Search Knowledge Base by Keyword

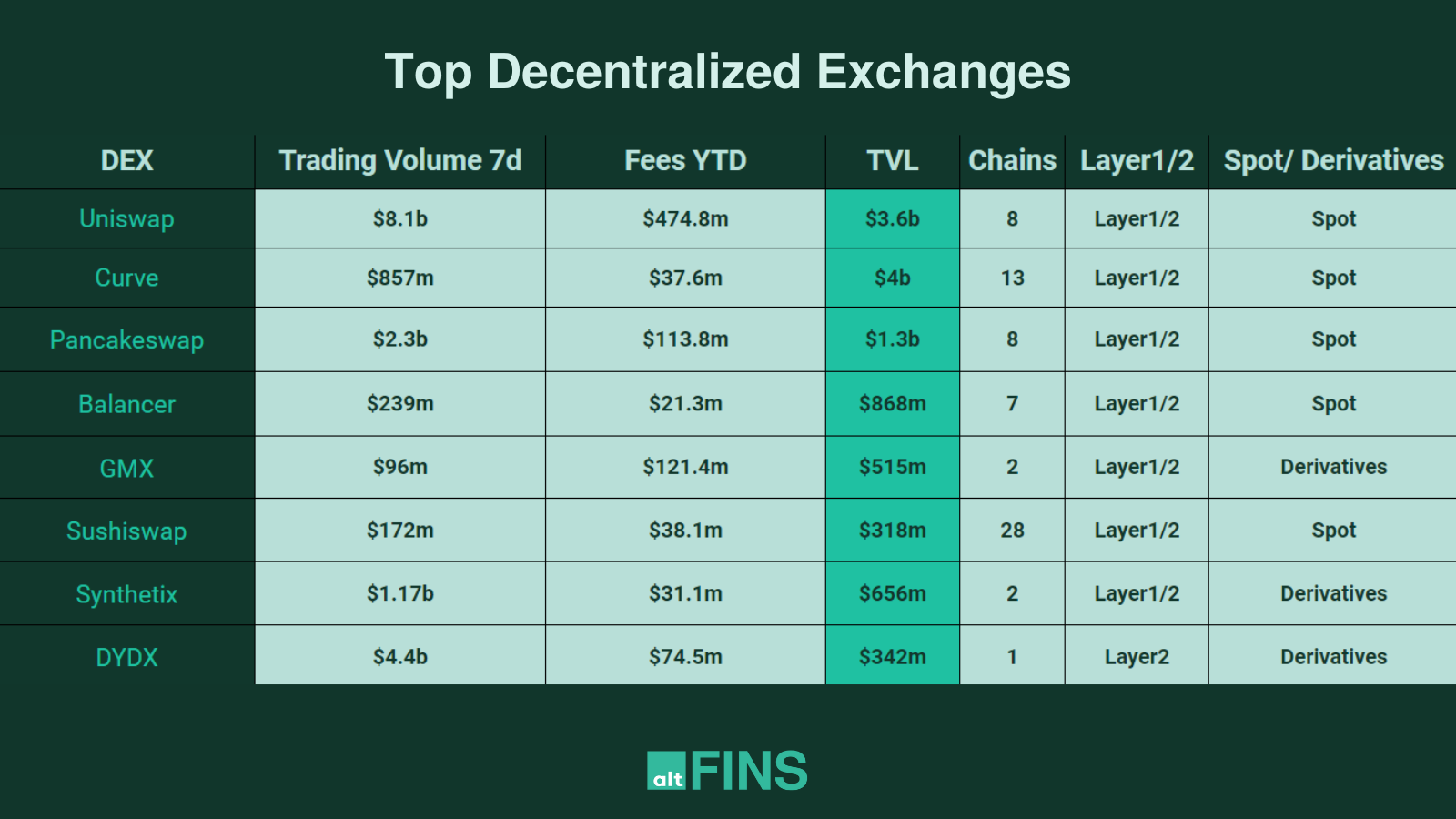

List of TOP Decentralized Exchanges 2024

Updated: Nov. 2023, Source: altFINS, Tokenterminal, DefiLama

Why we decided to list following 8 Decentralized Exchanges?

- Trading volume: We chose DEXs with high trading volume because this indicates that they are popular and well-used platforms. High trading volume also means that there is liquidity in the market, which makes it easier for users to buy and sell cryptocurrencies.

- Total value locked (TVL): We also chose DEXs with high TVL because this indicates that a large amount of value is being held on the platform. This is a sign of trust and confidence in the platform.

- Security: We selected DEXs that are built on secure blockchains and have a good track record of security. This is important to protect users’ funds.

- Features: We also considered the features offered by each DEX. We wanted to list DEXs that offer a variety of features, such as staking, yield farming, and margin trading.

- Community: We also considered the community around each DEX. We wanted to list DEXs that have a strong and active community. This is important for support and development.

Overall, we chose the 8 DEXs because they are popular, secure, and offer a variety of features. We believe that these DEXs will be the leaders in the decentralized exchange space in the years to come.

Here are the 8 DEXs that we have listed:

Performance Of DEXs Native Tokens

Uniswap DEX

Uniswap, established in 2018 by Hayden Adams, stands as a preeminent decentralized exchange (DEX), revolutionizing the landscape of ERC-20 token trading by eliminating the need for centralized intermediaries. Operating on a liquidity pool model, Uniswap enables users providing liquidity to earn fees from all ensuing trades. As an open-source project, its code is freely accessible for scrutiny and modification.

Uniswap is non-custodial, ensuring users maintain control of their funds continuously, while its permissionless nature allows anyone, irrespective of identity or location, to engage in the exchange. Notably, Uniswap distinguishes itself for its gas efficiency, minimizing trade-associated fees, and has garnered acclaim for its user-friendly interface, operational efficiency, and robust security measures.

Here are some of the things that Uniswap is used for:

- Trading cryptocurrencies: Uniswap can be used to trade a variety of ERC-20 tokens, including Ethereum, Tether, USD Coin, and Bitcoin.

- Providing liquidity: Users can provide liquidity to Uniswap pools and earn fees on all trades that are made.

- Building DeFi applications: Uniswap can be used to build decentralized finance (DeFi) applications, such as lending protocols and synthetic asset platforms.

- Earning rewards: Users can earn rewards by staking UNI tokens, the native token of the Uniswap protocol.

Overall, Uniswap is a powerful and versatile platform that has the potential to revolutionize the way we trade cryptocurrencies. It is a safe and secure platform that is used by millions of people around the world.

Here are some of the pros and cons of Uniswap:

Pros:

- Decentralized: Uniswap is a decentralized exchange, which means that it is not controlled by any single entity. This makes it more resistant to hacks and fraud.

- Open-source: Uniswap’s code is open-source, which means that it is transparent and can be audited by anyone. This makes it more secure and trustworthy.

- Non-custodial: Uniswap is a non-custodial exchange, which means that users retain control of their own funds at all times. This makes it more secure than centralized exchanges.

- Gas-efficient: Uniswap is gas-efficient, which means that the fees associated with trades are relatively low. This makes it a more affordable option for traders.

Cons:

- Liquidity: Uniswap’s liquidity pools may not always have enough liquidity to support large trades. This can lead to slippage, which is when the price of a token changes during a trade.

- Volatility: The prices of tokens traded on Uniswap can be volatile, which means that traders can lose money if the price of a token moves against them.

- Complexity: Uniswap can be complex to use, especially for beginners. This can lead to errors and losses.

Uniswap token – UNI

Uniswap token (UNI) is the governance and utility token of the decentralized exchange Uniswap, empowering holders to participate in protocol governance and benefit from the platform’s success.

Performance of UNI

Trends of UNI

Curve DEX

Curve-DEX, established in 2020 by Michael Egorov, stands out as a leading decentralized exchange (DEX) renowned for its prowess in facilitating stablecoin trading. Functioning on a liquidity pool model, users contributing to the pool not only enhance market depth but also earn fees from all ensuing trades. Distinguished by its open-source nature, Curve-DEX allows unrestricted scrutiny and modification of its code.

Operating on a non-custodial basis, users maintain absolute control over their funds, while its permissionless design ensures universal participation, transcending geographical and identity constraints. Notably, Curve-DEX excels in gas efficiency, translating to remarkably low fees associated with transactions. Its acclaim is rooted in its efficient operation, minimal fees, and narrow spreads, marking it as a pivotal player in the decentralized exchange landscape.

Here are some of the things that Curve-DEX is used for:

- Trading stablecoins: Curve-DEX can be used to trade a variety of stablecoins, such as Tether, USD Coin, and Dai.

- Providing liquidity: Users can provide liquidity to Curve-DEX pools and earn fees on all trades that are made.

- Building DeFi applications: Curve-DEX can be used to build decentralized finance (DeFi) applications, such as lending protocols and synthetic asset platforms.

- Earning rewards: Users can earn rewards by staking CRV tokens, the native token of the Curve protocol.

Overall, Curve-DEX is a powerful and versatile platform that has the potential to revolutionize the way we trade stablecoins. It is a safe and secure platform that is used by millions of people around the world.

Here are some of the pros and cons of Curve-DEX:

Pros:

- Decentralized: Curve-DEX is a decentralized exchange, which means that it is not controlled by any single entity.

- Open-source: Curve-DEX’s code is open-source, which means that it is transparent and can be audited by anyone.

- Non-custodial: Curve-DEX is a non-custodial exchange, which means that users retain control of their own funds at all times.

- Gas-efficient: Curve-DEX is gas-efficient, which means that the fees associated with trades are relatively low.

- Low fees: Curve-DEX has some of the lowest fees in the DeFi space.

- Tight spreads: Curve-DEX has tight spreads, which means that users can get a good price when they trade.

Cons:

- Limited liquidity: Curve-DEX’s liquidity pools might not consistently possess sufficient liquidity to accommodate substantial trades, potentially resulting in slippage—a phenomenon where the token’s price undergoes fluctuations during the trade.

- Volatility: The prices of stablecoins can be volatile, which means that traders can lose money if the price of a stablecoin moves against them.

- Complexity: Curve-DEX can be complex to use, especially for beginners. This can lead to errors and losses.

Curve DAO token – CRV

Curve DAO Token (CRV) is the native utility token of the Curve Finance decentralized autonomous organization (DAO), serving as a governance and staking token within the decentralized stablecoin exchange platform.

Performance of CRV

Trends of CRV

PancakeSwap

PancakeSwap, a decentralized exchange (DEX) established on the Binance Smart Chain (BSC) in September 2020, has swiftly risen to prominence as one of the most widely used DEXes on the BSC network. Employing an automated market maker (AMM) model, PancakeSwap facilitates trades without necessitating users to deposit funds with a centralized exchange. As an open-source project, its code is transparent and accessible for scrutiny and modification.

Being non-custodial ensures that users maintain control of their funds at all times, while its permissionless nature allows for universal participation in the exchange without constraints related to identity or location. With its cost-effective fee structure, PancakeSwap offers an attractive avenue for trading cryptocurrencies. Its versatile features encompass token swapping, liquidity provision to pools, yield farming for earning rewards, and even integration of non-fungible tokens (NFTs), reflecting its comprehensive and dynamic approach to decentralized finance.

Here are some of the things that PancakeSwap is used for:

- Trading cryptocurrencies: PancakeSwap can be used to trade a variety of cryptocurrencies, including BEP-20 tokens.

- Providing liquidity: Users can provide liquidity to PancakeSwap pools and earn fees on all trades that are made.

- Earning rewards: Users can earn rewards by yield farming, which is the process of staking tokens in liquidity pools to earn interest.

- Incorporating NFTs: PancakeSwap has recently incorporated NFTs, which are unique digital assets that can be used to represent ownership of items such as artwork, collectibles, and in-game items.

Overall, PancakeSwap is a powerful and versatile platform that has the potential to revolutionize the way we trade cryptocurrencies. It is a safe and secure platform that is used by millions of people around the world.

Here are some of the pros and cons of PancakeSwap:

Pros:

- Decentralized: PancakeSwap is a decentralized exchange, which means that it is not controlled by any single entity. This makes it more resistant to hacks and fraud.

- Open-source: PancakeSwap’s code is open-source, which means that it is transparent and can be audited by anyone. This makes it more secure and trustworthy.

- Non-custodial: PancakeSwap is a non-custodial exchange, which means that users retain control of their own funds at all times. This makes it more secure than centralized exchanges.

- Low fees: PancakeSwap has low fees, which makes it a cost-effective way to trade cryptocurrencies.

- Variety of features: PancakeSwap has a variety of features, which makes it a versatile platform.

- Growing community: PancakeSwap has a growing community, which means that there is a lot of support available.

Cons:

- Liquidity: PancakeSwap’s liquidity pools may not always have enough liquidity to support large trades. This can lead to slippage, which is when the price of a token changes during a trade.

- Volatility: Cryptocurrency prices are subject to volatility, posing a risk for traders who may experience financial losses when the value of a cryptocurrency moves unfavorably.

- Complexity: Using PancakeSwap may present challenges for beginners due to its complexity, potentially resulting in errors and financial losses.

PancakeSwap token – CAKE

PancakeSwap token (CAKE) is the native cryptocurrency of the PancakeSwap decentralized exchange on the Binance Smart Chain, used for governance, staking, and as a medium of exchange within the platform.

Performance of CAKE

Trends of CAKE

Balancer DEX

Balancer is an automated market maker (AMM) that allows users to create liquidity pools with up to eight different tokens in any ratio. This makes it more flexible than other AMMs, which typically only allow for two or three tokens per pool.

Balancer also allows users to set the fees for their liquidity pools, which gives them more control over how they earn rewards. Additionally, Balancer supports weighted pools, which means that users can give more weight to certain tokens in a pool. This can be useful for creating pools that track specific indexes or portfolios.

Balancer is a non-custodial platform, which means that users retain control of their own funds at all times.

Balancer is a relatively new platform, but it has been gaining popularity in recent months. It is a promising project with the potential to revolutionize the way we trade cryptocurrencies.

Here are some of the features of Balancer:

- Supports up to 8 tokens per pool

- Allows users to set fees for their liquidity pools

- Supports weighted pools

- Non-custodial

- Open-source

- Gas-efficient

Here are some of the things that Balancer can be used for:

- Trading cryptocurrencies: Balancer can be used to trade a variety of cryptocurrencies.

- Providing liquidity: Users can provide liquidity to Balancer pools and earn fees on all trades that are made.

- Building DeFi applications: Balancer can be used to build decentralized finance (DeFi) applications.

- Earning rewards: Users can earn rewards by staking BAL tokens, the native token of the Balancer protocol.

Here are some of the pros and cons of Balancer:

Pros:

- Flexible: Balancer allows users to create liquidity pools with up to 8 different tokens in any ratio. This makes it more flexible than other AMMs.

- Control: Balancer allows users to set the fees for their liquidity pools and to weight the tokens in their pools. This gives users more control over how they earn rewards.

- Security: Balancer is a non-custodial platform, which means that users retain control of their own funds at all times.

- Open-source: Balancer is open-source, which means that its code is freely available for anyone to inspect and modify.

- Gas-efficient: Balancer is gas-efficient, which means that the fees associated with trades are relatively low.

Cons:

- Liquidity: Balancer’s liquidity pools may not always have enough liquidity to support large trades. This can lead to slippage, which is when the price of a token changes during a trade.

- Volatility: Cryptocurrency prices are prone to volatility, making it possible for traders to incur losses when the value of a cryptocurrency moves in an unfavorable direction.

Balancer token – BAL

Balancer token (BAL) is the native governance token of the Balancer decentralized finance (DeFi) platform, providing holders with voting rights and the ability to participate in decision-making processes within the protocol.

Performance of BAL

Trends of BAL

GMX DEX

GMX is a decentralized exchange (DEX) that allows users to trade cryptocurrencies and derivatives on-chain. It is built for and deployed on Avalanche (L1) and Arbitrum Protocols, which is a Layer-2 blockchain and uses an automated market maker (AMM) model to facilitate trades. The Layer-2 deployment makes it to stand out over other exchanges that still use Layer-1 infrastructure.

GMX was launched in September 2021 and is one of the newer DEXes on the market. However, it has quickly gained popularity due to its low fees, high liquidity, and innovative features.

One of the unique features of GMX is its support for perpetual swaps. Perpetual swaps are a type of derivative that allows users to trade the price of an asset without actually owning it. This can be a more efficient way to trade volatile assets, such as cryptocurrencies.

GMX also offers a variety of other features, such as:

- Spot trading: Users can trade cryptocurrencies on a spot market, which means that they buy and sell cryptocurrencies at the current market price.

- Margin trading: Users can trade cryptocurrencies with leverage, which means that they can borrow funds to increase their trading positions.

- Liquidity mining: Users can earn rewards by providing liquidity to GMX pools.

- Governance: GMX is a community-owned project, and users can vote on proposals that affect the future of the platform.

GMX is a promising new DEX with the potential to become a major player in the cryptocurrency space. It is a secure and reliable platform that offers a variety of features for traders of all levels.

Here are some of the pros and cons of GMX:

Pros:

- Low fees: GMX has low fees, which makes it a cost-effective way to trade cryptocurrencies.

- High liquidity: GMX has high liquidity, which means that users can easily buy and sell cryptocurrencies without slippage.

- Innovative features: GMX offers a variety of innovative features, such as support for perpetual swaps and margin trading.

- Community-owned: GMX is a community-owned project, which means that users have a say in its future.

Cons:

- New: GMX is a relatively new platform, so it is not as well-established as some of the other DEXes.

- Complex: GMX can be complex to use, especially for beginners.

- Risky: Trading cryptocurrencies and derivatives is risky, and users should be aware of the potential losses involved.

Explore our in-depth research on GMX here!

GMX token- GMX

GMX has a native token called GMX, which functions as a governance, utility, and value-accrual token for the GMX protocol.

Performance of GMX

Trends of GMX

SushiSwap DEX

SushiSwap is a decentralized exchange (DEX) that is built on the Ethereum blockchain. It is an automated market maker (AMM) that allows users to swap tokens without the need for a centralized exchange.

SushiSwap was launched in September 2020 as a fork of Uniswap, another popular DEX. However, SushiSwap has since added a number of features that make it unique, such as:

- A yield farming program that rewards users for providing liquidity to SushiSwap pools.

- A governance token, SUSHI, that allows users to vote on proposals that affect the future of the platform.

- A decentralized exchange aggregator that allows users to find the best prices for their trades.

SushiSwap has quickly become one of the most popular DEXes in the world.

Here are some of the pros and cons of SushiSwap:

Pros:

- Low fees: SushiSwap has low fees, which makes it a cost-effective way to trade cryptocurrencies.

- High liquidity: SushiSwap has high liquidity, which means that users can easily buy and sell cryptocurrencies without slippage.

- Innovative features: SushiSwap offers a number of innovative features, such as yield farming and governance.

- Community-owned: SushiSwap is a community-owned project, which means that users have a say in its future.

Cons:

- Complex: SushiSwap can be complex to use, especially for beginners.

- Security: SushiSwap has been the target of a number of attacks, and users should be aware of the risks involved.

SushiSwap token – Sushi

SushiSwap’s native token, SUSHI, is the governance and utility token of the decentralized exchange platform, enabling users to participate in decision-making and providing various functions within the ecosystem.

Performance of Sushi

Trends of Sushi

Synthetix DEX

Synthetix is a decentralized finance (DeFi) protocol that allows users to mint synthetic assets, also known as Synths. Synths are tokens that track the price of real-world assets, such as fiat currencies, commodities, and stocks.

Synthetix was launched in 2018 and is one of the most popular DeFi protocols in the world. It has over $0.6 billion in total value locked (TVL) and is used by millions of users. Synthetix was built and deployed on Ethereum (Layer-1) and Optimism (Layer-2), which is the second biggest Layer-2 protocol after Arbitrum, with a TVL equal to over $3.7 billion.

Here are some of the features of Synthetix:

- Minting Synths: Users can mint Synths by depositing collateral into Synthetix pools.

- Trading Synths: Users can trade Synths on Synthetix’s decentralized exchange (DEX).

- Leverage trading: Users can trade Synths with leverage, which means that they can borrow funds to increase their trading positions.

- Liquidity mining: Users can earn rewards by providing liquidity to Synthetix pools.

- Governance: Synthetix is a community-owned project, and users can vote on proposals that affect the future of the protocol.

Here are some of the pros and cons of Synthetix:

Pros:

- Decentralized: Synthetix is a decentralized protocol, which means that it is not controlled by any single entity

- Open-source: Synthetix’s code is open-source, which means that it is transparent and can be audited by anyone.

- Flexible: Synthetix allows users to mint Synths that track the price of a variety of real-world assets.

- Scalable: Synthetix is designed to be scalable, which means that it can handle a large number of users and transactions.

Cons:

- Complex: Synthetix can be complex to use, especially for beginners.

- Risky: Trading Synths is risky, and users should be aware of the potential losses involved.

- Liquidity: Synthetix’s liquidity pools may not always have enough liquidity to support large trades. This can lead to slippage, which is when the price of a Synth changes during a trade.

Here are some of the things that Synthetix can be used for:

- Trading Synths: Synthetix can be used to trade Synths on its decentralized exchange (DEX).

- Leverage trading: Users can trade Synths with leverage, which means that they can borrow funds to increase their trading positions.

- Hedging: Synthetix can be used to hedge against the risk of price movements in real-world assets.

- Speculating: Synthetix can be used to speculate on the future price movements of real-world assets.

- Providing liquidity: Users can provide liquidity to Synthetix pools and earn fees on all trades that are made.

Explore our in-depth research on Synthetix here!

Synthetix token- SNX

Synthetix’s native token, SNX, serves as collateral within the decentralized synthetic asset platform, allowing users to mint and trade various synthetic assets, representing real-world assets like currencies, commodities, and cryptocurrencies.

Performance of SNX

Trends of SNX

DYDX DEX

dYdX is a decentralized exchange (DEX) that allows users to trade perpetual contracts on a variety of assets, including cryptocurrencies, commodities, and stocks. dYdX was launched in 2018 and is one of the leading DEXes for perpetual contract trading.

Here are some of the pros and cons of dYdX:

Pros:

- Perpetual contracts: dYdX allows users to trade perpetual contracts, which are a powerful tool for traders.

- Up to 20x leverage: dYdX allows users to trade with up to 20x leverage, which can be used to amplify profits or losses.

- Low fees: dYdX has low fees, which makes it a cost-effective way to trade perpetual contracts.

- Non-custodial: dYdX is a non-custodial exchange, which means that users retain control of their own funds at all times.

- Secure: dYdX is built on the Ethereum blockchain, which is a secure and decentralized platform.

Cons:

- Complex: dYdX can be complex to use, especially for beginners.

- Risky: Trading perpetual contracts is risky, and users should be aware of the potential losses involved.

- Liquidity: dYdX’s liquidity pools may not always have enough liquidity to support large trades.

Here are some of the things that dYdX can be used for:

- Trading perpetual contracts: dYdX can be used to trade perpetual contracts on a variety of assets, including cryptocurrencies, commodities, and stocks.

- Leveraged trading: Users can trade with up to 20x leverage, which means that they can borrow funds to increase their trading positions.

- Hedging: dYdX can be used to hedge against the risk of price movements in underlying assets.

- Speculating: dYdX can be used to speculate on the future price movements of underlying assets.

DYDX token- DYDX

The dYdX token (DYDX) is the governance and utility token of the dYdX decentralized trading platform, enabling users to participate in protocol governance and access various platform features.

Performance of DYDX

Trends of DYDX

What is DEX?

A decentralized exchange, commonly referred to as DEX, is a cryptocurrency exchange platform that operates without a central authority or intermediary. Unlike traditional centralized exchanges (CEX), which are controlled by a single entity, DEXs rely on blockchain technology and smart contracts to facilitate peer-to-peer trading of digital assets. This decentralized nature brings several advantages, including enhanced security, transparency, and user control over their funds.

How to Choose the Best Decentralized Exchange

Selecting the right decentralized exchange for your trading needs requires careful consideration of various parameters. Here are the key factors to keep in mind:

- Security: Prioritize DEXs with a strong track record of security and robust smart contract auditing.

- User Interface: A user-friendly interface is essential for seamless trading. Check if the DEX offers an intuitive platform.

- Liquidity: High liquidity ensures that you can execute trades without significant price slippage. Look for DEXs with active trading pairs.

- Supported Assets: Ensure that the DEX supports the cryptocurrencies you want to trade.

- Trading Fees: Evaluate the fee structure, including maker and taker fees, and compare them with other DEXs.

- Community and Development: Research the project’s community involvement and ongoing development to gauge its long-term viability.

How to Use a Decentralized Exchange for Trading

- Choose a DEX. There are many different DEXs available, so it’s important to choose one that is reputable and has a good liquidity pool. Some popular DEXs include Uniswap, SushiSwap, and PancakeSwap.

- Set up a crypto wallet. You will need a crypto wallet to store your cryptocurrency and connect to the DEX. Some popular crypto wallets for DEXs include MetaMask, Coinbase Wallet, and Trust Wallet.

- Fund your wallet. You will need to fund your wallet with the cryptocurrency you want to trade. You can do this by buying cryptocurrency from an exchange like Coinbase or Binance and then transferring it to your wallet.

- Connect your wallet to the DEX. Once you have funded your wallet, you can connect it to the DEX. This will allow you to see the trading pairs available and make trades.

- Place a trade. To place a trade, you will need to specify the trading pair, the amount of cryptocurrency you want to trade, and the price you are willing to pay.

- Confirm the trade. Once you have placed a trade, you will need to confirm it. This will usually involve signing a transaction with your wallet.

- Wait for the trade to be executed. Once the trade is confirmed, it will be executed and your cryptocurrency will be exchanged.

Here are some additional things to keep in mind when using a DEX:

- The trading fees on DEXs are typically higher than on centralized exchanges.

- You will need to pay gas fees for every transaction you make on a DEX.

Overall, DEXs offer a more decentralized and secure way to trade cryptocurrency. However, they are also more complex to use and have higher fees.

Here are some of the benefits of using a decentralized exchange:

- Decentralization: DEXs are not controlled by any central authority, which means that your funds are not at risk of being hacked or frozen.

- Transparency: All transactions on a DEX are recorded on the blockchain, which makes them transparent and auditable.

- Liquidity: DEXs are becoming increasingly liquid as more and more people use them.

- Fees: The fees on DEXs are typically lower than on centralized exchanges.

Here are some of the risks of using a decentralized exchange:

- Complexity: DEXs can be more complex to use than centralized exchanges.

- Liquidity: Some DEXs may have low liquidity, which can make it difficult to trade large amounts of cryptocurrency.

- Security: DEXs are still a relatively new technology, so there is a risk of bugs and security vulnerabilities.

FAQ

What is the best decentralized exchange? The best DEX depends on your specific needs and preferences. Factors like security, liquidity, and supported assets should influence your choice.

What is the most secure decentralized exchange? DEXs with a strong security track record and audited smart contracts are generally considered more secure. Conduct thorough research before using any DEX.

What is the largest DEX in the world? Uniswap, Curve and Pancakeswap are among the largest DEXs in terms of trading volume and liquidity.

Which decentralized exchange is the cheapest? Fees vary among DEXs. Various decentralized exchanges, including 1inch, Curve, PancakeSwap are known for offering low trading fees, appealing to cost-conscious traders seeking affordable transactions in the DeFi space.

What is the world’s biggest DEX? Uniswap and DyDX are the world’s largest DEXs in terms of trading volume and popularity.

Which exchanges are decentralized? Popular decentralized exchanges include Uniswap, SushiSwap, PancakeSwap, and many others.

Can decentralized exchanges be banned? DEXs operate in a decentralized manner, making it challenging for authorities to shut them down entirely. However, regulatory environments may vary by region.

In conclusion, decentralized exchanges offer an exciting and innovative way to trade cryptocurrencies. If you want to explore DEXs further or access related resources, don’t hesitate to check out our DEX aggregator and additional articles on this topic. Happy trading!