Search Knowledge Base by Keyword

Where To Buy And Sell Cryptocurrency?

Buying and selling cryptocurrency is getting easier every day. There are several crypto providers like centralized or decentralized exchanges or brokers where you can buy or sell cryptocurrency in few steps.

To buy or sell cryptocurrency, all you need is access to an exchange or a broker to trade crypto. And a way to deposit your fiat money (USD, EUR) to buy crypto. You also need a tool to scan the crypto market for trading ideas and strategies.

As a next step, you can place your cryptocurrency buy or sell order. Before buying your cryptocurrency, consider the storage method for your digital assets. Some providers offer custody services for your digital assets instead of having your own currency wallet.

Traditional brokers offering crypto assets in their product mix have the advantage of offering a wide selection of investible assets. Whereas crypto exchanges are limited to digital currencies and tokens.

What Are The Differences Between Centralized (CEX) and Decentralized (DEX) Execution Venues?

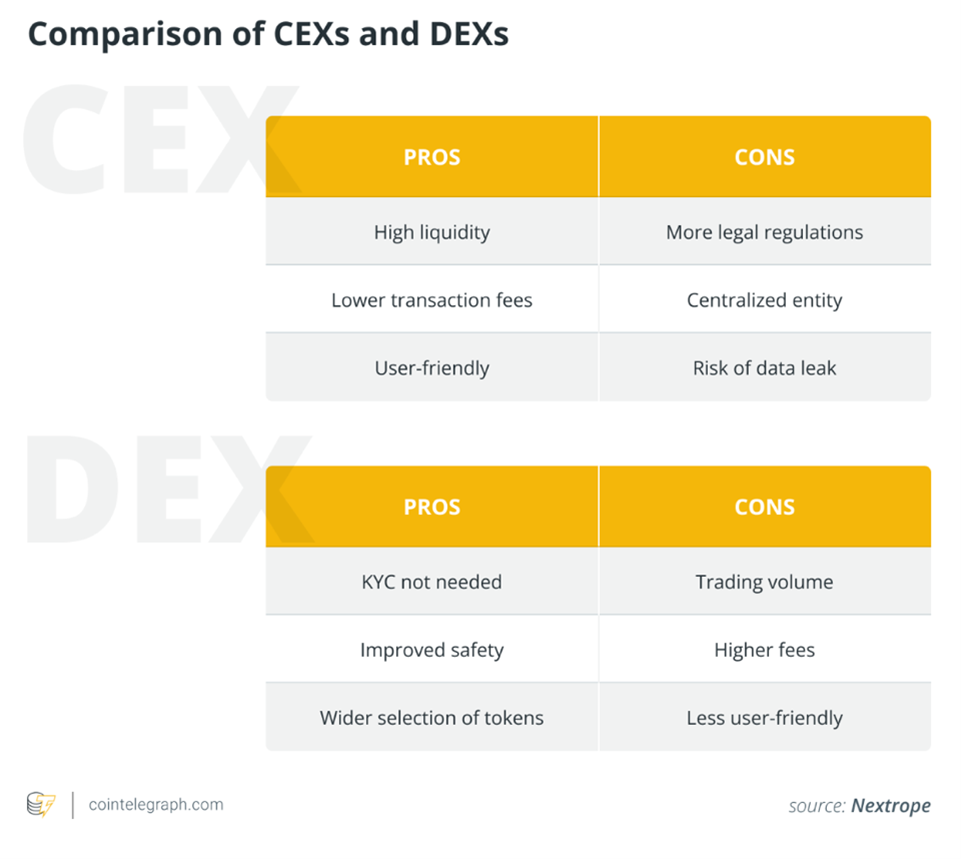

In terms of a difference between centralized (CEX) and decentralized (DEX) exchanges, DEXs have wider selection of tokens with easier access to newly listed tokens. So if you’re looking for potentially giant gains on newly created blockchain projects (DeFi, NFTs), DEX is the way to go. They also possess anonymity and have lower counterparty risk. As users must self-custody their digital assets in own wallets, unlike using CEXs, where the exchange takes care of the custody of users’ assets.

Traders usually start with CEX and add DEX when they start looking for new altcoins listings. But if you’re looking to systematically trade altcoins, you need solid liquidity, low fees, and fast trade execution, which means CEX is still the way to go.

Moreover, DEXs do not perform KYC and ALM checks for its users. This makes them more vulnerable to hacks, money laundering and make it impossible for traditional institutional asset managers to use due to their regulatory compliance requirements. That said, DEXs continue to make strides toward refining the user experience and developing their scalable infrastructure year by year.

In overall, DEXs have higher fees than CEXs and the biggest disadvantage of DEXs is that they currently have lower trading volumes as they are still young and attract mostly more experienced traders as opposed to retail investors and newcomers who prefer CEXs for more convenience, security, and digital asset custody services.

Source: Cointelegraph

Some of the biggest CEXs are now regulated and authorized entities, like for example Binance, FTX, Kraken or Coinbase. They benefit from much higher liquidity compared to DEXs and offer user friendly platforms for newcomers and retail investors, which makes their user base much bigger than that of DEXs. Some of these CEXs even provide insurance on deposited assets attracting even more retail investors.

On the other hand, DEX are basically peer-to-peer (P2P) platforms and work directly with users’ crypto wallets like MyEtherWallet or MetaMask. The most famous DEXs include Uniswap, dYdX, Curve, PancakeSwap, TraderJoe, Sushiswap, DODO, Synthetix, etc.

Where To Buy and Sell Cryptocurrency?

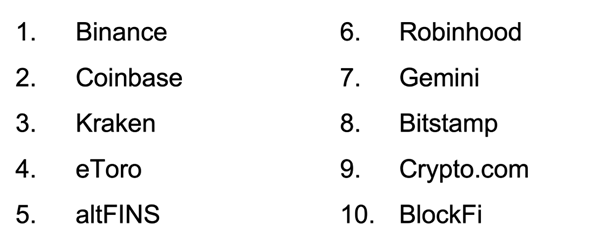

Below we list TOP 10 venues for buying and selling cryptocurrency. Some of them also offer investing and active trading services including technical coin analytics as well as more fundamental reviews of specific crypto projects.

What Are The Differences Between Investing And Trading Cryptocurrencies?

Investing typically refers to longer term holding of cryptocurrencies (aka HODLing) while trading implies more frequent buying and selling of altcoins.

Investing is often based on fundamental research and analysis of crypto projects including their use case, tokenomics, product roadmap, competition, founders, level of decentralization, token supply, on-chain data, etc. Cryptocurrency trading is driven by various strategies including news driven, sentiment driven, technical analysis, arbitrage, etc.

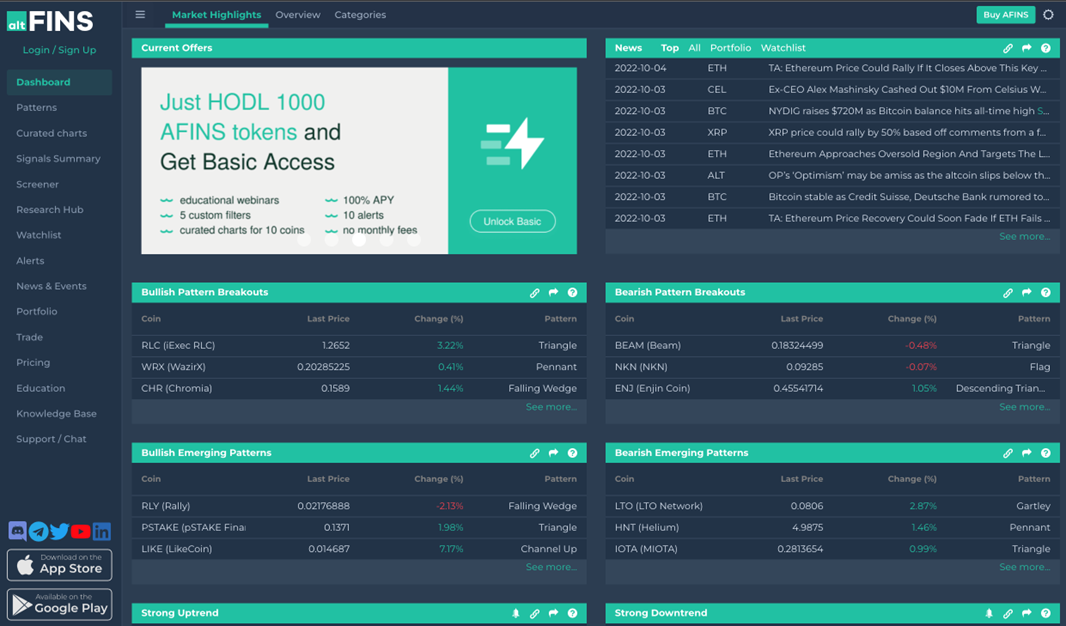

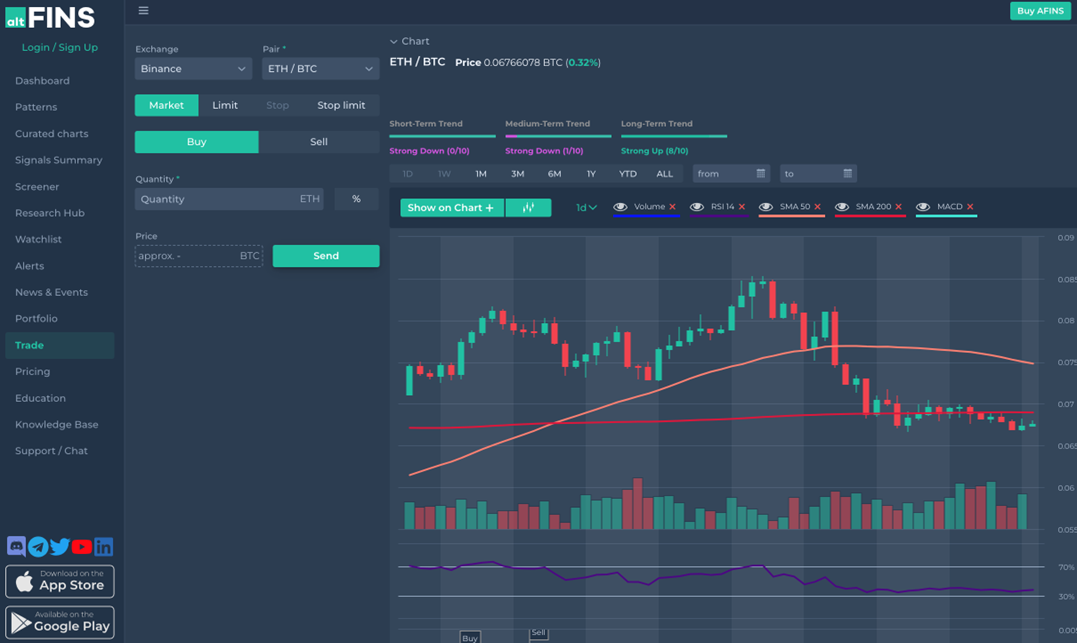

Buy Cryptocurrency With altFINS In Few Easy Steps

Here we explain how to buy cryptocurrency using altFINS platform, simple execution in few easy steps.

- Visit altFINS and sign up or login if you already have an altFINS account:

- Connect to your wallet and your preferred centralized exchange in your Account Settings, via quick guide.

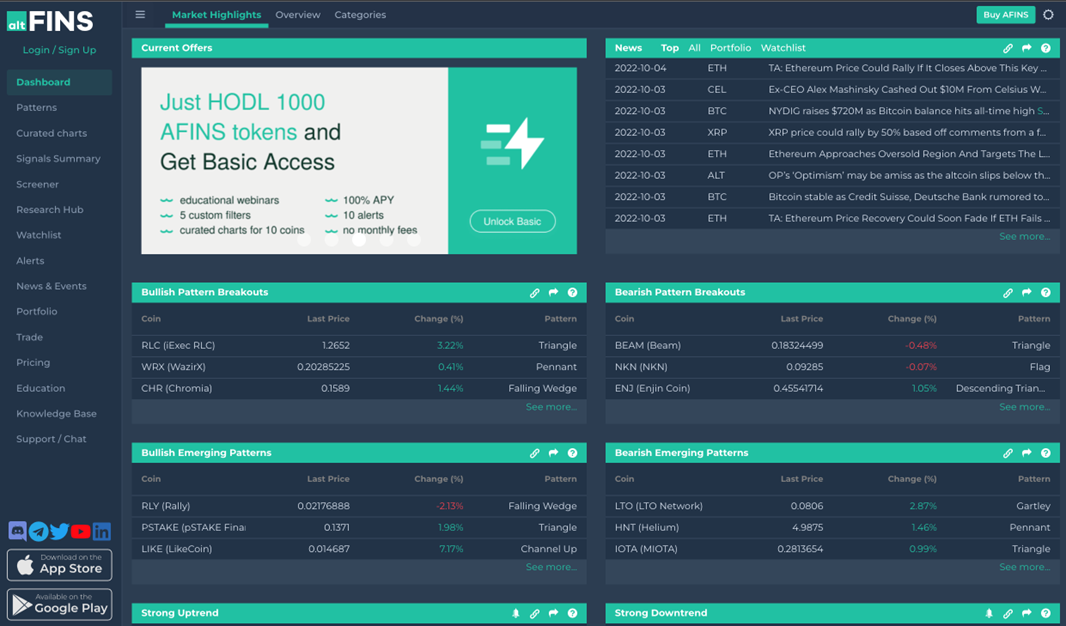

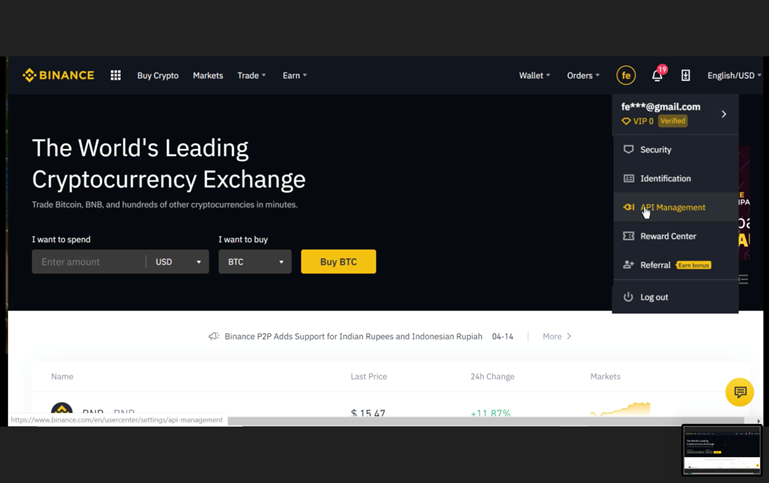

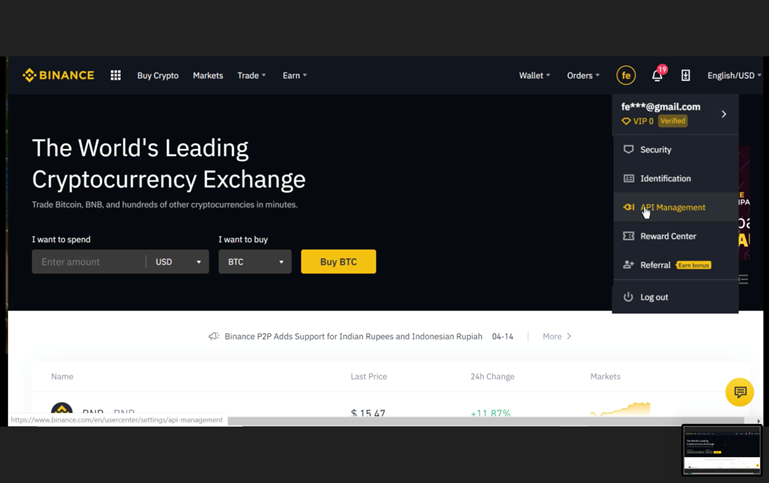

- For example, connecting to a centralized exchange, Binance, where you already have an account, go to API Management located in your Profile dropdown menu:

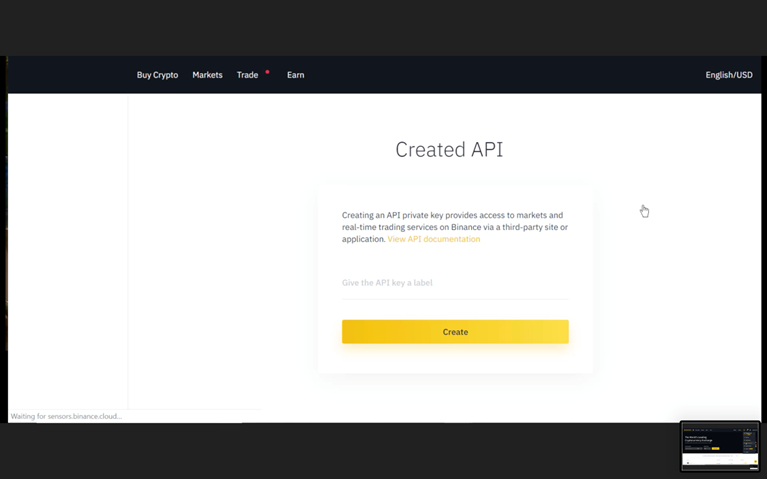

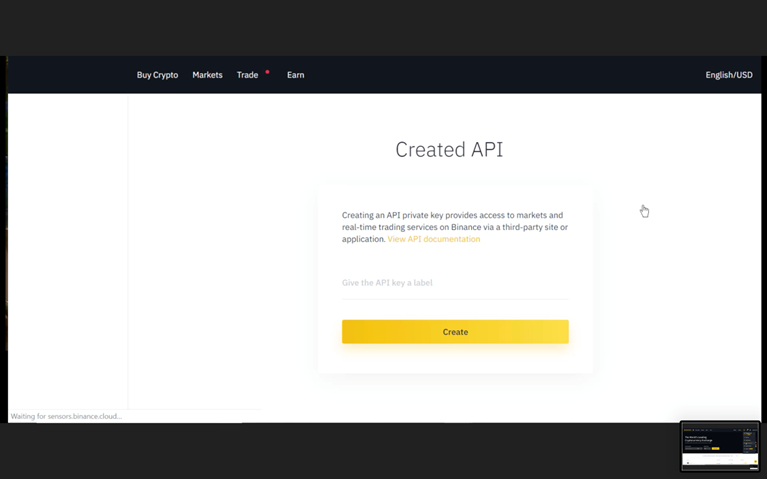

- Create API Name as you like:

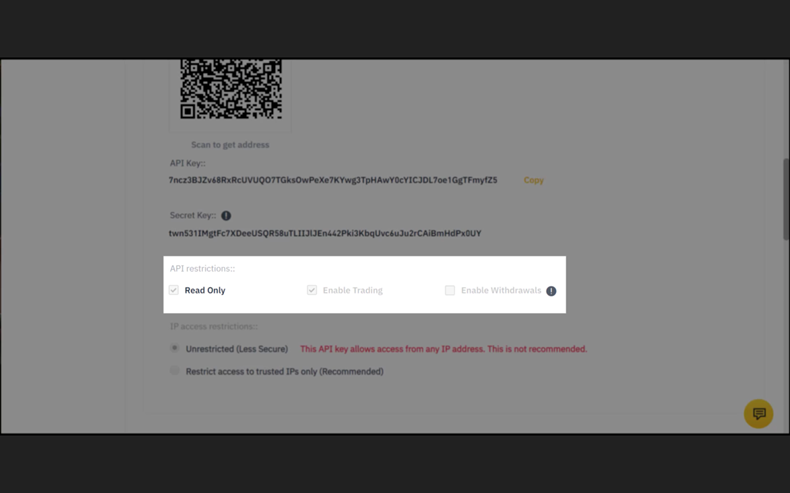

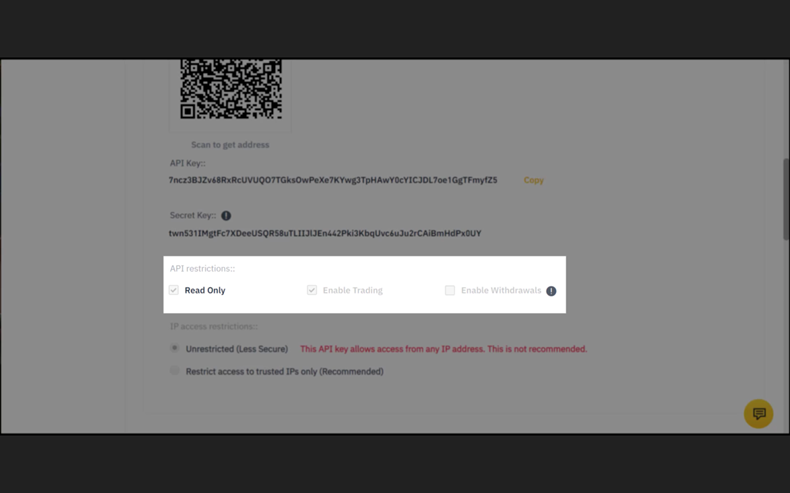

- After several steps followed by double authentication and verification process, you will get your new API Key and Secret Key generated. You can now set up the API restrictions with Read Only and Enable Trading rules, and disabling Withdrawals.

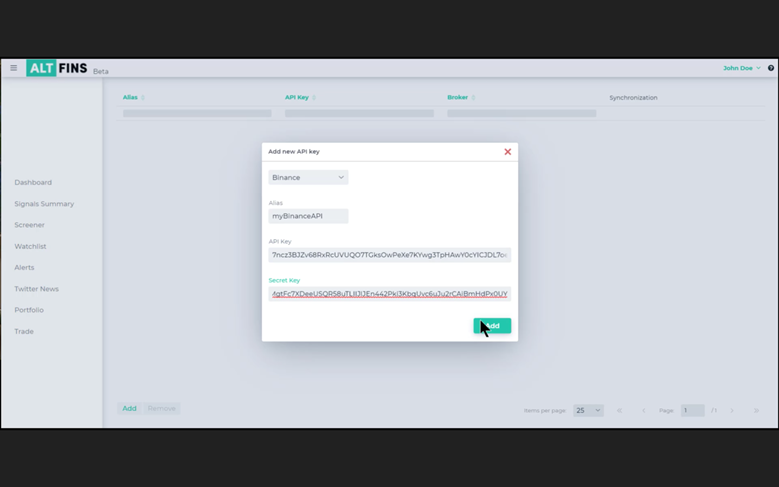

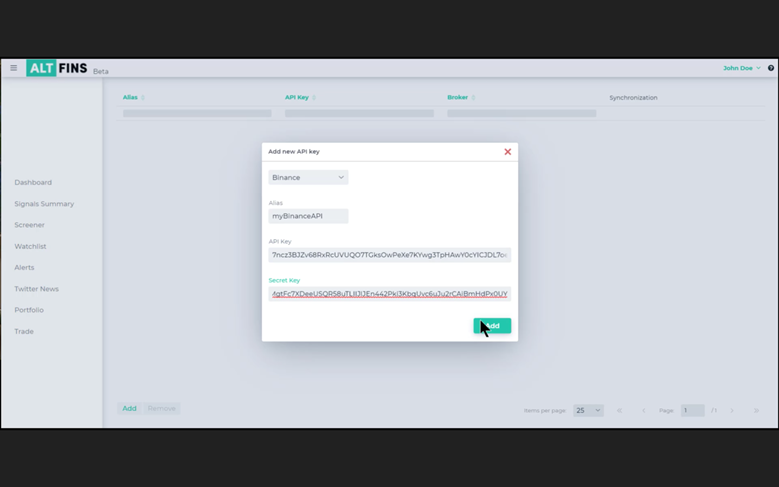

- Go back to altFINS platform, select your Profile Name > Accounts > Exchanges > Add and paste your API Name/Alias, API Key and Secret Key into the fields provided, and hit Add:

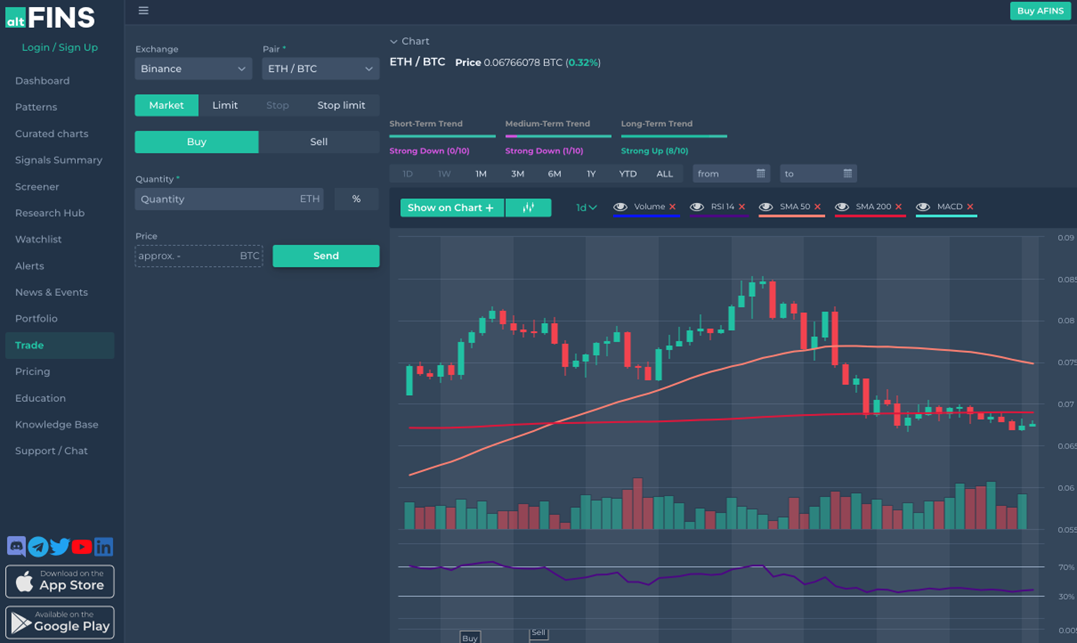

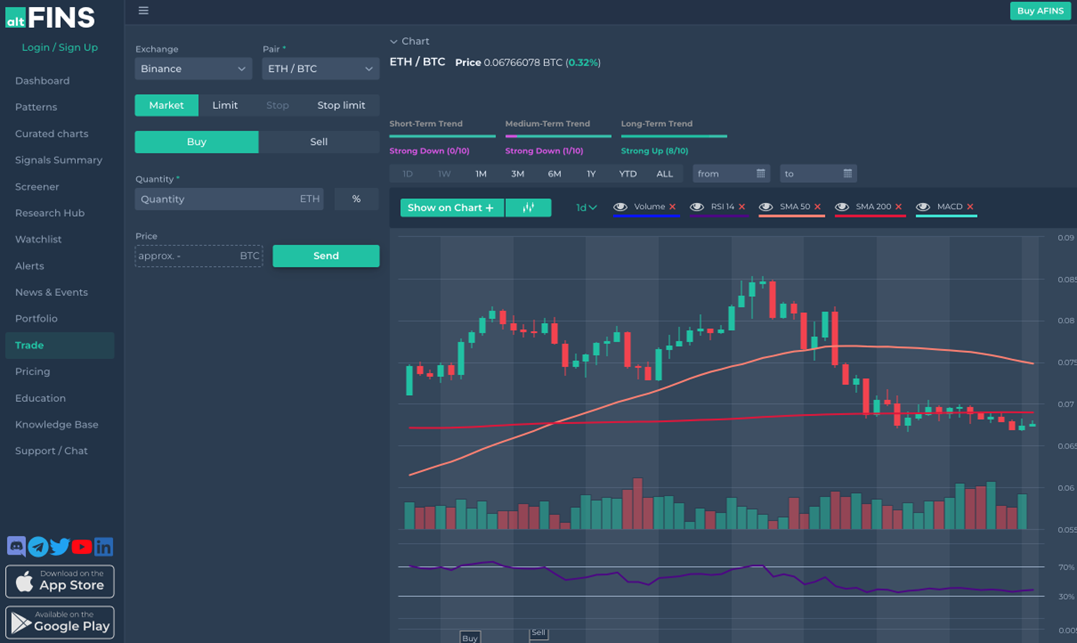

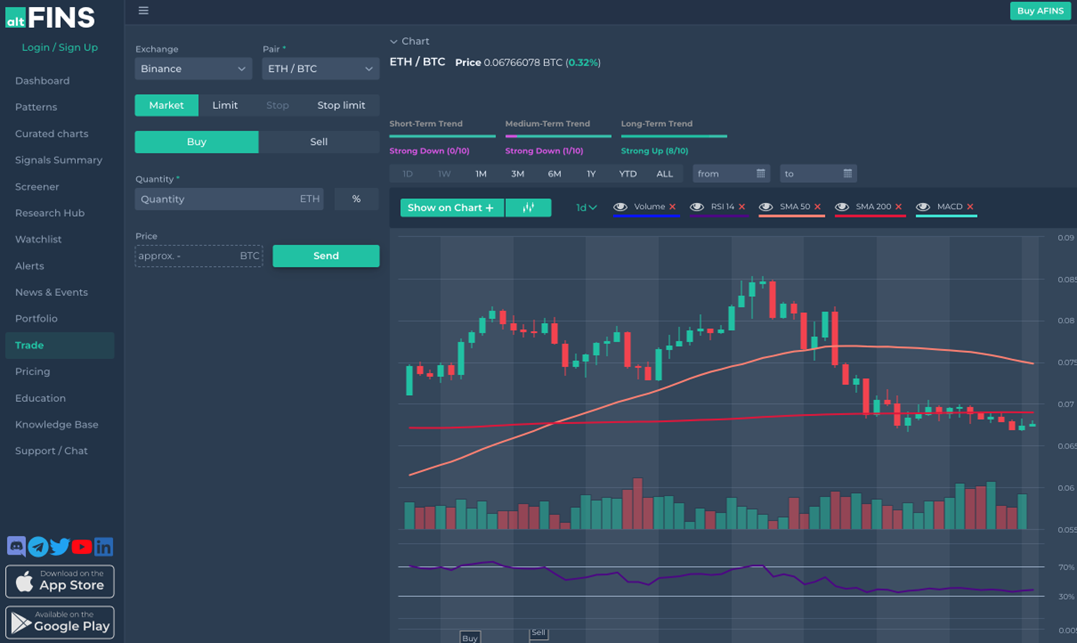

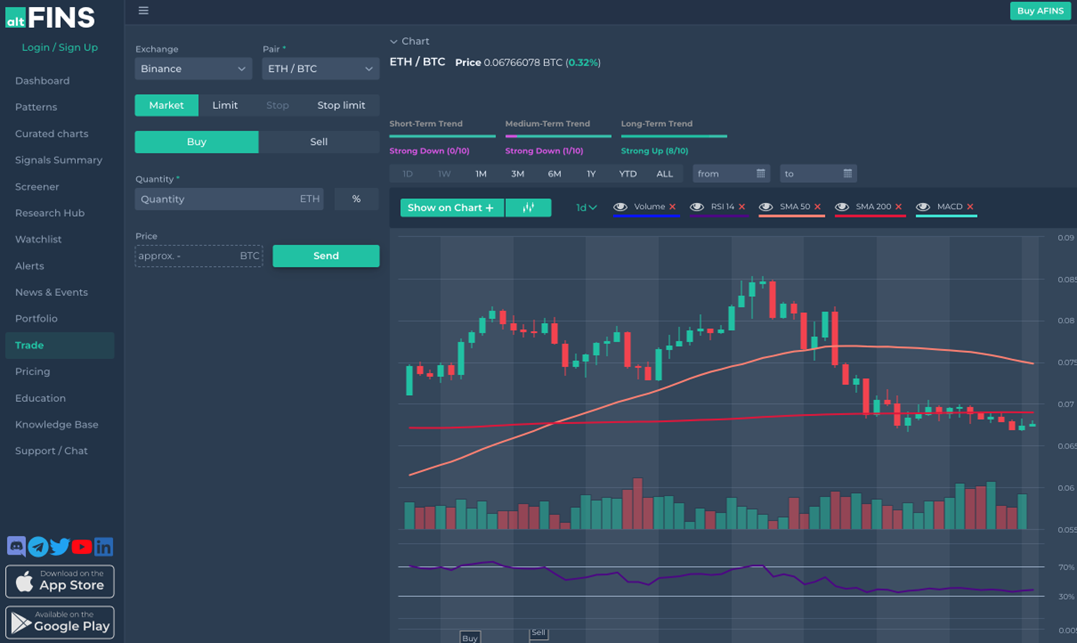

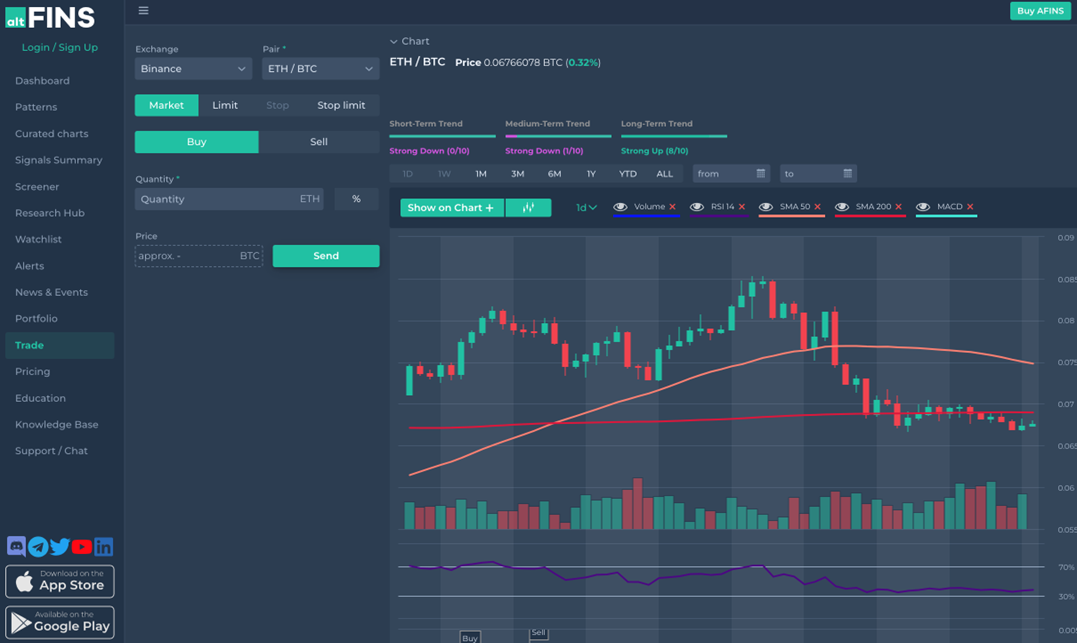

- Go to Trade, select your Exchange that you have just connected to altFINS and choose your Pair:

- Select if you want to trade at Market, Limit, or Stop Limit Order.

What is Market Order?

A market order to buy is an instruction to buy an asset immediately at the market’s current price, or the best offer price. On the other hand, a market order to sell is an instruction to sell an asset immediately at the market’s current price, or the best bid price.

What is Limit Order?

When you set a limit order, you choose a maximum purchase (BID) price or minimum sale (OFFER) price. Your exchange will automatically attempt to fill the limit order when the market price meets your limit price. This order is useful when you have a target entry or exit price and do not mind waiting for the market to meet your set conditions.

For example, if the market price of Bitcoin is $20,000 (USDT), you could set a buy limit order at $19,000 to purchase BTC as soon as the price hits $19,000 or lower in case of very volatile moves. You might also place a sell limit order at $21,000. Meaning that the exchange will sell your BTC if the price goes to $21,000 or higher.

What is Stop-Limit Order?

Stop-limit order combines a stop trigger and a limit order together. The stop order adds a trigger price for the exchange to place your limit order.

- Enter quantity and execute your Buy or Sell cryptocurrency order via the SEND button

How To Sell My Cryptocurrency At altFINS?

altFINS gives users also option to exit their trades. Here is a quick guide explaining how to sell cryptocurrency:

Go to Trade, select your Exchange, choose your Pair. Indicate if you intend to sell at Market, Limit, or Stop- Limit Order. Set the Order, accordingly, enter the quantity and confirm the order by hitting the SEND button:

Alternative Ways How to Buy and Sell cryptocurrency

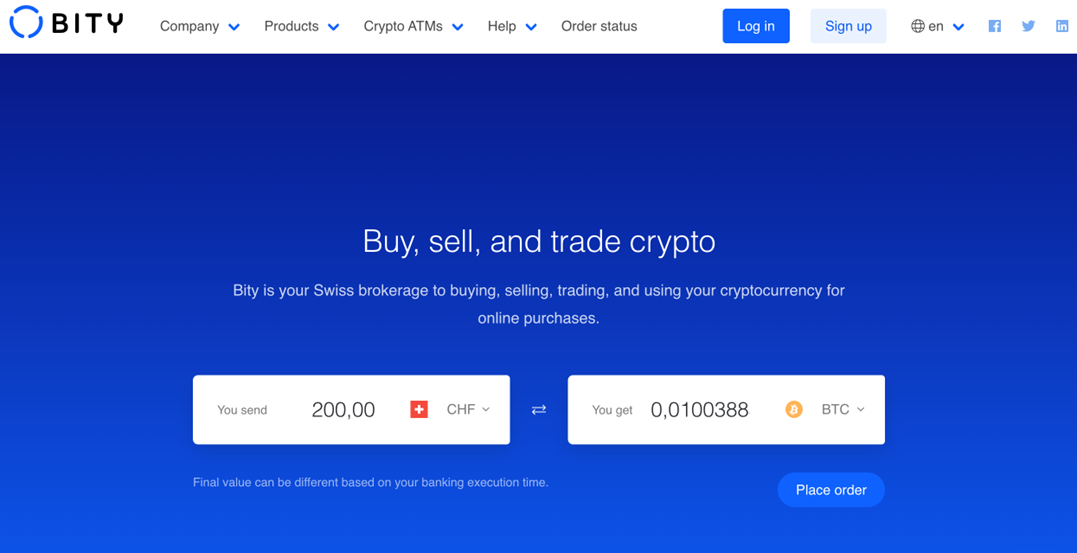

Source: Bity

Another way where to buy and sell cryptocurrency is directly through authorized crypto brokers like Simplex, or Bity.com. These platforms are licensed gateways to cryptocurrencies. They are offering users also payments via wider range of payment methods including VISA, MasterCard, Apple Pay, SWIFT, SEPA, etc.

Their biggest disadvantage is that their typically much more expensive than DEXs and CEXs. And it takes more time for the trade to settle, especially when using SWIFT or SEPA payments. The settlement date can be up to 2 business days, which means that when you buying for example 1 Ethereum. And you pay via a bank transfer, you will have to wait up to 2 business days for your digital asset to appear in your digital wallet, and vice versa.

These platforms also do not offer custody service and users have to self-custody their digital assets through their partner wallet providers.

FAQ