Search Knowledge Base by Keyword

Three White Soldiers Candlestick Pattern: A Comprehensive Guide

The Three White Soldiers candlestick pattern is a widely recognized bullish reversal signal used in technical analysis. It often signals a strong upward momentum in an asset’s price after a prolonged downtrend. This guide will help you understand the pattern’s structure, significance, and strategies for effectively incorporating it into your trading arsenal.

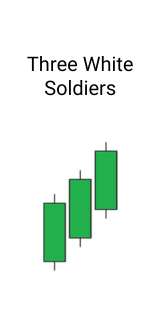

What Is the Three White Soldiers Pattern?

The Three White Soldiers is a candlestick pattern comprising three consecutive long-bodied bullish candles that indicate a strong shift in market sentiment from bearish to bullish. Each candle in the pattern opens within or near the previous candle’s real body and closes at a higher price, reflecting persistent buying pressure.

This pattern is considered reliable due to its clear depiction of market sentiment transition. However, it should be used in conjunction with other technical indicators and market context to confirm its validity.

How to Identify the Three White Soldiers Pattern

To recognize the Three White Soldiers pattern, look for the following characteristics:

- Downtrend Preceding the Pattern: The pattern typically emerges after a sustained downtrend or period of consolidation.

- Three Consecutive Bullish Candles: Each candlestick has a long body and closes higher than the previous one, with small or no upper shadows.

- Minimal Shadows: The candles should exhibit small wicks, suggesting strong buying activity and minimal price rejection.

- Opening Prices: Each candle opens within or near the previous candle’s real body.

Examples of the Three White Soldiers Pattern

The chart of Moon coin has formed a bullish Three White Soldiers pattern, indicating a potential trend reversal from the recent downtrend. This pattern consists of three consecutive green candlesticks with higher closes, signaling strong buying momentum and growing investor confidence.

The steady upward movement, combined with increasing volume, suggests that bullish sentiment is taking control. Traders may view this as an opportunity to enter long positions, with a stop-loss placed below the pattern’s low to manage risk.

How to Find the Three White Soldiers Pattern on altFINS?

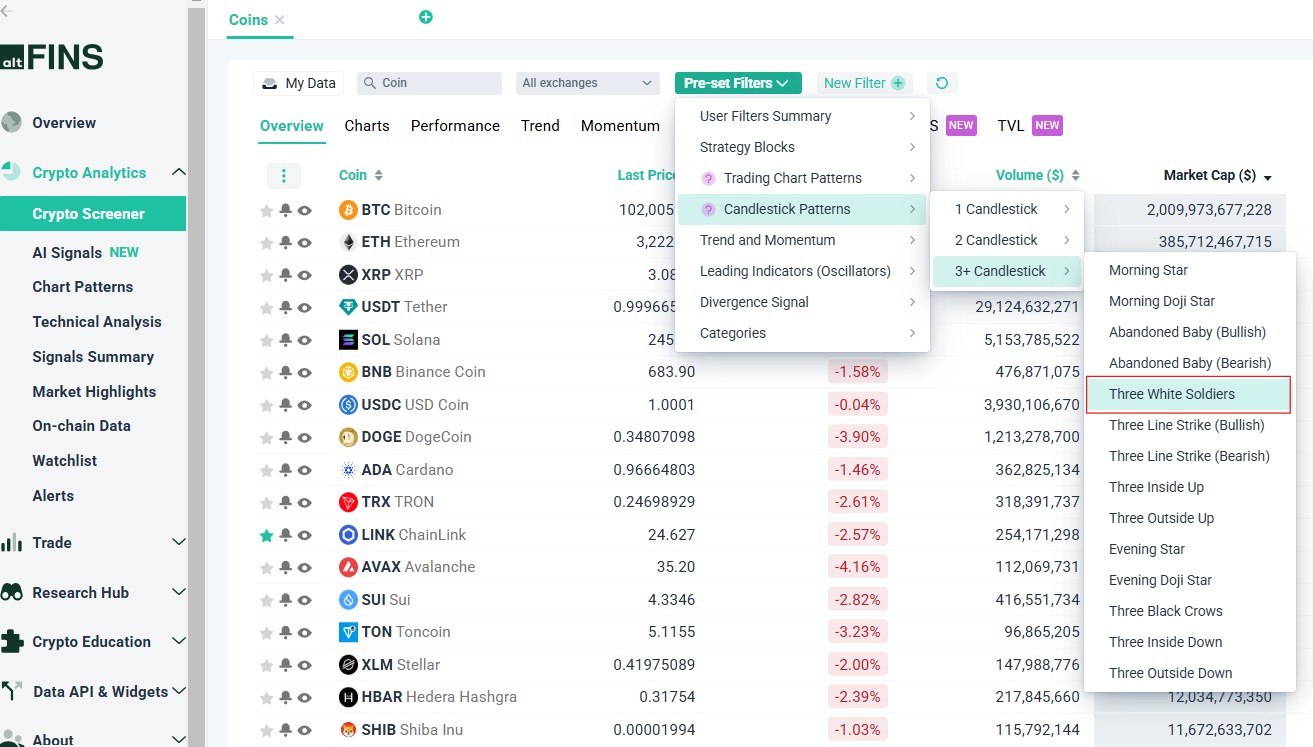

altFINS provides a powerful cryptocurrency screening tool that analyzes over 3,000 altcoins using 120 different indicators across multiple time frames. The platform offers Pre-set Filters designed to quickly identify popular patterns, such as the Three White Soldiers pattern.

Using the Crypto Screener

Pre-set Filters: Select “Candlestick Patterns – 1 Candlestick – Three White Soldiers” to generate results.

Source: altFINS

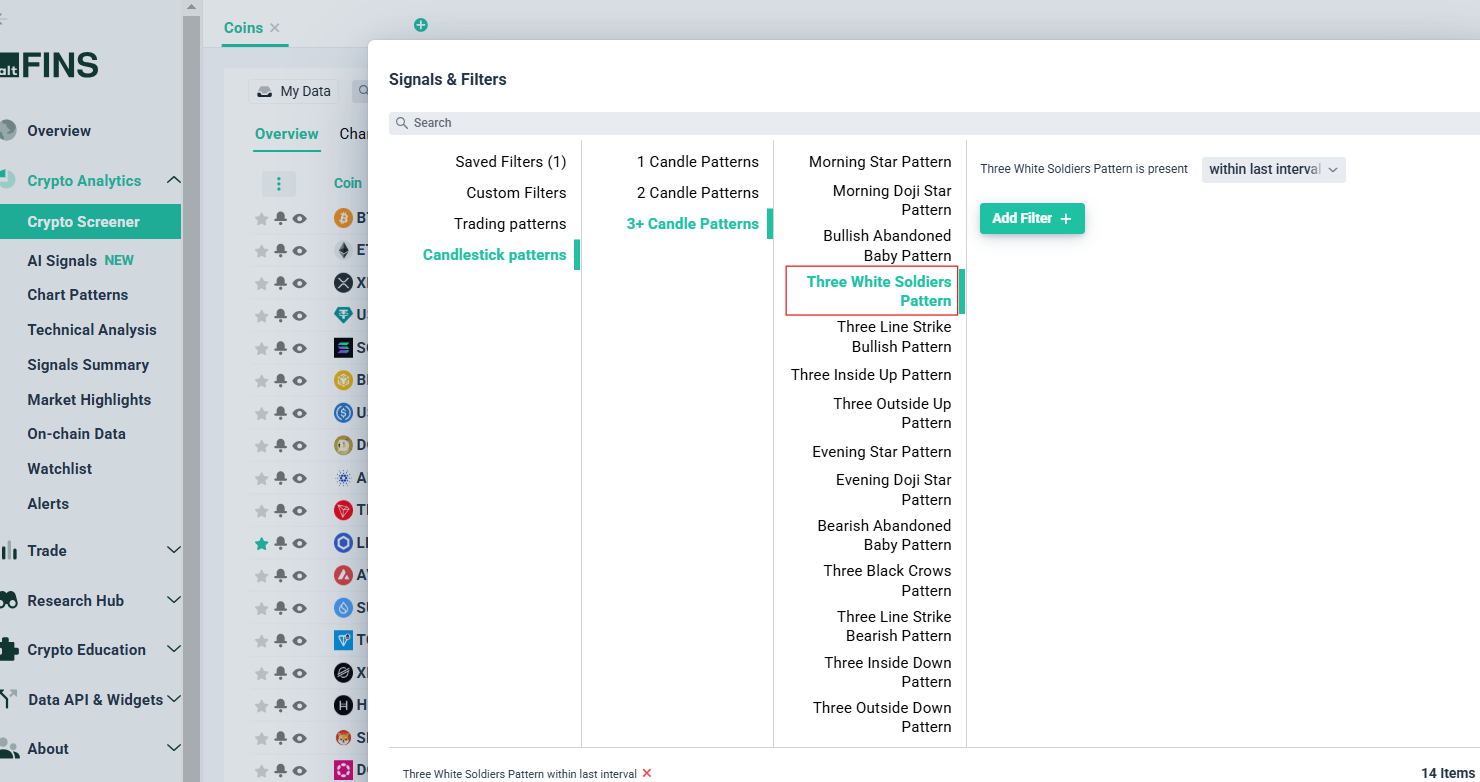

Custom Filters on Crypto Screener: Create a new filter by selecting “Candlestick Patterns – 1 Candlestick – Three White Soldiers” and choose the desired time interval.

Source: altFINS

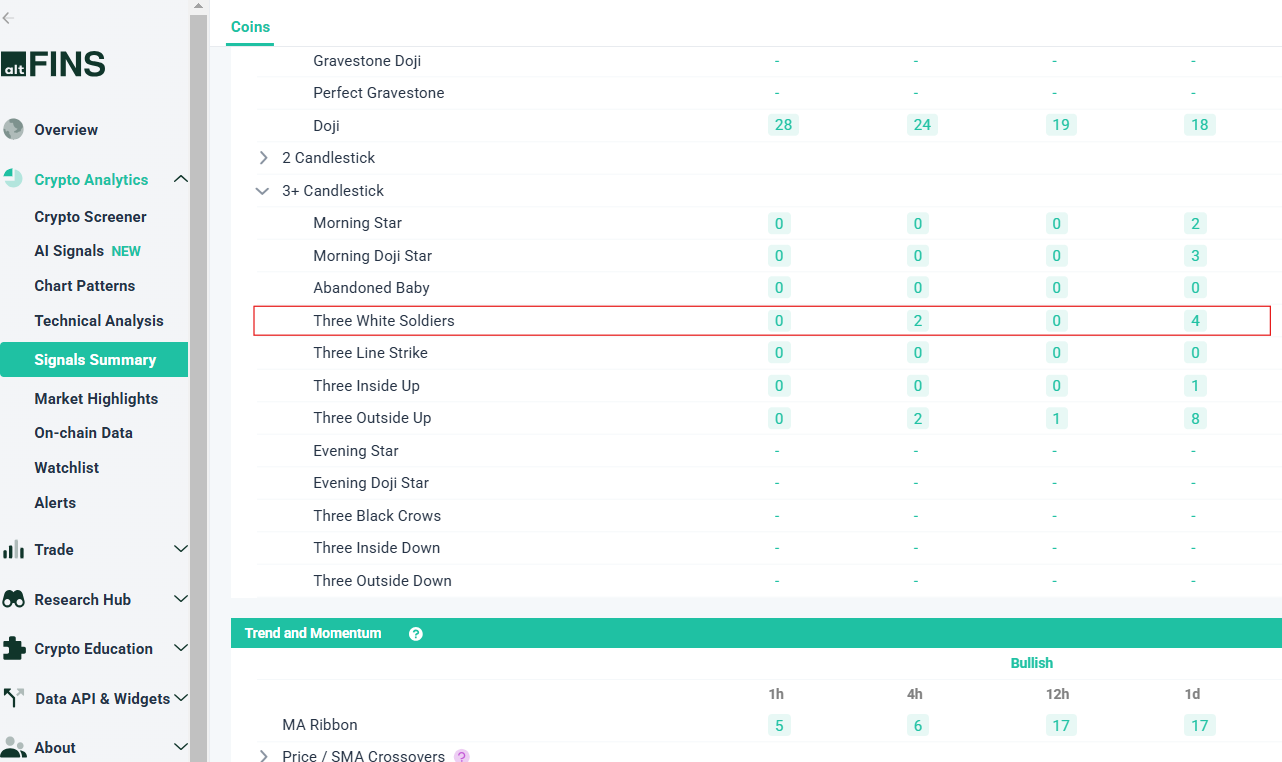

Using Signals Summary

Source: altFINS

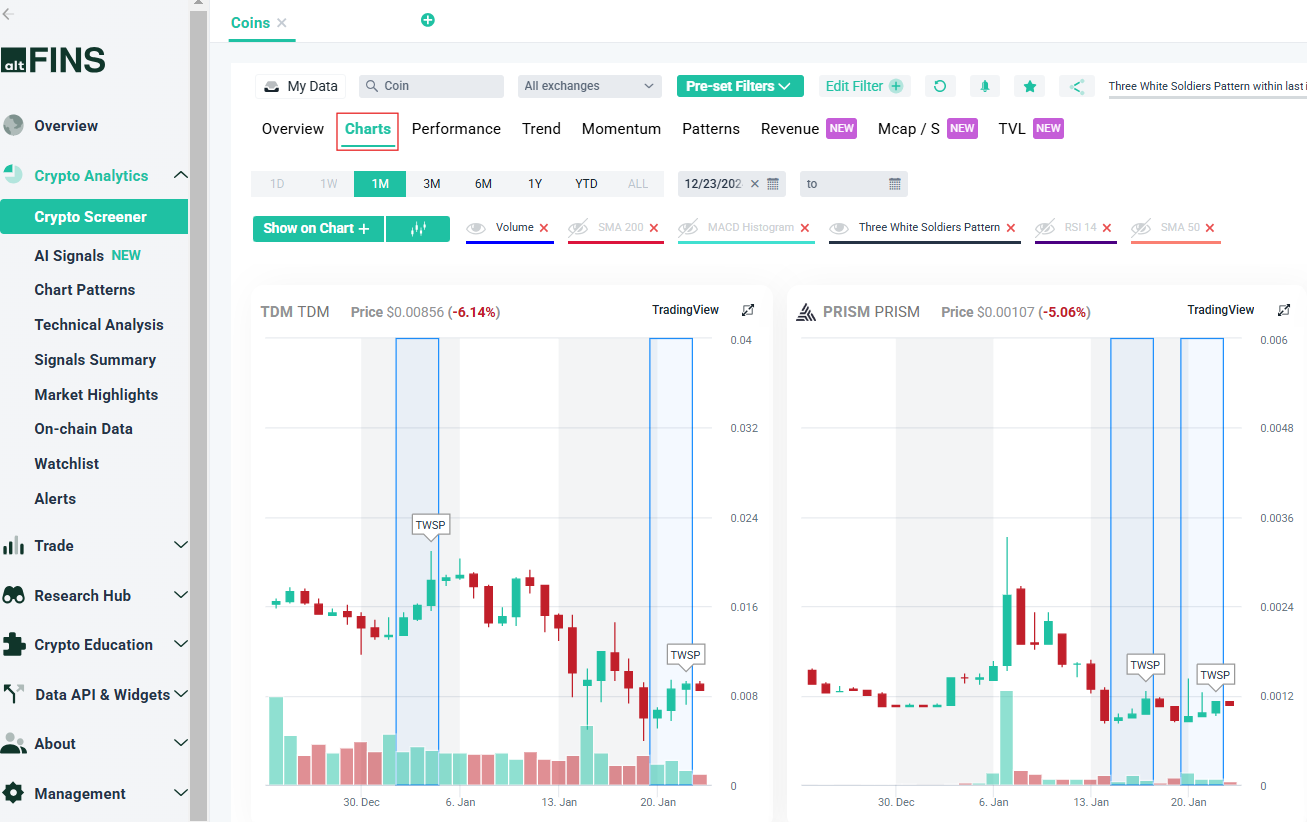

Once you identify a coin with the Three White Soldiers pattern using the Scrypto screener or Signals Summary, proceed to the Chart Tab for a more detailed analysis of the findings.

Source: altFINS

Trading Strategies Using the Three White Soldiers Pattern

1. Confirmation with Volume

Ensure that the formation is accompanied by high trading volume. This confirms that the price movement is supported by significant market participation.

2. Support and Resistance Levels

Verify that the pattern forms near a key support level. Avoid initiating trades if the asset is approaching a major resistance level.

3. Use of Technical Indicators

Combine the Three White Soldiers with indicators such as the Relative Strength Index (RSI) to avoid overbought conditions or Moving Averages to confirm trend reversals.

4. Entry Points

Enter a long position after the pattern’s completion.

Alternatively, wait for a minor pullback to a key support level for a better risk-reward ratio.

5. Risk Management

Place a stop-loss order below the low of the first candlestick in the pattern.

Use a trailing stop to lock in profits as the price moves in your favor.

Opposite Pattern (Bearish Equivalent)

Three Black Crows

The bearish counterpart of the Three White Soldiers, consisting of three consecutive long bearish candles, signaling a strong downtrend.

Read also an article:

Mastering Candlestick Patterns for Successful Crypto Trading

The Dragonfly Doji Candlestick Pattern

The Inverted Hammer Candlestick Pattern

The Hammer Candlestick Pattern

The Gravestone and Perfect Gravestone Doji Candlestick Patterns

Bullish Engulfing Candlestick Pattern

The Spinning Top Candlestick Pattern

The Hanging Man Candlestick Pattern

What is Candlestick Pattern (source: Investopedia)