Search Knowledge Base by Keyword

Tutorial: Using Custom Chart Pattern Filters

altFINS is a powerful platform designed to simplify technical analysis and trading for investors across various markets. One of its standout features is the ability to automatically detect 26 different chart patterns, such as wedges, channels, triangles, and inverse head and shoulders, across a wide range of assets. In addition to these automated detections, altFINS offers traders the flexibility to create and save custom chart pattern filters, providing a more personalized and efficient trading experience. In this knowledge base article, we’ll guide you through the process of creating and utilizing custom chart pattern filters within altFINS.

Watch This Tutorial Video – Custom Chart Pattern Filters

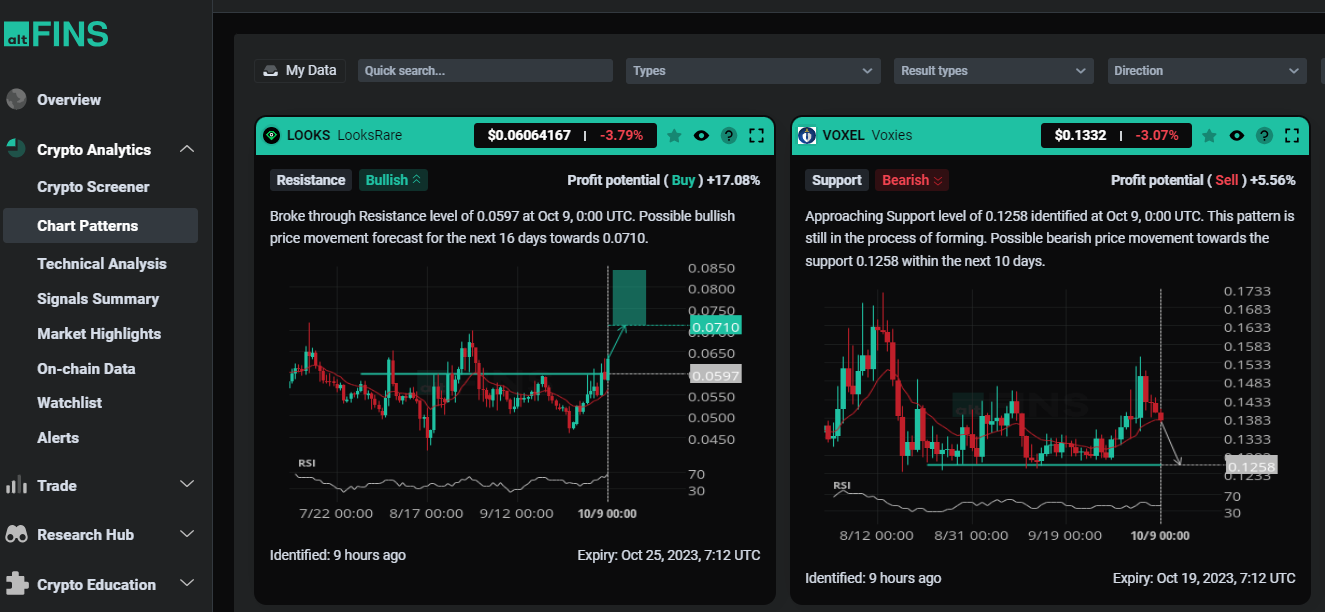

Automatic Chart Pattern Detection

altFINS automatically scans and identifies 26 different chart patterns, making it easier for traders to spot potential trading opportunities without manual analysis. These patterns include commonly used formations like flags, pennants, and double tops.

Key Sections for Chart Patterns

- Chart Patterns Section: This section allows you to filter chart patterns based on various criteria, such as type, direction, and exchange. It’s a quick way to find specific patterns in the altFINS platform.

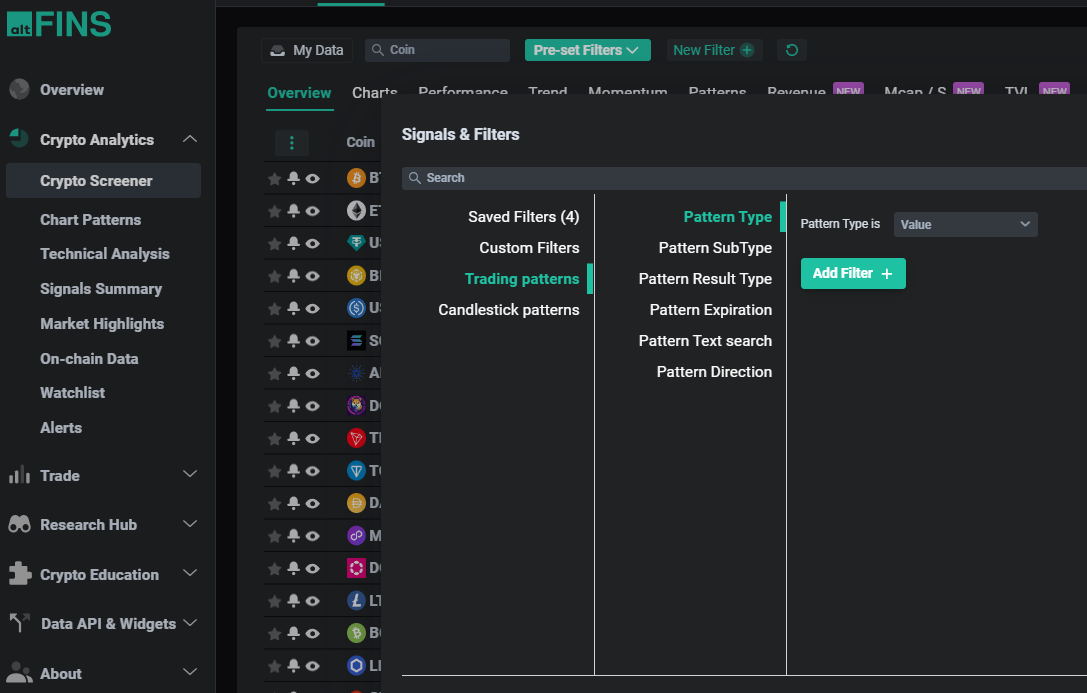

- Screener Section: The Screener is where you can create and customize your chart pattern filters. This feature provides traders with unparalleled flexibility to tailor their analysis to their unique trading strategies.

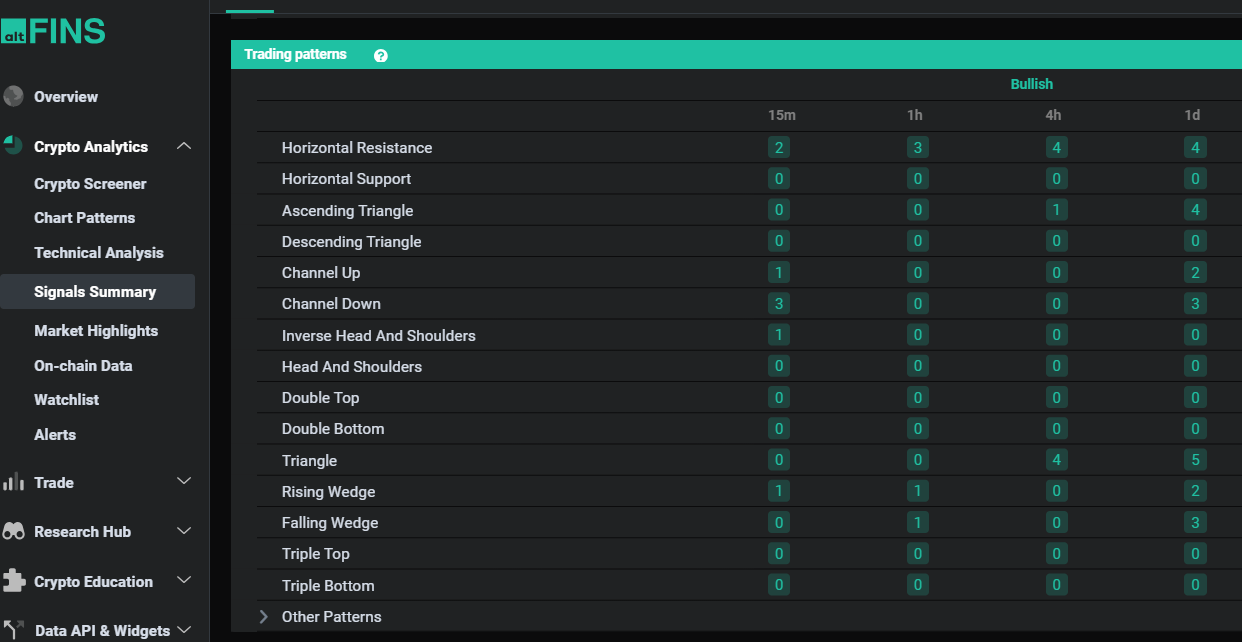

- Signals Summary Section: Here, you can see how many assets match your filter criteria across different time intervals. You can also apply additional filters, such as Portfolio or Watchlist, to fine-tune your search for trading opportunities.

Creating Custom Filters

In the Screener section of altFINS, you can create your custom chart pattern filters by following these steps:

a. Select the Screener tab.

b. Access basic chart pattern types or create your custom filter using various parameters like pattern type, exchange, and more.

c. Save your custom filter for future use, allowing you to easily access your preferred setups.

Saving Your Custom Filters

Saving your custom filters in altFINS is essential for efficient trading. After creating a filter, simply save it with a descriptive name so that you can quickly retrieve it whenever needed. This feature eliminates the need to recreate your filter criteria every time you log in.

Effortless Access to Your Favorite Trade Setups

Here’s a valuable tip: Once you’ve saved your custom filter, you can conveniently find it in the Signals Summary section. Here, you can view how many assets meet your filter criteria across various time intervals. Furthermore, you can apply additional filters, such as Portfolio or Watchlist, to further refine your search and identify the most promising trade setups. With just a couple of clicks, you’re ready to take action.

altFINS’ ability to automatically detect chart patterns and its feature-rich Screener section for creating and saving custom filters provide traders with a powerful toolset for technical analysis and trading. By utilizing these features effectively, you can streamline your trading process, save time, and make more informed decisions. Whether you’re a novice or experienced trader, altFINS can help you identify and execute profitable trading opportunities.