Search Knowledge Base by Keyword

What Is the 200-Day Simple Moving Average and How to Find It on altFINS

What Is the 200-Day Simple Moving Average (200 SMA)?

The 200-day Simple Moving Average (200 SMA) is one of the most widely followed indicators in technical analysis. It calculates the average closing price of an asset over the last 200 trading days (roughly 40 weeks) and plots it as a line on a price chart.

Because it smooths out short-term fluctuations, the 200 SMA helps traders and investors see the underlying long-term trend.

- When the price stays above the 200 SMA, the asset is generally considered in a long-term uptrend.

- When the price is below the 200 SMA, it’s seen as a long-term downtrend.

This line also often acts as support (if price is above) or resistance (if price is below).

Richard Fetyko, CEO and founder of altFINS: “200 SMA (simple moving average) is a super critical level. It acts either as support or resistance. Traders pay attention to this level, so when it’s breached, it’s typically very meaningful. When price crosses above its 200-day Moving Average (200 SMA), it’s typically a sign that price trend is reversing from Downtrend to Uptrend.“

Watch the Tutorial Video

Here’s a 3 min tutorial video on how to find assets with bullish Price crossover with 200 SMA on altFINS platform.

Why the 200 SMA Matters So Much

The 200 SMA is powerful because millions of traders, analysts, and algorithms watch it. That makes it almost a self-fulfilling level—when it’s breached, markets often react strongly.

- Bullish signal: Price crossing above the 200 SMA can signal the start of a new uptrend.

- Bearish signal: Price falling below the 200 SMA can signal the start of a downtrend.

This is why the 200 SMA is often paired with shorter-term averages like the 50-day SMA. When these lines cross, it creates well-known signals:

- Golden Cross: 50-day SMA crosses above the 200-day SMA → often seen as the start of a bull market.

- Death Cross: 50-day SMA crosses below the 200-day SMA → often seen as the start of a bear market.

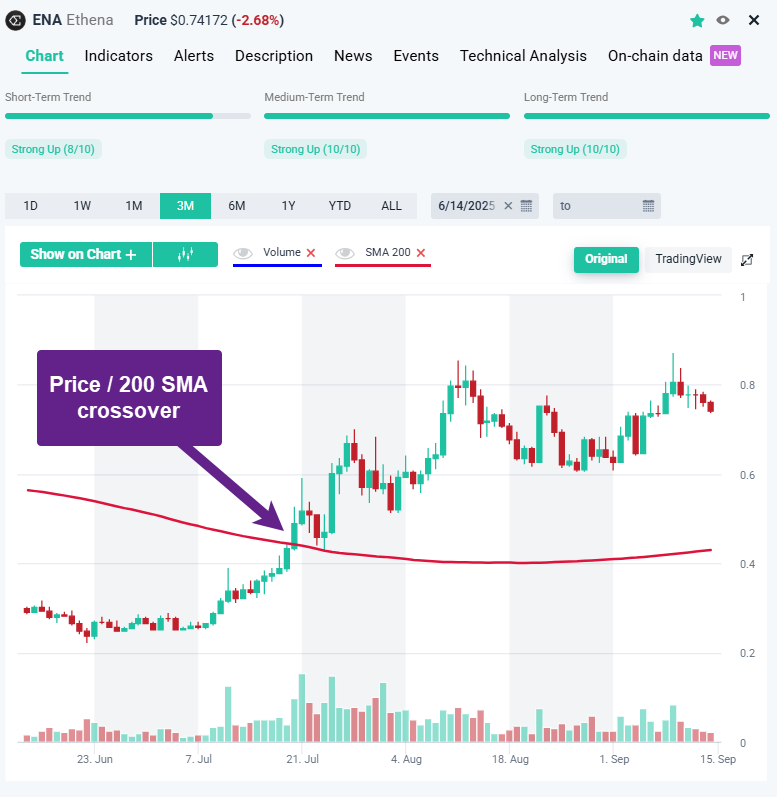

Real Example: Ethena (ENA) 200 SMA Breakout

On July 21, ENA’s price crossed above its 200 SMA, signaling a possible trend reversal. Since then, ENA has rallied over 40% — a textbook example of how spotting 200 SMA crossovers early can uncover strong bullish opportunities.

200 SMA vs. 50 SMA vs. EMA

While the 200 SMA is the most popular long-term moving average, traders also use:

- 50 SMA for medium-term trend analysis

- Exponential Moving Average (EMA), which gives more weight to recent prices and reacts faster to price changes

Many traders watch both SMA and EMA to confirm trends. For example, a 50 SMA crossing above a 200 SMA (golden cross) is even more powerful if price is also above the 200 EMA.

How to Find 200 SMA Crossovers on altFINS

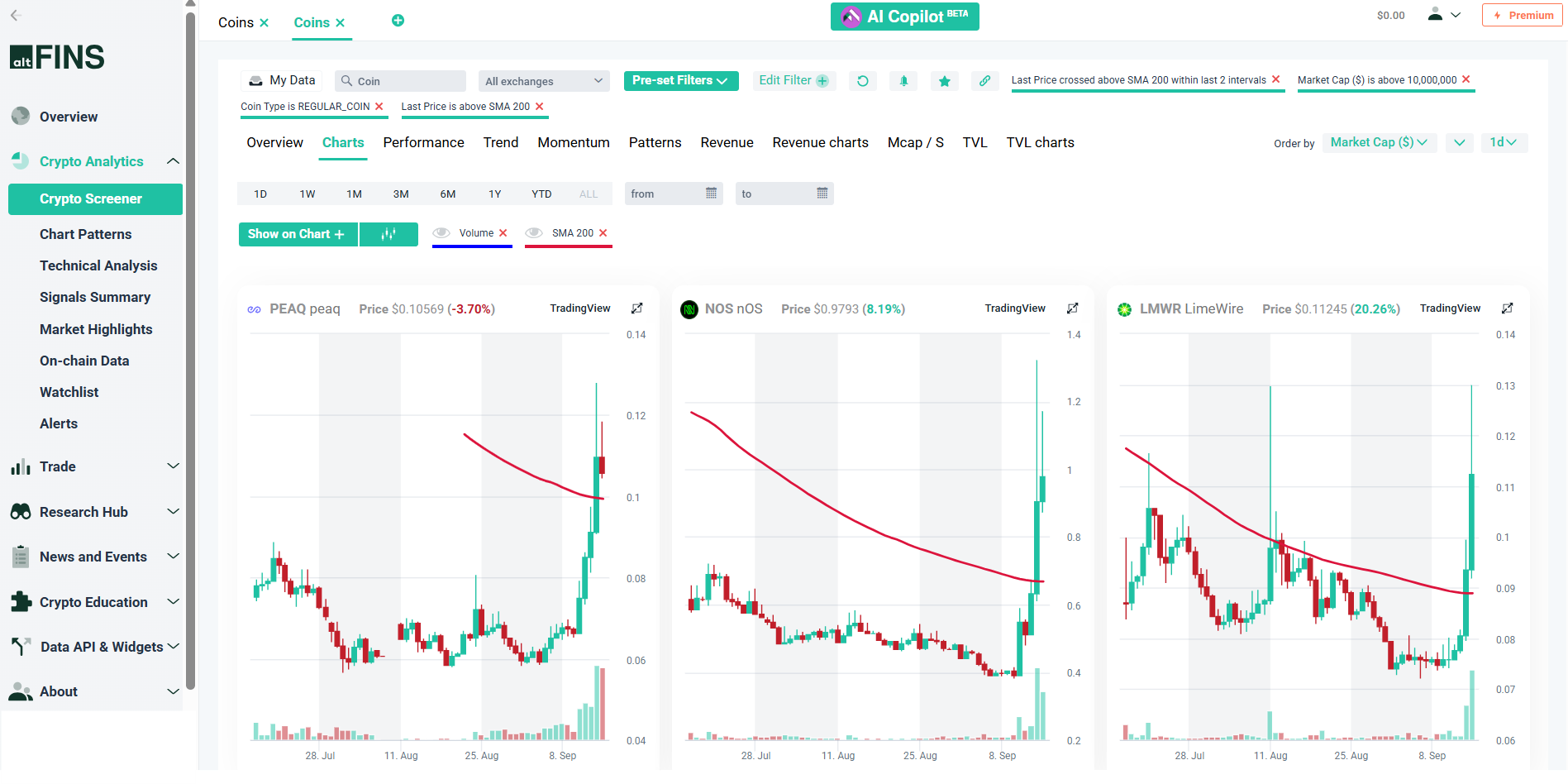

Finding coins that are breaking above their 200 SMA is simple with altFINS.

altFINS Screener offers a quick way to find such trade opportunities.

Here’s a custom market scan that finds coins with a recent 200 SMA crossover.

Follow the link, then click on Charts tab and check out the price / 200 SMA crossovers.

Then click on Edit Filter and save it! You can use this market scan in the future.

You can also create an Alert for this filter and receive notifications in your email and mobile app. See how.

Why Every Trader Should Monitor the 200 SMA

Monitoring the 200 SMA can give you a major edge in crypto trading:

- Spot early trend reversals before the crowd

- Use it as support/resistance for stop-losses and entries

- Time high-conviction trades when price breaks above this key level

Bottom Line

The 200-day Simple Moving Average is a must-watch line on any crypto chart. A bullish crossover can be the first sign that a downtrend is ending and a new uptrend is beginning.

With altFINS Crypto Screener, you can scan for 200 SMA crossovers, save custom filters, and set alerts to catch trend reversals as they happen.

Stay ahead of the market — keep an eye on the 200 SMA!