Search Knowledge Base by Keyword

Why And How Use altFINS Crypto Screener

A coin screener helps you filter, sort, and monitor thousands of cryptocurrencies by technical, fundamental, and on-chain criteria — transforming a massive, noisy market into actionable trade ideas. A robust screener:

-

Saves time (you don’t have to eyeball each coin)

-

Helps you discover hidden opportunities

-

Lets you codify and reuse your own strategies

-

Powers alerts so you never miss a setup

Below is a comparison of the altFINS Crypto Screener against some popular competitors.

Comparison Table: altFINS vs Competitors

| Feature / Metric | altFINS (Crypto Screener) | CoinGecko Pro / Screener) | TradingView Screener) | CoinMarketCap Advanced Filter | Notes / Comments |

|---|---|---|---|---|---|

| Universe coverage | ~3,000+ altcoins (data from 30 major exchanges) | ~2,000 coins / pairs | ~5,000 pairs across crypto + stocks | ~7,000 coins but limited filter depth | Coverage improves your chance to find outliers |

| Number of filterable indicators & metrics | 100+ preset filters + ability to build custom filters from ~120 indicators (SMA, EMA, MACD, RSI, volume, on-chain metrics) | ~60 filters | ~80 built-in indicators (plus custom scripting) | ~30 standard filters | Depth and flexibility differ strongly |

| Chart pattern recognition / AI patterns | Automated detection of 26 chart patterns across timeframes (15 min, 1h, 4h, 1d) | Some basic patterns | Full chart scripting + user patterns | Very limited pattern support | Patterns often distinguish more advanced tools |

| Result organization / tabs | Six or more tabs: Overview, Charts, Scorecards, Performance, Trend, Oscillators, (Momentum / Patterns / Revenue / TVL) | Fewer categories (e.g. Overview, Performance) | Very flexible dashboard / widgets | Basic table layout | Good UX makes interpretation easier |

| Alerts & signal notifications | Yes — alerts per filter, via email & push, tied to specific time intervals | Some alerts | Full alerts + alert scripting | Basic price alerts | Alerts are critical to not miss setups |

| Portfolio / watchlist filtering | Yes — filter by your own watchlist or portfolio coins | Limited | Yes | No | Helps you concentrate on coins you already track |

| On-chain / fundamental data | Yes — revenue, TVL, on-chain metrics integrated | Some basic fundamentals | Mostly technical only | Some fundamentals (market cap, volume) | A differentiator for longer-term setups |

| User-saved filters / reuse | Yes — save filters / screens; custom signals show up in “Signals Summary” | Some ability | Yes (via scripting) | Minimal | Reusability is key for consistency |

| Ease of use / learning curve | Moderate — many options, but with tutorials & knowledge base | Easier for casual users | Medium to high (depending on scripting) | Very easy, shallow depth | Trade-off between power and simplicity |

| Typical signal hit rate / pattern success | Inverse Head & Shoulders ~84%, Head & Shoulders ~82%, Double Bottom ~82% (from pattern stats) | N/A | Depends on user scripts | N/A | Patterns are probabilistic, not guarantees |

Key takeaways from the comparison:

-

altFINS stands out for combining both technical + on-chain + pattern filters in one platform.

-

Its alerting and saved-scan workflow is more advanced than many light screeners.

-

Competitors usually trade off ease for depth; altFINS aims to provide depth with a guided interface.

-

ROI benchmarks are suggestive and depend entirely on strategy discipline and risk management.

Traders Use the Crypto Screener to Discover Trading Opportunities

altFINS includes many pre-defined crypto trading signals, or you can set-up your own custom screens using combinations of technical indicators (SMA, EMA, RSI, MACD…) and variables like market cap, traded volume, and price performance.

Watch an Introduction Video about altFINS Crypto Screener

As a registered user, you can also save your custom filters and set alerts, so that the system alerts you of assets that fit your filter criteria (via email).

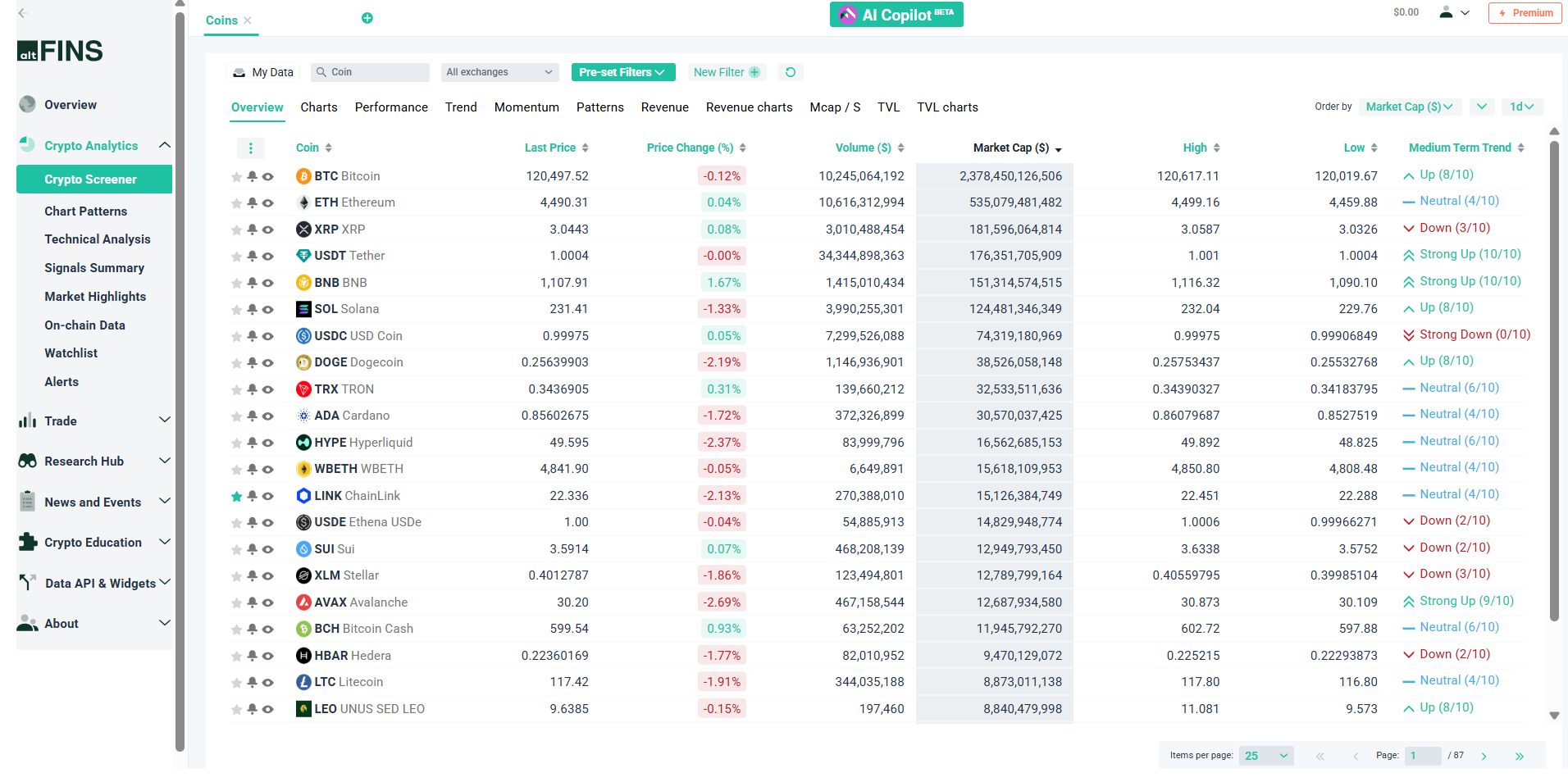

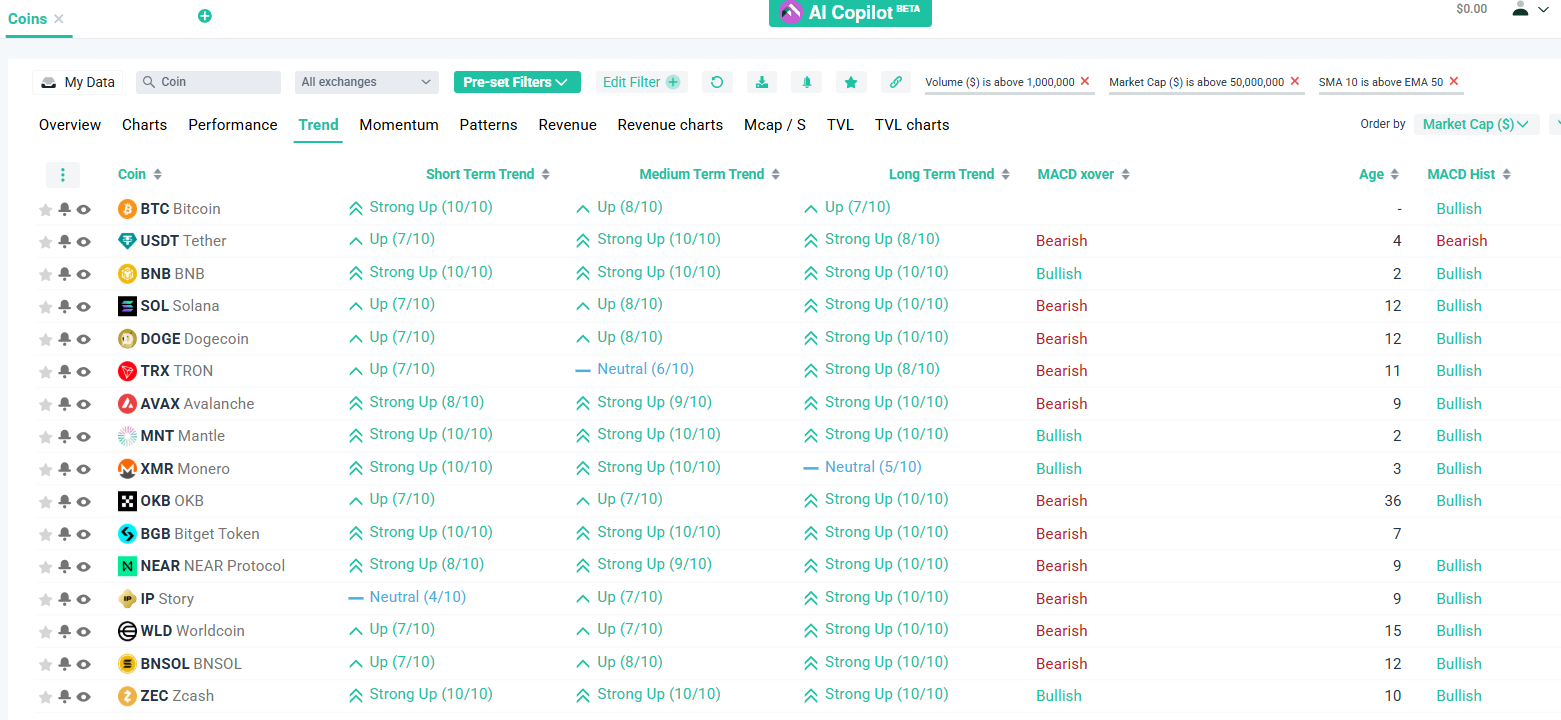

Screener results are organized into six tabs: overview, charts, scorecards, performance, trend and oscillators. You can add columns (indicators, data) to these columns; the system will save your preferences, if you’re a registered user. Registration is free.

Beware of which time interval you’re working with. You can change the interval even after you create and run a screen.

Here are examples of pre-defined screens that you case use as a starting point for building your own custom screens.

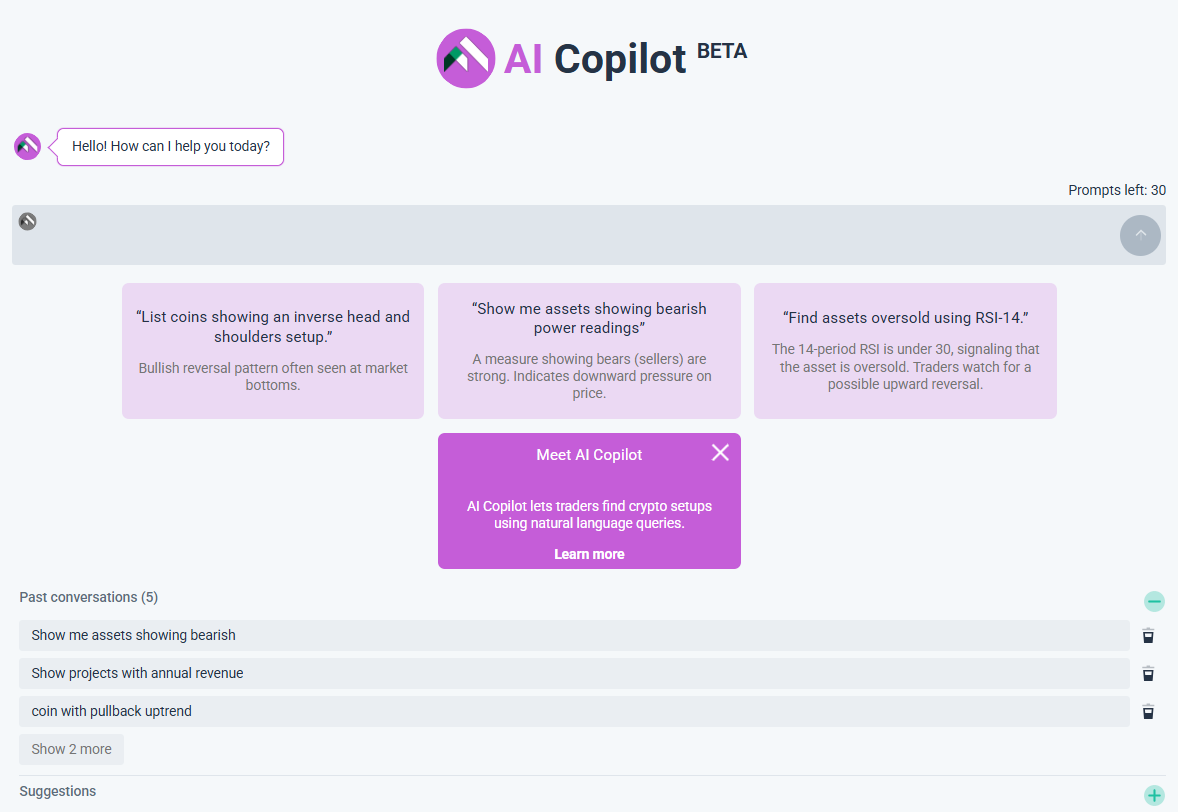

Introducing altFINS AI Copilot

altFINS AI Copilot is your personal trading assistant, designed to make crypto research and decision-making faster and smarter. Powered by advanced AI, the Copilot can answer your trading questions, explain technical indicators, suggest strategies, and even help you build custom filters for the coin screener.

Instead of manually scanning thousands of charts or memorizing complex setups, you can simply ask the Copilot things like “show me oversold DeFi coins on the 4H timeframe” or “explain this bullish divergence signal”. It’s integrated directly into the altFINS platform, so you can move seamlessly from insights to action. With daily prompt limits depending on your plan, the AI Copilot is a game-changer for traders who want clear, on-demand guidance without wasting hours digging through data. Try it now!

Step-by-Step Annotated Guide: Setting Up a Screener on altFINS

You can create a custom filters or use pre-set filters on altFINS Crypto Screener.

Step 1: Access the Crypto Screener

-

Log into altFINS → from the left menu, choose Crypto Screener.

-

You’ll see a initial default screen showing “Overview” with a list of coins.

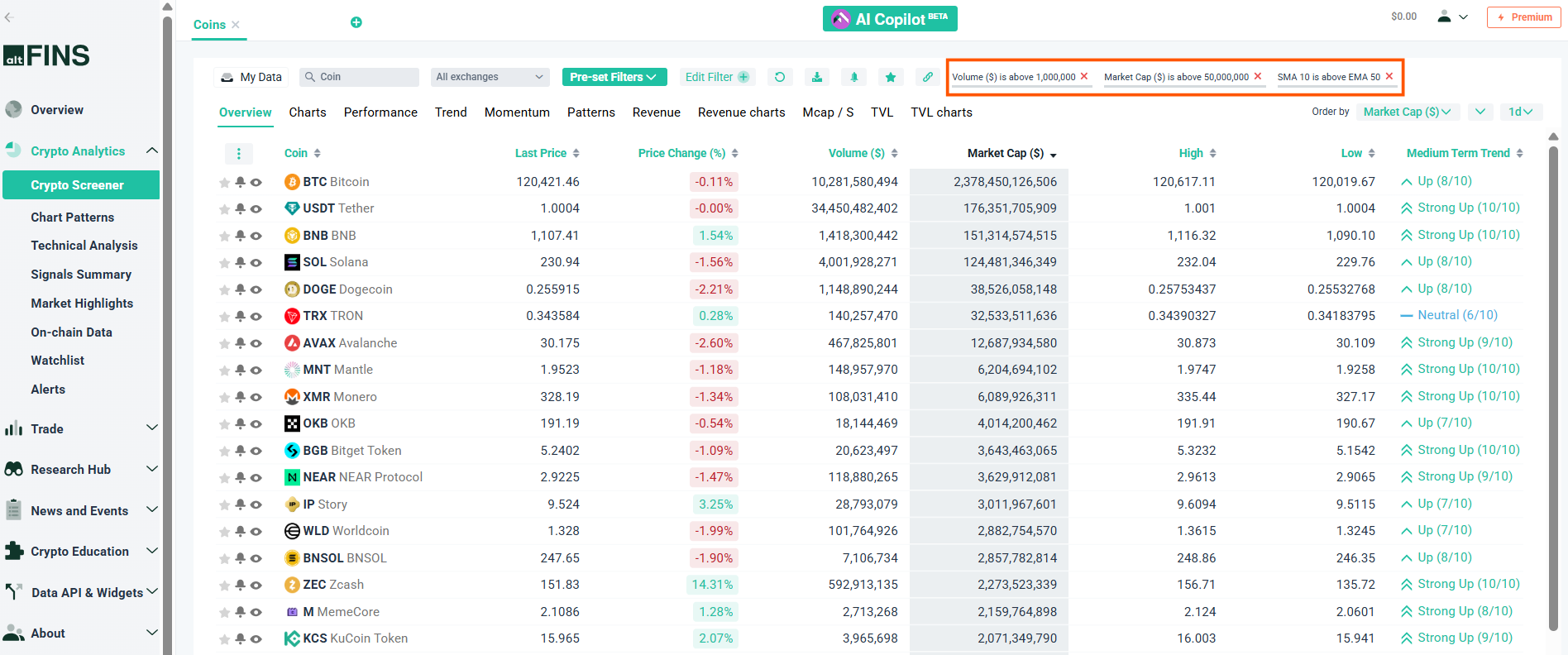

Step 2: Choose Time Interval & Base Parameters

-

At the top, select interval (e.g. 1 h, 4 h, 1 d).

-

Apply basic filters like Market Cap > $50M, Volume > $1M — this weeds out thinly traded coins.

Step 3: Add Indicator / Technical Filters

-

Click “+ Add Filter” → e.g. choose EMA10 > EMA50 (bullish crossover). Find the live filter here. Now from 2000+ altcoins we narrow down the number to 87.

-

Add another: RSI between 50 and 70.

-

You can chain filters with AND / OR logic.

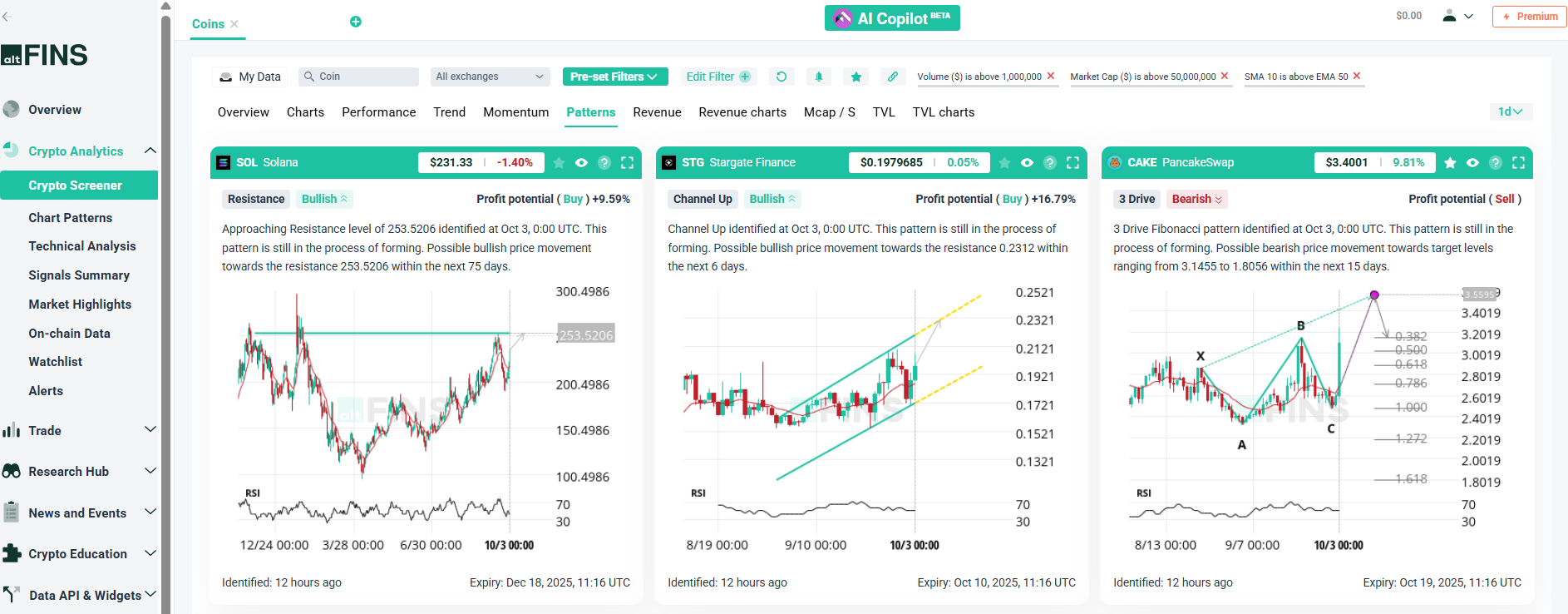

Step 4: Include Chart Patterns (optional)

-

In filter menu, pick “Pattern type” → ascending triangle or inverse head & shoulders.

-

Specify timeframe (e.g. pattern forming on 4h chart).

Step 5: Run the Screen & Inspect Tabs

-

Click Apply / Run.

-

The results appear, organized in tabs:

-

Overview: key columns (price, volume, etc.)

-

Charts: mini-charts for each coin

-

Performance: returns over 24h, 7d, 30d

-

Trend / Oscillators: indicator readings

-

-

You can drag to add or hide columns; preferences are saved for registered users.

Step 6: Save & Set Alert for Your Filter

-

Click “Save Filter / Create Signal”.

-

Name it, e.g. “EMA10>EMA50 + triangle”.

-

Set an alert: e.g. notify me when new assets match this filter (on 4h interval).

-

Alerts are delivered via email or push.

Learn how to set up different kind of alerts.

Step 7: Monitor & Refine

-

New matching coins show up — click a coin to open detailed view with full chart, news, on-chain stats.

-

Use “Signals Summary” to see your saved filters and built-in ones at a glance.

-

Modify filters or combine with other indicators as you see results.

Example Filter (Sample Use Case)

Suppose you look for mid-cap coins breaking out:

-

Market cap between $50M and $300M

-

Volume > $5M daily

-

Price > 20 EMA

-

Price crossing above upper boundary of ascending triangle

-

RSI < 70 (to avoid exhaustion)

Save this as “Mid-cap breakout” and run it. Let alerts notify you when new coins meet this criteria.

How to use Pre-set Filters in the altFINS Crypto Screener

Before you start (2 quick checks)

- Open: Crypto Analytics → Crypto Screener.

- Set context (top toolbar):

- Timeframe (e.g., 1h / 4h / 1D).

- Universe (All exchanges or a specific one).

- Optional baseline filters like Volume ($) > 1,000,000 to avoid illiquid coins.

Step-by-step

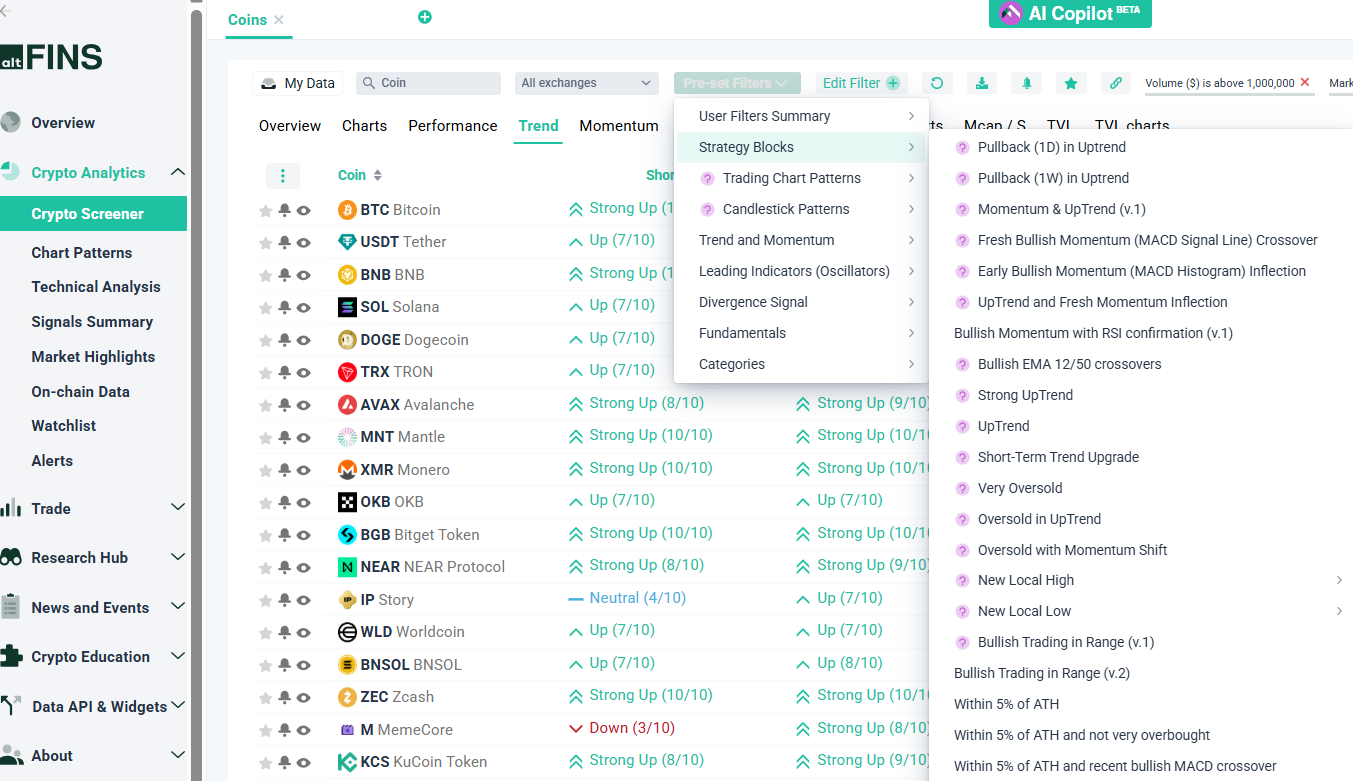

1) Open the Pre-set Filters menu

Click Pre-set Filters (top toolbar). You’ll see groups of ready-made scans.

2) Pick a group (what you want to find)

- Strategy Blocks

- Trading Chart Patterns (e.g., Bullish Pattern Breakouts, Ascending Triangle, H&S, Double Bottom, Rising/Falling Wedge).

- Candlestick Patterns (common single/multi-candle signals).

- Trend and Momentum (Quick momentum/trend scans like Price/SMA Crossovers, EMA Crossovers, MA Ribbon, Unusual Volume Gainers, BB Upper-band breaks, OBV UpTrend, RVOL spikes, etc.)

- Leading Indicators (Oscillators) Ready RSI/Stoch/Williams setups like Oversold (RSI-14/9/25), Stoch RSI fast, Bull Power (+), Bear Power (+)

- Divergence Signal (Bullish/Bearish divergence combinations (price vs. indicator).

- Fundamentals (Filters that lean on non-price data (mcap, liquidity, TVL/revenue where available).

- Categories (Sector tags such as DeFi, Gaming, Metaverse, Stablecoin, NFTs, MEMEs.)

Tip: If you’re looking for patterns, start in Strategy Blocks → Trading Chart Patterns.

For momentum/trend hunting, use Trend and Momentum.

3) Apply a preset

Click any preset (e.g., Bullish EMA 12/50 crossovers or Ascending Triangle).

The screener instantly updates and shows only coins that currently match.

You’ll notice filter chips appear along the top (e.g., Volume ($) is above 1,000,000). Those represent the logic behind the preset.

4) Review results by tabs

Use the tabs above the table to investigate candidates:

- Overview: price, volume, liquidity basics.

- Trend / Momentum: altFINS trend scores (e.g., Up (7/10)) and key indicator states.

- Charts: quick visual check.

- Performance: 24h/7d/30d stats.

- Oscillators: RSI/Stoch/… readings.

- Sort by any column (e.g., Long-Term Trend, RVOL, Performance 7D) to surface the best fits.

5) Tweak the preset (optional)

Click Edit Filter (+) next to the Preset menu to:

Adjust thresholds (e.g., RSI < 70, Volume > $5M, Mcap > $50M).

Add/remove criteria (e.g., add Category = DeFi to a momentum scan).

Change which timeframe the logic evaluates on.

Presets are just starting points. Tuning them to your liquidity/risk rules usually improves results.

6) Save it

Hit Save (star/disk icon) and give your scan a name, e.g., “4H AscTriangle + RVOL”.

Saved scans appear under User Filters Summary for one-click reuse.

7) Set alerts (recommended)

Click the bell icon to create an alert for this filter/timeframe.

Choose how you want to be notified (email/push). You’ll get a ping whenever new coins start matching.

8) Change or reset quickly

To try another preset, open Pre-set Filters again and pick a new one.

To clear everything, use the reset/refresh icon or remove individual chips.

9) (Optional) Narrow to your lists

Use My Data / Watchlist / Portfolio to run the same preset only on coins you track.

Quick “recipes” using Pre-sets

- Pullback (1D) in Uptrend → Great for buying strength on dips.

- UpTrend & Fresh Momentum Inflection → Momentum just turned; early continuation.

- Bullish EMA 12/50 Crossovers → Classic trend-following entry.

- Oversold in Uptrend (RSI-14) → Mean-reversion entries during strong trends.

- Bullish Pattern Breakouts → Names breaking out from chart structures.

- Within 5% of ATH → Strength screeners for potential blue-sky runs.

- Category = DeFi/Gaming/NFTs + RVOL Spike in Uptrend → Sector rotations.

Troubleshooting – Zero results?

- Timeframe too strict → switch 1h ↔ 4h ↔ 1D.

- Liquidity caps too high → lower Volume / Mcap thresholds.

- Wrong universe → switch All exchanges or include more markets.

Too many results?

- Add Volume/Mcap floors, Category, or an extra indicator condition.

- Sort by Trend score or Performance and work from the top.

Best practices

- Create one saved scan per timeframe (e.g., 1H momentum, 4H pattern, 1D pullback).

- Always layer a liquidity floor (Volume & Mcap) before acting.

- After finding candidates, open Charts to confirm structure and risk levels.

Real Use Cases: Who Benefits Most from a Crypto Screener?

Different traders use a screener in different ways. Here are three common personas:

-

Swing Trader – Uses chart pattern detection to find medium-term opportunities, such as triangles, wedges, or double bottoms. For example, a swing trader may screen for coins forming an ascending triangle on the 4H timeframe, aiming to capture multi-day breakouts.

-

Day Trader – Focuses on short-term filters like sudden volume spikes, oversold RSI, or intraday moving average crossovers. The screener helps day traders quickly identify which coins are showing momentum shifts on the 15m or 1h charts.

-

Long-Term Investor – Filters by fundamental and on-chain metrics such as market cap, trading volume, total value locked (TVL), or project revenue. This allows long-term investors to focus on fundamentally strong coins while still considering technical signals for entry timing.

By serving multiple trading styles, altFINS makes the screener flexible enough to fit into any trader’s workflow.

Case Study: A Breakout Opportunity Spotted with the Screener

A trader was scanning the altFINS screener for bullish chart patterns on the 4H interval. The filter highlighted Solana (SOL) forming an ascending triangle with strong volume support. The trader saved this filter and set an alert.

Just a few days later, SOL broke above the triangle’s resistance line. Thanks to the alert, the trader entered early. Within 7 days, SOL rallied by +22%, validating both the chart pattern detection and the alert system.

This example shows how combining pre-set filters, chart pattern recognition, and alerts can turn market noise into actionable trade ideas — and help traders act at the right time.

❓ FAQ: altFINS Crypto Screener

1. What is a crypto screener?

A crypto screener is a tool that lets you filter, sort, and analyze thousands of cryptocurrencies based on technical indicators, candlestick patterns, chart patterns, fundamentals, and on-chain data. Instead of manually scanning charts, you can use preset or custom filters to quickly find trade opportunities.

2. Why should I use altFINS’ screener instead of others?

altFINS combines technical + on-chain + chart pattern filters in one platform, which most competitors don’t. It also lets you save filters, set alerts, and track your watchlist/portfolio, making it more powerful for active traders.

3. How do pre-set filters work?

Pre-set filters are ready-made scans (e.g., “Bullish EMA Crossovers” or “Oversold RSI”) that instantly show coins meeting those conditions. You can apply them in one click, tweak them, and then save them as your own custom filter.

4. Can I create my own custom filters?

Yes. You can build custom filters using over 120 indicators (RSI, MACD, SMA, EMA, volume, fundamentals, etc.). You can also combine conditions with AND/OR logic for more precise screening.

5. Does the screener detect chart patterns automatically?

Yes — altFINS automatically detects 26 chart patterns (triangles, wedges, double tops/bottoms, head & shoulders, etc.) across multiple timeframes, helping you spot breakouts and reversals faster.

6. Can I get alerts when coins match my filter?

Yes. After saving a filter, you can set alerts by email or push. You’ll be notified whenever new coins meet your criteria (e.g., when a fresh breakout pattern appears). Learn more about alerts.

7. Does altFINS screener support fundamentals or on-chain data?

Yes. In addition to technical filters, you can screen coins based on market cap, trading volume, TVL (total value locked), revenue, tokenomics, and other fundamental metrics.

8. How many coins can I screen?

altFINS covers 2,000+ altcoins from 30 major exchanges. This broad coverage helps traders discover opportunities that may be missed by other screeners.

9. What’s the biggest mistake new users make?

The most common mistake is forgetting to check the timeframe. A coin may look bullish on the 4h chart but not on the daily chart. Always match your screener timeframe to your trading style.

Do I need to pay to use the screener?

1. Is there a free plan for altFINS?

Yes. The Starter Plan is free and includes AI Copilot (5 prompts daily), 2 automated chart pattern scans per day, the trading course, and up to 2 trade setups. However, screener results are limited to 3 results per filter.

2. What’s included in the Basic Plan ($20/month)?

The Basic Plan unlocks:

-

10 AI Copilot prompts daily

-

Automated chart patterns on all charts at 1D interval

-

10 trade setups

-

Unlimited screener results

-

Up to 5 saved custom filters

-

Up to 5 simultaneous screeners

-

10 alert rules (50 daily alerts)

-

Coin Picks & Reports, Trading Videos, and full crypto news access.

3. What’s the difference between Essential ($40/month) and Premium ($60/month)?

-

Essential Plan:

-

20 AI Copilot prompts daily

-

Automated chart patterns on 4h + 1D intervals

-

20 trade setups

-

Save 10 custom filters

-

10 simultaneous screeners

-

20 alert rules (500 daily alerts)

-

-

Premium Plan:

-

30 AI Copilot prompts daily

-

Automated chart patterns on all intervals

-

Unlimited trade setups

-

Unlimited saved custom filters

-

15 simultaneous screeners

-

Unlimited alert rules (5,000 daily alerts)

-

Both include TradingView charts, Coin Picks & Reports, fundamentals, crypto news, watchlist, and ad-free access.

Explore Pricing Page.