Crypto Market Review Week 39 - 2023: Fed's Monetary Policy and ETF Expectations

Welcome to our weekly macro review for the 39th week of 2023. In this update, we’ll delve into the performance of key financial markets, the latest on inflation, and the cryptocurrency landscape. As the world continues to navigate economic uncertainties, we provide insights to help you stay informed.

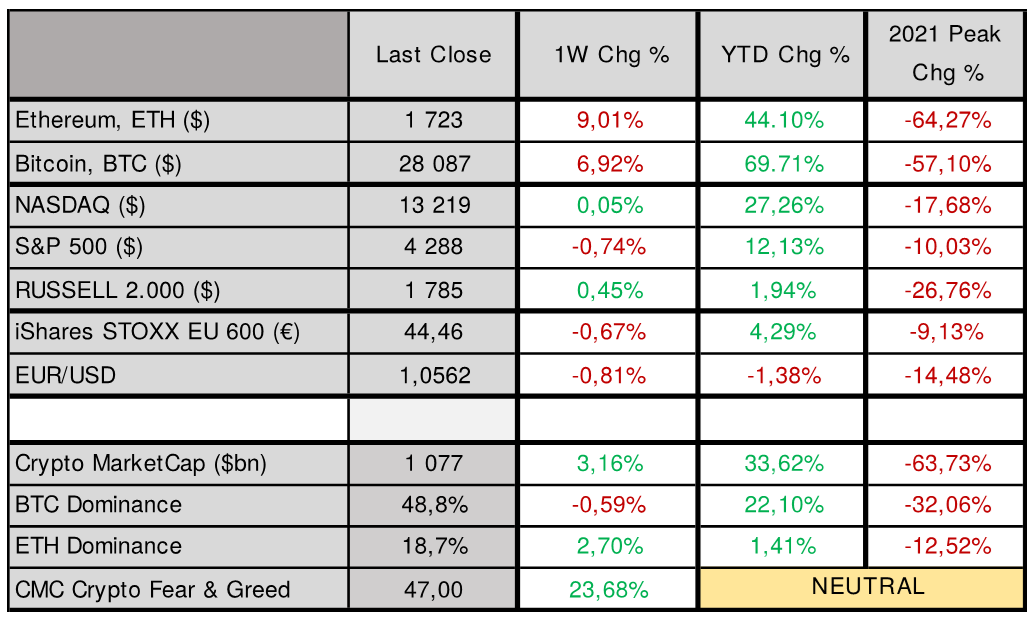

Market Performance

Cryptocurencies: Bitcoin and Ethereum Surge

Cryptocurrencies have remained in the spotlight, with Bitcoin (BTC) and Ethereum (ETH) showing significant gains. Bitcoin traded at $28,087 USDT, marking a 6.9% increase compared to the previous week. Ethereum, on the other hand, surged by 9% to reach around $1,723 USDT. Since the beginning of 2023, both BTC and ETH have significantly outperformed equity markets, with BTC up by an impressive 70% year-to-date and ETH up by 44%.

Traditional Markets: NASDAQ, S&P 500, and European Stocks

In traditional markets, the NASDAQ index closed at $13,219, showing marginal growth of 0.05% compared to the previous week. However, the S&P 500 experienced a slight decline, closing at $4,288, down by 0.7%. The European Top 600 stocks index also dipped by 0.7% to €44.46.

Inflation and the Federal Reserve

The Federal Reserve has maintained its cautious approach to interest rate hikes. While the FOMC meeting decided against an interest rate increase, the committee remains vigilant about inflation risks. Economic activity is expanding healthily, although job gains are slower but robust.

The core US CPI for August 2023 rose by 4.3%, in line with market expectations but lower than the Fed’s earlier prediction of 4.46%. This suggests that the Fed might consider altering its monetary policy tightening strategy sooner than expected. The headline US CPI increased to 3.7%, slightly higher than economists’ forecast of 3.6%.

The Federal Reserve Bank of Cleveland predicts that US headline inflation will remain flat at around 3.7% in September 2023, while the core US CPI is expected to fall to 4.17% year-on-year.

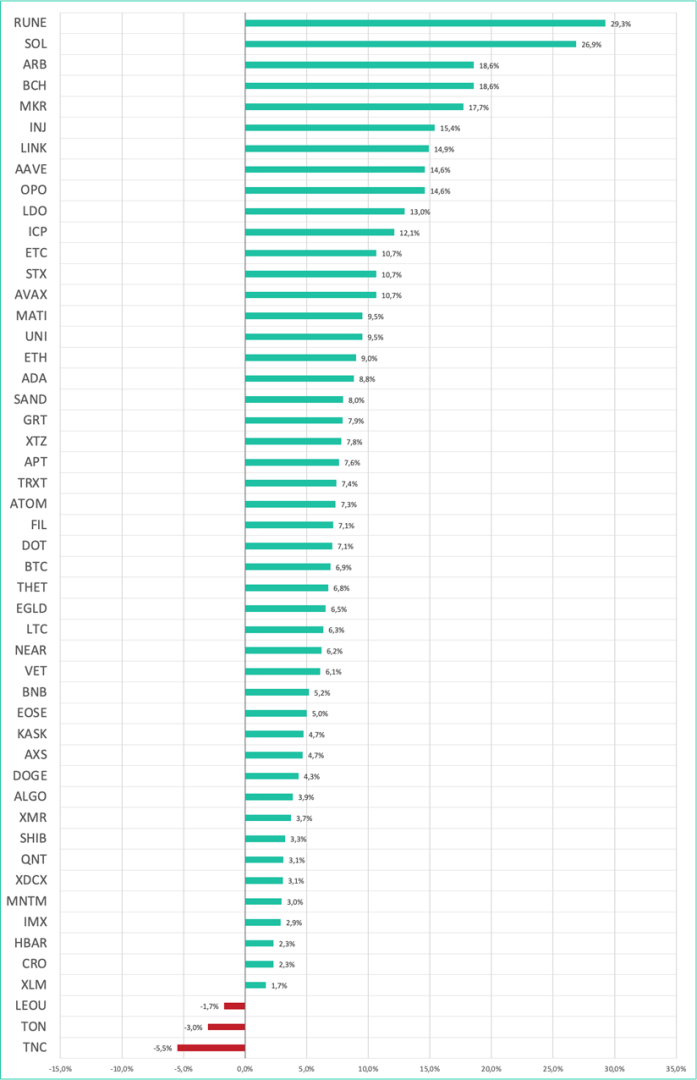

Cryptocurrency Market Outlook – Week 39

The cryptocurrency market began October 2023 with a significant liquidation of more than $70 million in crypto shorts following a surge in Bitcoin and Ethereum prices on October 1st. One potential catalyst for a bullish trend in the crypto market is the potential approval of a spot Bitcoin ETF by the SEC.

Once spot Bitcoin ETF applications are approved, major institutions such as Fidelity, BlackRock, and others will have the green light to invest in cryptocurrencies. This could lead to a substantial reduction in Bitcoin’s circulation on decentralized and centralized exchanges.

Historically, when Bitcoin’s price rises, the overall altcoin market capitalization also increases, often outpacing Bitcoin’s price gains. This dynamic was evident during the second wave, where Bitcoin’s rise from $30,000 to $50,000 coincided with the altcoin market cap surging from around $250 billion to over $1.5 trillion.

Additionally, investment firms like Valkyrie and VanEck have announced plans to offer exposure to Ethereum futures and Ethereum Strategy ETFs, respectively, which could further boost interest in cryptocurrencies.

Market Sentiment

The digital asset market sentiment, as indicated by our data, stands at 47.00, signaling a neutral sentiment compared to the previous week. The total cryptocurrency market cap gained approximately 3.2% and closed the week at around $1.077 billion. Ethereum’s dominance remains steady at around 18-19%, while Bitcoin’s dominance hovers just below 50%.

What to Watch For

As we move forward, keep an eye on the next monetary policy meetings for the Federal Reserve (October 31st – November 01st, 2023) and the European Central Bank (October 26th, 2023). Additionally, stay tuned for the release of US headline and core CPI figures for September 2023 on October 12th, 2023, at 08:30 AM ET.

In Conclusion

The cryptocurrency market continues to capture attention, with Bitcoin and Ethereum making significant gains. Inflation remains a key concern for central banks, influencing their monetary policy decisions. As we navigate these economic dynamics, staying informed and monitoring market developments will be crucial for investors and traders alike.

For the latest updates and insights, visit www.altfins.com.

0 Comments

Leave a comment