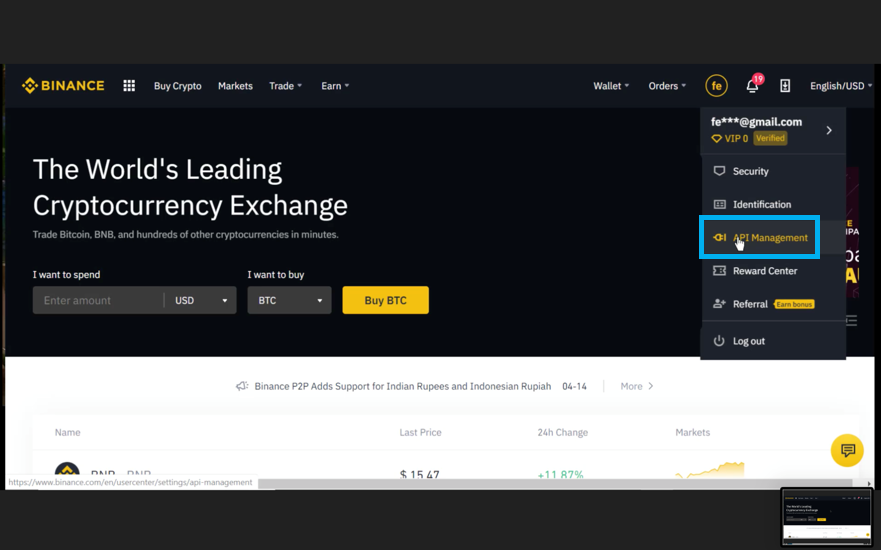

- For example, connecting to a centralized exchange, BINANCE, where you already have an account, go to API Management located in your Profile dropdown menu:

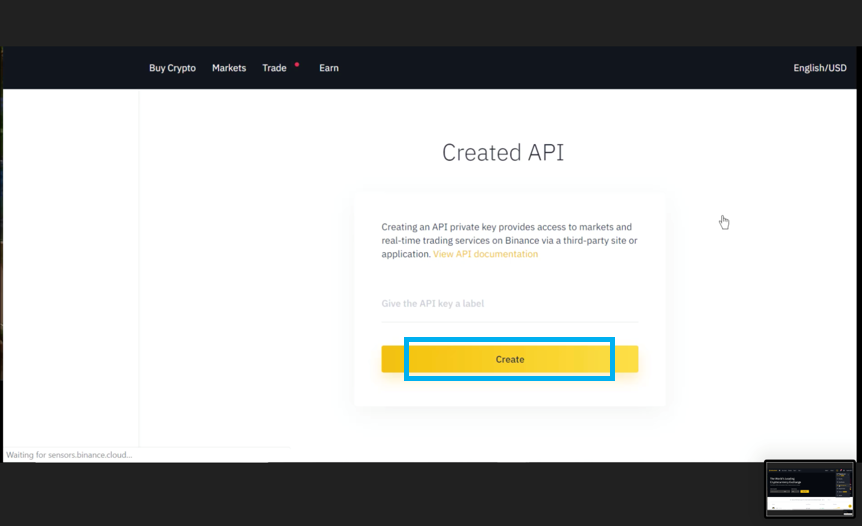

- Create API Name as you like:

- After several steps followed by double authentication and verification process, you will get your new API Key and Secret Key generated. You can now set up the API restrictions with Read Only and Enable Trading rules and disabling Withdrawals.

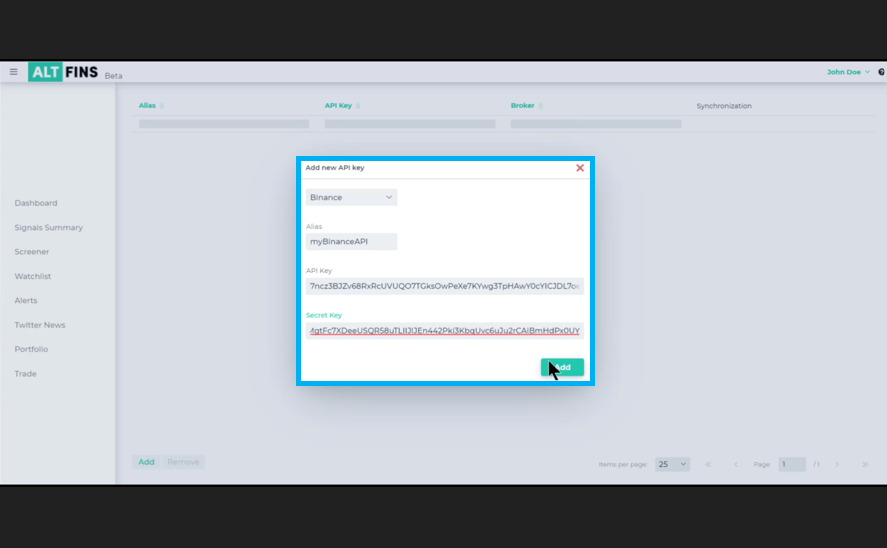

- Go back to altFINS platform, select your Profile Name > Accounts > Exchanges > Add and paste your API Name/Alias, API Key and Secret Key into the fields provided, and hit Add:

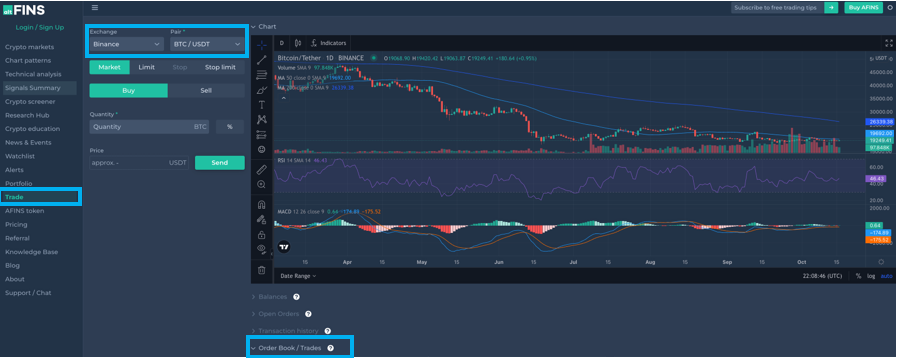

- Once you get a notification, or a signal, go to Trade, quickly screen between exchanges. Using your Pair and check the Order Books to confirm the arbitrage opportunity.

- If you confirm that you can buy the crypto at one exchange cheaper (e.g. 19,287.2 at Kraken) and sell the same cryptocurrency at another exchange at a higher price (e.g. 19,335.12), execute both trades by filling in the Buy and Sell orders.

Source: altFINS, Kraken, BTC/USDT

Source: altFINS, Binance, BTC/USDT

FAQ