Search Knowledge Base by Keyword

How To Trade Inverse Head and Shoulders pattern? | Crypto Chart Pattern

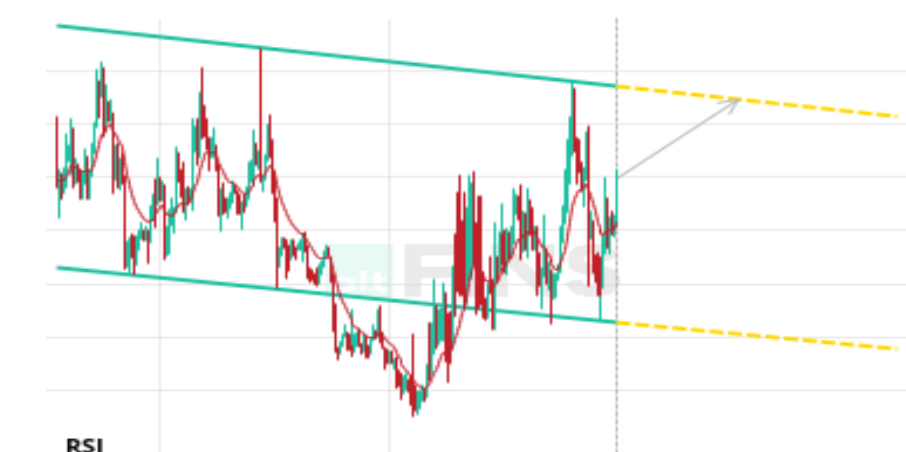

Inverse Head and Shoulder pattern is characterized by three troughs – a lower trough (head) between two higher troughs (shoulders) on a price chart. The first trough forms as the price reaches a low point, followed by a temporary rally. The subsequent decline forms the lower head, followed by a second rally forming the second shoulder.

The pattern is considered complete when the price breaks above the “neckline,” a resistance level connecting the highs of the two shoulders. Investors and traders often interpret the inverse head and shoulders as a shift from bearish to bullish sentiment, anticipating a potential upward trend in the asset’s price.

Inverse Head and Shoulders Pattern: STG Example

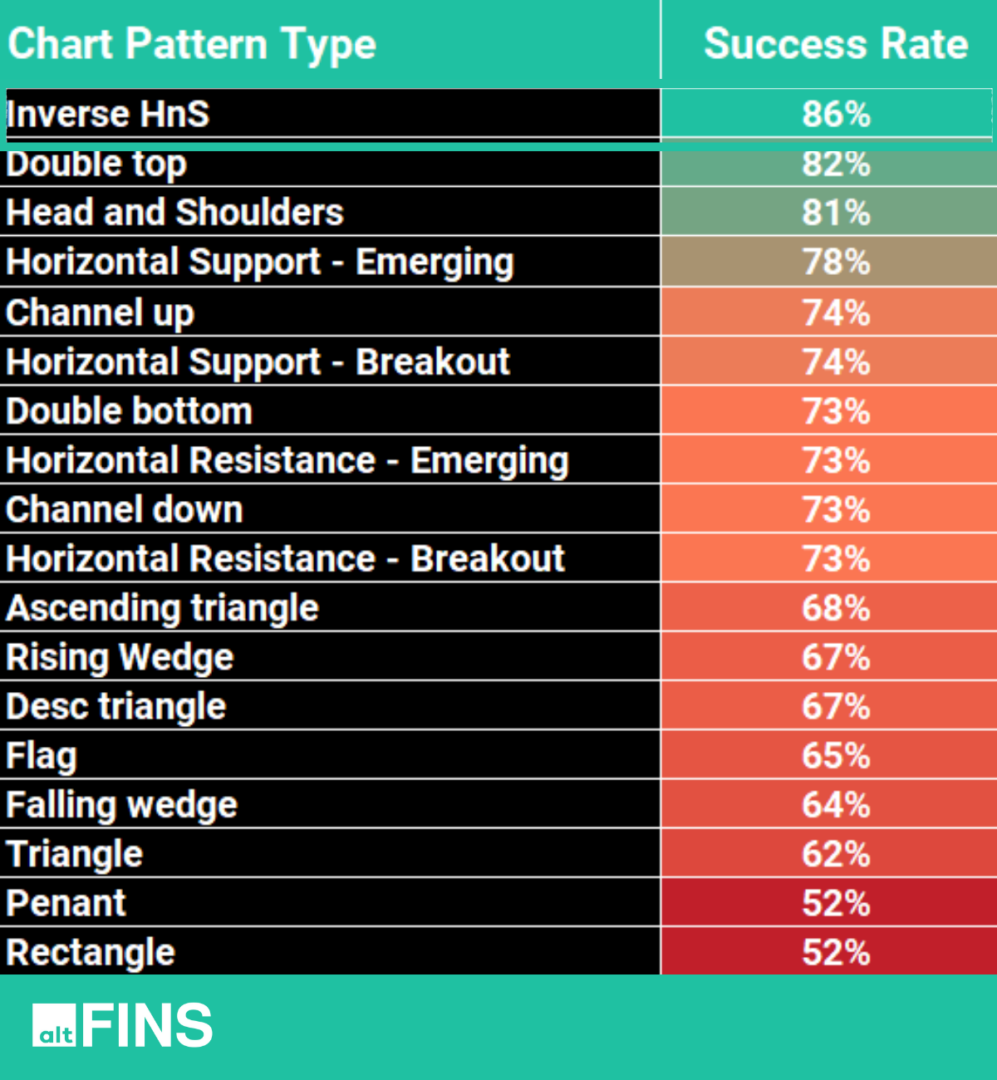

Inverse Head and Shoulders (Bullish) and Head and Shoulders (Bearish) are among patterns with the highest hit rates!

These are also some of the rarest patterns. But they’re well worth waiting for. And waiting is all you need to do because altFINS automatically detects the patterns for you.

Historical backtests conducted on the altFINS platform say that the Inverse Head and Shoulder pattern exhibits an impressive 86%!

According to Investopedia, these are the “Key takeaways:

- An inverse head and shoulders is similar to the standard head and shoulders pattern, but inverted.

- It may be used to predict reversals in downtrends.

- An inverse head and shoulders pattern, upon completion, signals a bull market.

- Investors typically enter into a long position when the price rises above the resistance of the neckline.”

Characteristics of Inverse Head and Shoulder chart pattern

The inverse head and shoulders pattern is a reversal pattern that typically forms after a downtrend and signals a potential change in trend direction. Here are the key characteristics of the inverse head and shoulders chart pattern:

- Structure: The pattern consists of three troughs: a lower low (head) between two higher lows (shoulders). The middle trough (head) is lower than the two surrounding troughs (shoulders).

- Trend Reversal: Inverse head and shoulders are considered bullish reversal patterns. They indicate a potential shift from a downtrend to an uptrend.

- Left Shoulder: The left shoulder is formed at the end of a downtrend and represents the first attempt of the price to reverse.

- Head:The head is the lowest point in the pattern, forming after the left shoulder. It represents a deeper dip in price, often indicating increased selling pressure.

- Right Shoulder: The right shoulder is formed after the head and is usually higher than the left shoulder but lower than the head. It represents another attempt to reverse the downtrend.

- Neckline: The neckline is a horizontal line drawn across the peaks of the left and right shoulders. It serves as a crucial support level. Once the price breaks above the neckline, it is a confirmation of the bullish reversal.

- Volume: Volume is an essential factor in analyzing chart patterns. During the formation of the pattern, volume often decreases as the pattern progresses. However, when the price breaks above the neckline, there should be a noticeable increase in volume, supporting the validity of the reversal.

- Confirmation: The pattern is confirmed when the price breaks above the neckline. Traders often wait for this breakout to enter long positions.

- Price Target: The price target is estimated by measuring the distance from the head to the neckline and then projecting that distance upward from the breakout point. This provides an approximate target for the upward move.

- False Signals: While the inverse head and shoulders pattern is a reliable reversal indicator, it’s essential to be aware of false signals. Not all patterns lead to a significant trend reversal, so confirmation through price action and volume is crucial.

How to trade Inverse Head and Shoulder patterns?

Trading the inverse head and shoulders pattern involves identifying the pattern, confirming its validity, and then executing trades based on the anticipated trend reversal. Here is a step-by-step guide on how to trade the inverse head and shoulders pattern:

- Identification: Look for a downtrend: The inverse head and shoulders pattern typically forms after a prolonged downtrend.

Identify the left shoulder, head, and right shoulder: Locate the three troughs on the chart, with the head being the lowest point. - Confirmation: Wait for the breakout: The pattern is confirmed when the price breaks above the neckline. This breakout should ideally be accompanied by a significant increase in volume, signaling a strong potential for a bullish reversal.

- Entry Point:Enter a long position: Once the price breaks above the neckline and the breakout is confirmed, consider entering a long (buy) position. Some traders prefer to wait for a slight pullback to the neckline before entering to get a better entry point.

- Set a stop-loss order: Place a stop-loss order below the neckline to limit potential losses if the breakout turns out to be a false signal. The stop-loss level should be chosen based on your risk tolerance and the characteristics of the specific chart.

- Determine a price target: Measure the distance from the head to the neckline and project that distance upward from the breakout point. This provides an approximate target for the upward move. Consider this target when setting profit-taking levels.

- Volume Confirmation: Confirm with volume: Ensure that the breakout is supported by a significant increase in trading volume. Volume confirmation adds credibility to the validity of the pattern.

- Monitor the Trade:Keep an eye on the trade: Watch how the price behaves after the breakout. If the price continues to move upward and reaches your profit target, consider taking profits. If the price starts to reverse and break below the neckline again, it might be a signal that the pattern is failing.

- Additional Technical Analysis:Use other technical indicators: Consider complementing your analysis with other technical indicators, such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence), to gain further confirmation and insights into market conditions.

- Risk Management:Manage risk: Always use proper risk management techniques, including setting stop-loss orders and not risking more than a predefined percentage of your trading capital on a single trade.

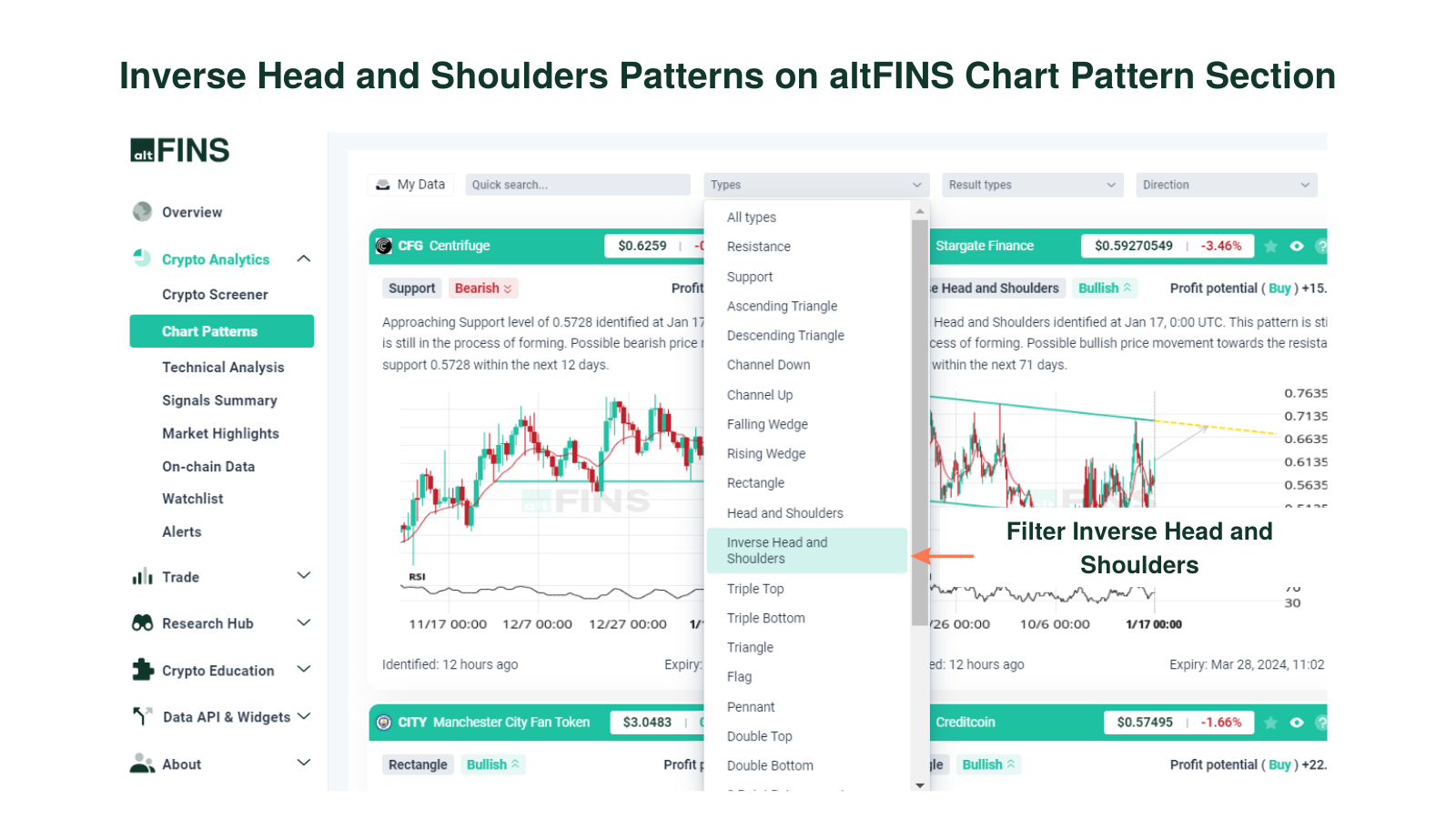

How To Identify Inverse Head and Shoulders Pattern on altFINS?

To identify cryptocurrencies with Inverse Head and Shoulders Pattern, visit these altFINS sections:

-

Chart Patterns section:

altFINS’ AI chart pattern recognition engine identifies 26 trading patterns across multiple time intervals (15 min, 1h, 4h, 1d), saving traders a ton of time.

You can filter chart patterns by type, profit potential, success rate, buy or sell direction, exchange, and more.

-

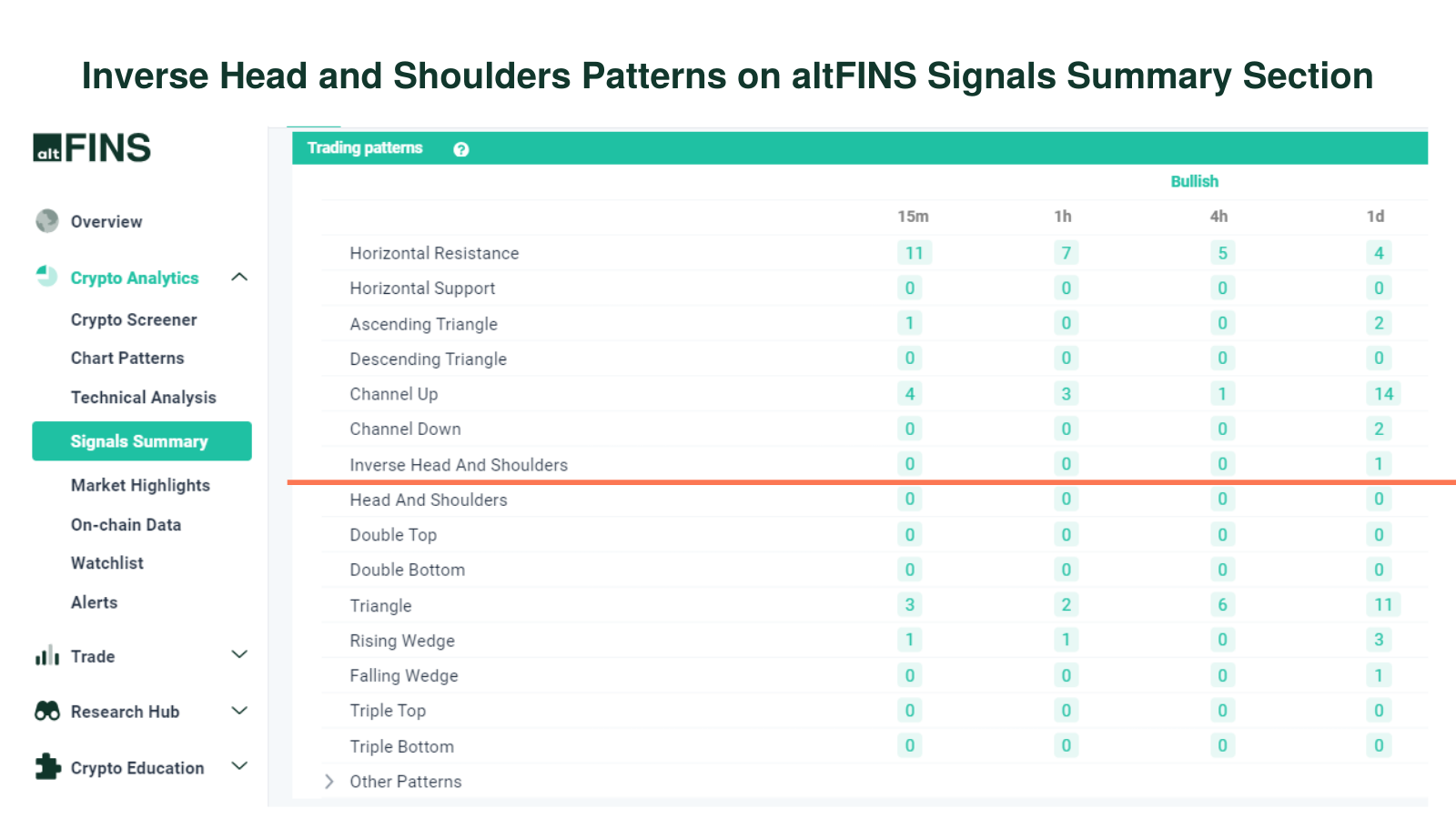

Signals Summary

Crypto signals represent a summary of pre-defined and custom filters for trading strategies. Signals Summary is a great starting point for discovering trading opportunities. Ascending triangle chart patterns can be found in the Trading Patterns category.

-

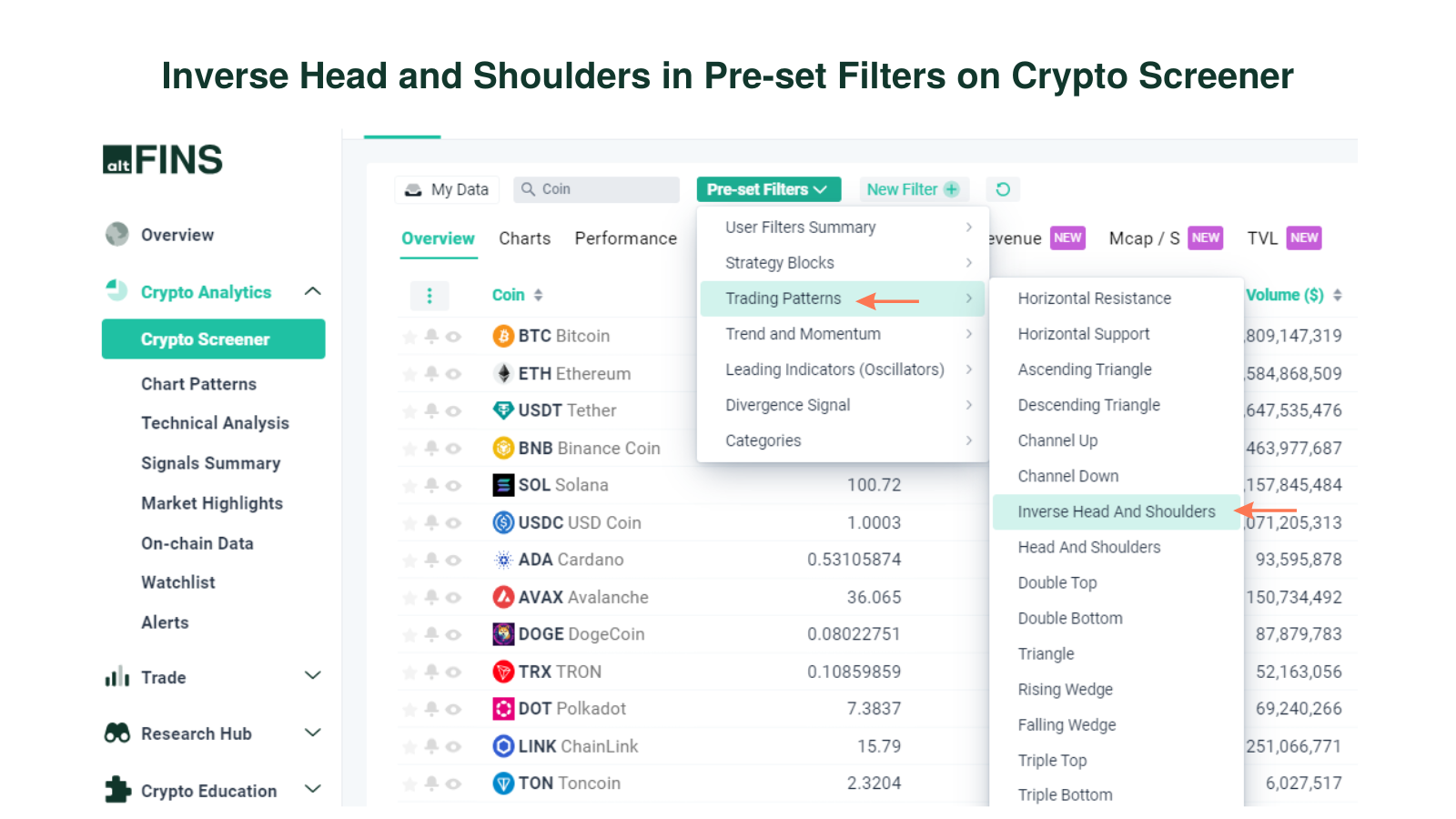

Crypto Screener – Pre-set filters

altFINS offers the best free crypto screener. It includes a wide range of pre- set filters to help find the best cryptocurrencies to invest in based on your specific trading strategy. Learn how to use crypto screener.

-

Crypto Screener – Custom filters

You can set up your own custom screens using combinations of technical indicators (SMA, EMA, RSI, MACD), variables like market cap, traded volume and price performance. You can also create price alerts for your scans.

-

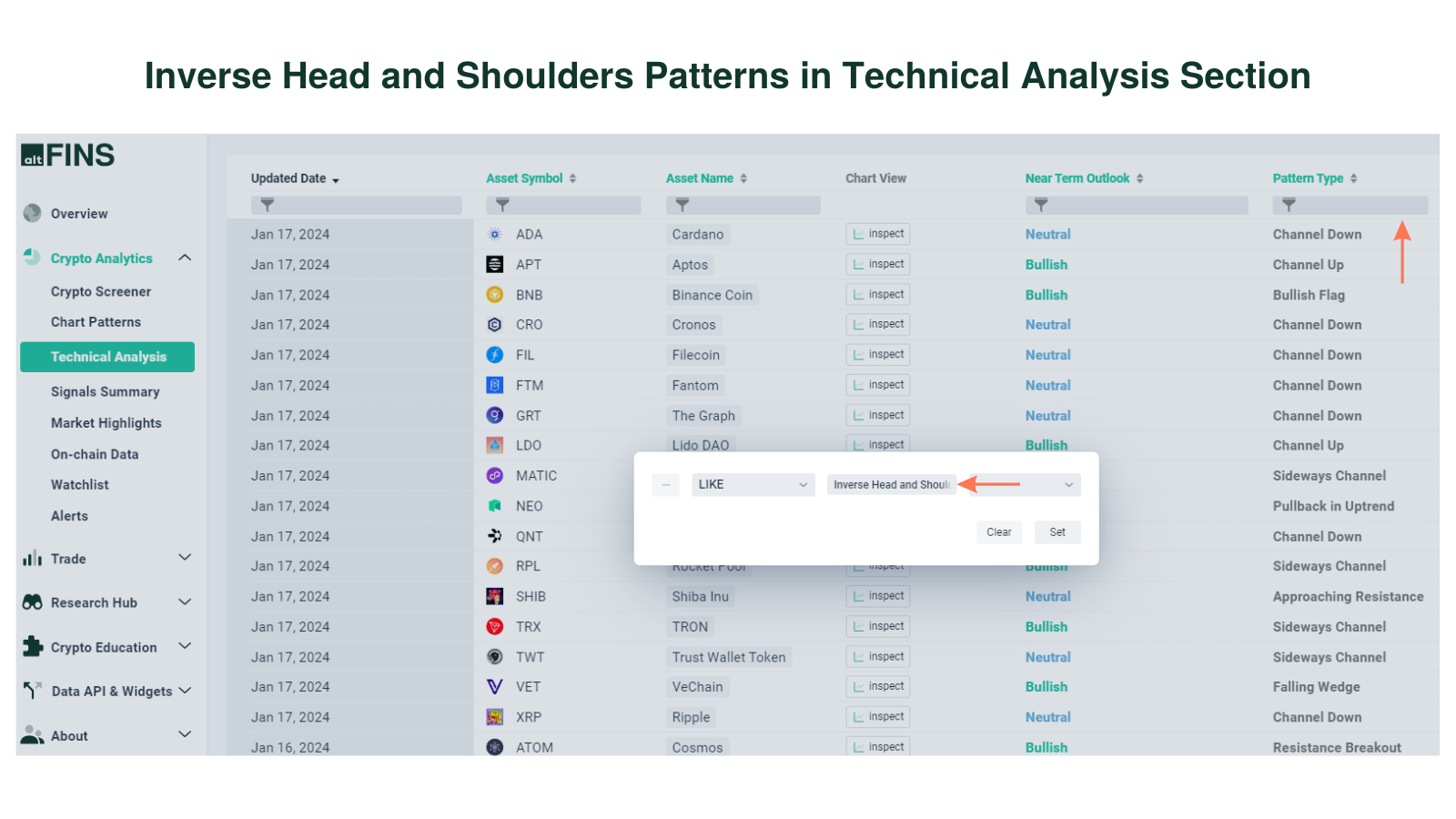

Technical Analysis

altFINS’ analysts conduct technical analysis of top 60 coins. Thea technical nalysis is simple and consistent. It follows the key concepts of Technical Analysis (TA): 1) Trend 2) Momentum 3) Volume 4) Chart Patterns 5) Support and Resistance.

Go to Technical Analysis Section

More tips:

- Lean how to trade Chart Patterns?

- What are Crypto Chart Patterns?

- How to Trade Channel Down Pattern?

- How to Trade Channel Up Pattern?

- How to Set up Chart Pattern Alerts?

- How To Trade Rising Wedge pattern?

- How To Trade Falling Wedge pattern?