Pullback in Uptrend Opportunities

In crypto trading, a pullback in uptrend refers to a temporary reversal or decline in the price of an asset that is otherwise in a general upward trend. Pullbacks are often viewed as a natural part of market movements and can present opportunities for traders.

During an uptrend, where the overall direction of the price is rising, pullbacks are characterized by a temporary dip or correction before the upward movement resumes. These pullbacks can be caused by various factors, including profit-taking by traders, market sentiment shifts, or technical factors such as overbought conditions.

Traders and investors often look for pullbacks as potential buying opportunities, expecting that the uptrend will continue after the temporary decline. Technical analysis tools, such as trendlines, support levels, and various indicators, can be used to identify potential entry points during a pullback.

Crypto markets took a brief pause but are poised to resume their Uptrend. These dips can be profitable opportunities to join an established Uptrend and ride it higher.

Ideally, the price dips to a support area, which can serve as a trade entry (see CRO example below).

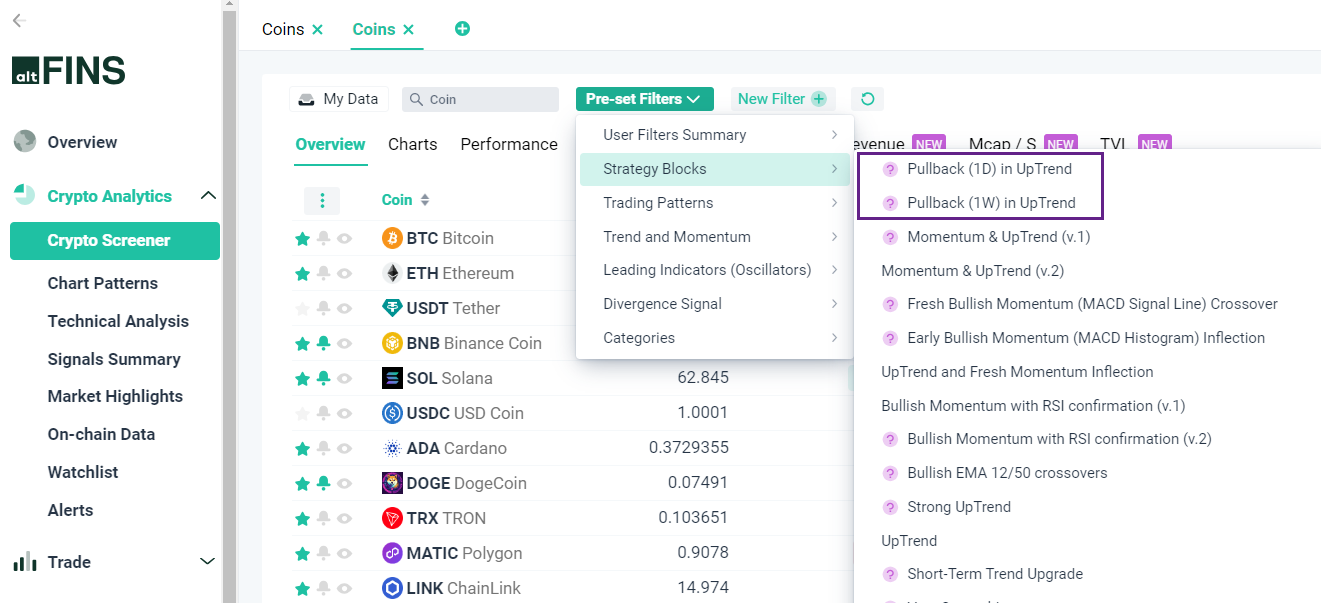

altFINS platform identifies such opportunities in two sections:

1. Screener: try this pre-set market scan that finds coins in Uptrend but with a recent pullback (see live results).

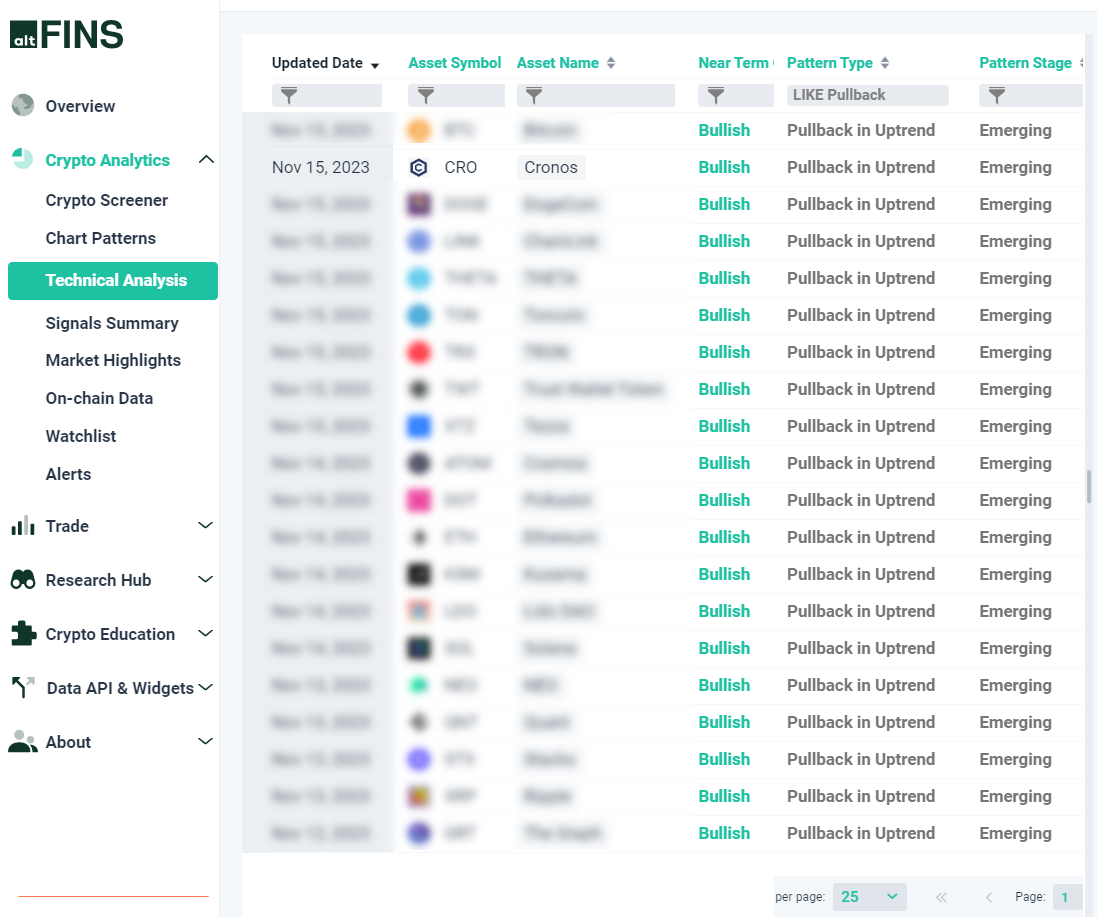

2. Technical Analysis: our analysts identify opportune trade setups and currently there are 20 Pullback in Uptrend opportunities and 17 Resistance Breakouts.

Pre-Set Market Scan: Pullback in Uptrend

Pullback in Uptrend – Trade Setups

Cronos (CRO) – Example

0 Comments

Leave a comment