Search Knowledge Base by Keyword

What Is Leverage Trading Cryptocurrency?

What Is Leverage In Crypto Trading?

Leverage in cryptocurrency trading is used by investors who want to amplify their capital exposure that they initially invest in the crypto market in order to increase their profits. It refers to the use of borrowed money or crypto asset to either buy or sell cryptocurrencies and increase purchasing or selling power.

Let’s take an example. If you have Ethereum (ETH) worth $1.000 in your wallet and you anticipate increase in price and would like to leverage your Long Position, you can borrow funds to buy more Ether and if your Leverage Ratio is 1:10 (10x). You increase your initial capital ten times and execute trade worth $10.000, with only $1.000 of your initial capital invested. Be aware that leveraging your cryptocurrency trading bears also high risk, especially in volatile crypto market. The higher the leverage, the higher the risks of getting liquidated on your Margin Account. Before taking leverage you must understand the crypto market and know how the risks and return mechanics of investing in cryptocurrencies work. The market is unpredictable. And you can easily lose your invested capital if you do not approach leverage in cryptocurrency trading with discipline and the right trading tools.

Meaning Of Crypto Leverage Trading

The use of borrowed funds to trade cryptocurrencies or other financial assets is referred to as Financial Leverage. It increases your purchasing or selling power, allowing you to trade with more capital than you have in your wallet. You might borrow up to between 2 and 100 times your account balance depending on the crypto exchange or broker you use to access crypto leverage trading.

How Does Crypto Leverage Trading Work?

Crypto Asset Margin Account

Margin accounts for crypto assets allow traders to access larger quantities of crypto assets like stable coins. Also allowing them to leverage their crypto holdings. In traditional markets, traders often borrow cash through banks or authorized and regulated investment broker/dealers. However, in cryptocurrency trading, funds are frequently given by other traders or market participants. Simply called Lenders, who earn interest on borrowed money based on market supply and demand forces. Although it is less typical, some cryptocurrency exchanges provide their users crypto asset margin accounts.

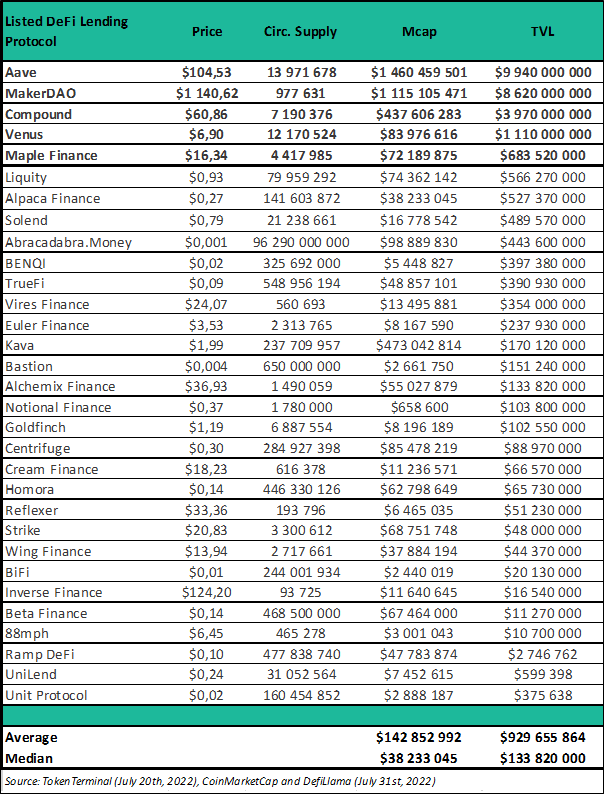

Margin account can be opened at various DeFi borrowing and lending platforms in few easy steps. At some platforms it is enough the borrower just connects his wallet. Borrower then deposits his crypto assets as collateral which serves as security for the borrowed crypto asset while the Margin Position is open. The attached table lists some of the top DeFi Lending platforms where users can easily open crypto asset margin account. Then deposit their crypto assets and borrow crypto assets or crypto stable coins. The platforms differ in their total value locked as well as leverage ratios they offer to borrowers.

Futures Margin Account

Often, at crypto currency exchanges and regulated brokers it is possible to trade Cryptocurrency Futures. Futures trading provides traders with far more leverage than crypto asset margin account. This means that a trader can invest in a futures contract with as little as 10% of the contract’s real value. The leverage multiplies the influence of any price changes, such that even little price changes might result in significant gains or losses.

Using futures instruments, traders must exercise more disciplined money and risk management techniques by employing intelligent stop-loss orders to minimize possible losses.

Leveraged Token Trading

Leveraged tokens are an easy way for crypto traders to trade with leverage. They are offered by some centralized crypto exchanges and only for a few major coins. It provides you with leveraged exposure to a cryptocurrency’s price without the danger of liquidation when the market goes against you. Novice traders do not have to handle collateral or margin requirements, and there’s almost no chance of liquidation.

FTX, a centralized derivatives exchange, pioneered the concept of Leveraged Tokens, however Binance, another centralized cryptocurrency exchange, came with slightly different concept and offers its users so-called Binance Leveraged Tokens (BLVT).

Some examples of leveraged tokens are XXXX on Binance and XXXX on Bittrex. When you buy these leveraged coins, your gains or losses are automatically multiplied by a factor 2, in these cases. So a 10% increase in price of Solana (SOL) will result in a 20% increase in price of SOL2 (???), and vice versa, a -10% decrease in price of SOL will result in a -20% loss in SOL2.

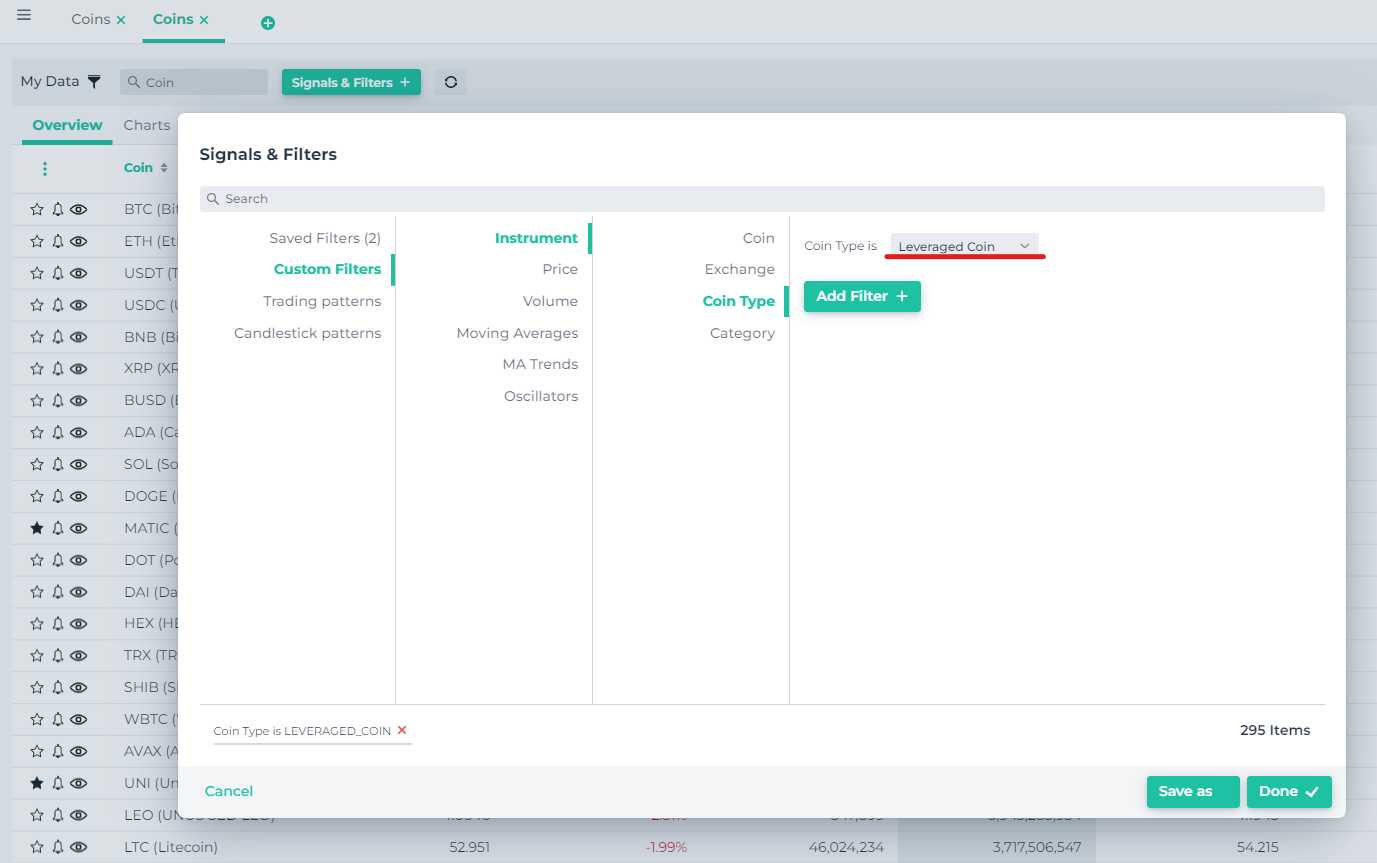

You can find the list of leveraged tokens on altFINS’ platform by going to the Crypto Screener section, selecting Filter/Signal and selecting Leveraged from Instruments menu:

When To Use Leveraging In Crypto Trading?

Advanced traders use leverage with caution, and they take varied risks based on the opportunity they see. Disciplined and experienced traders use leverage only when they are completely confident entering the market with borrowed assets and only before they conduct a thorough research. We recommend that in the cryptocurrency market, before leveraging crypto, your transaction should be supported and justified by both technical and fundamental factors, and only then the leveraged position should it be executed.

Generally, novice traders should not use leverage, and if so, only 2-3x max. Staying solvent (i.e. not losing all of your equity too quickly) should be a trader’s main objective and leverage trading is a sure way to blow that up quickly.

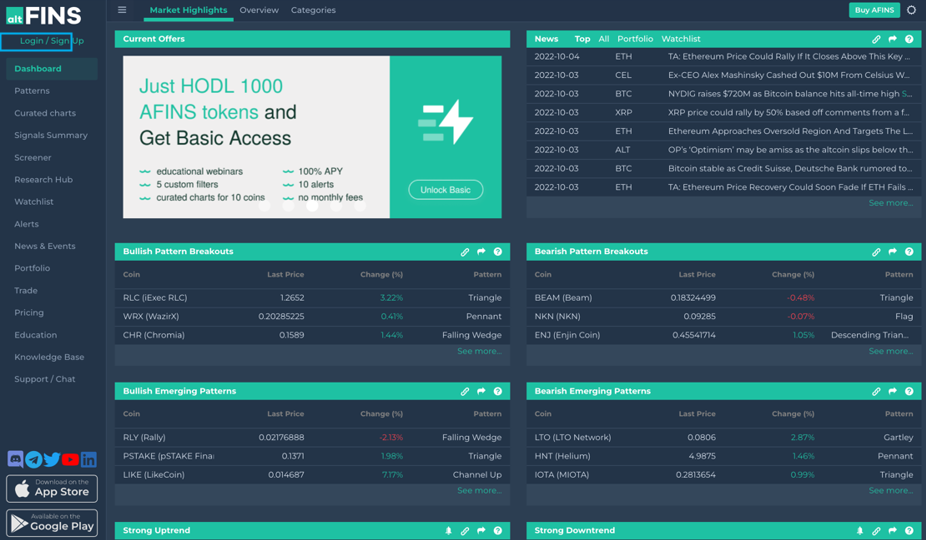

You may access both fundamental and technical analysis of thousands cryptocurrencies on altFINS. The platform screens projects and looks at projects’ market metrics, tokenomics, token adoption, market size, risks and challenges, growth prospects, team, investors, as well as competitor landscape.

altFINS seeks to bring efficiency to crypto investment cycle by covering 1) pre-trade analysis (investment idea generation, technical indicators, fundamental data, screening, charting, alerts, news, research). To 2) trade execution across exchanges, and 3) post-trade analysis (asset tracking, P&L, NAV, risk analysis). altFINS also offers investors and novice traders educational packages and trading courses, available for all subscribers that have a strong desire to learn technical analysis and trading strategies for cryptocurrencies. Learn before you use leveraged trading strategies for crypto assets.

How To Use Leverage In Crypto Trading?

Scenario 1: Anticipating Increase In price

Traders can use leverage in crypto trading when they want to access liquidity and they anticipate increase in prices. They leverage their existing long position by depositing the crypto asset as a collateral.

To explain, lets assume you own some Ethereum (ETH) and want to keep it, but you would like to increase your investment size as you anticipate rise in price in near future. To leverage your long position, you must borrow crypto stable coin, USDT for example, with 80% Loan-to-Value (LTV) ratio, using the deposited crypto asset (ETH in our example) as a collateral. The LTV ratio differs across assets and DeFi borrowing and lending platforms. You will have to pay some interest rate on the borrowed USDT and, typically in DeFi space, the interest rate is calculated as using market forces. The higher the supply for the loan product, the lower the borrowing costs will be, and vice versa. Sometimes this can even result in negative borrowing rates if the supply is substantially bigger than demand, which means that you are paid to borrow. Many, especially new, DeFi borrowing, and lending platforms build their user base by offering extra rewards to borrowers.

As next step, you can use the borrowed USDT to purchase more Ethereum (ETH) or other digital asset, or just keep the coins as a working capital. To purchase more Ethereum (ETH), or any other crypto asset with your borrowed USDT, you can use altFINS where you simply connect your cryptocurrency exchange account through an API (see a step-by-step guide “LEVERAGE CRYPTO TRADING WITH altFINS” at the end of this article).

Scenario 2: Anticipating Decrease In price

Second scenario is when traders anticipate substantial drop in price, or they desire to simply hedge their long positions against a backdrop in price. Typically, experienced traders deposit crypto asset as collateral, and once they see an opportunity that the market is going to selloff, they quickly borrow the same or any other crypto asset that is positively correlated with their deposited crypto asset and immediately sell it on the market to get a crypto stable coin, for example, USDT.

After the price of Ethereum (ETH) drops, they buy back more Ether at a lower price in exchange for the USDT they hold in their wallet. To conclude their leveraged crypto trade, they quickly return the borrowed size of the crypto asset on the DeFi borrowing and lending platform together with any interest rate due and realize their profit.

What Is 100X Leverage In Crypto?

Leverage is expressed as a ratio, such as 1:5 (5x), 1:10 (10x), 1:20 (20x), or 1:100 (100x). It indicates how many times your starting deposited capital has been doubled. Assume you have $100 in your cryptocurrency exchange account wallet and wish to initiate a trade in Bitcoin (BTC) worth $10,000. Your $100 will have the same purchasing power as $10,000 with a 100x leverage, if your cryptocurrency exchange allows such leverage ratio.

Different trading platforms and marketplaces like crypto exchanges have their own set of regulations and leverage ratios. In the stock market, for example, a normal leverage ratio is 1:2, although futures contracts are sometimes traded at a 1:15 leverage ratio. Margin transactions at Forex brokerages are typically leveraged at a 1:50 ratio, however 1:100, or higher, are also employed in some situations. In cryptocurrency markets, the leverage ratio often ranges from 1:2 to 1:100, or from 2x to 100x.

Novice traders must realize that even though it is possible to achieve magnified profits by using leverage. It is also possible to achieve magnified losses. If your position turns against you and the price of your collateral drops significantly, cryptocurrency exchange or broker may ask you to put up additional funds to avoid your position to be liquidated. This is called Margin Call. If you get such a call, you will have to either exit your position immediately. Or add fresh capital so that your leveraged position does not get automatically liquidated. That can be quite costly on some of the providers like crypto exchanges, brokers or other DeFi borrowing and lending platforms.

Leverage Crypto Trading With altFINS

Scenario: Leveraging your Long Position and anticipating increase in prices.

- First, you must choose DeFi Lending platform where you can deposit your collateral and borrow funds. You can deposit Ethereum (ETH). Depending on your leverage ratio your lending platform gives you, you can borrow either more Ethereum (ETH) directly Or a crypto stable coin USDT to your wallet. If you DeFi Lending platform does not offer you to borrow Ethereum (ETH), you can borrow USDT. And buy more crypto assets using altFINS platform.

- Simply visit https://altfins.com/ and sign up or login if you already have an altFINS account:

- Connect to your wallet with the borrowed USDT and add your API connection with a crypto exchange in your altFINS Account Settings. Follow full guide at: https://altfins.com/knowledge-base/connecting-to-exchanges/.

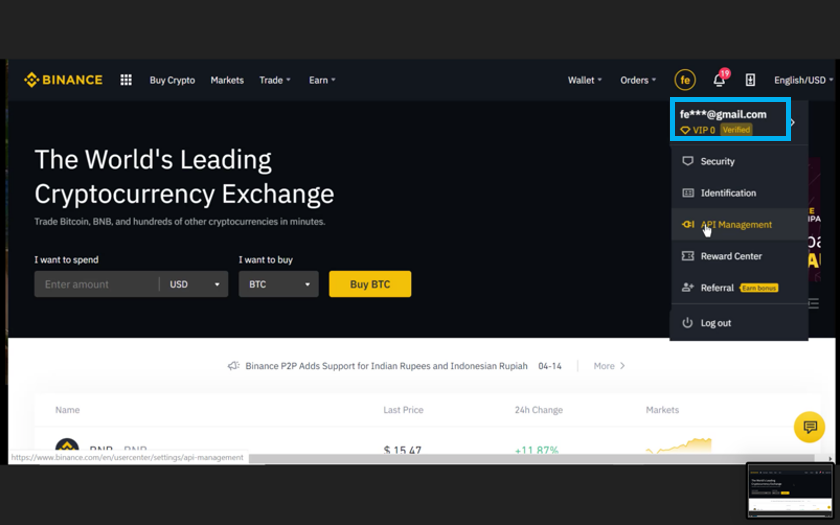

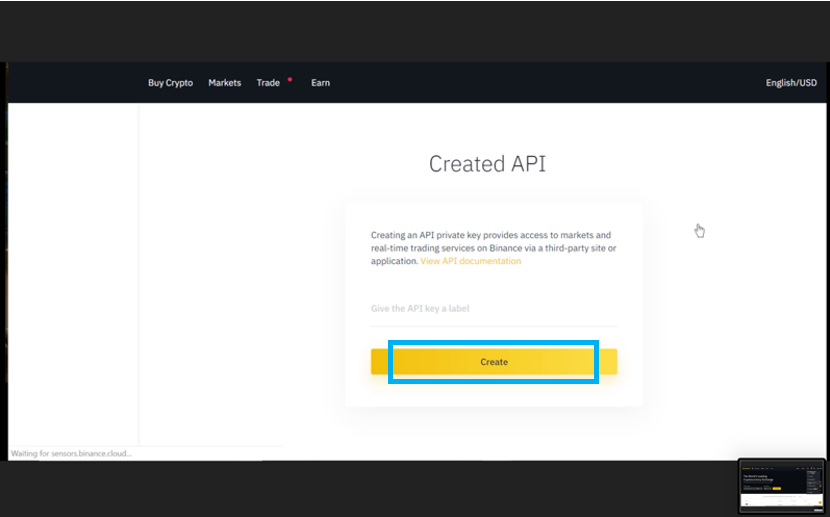

- Connect to a centralized exchange, BINANCE, where you already have an account. Go to API Management located in your Profile dropdown menu:

- Create API Name as you like:

- After several steps followed by double authentication and verification process, you will get your new API Key and Secret Key generated. You can now set up the API restrictions with Read Only and Enable Trading rules and disabling Withdrawals.

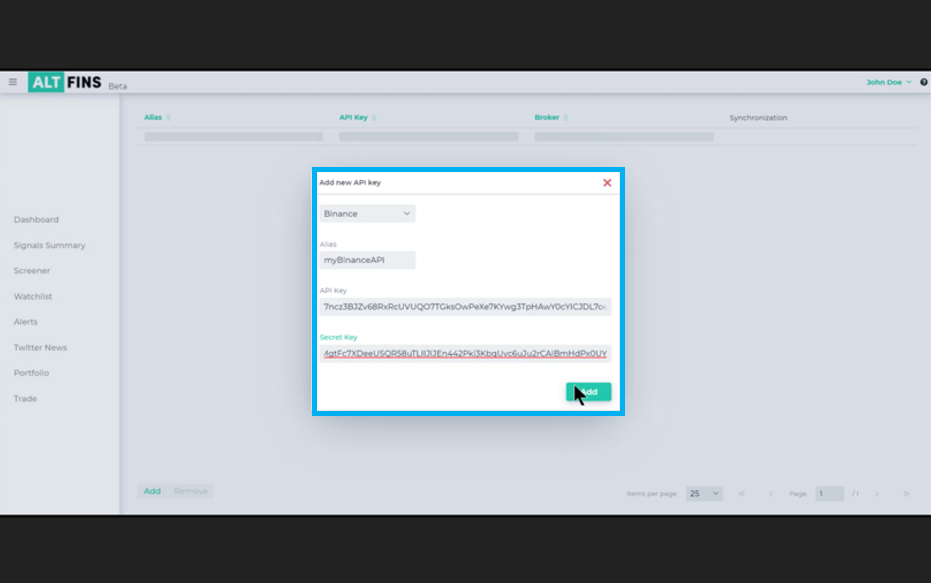

- Go back to altFINS platform, select your Profile Name > Accounts > Exchanges > Add and paste your API Name/Alias, API Key and Secret Key into the fields provided, and hit Add:

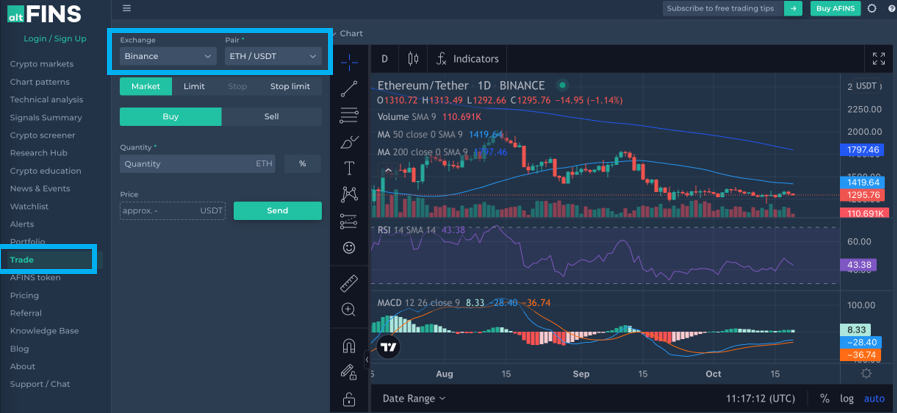

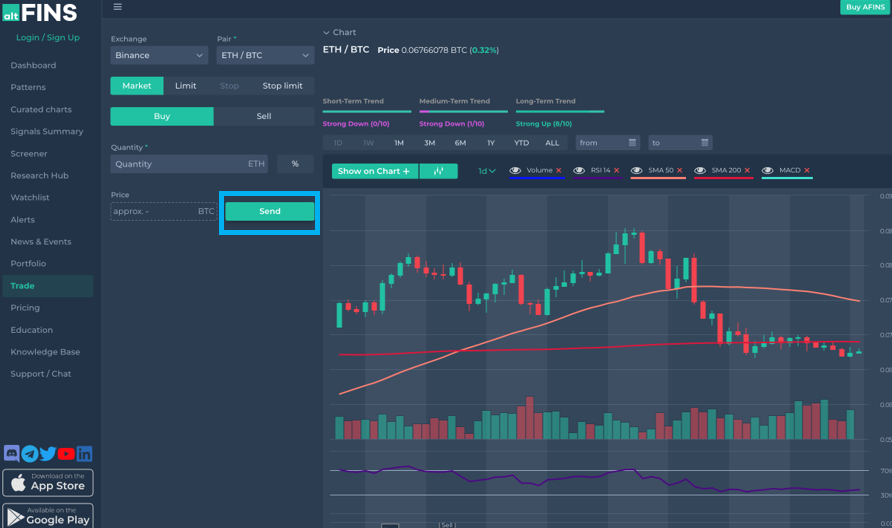

- Go to Trade, select your Exchange that you have just connected to altFINS and choose your Pair. For example, if you want to buy more Ethereum (ETH) with the borrowed USDT, select ETH / USDT.

- Select if you want to trade at Market, Limit, or Stop Limit Order.

Market Order

A market order to buy is an instruction to buy an asset immediately at the market’s current price, or the best offer price. On the other hand, a market order to sell is an instruction to sell an asset immediately at the market’s current price, or the best bid price.

Limit Order

When you set a limit order, you choose a maximum purchase (BID) price or minimum sale (OFFER) price. Your exchange will automatically attempt to fill the limit order when the market price meets your limit price. This order is useful when you have a target entry or exit price and do not mind waiting for the market to meet your set conditions.

If the market price of Bitcoin is $20,000 (USDT), you could set a buy limit order at $19,000 to purchase BTC. As soon as the price hits $19,000 or lower in case of very volatile moves. You might also place a sell limit order at $21,000. Meaning that the exchange will sell your BTC if the price goes to $21,000 or higher.

Stop -Limit Order

Stop-limit order combines a stop trigger and a limit order together. The stop order adds a trigger price for the exchange to place your limit order.

- Enter quantity of the Ethereum (ETH) you would like to buy. In exchange for the borrowed USDT and execute your Buy order via the SEND button:

Benefits Of Using altFINS

- Screen and analyse different alt coins at one place using. Find coins with Breakouts, Uptrend, Momentum or Oversold and Overbought positions.

- Easily identify trade entry and exit points with technical analysis using chart patterns . Use Channels, Triangles, Wedges, Inverse Head & Shoulders, etc.

- Get access to professional investment research reports. Understand the fundamental aspect of different crypto projects. Support and justify your investment decision making process with comprehensive research reports.

- Stay on top of the market with price and screener alerts.

- Get access to breaking news on exchange listings, AMA, airdrops, and events for thousands of crypto projects in real time.

- Learn trading strategies, technical analysis and how to use altFINS platform to find profitable investments.

FAQ