How Do Traders Use Candlestick Patters?

If you’re a crypto trader looking to level up your game, you’ve probably heard about candlestick patterns. These quirky-named patterns are not only fascinating but also incredibly valuable tools for traders. In this blog post, we’ll explore how candlestick patterns can help you make informed trading decisions and show you how to use them on the altFINS platform.

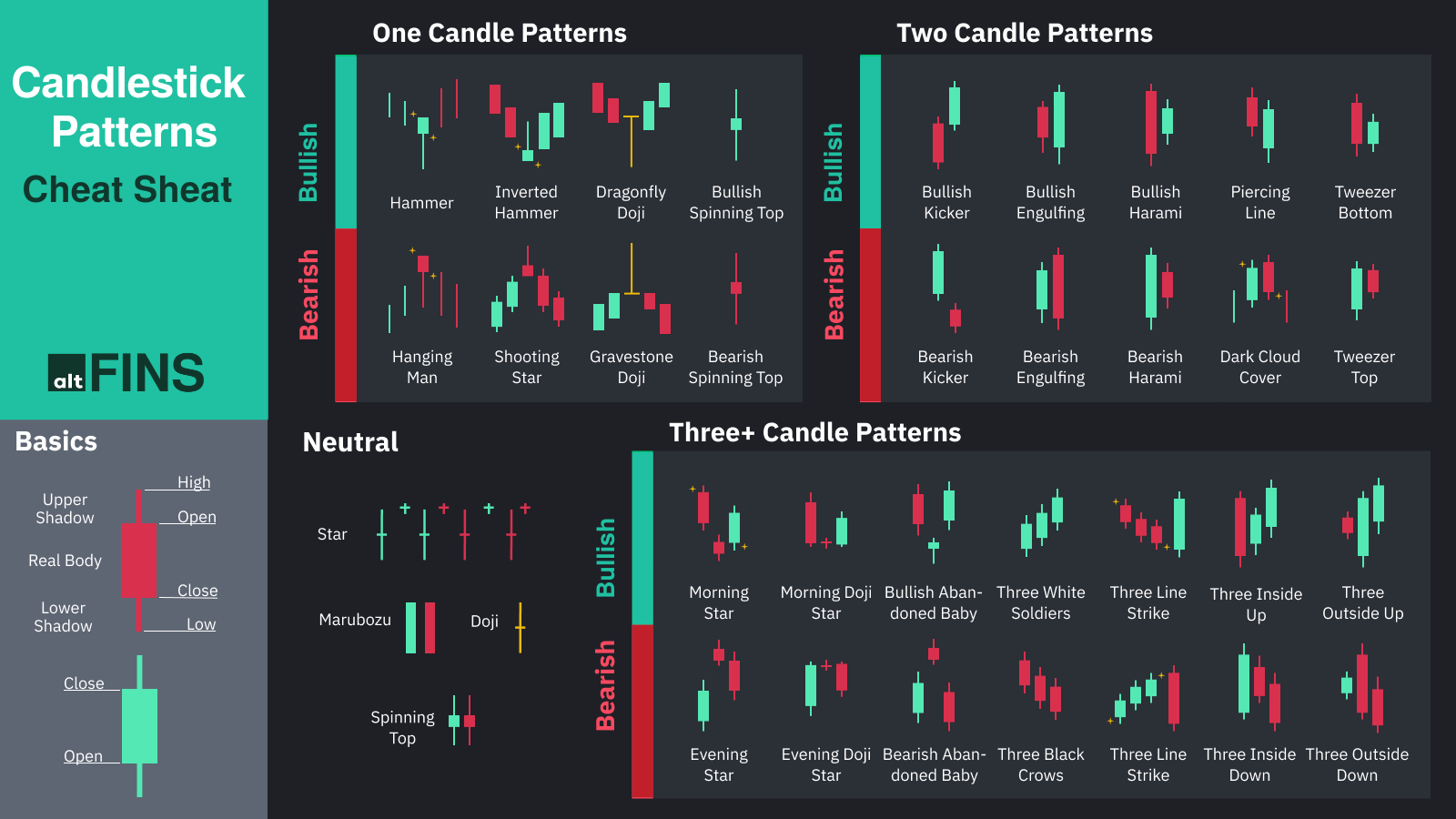

Candlestick patterns are a visual representation of market sentiment, and they can be found in various forms, each with its own significance. There are 32 popular candlestick patterns available on altFINS, divided into three categories:

- 1-Candle Patterns: These include patterns like the Hammer, Inverted Hammer, Dragonfly Doji, and more. They offer insights into short-term market sentiment and can help you identify potential reversals or continuations.

- 2-Candles Patterns: This category features patterns like Bullish Engulfing, Bearish Harami, and Dark Cloud Cover. These patterns often signal a more significant shift in market direction and can be used for medium-term trading strategies.

- 3+ Candles Patterns: Patterns like Morning Star, Bullish Abandoned Baby, and Three White Soldiers fall into this category. These patterns are considered powerful indicators of trend reversals and can be valuable for long-term traders.

Why To Use Candlestick Patterns in Crypto Trading?

Now that we know about the different types of candlestick patterns let’s delve into how traders can use them effectively:

- Confirming Signals: Candlestick patterns can confirm signals from other technical indicators. When you see a Doji pattern forming alongside a support level, it can provide stronger evidence for a potential reversal.

- Setting Stop-Loss and Take-Profit Levels: These patterns can help you establish precise stop-loss and take-profit levels, which are crucial for effective risk management. For instance, a Bearish Harami pattern after a strong uptrend might be a signal to set a stop-loss just above the recent high.

- Understanding Market Sentiment: Candlestick patterns offer insight into market sentiment, helping traders make more informed decisions. For example, a Hanging Man pattern signifies uncertainty or potential weakness in an uptrend.

How to Use Candlestick Patterns on altFINS?

To make the most of candlestick patterns, you can watch the tutorial video below and read our knowledgebase article to fully understand, how to scan for 32 candlestick patterns on altFINS platform.

Candlestick patterns are powerful tools that can enhance your crypto trading strategy. They provide insights into market sentiment, help confirm signals, and promote effective risk management. With altFINS’ Crypto Screener, you can easily scan 3000 of crypto assets and spot these patterns within seconds.

So, whether you’re a seasoned trader or just getting started, dive into the world of candlestick patterns and take your crypto trading to the next level. Happy trading!

0 Comments

Leave a comment