Search Knowledge Base by Keyword

DEX Swap

What Is DEX Swap?

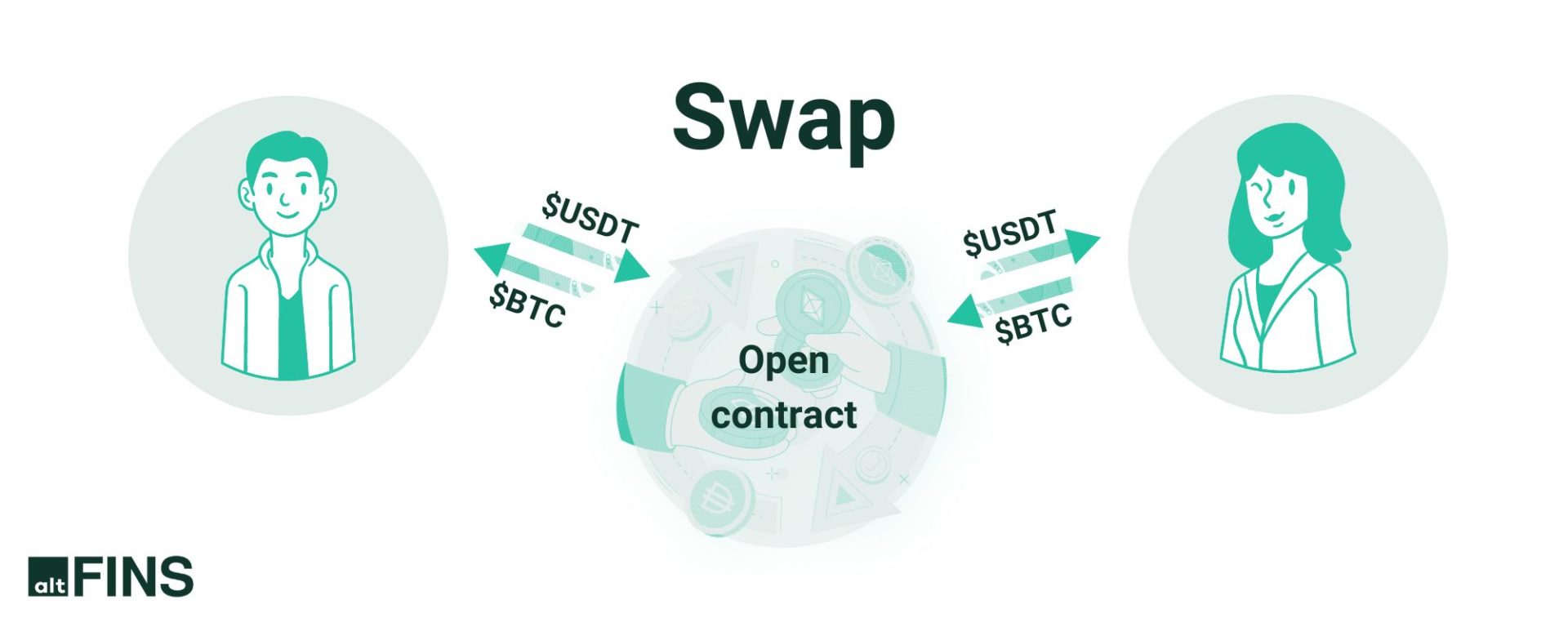

The process of trading one cryptocurrency for another using a smart contract-based exchange protocol is known as “swapping” on a DEX (decentralized exchange). Users can exchange cryptocurrencies directly with one another utilizing a decentralized, trustless platform thanks to DEXs. It eliminates the need for a centralized intermediary.

A user normally connects their digital wallet to the DEX platform. They choose the cryptocurrency they desire to trade in order to swap on the DEX. After selecting the cryptocurrency they want to receive in exchange, they would enter the desired exchange amount. The exchange is then carried out through the DEX’s smart contract, and the user’s digital wallet receives the freshly acquired coin.

A DEX’s liquidity pool, which is a collection of user-contributed money that enable trading on the platform, facilitates the swapping process. The smart contract accesses the liquidity pool when a user requests a swap and exchanges the requested cryptocurrency at the going rate. The liquidity pool makes sure there is enough liquidity available for trade, allowing for quicker transactions and improved price stability.

Since there is no need for a centralized intermediary when swapping on a DEX, there is less chance of hacking or other security breaches than there might be on centralized exchanges. Due to the ability for users to keep ownership of their private keys and do direct business with other users, DEXs also provide better privacy and financial control.

However, trading on a DEX may have some drawbacks. Since DEXs frequently have lower trading volumes than centralized exchanges, there might not be as much liquidity, which could lead to longer trade execution times or greater price slippage.

Types Of Decentralized Crypto Swap?

DEX swaps come in a variety of forms, each with advantages and features:

-

- Automated Market Maker (AMM) Swaps: AMM swaps allow for direct trading between users by using a liquidity pool that is managed by a smart contract. To maintain pool balance and guarantee that trades are carried out at fair market value, the price of each cryptocurrency in the pool is established using a mathematical formula. The AMM DEXs Uniswap, PancakeSwap, and SushiSwap are all well-known.

- Order Book Swaps: To match buyers and sellers, order book DEXs rely on an order book. When a user places an order, it is recorded in the order book and carried out when another order that matches it is discovered. The price of each cryptocurrency in an order book DEX is set by market supply and demand, unlike AMM swaps. Order book DEXs include altFINS DEX, Matcha, Kyber Network, and 0x as examples.

- Atomic Swaps: An instance of a DEX swap that allows for the direct exchange of cryptocurrency between several blockchain networks is the atomic swap. Atomic swaps rely on a time-locked smart contract to guarantee that the exchange is carried out properly and are trustless and decentralized. Komodo and AtomicDEX are two instances of atomic switch DEXs.

- Derivatives Swaps: Users can trade synthetic assets that mimic the value of an underlying coin through derivatives swaps. Typically, a decentralized derivatives protocol that uses a price oracle to calculate the value of the underlying asset facilitates these swaps. DEXs for derivatives swaps include Synthetix and UMA, for instance.

Join altFINS Community

How Does DEX Swap Work?

DEX swapping works by using liquidity pools, which are smart contracts that hold reserves of at least two cryptocurrencies. To initiate a swap on a DEX, a user connects their digital wallet to the platform, selects the cryptocurrency they want to trade and the one they want to receive in exchange, and inputs the amount they wish to swap.

Once the user approves the transaction, the DEX’s smart contract executes the exchange by accessing the liquidity pool and exchanging the requested cryptocurrencies at the current market rate. The newly acquired cryptocurrency is then transferred directly into the user’s digital wallet. DEXs charge small transaction fees, which are usually much lower than those charged by centralized exchanges. DEX swapping is decentralized and trustless, meaning that users maintain control of their private keys and transact directly with other users without the need for a centralized intermediary.

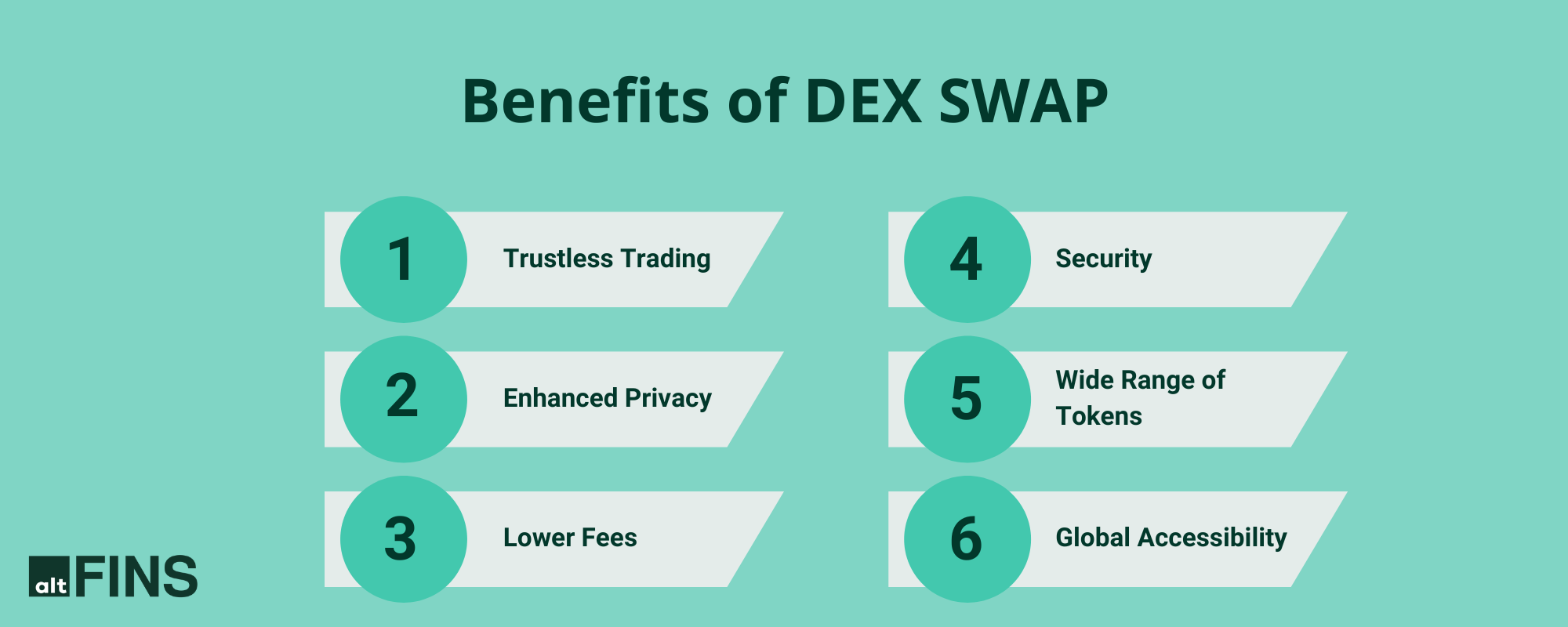

What Are the Benefits of DEX Swap?

- Trustless and Secure Trading: DEX swaps eliminate the need to trust centralized authorities, ensuring that users have full control over their funds and reducing the risk of hacks or theft associated with centralized exchanges.

- Privacy and Anonymity: DEX swaps allow users to trade without extensive KYC requirements, providing enhanced privacy and anonymity compared to centralized exchanges.

- Lower Fees: DEX swaps typically have lower trading fees compared to centralized exchanges, as they eliminate intermediaries and operate on blockchain networks with minimal overhead.

- Global Accessibility: DEX swaps are accessible to users worldwide, enabling participation in trading and access to a wide range of tokens and assets.

- Integration with DeFi: DEX swaps seamlessly integrate with decentralized finance (DeFi) protocols, enabling users to easily participate in yield farming, liquidity provision, and other DeFi activities.

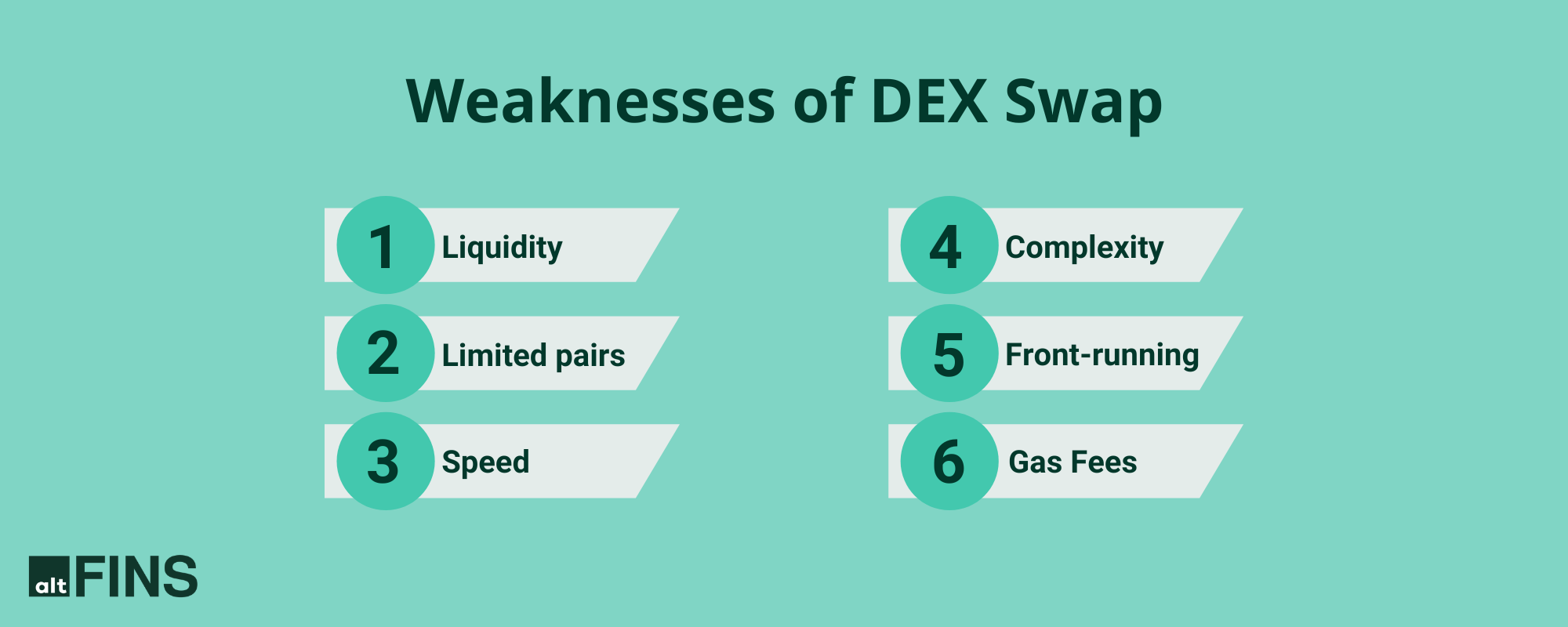

Weaknesses of Decentralized Crypto Swap

Although DEX swapping has many advantages, there are some drawbacks to take into account. The following are some of the primary weaknesses of DEX swapping:

- Decentralized exchanges frequently have lower levels of liquidity than centralized exchanges. It can increase price volatility and slippage when trading big sums.

- Limited Trading Pairs: Compared to centralized exchanges, DEXs often offer fewer trading pairs. It reduces the variety of assets that customers can trade.

- Speed: Due to the requirement for on-chain confirmations, DEX transactions can take longer to complete than those on centralized exchanges.

- Complexity: DEXs might be trickier to use than centralized exchanges, necessitating that users have a working knowledge of smart contracts, decentralized wallet and blockchain technology.

- Even though DEXs are unreliable, front-running can still happen. When a third party submits their own transaction with a greater gas cost in advance of a user’s trade, front-running occurs, which results in the user’s trade failing or being executed at a worse price.

- Gas costs: In order to perform transactions on the blockchain, DEXs often charge customers gas costs, which can be expensive when the network is congested.

The Difference Between Centralized Exchange, Swap and Aggregator

A centralized exchange is a platform where users can trade one cryptocurrency for another or for fiat money. Exchanges often follow a classic client-server design and are centralized. Meaning they are managed by a single company. In order to purchase or sell a cryptocurrency at a specific price, users can issue orders and wait for the exchange to find a counterparty.

Swap allows for the direct exchange of one cryptocurrency for another without the use of an order book or a middleman. Users can trade one cryptocurrency for another depending on the current market price established by a mathematical algorithm or market supply and demand using liquidity pools, which are supported by decentralized exchanges (DEXs). Atomic swaps, which are peer-to-peer transactions between users on various blockchain networks, can also be used to carry out swaps.

A platform known as an aggregator pulls liquidity from many exchanges and DEXs in order to provide users with the best pricing for their trades. To guarantee that trades are performed at the optimal price across all supported exchanges and liquidity pools, these platforms employ algorithms and smart routing. Trades can be carried out via aggregators on both DEXs and controlled exchanges.

In conclusion, while DEX swaps enable direct peer-to-peer transactions without the need for a middleman or order book, exchanges provide a centralized platform for buying and selling cryptocurrencies based on an order book. To provide users with the best rates for their trades across several platforms, aggregators source liquidity from numerous exchanges and DEXs.

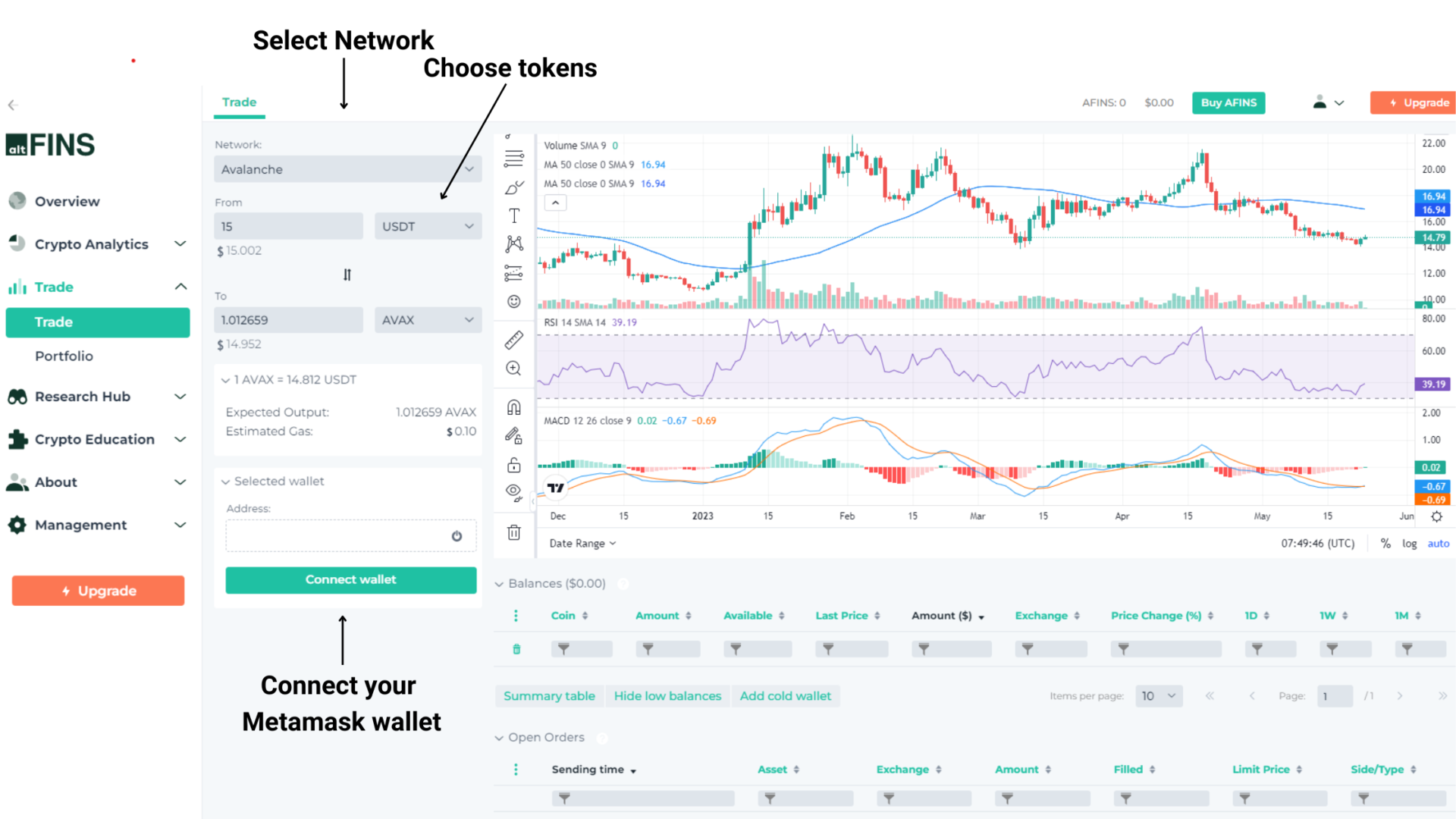

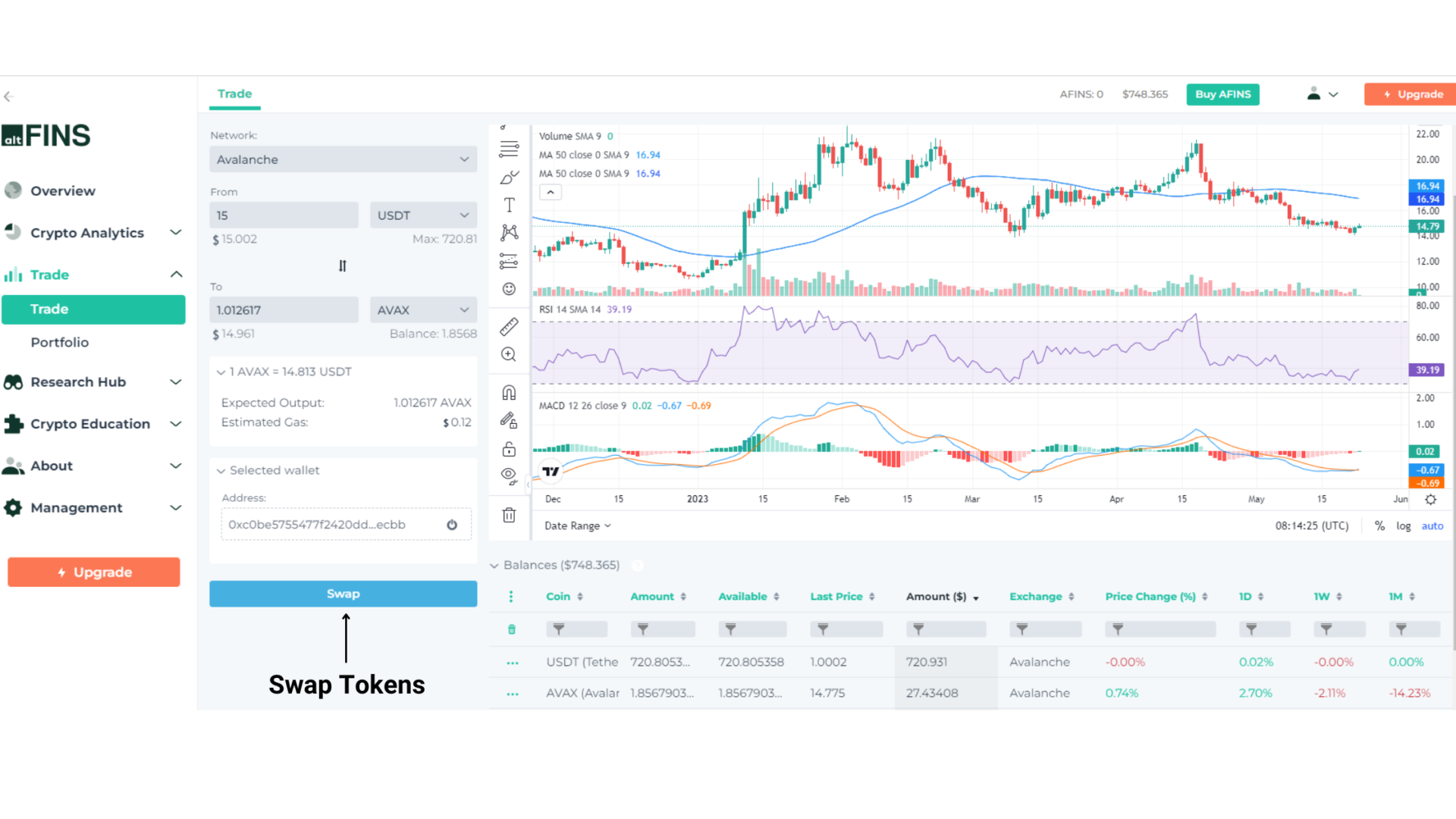

How To Swap on altFINS DEX Aggregator?

To use altFINS DEX Aggregator, follow the steps below to connect your MetaMask Wallet:

1. Visit altFINS.com, sign-up or login if you already have an altFINS account

2. Go to Trade, select altFINS (DEX).

3. Choose Network among: Ethereum, BSC, Polygon, Fantom, Arbitrum, Avalanche

4. Select tokens you want to swap.

5. Connect your MetaMask Wallet.

6. Swap tokens

Why To Swap on altFINS?

The Main Points Of DEX Swap

- DEX Swaps are a smart contract-based exchange protocol that allows users to trade one cryptocurrency for another directly, eliminating the need for a centralized intermediary.

- Liquidity pools make sure there is sufficient liquidity available for trading and enable quicker transactions with improved price stability.

- Swaps have better privacy and financial control than centralized exchanges. They may have longer trade execution times or greater price slippage due to lower liquidity levels.

DEX Swap FAQ

Download Mobile app