Search Knowledge Base by Keyword

How To Trade Bullish Flag Pattern? | Crypto Chart Pattern

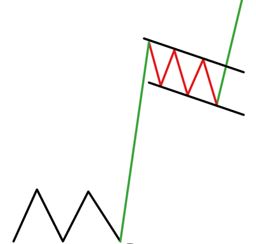

A bullish flag pattern is a technical analysis pattern that appears on price charts. It’s considered a continuation pattern and is formed during an uptrend. The pattern resembles a flag on a flagpole, hence its name.

Bullish Flag pattern

Bullish Flag Pattern Trade Setup

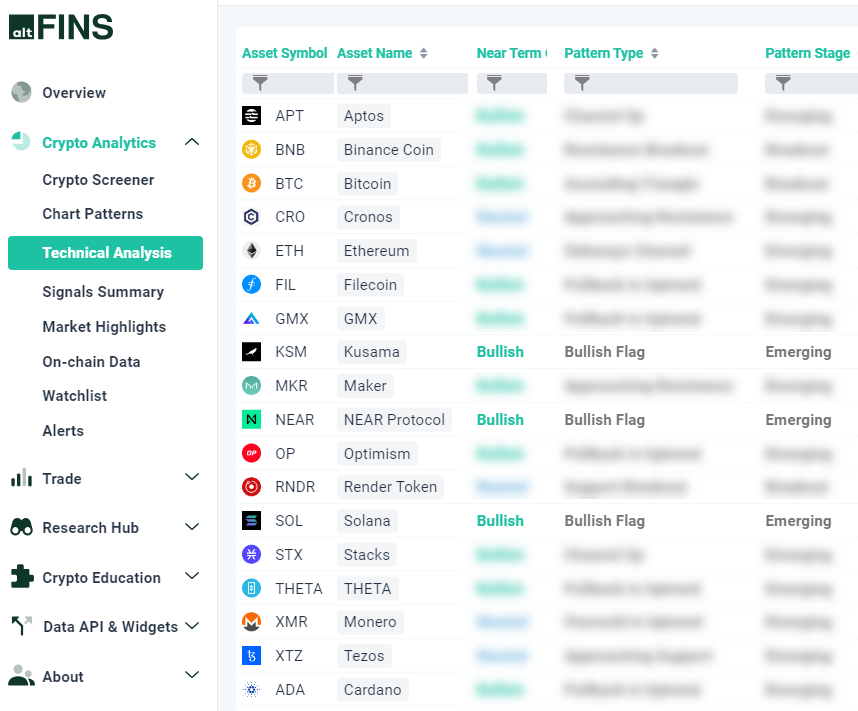

In this trading video, Richard (CEO of altFINS) explains the Bullish Flag patterns using SOL, KSM and NEAR as example trade setups.

Bullish Flag pattern is among the most reliable continuation patterns that traders use because it generates a setup for entering an existing trend that is ready to continue.

Watch and learn his approach:

1. Where to find trade setups on altFINS platform

2. Identifying Bullish Flag patterns

3. Determine Take Profit (TP) and Stop Loss (SL) levels

TIP: You can create an alert for Chart Patterns and receive them on iOS or Android mobile app! Don’t ever miss another trading opportunity.

Technical Analysis for top 60 altcoins

Our team of analysts maitain TAs with trade set ups on 60 large cap altcoins (see here) that can provide a great starting point for discovering trading ideas as well as learning TA yourself!

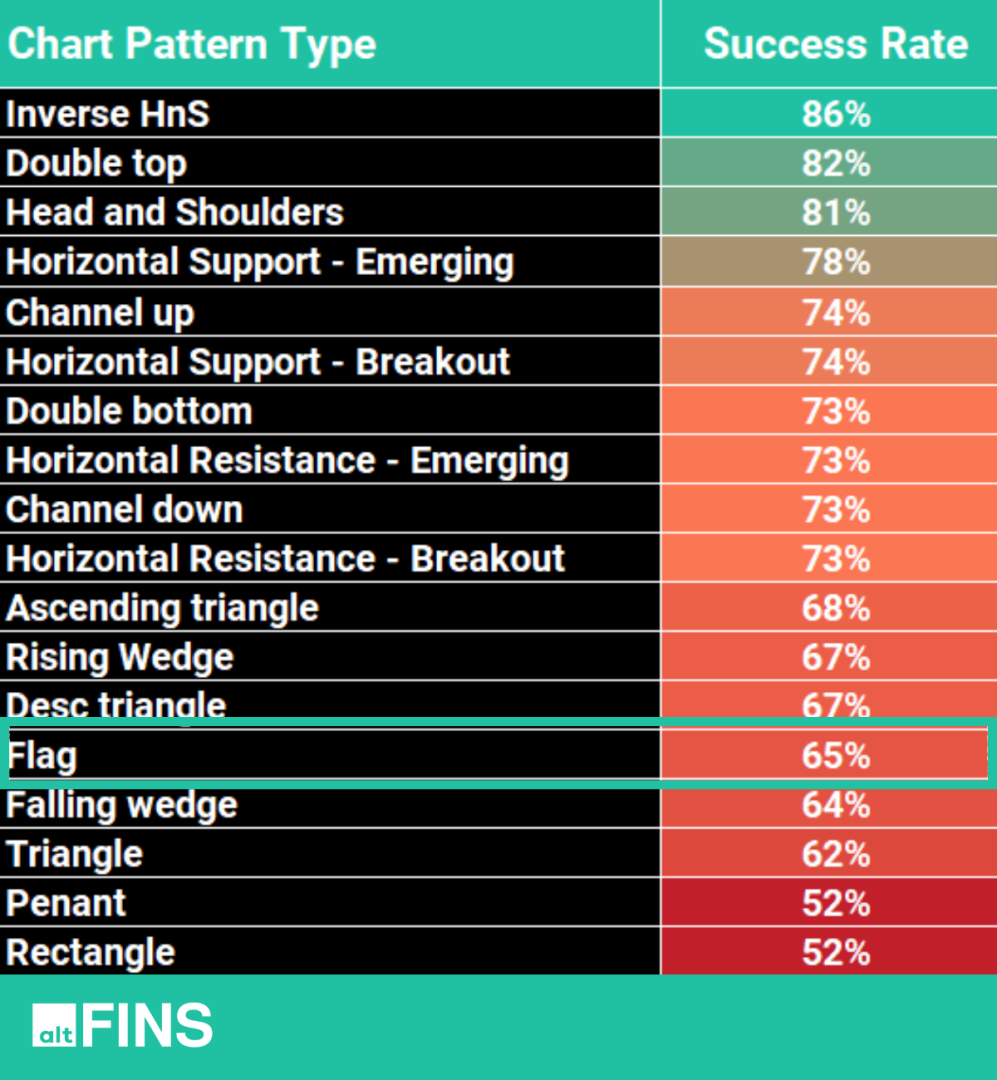

According to historical backtests conducted on the altFINS platform, the Flag pattern exhibits an impressive 65%!

Characteristics of Bullish Flag Pattern

A bullish flag pattern in crypto trading is a continuation pattern that typically occurs after a strong upward price movement (known as the flagpole) followed by a period of consolidation. Some characteristics of a bullish flag pattern include:

- Flagpole: The flagpole is the initial strong upward movement in price, often steep and with high trading volume, representing the initial momentum.

- Flag Formation: After the flagpole, there’s a period of consolidation where the price forms a rectangular or parallelogram-shaped flag. This consolidation phase usually sees decreasing trading volume and is characterized by lower volatility compared to the flagpole.

- Duration: The flag pattern can last from a few days to several weeks, depending on the timeframe of the chart being analyzed.

- Slope: The flag itself typically has a slight downward slope, usually in the range of 45 degrees against the preceding trend.

- Volume: Volume tends to decline during the formation of the flag. A decrease in volume during the flag pattern signals a temporary pause in the market before a potential continuation of the prior upward trend.

- Breakout: The bullish signal occurs when the price breaks out of the upper boundary of the flag pattern. This breakout is often accompanied by an increase in volume, confirming the validity of the pattern.

How To Trade Bullish Flad Pattern?

Traders often use the bullish flag pattern as a signal to enter a long position, aiming to capitalize on the expected continuation of the prior uptrend.

Trading bullish flag chart patterns involves identifying a bullish continuation pattern within a larger uptrend. Here’s a step-by-step guide on how to approach trading bullish flag patterns:

Identifying the Bullish Flag Pattern:

- Uptrend Confirmation: Ensure that coin has been in a clear upward trend before the formation of the flag pattern. This pattern typically occurs after a strong upward move (the flagpole).

- Flagpole Formation: Look for a sharp, almost vertical price movement (the flagpole) followed by a consolidation period. This consolidation often appears as a parallel channel or a slight downward sloping channel.

- Flag Formation: The consolidation forms a rectangular-shaped flag, characterized by lower highs and higher lows. This usually lasts for a relatively shorter period compared to the prior uptrend.

Trading Strategies for Bullish Flags:

- Entry Points: The ideal entry point is after the breakout above the upper trendline of the flag pattern. This breakout confirms the continuation of the prior uptrend.Volume Confirmation: Ideally, there should be an increase in volume when the price breaks out of the flag pattern. Higher volume can validate the strength of the breakout.

- Set Stop Loss: Place a stop loss order below the lower trendline of the flag pattern. This helps protect against potential losses if the pattern fails.

- Target Price: Calculate a target price by measuring the flagpole’s length and extending it from the breakout point. This can provide an approximate target for the upward move.

Risk Management and Additional Tips:

- Confirmation Signals: Use additional technical indicators (like moving averages, RSI, MACD) to confirm the bullish signal from the flag pattern.

- Manage Risk: Determine your risk-reward ratio before entering the trade. Ensure that potential profits outweigh potential losses.

- Patience and Caution: Wait for a clear breakout confirmation before entering the trade. False breakouts can occur, so patience is crucial.

- Practice and Observation: Practice identifying bullish flag patterns on historical charts and observe how they behave in different market conditions.

How To Identify Bullish Flag Pattern on altFINS?

To identify cryptocurrencies with Flag patterns, visit these altFINS sections:

-

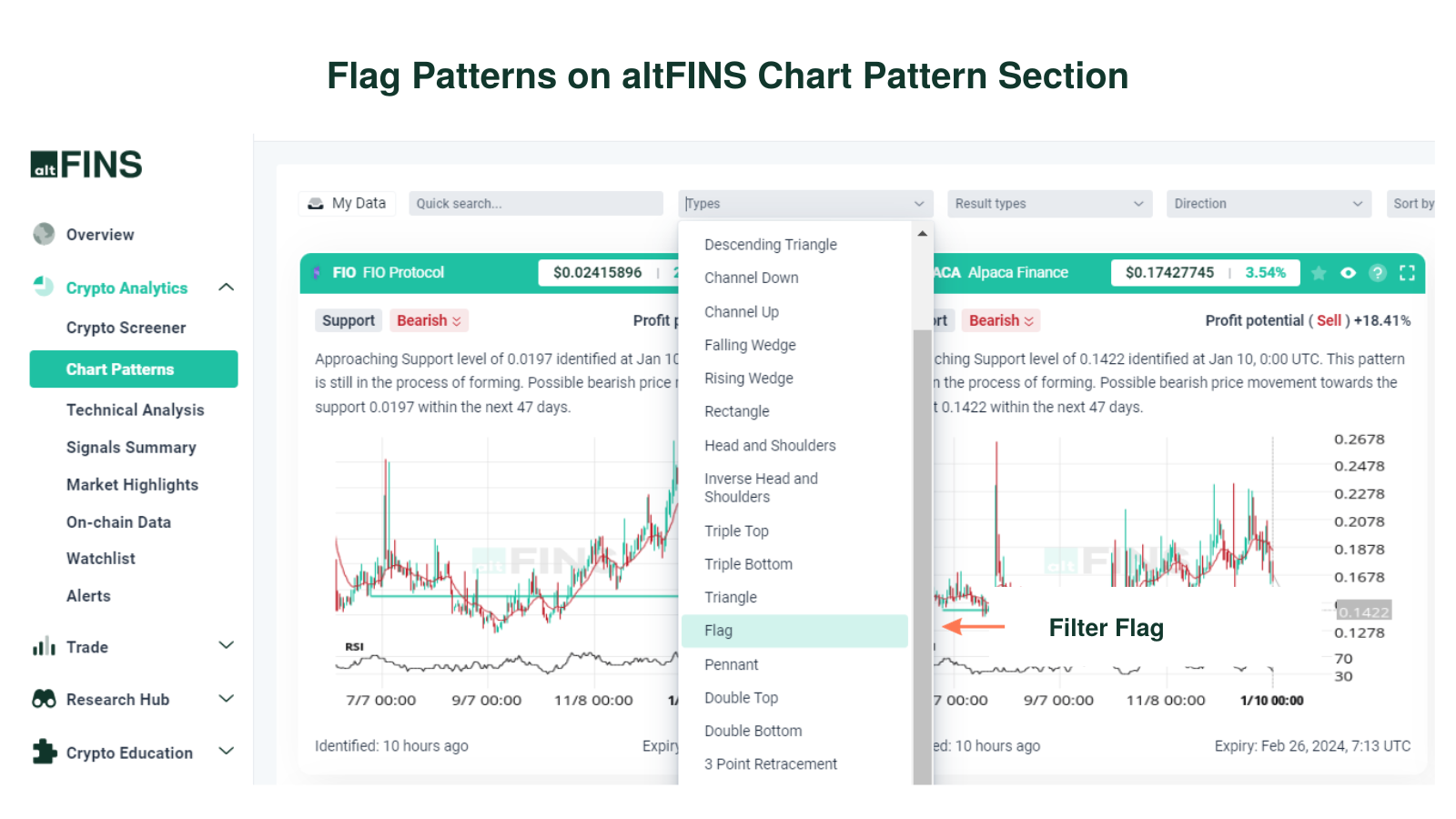

Chart Patterns section:

altFINS’ AI chart pattern recognition engine identifies 26 trading patterns across multiple time intervals (15 min, 1h, 4h, 1d), saving traders a ton of time.

You can filter chart patterns by type, profit potential, success rate, buy or sell direction, exchange, and more.

-

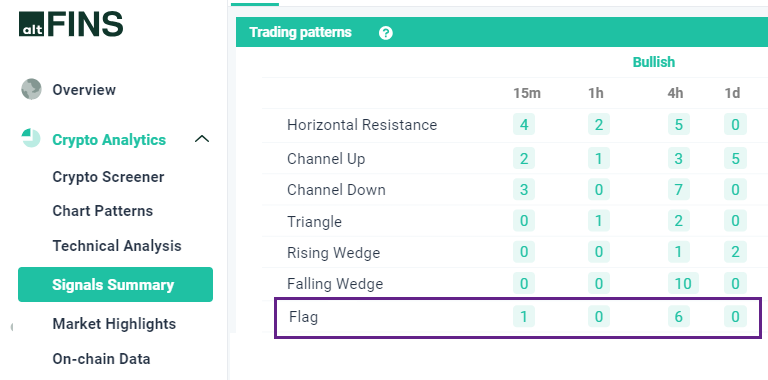

Signals Summary

Crypto signals represent a summary of pre-defined and custom filters for trading strategies. Signals Summary is a great starting point for discovering trading opportunities. Ascending triangle chart patterns can be found in the Trading Patterns category.

-

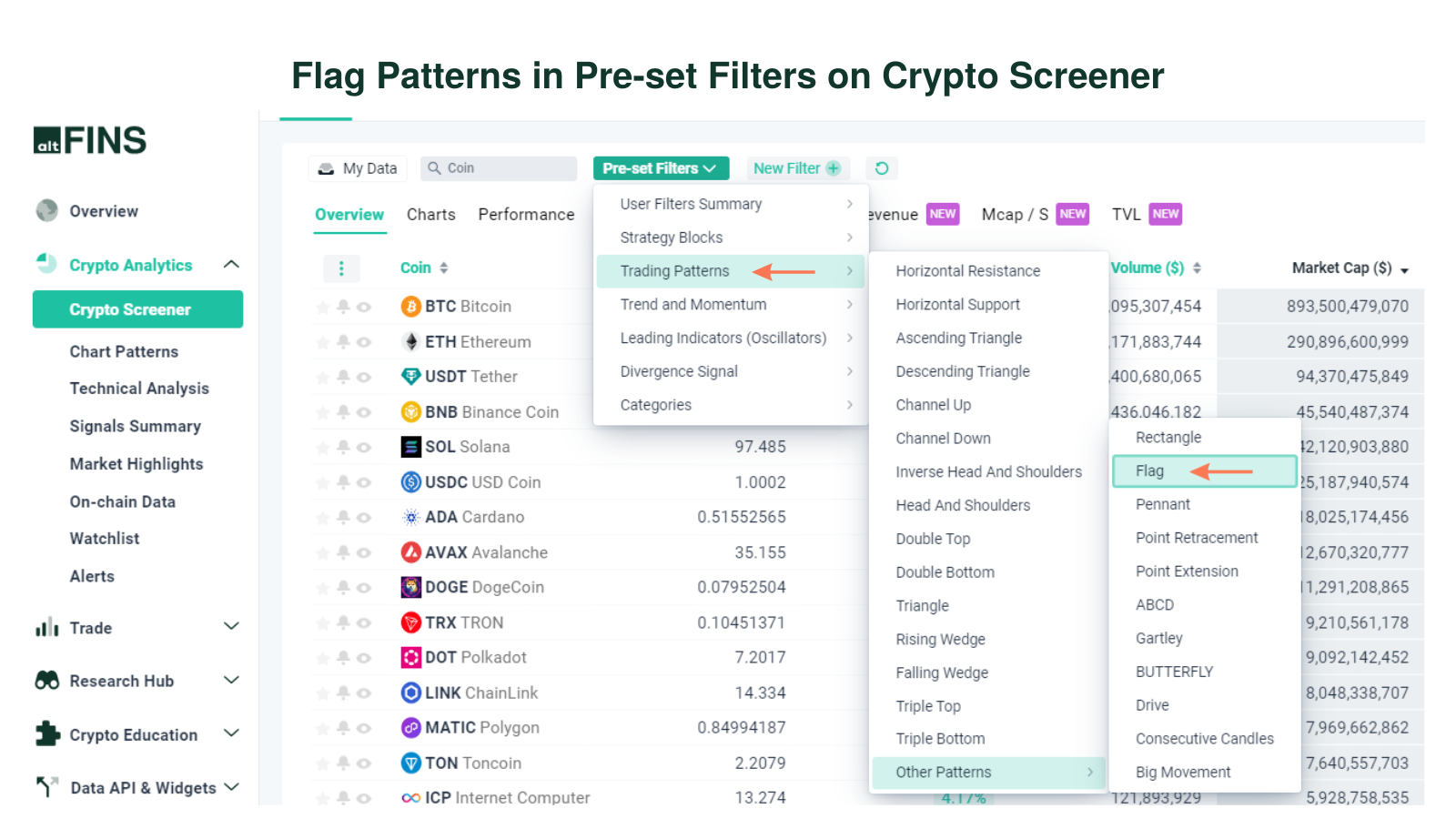

Crypto Screener – Pre-set filters

altFINS offers the best free crypto screener. It includes a wide range of pre- set filters to help find the best cryptocurrencies to invest in based on your specific trading strategy. Learn how to use crypto screener.

-

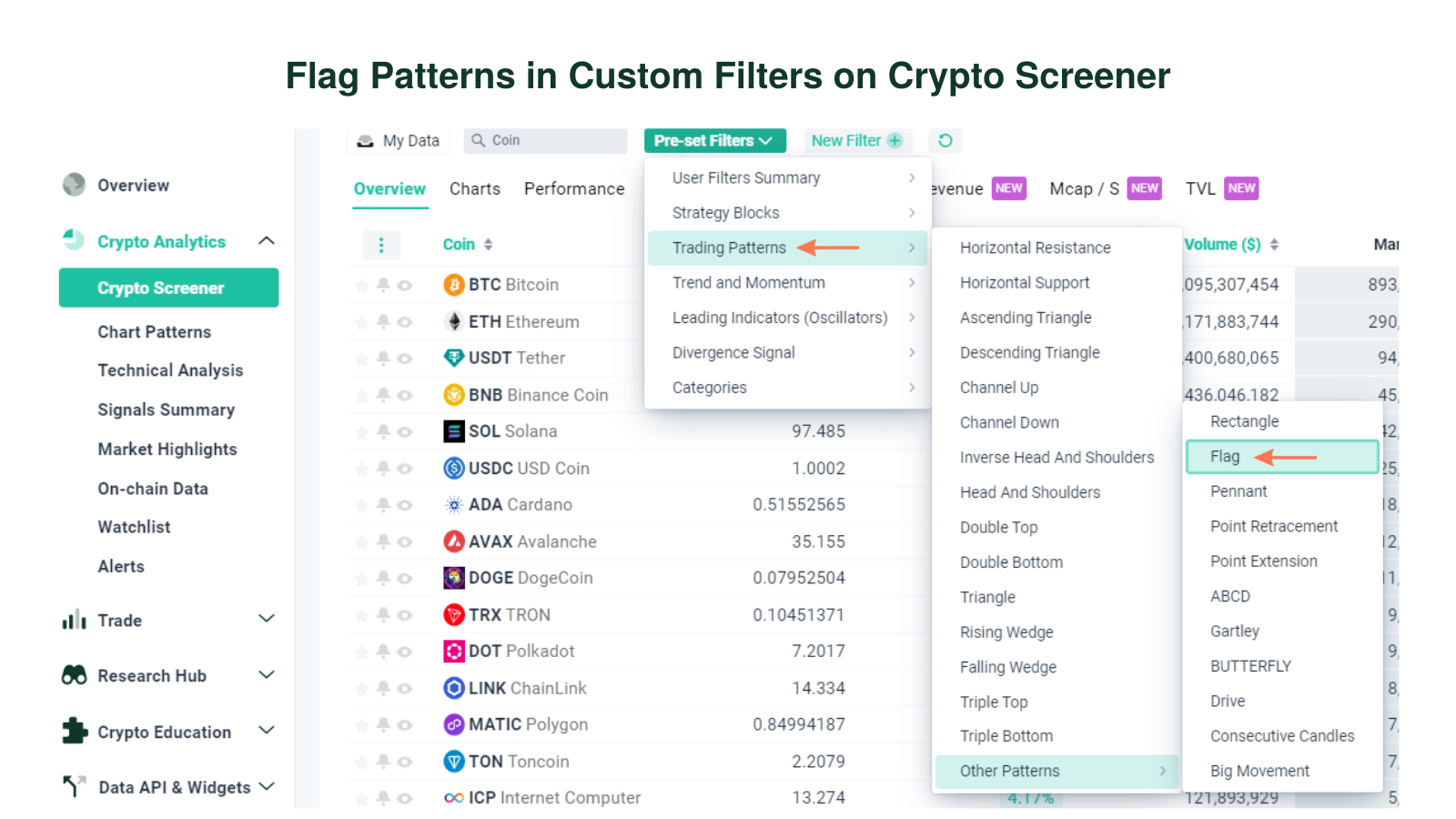

Crypto Screener – Custom filters

You can set up your own custom screens using combinations of technical indicators (SMA, EMA, RSI, MACD), variables like market cap, traded volume and price performance. You can also create price alerts for your scans.

-

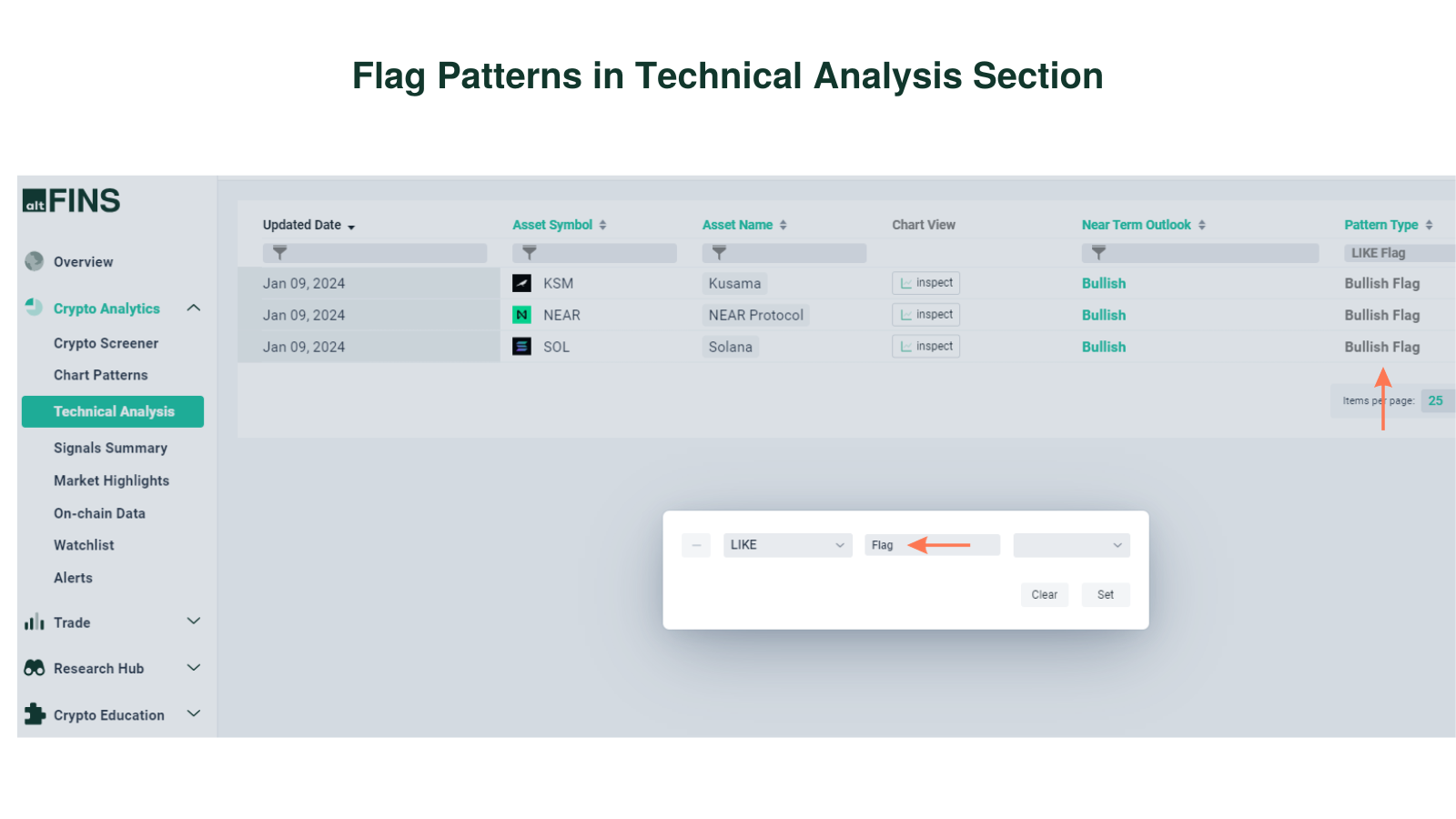

Technical Analysis

altFINS’ analysts conduct technical analysis of top 60 coins. The technical analysis is simple and consistent. It follows the key concepts of Technical Analysis (TA): 1) Trend 2) Momentum 3) Volume 4) Chart Patterns 5) Support and Resistance.

Go to Technical Analysis Section

More tips:

- Lean how to trade Chart Patterns?

- What are Crypto Chart Patterns?

- How to Trade Channel Down Pattern?

- How to Trade Channel Up Pattern?

- How to Set up Chart Pattern Alerts?