Search Knowledge Base by Keyword

The Ultimate Guide to Smart Money Whales in Crypto

Introduction

In the world of cryptocurrency, the term “Smart Money” refers to institutional investors, funds, and influential whales that have significant market knowledge and capital. Tracking Smart Money Whales in Crypto movements can provide retail traders with powerful insights into market trends, profitable strategies, and early investment opportunities.

In this guide, we will explore what Smart Money is, why crypto whales are considered Smart Money, and how to effectively track their wallets. Additionally, we will discuss the pros and cons of following Smart Money and provide report tracking whales on a weekly basis.

Discover What “Smart Money” Are Buying This Week!

To help traders stay ahead, altFINS provides a weekly report on what whales are buying from altcoins and meme coins, giving investors actionable insights into Smart Money’s latest movements. This report is a crucial tool for anyone looking to follow high-impact market participants and capitalize on emerging trends.

Read weekly Crypto Whales Insights Report here…

What Is Smart Money in Crypto?

Smart Money in the crypto space consists of two primary categories:

1. Institutions, Funds, and Influential Whales

Just like in traditional markets, institutional investors and funds have access to deep market insights, proprietary research, and substantial capital. These entities strategically enter and exit trades, often influencing price movements. Examples include hedge funds, crypto investment firms, and large individual investors known as “whales.”

2. Top-Performing Onchain Participants

Onchain analysis has revealed that some wallets consistently outperform others in decentralized finance (DeFi) activities, yield farming, and trading. These wallets may not belong to institutions but instead to highly skilled traders who excel at leveraging blockchain opportunities.

By tracking both these groups, traders can gain an edge by identifying trends early and making data-driven trading decisions.

Why Are Whales Considered Smart Money?

Whales are large holders of a specific cryptocurrency and play a crucial role in market dynamics. Here’s why they are considered Smart Money:

- Market Influence: Due to their large holdings, whales can impact price movements when they buy or sell assets.

- Strategic Investments: Whales often participate in early-stage token sales, initial DEX offerings (IDOs), and liquidity provisions.

- High Risk Management: They have a deep understanding of market cycles and employ advanced trading strategies to maximize profits.

Tracking whale activity can help retail traders understand where the market might be headed.

Advanced Techniques for Tracking Smart Money Whales in Crypto

While tools provide a great starting point, understanding how to interpret the data is key to successfully tracking Smart Money. Here are some expert techniques:

1. Analyzing Wallet Transactions

- Identify recurring investment patterns across different chains.

- Look for sudden large buys that indicate accumulation before a price surge.

- Monitor divestment patterns to spot early exit strategies before downturns.

2. Spotting Early-Stage Investments

- Follow wallets that frequently engage in seed round and IDO investments.

- Check smart contract deployments linked to new projects.

- Identify funding rounds from major crypto VCs to anticipate upcoming trends.

3. Tracking Liquidity Movements

- Use DeFi analytics tools to detect liquidity shifts in top pools.

- Observe LP positions and yield farming activities for profitable strategies.

- Track governance participation and voting trends to gauge investor confidence.

4. Whale Watching on Centralized Exchanges

- Monitor exchange inflows and outflows for whale movements.

- Track large buy and sell orders on order book data.

- Compare onchain vs. offchain behavior for comprehensive insights.

Pros and Cons of Tracking Smart Money

✅ Pros

- Early Market Insights: Identifying Smart Money trends helps traders enter early before mass adoption.

- Better Risk Management: Following Smart Money can reduce the risk of investing in low-quality projects.

- Enhanced Trading Strategies: Learning from whale movements can improve personal trading approaches.

- Access to Institutional-Grade Insights: Using blockchain analytics allows retail traders to access data once only available to institutional investors.

❌ Cons

- Delayed Information: By the time retail traders act, Smart Money may have already profited.

- Misleading Movements: Whales sometimes create fake signals to manipulate market sentiment.

- Complex Data Interpretation: Understanding onchain data requires technical knowledge and experience.

- Potential False Positives: Not all Smart Money movements lead to profitable outcomes, as institutions hedge risk in multiple directions.

Tracking Smart Money in crypto is an essential strategy for traders looking to gain an edge in the market.

However, while following Smart Money can be beneficial, it is crucial to conduct independent research and not blindly copy trades. The best approach is to combine Smart Money tracking with strong risk management and fundamental analysis.

Final Tip: Consistency is Key

To truly benefit from Smart Money tracking, traders should establish a daily or weekly monitoring routine. Keeping an eye on whale movements, liquidity shifts, and emerging trends will ensure you stay ahead in the fast-paced crypto landscape. altFINS can help with it! Check out our weekly Crypto Whales Insights reports.

Smart Money Whales Tracking: Weekly Crypto Whales Insights Report (2/17/2025)

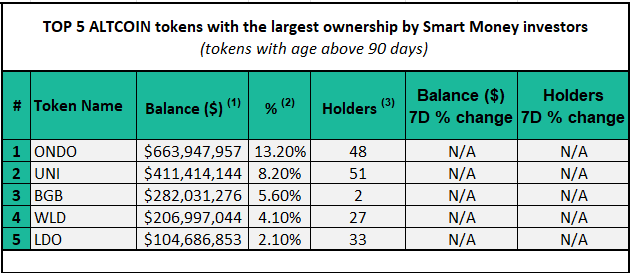

Top altcoins with the Largest Buying Interest

ONDO – $663,947,957 (13.2% allocation)

UNI – $411,414,144 (8.2% allocation)

BGB – $282,031,276 (5.6% allocation)

WLD – $206,997,044 (4.1% allocation)

LDO – $104,686,853 (2.1% allocation)

📈 Key Takeaway:

- ONDO leads the list with the highest allocation from smart money, suggesting whales see long-term potential.

- UNI and BGB also have significant smart whale ownership.

- WLD and LDO round out the top 5, showing interest in diverse altcoins.

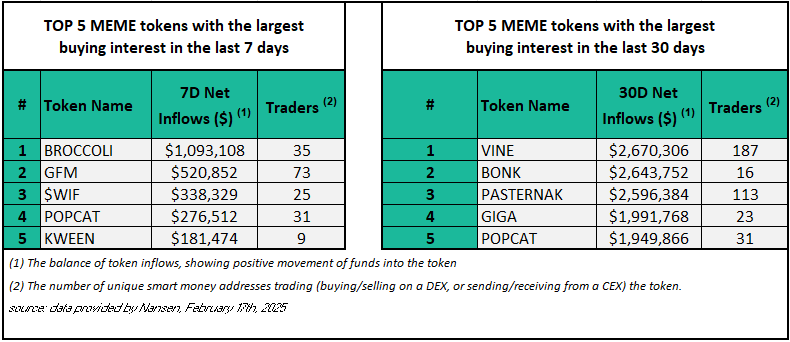

Top MEME Tokens with the Largest Buying Interest

In the Last 7 Days:

- BROCCOLI – $1,093,108 net inflows (35 traders)

- GFM – $520,852 net inflows (73 traders)

- WIF – $338,329 net inflows (25 traders)

- POPCAT – $276,512 net inflows (31 traders)

- KWEEN – $181,474 net inflows (9 traders)

📈 Key Takeaway:

- BROCCOLI has had the highest influx of smart money in the last week, indicating growing interest.

- GFM and $WIF also saw strong demand with notable trader activity.

- POPCAT is consistently attracting interest across both 7-day and 30-day periods.

In the Last 30 Days:

- VINE – $2,670,306 net inflows (187 traders)

- BONK – $2,643,752 net inflows (16 traders)

- PASTERNAK – $2,596,384 net inflows (113 traders)

- GIGA – $1,991,768 net inflows (23 traders)

- POPCAT – $1,949,866 net inflows (31 traders)

📈 Key Takeaway:

- VINE and BONK are the top-performing meme tokens in the last 30 days, with massive inflows of over $2.6M each.

- PASTERNAK is another strong performer, accumulating over $2.5M from smart whales.

- POPCAT remains a favorite among traders.

Start tracking Smart Money today and take your crypto trading to the next level!

Conclusion:

🔹 Smart whales are actively buying new and trending meme tokens such as BROCCOLI, VINE, BONK, and POPCAT, indicating their growing popularity.

🔹 In altcoins, ONDO, UNI, and BGB dominate in terms of ownership, suggesting confidence in these assets.

🔹 POPCAT appears in both short-term and long-term buying trends, making it one of the most consistently accumulated meme tokens.

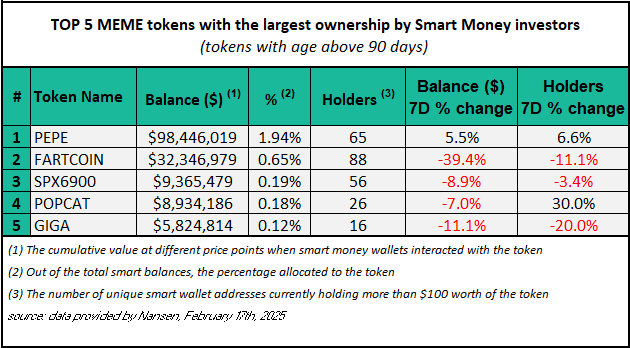

Table Breakdown:

- Token Name – The name of the meme cryptocurrency.

- Balance ($) – The total value of the token held by smart money wallets.

- % Allocation – The percentage of total smart money holdings allocated to this token.

- Holders – The number of unique smart money wallets holding more than $100 worth of the token.

- Balance ($) 7D % Change – The percentage change in holdings over the past 7 days.

- Holders 7D % Change – The percentage change in the number of holders over the past 7 days.

Key Insights from the Table:

PEPE dominates smart money holdings

- Largest allocation ($98.4M, 1.94%) among meme tokens.

- Positive 7-day trend: Holdings increased by 5.5%, with a 6.6% rise in holders.

- Likely remains a top choice for long-term investment.

FARTCOIN sees a major decline (-39.4%)

- Despite having the second-highest holdings ($32.3M), its 7-day change shows a significant drop.

- The number of holders also fell by 11.1%, suggesting smart money is exiting.

SPX6900 (-8.9%) and GIGA (-11.1%) lost smart money allocation.

POPCAT (-7.0%) is an exception because holders increased by 30%, indicating retail traders may be accumulating while smart money reduces exposure.

This suggests smart money is actively selling and reducing exposure to the token.

Conclusion:

🔹 PEPE remains the most significant smart whale holding, with continued accumulation.

🔹 FARTCOIN and GIGA are seeing heavy sell-offs, suggesting declining confidence from smart money.

🔹 POPCAT shows an interesting divergence, where smart money reduces holdings, but new holders increase, possibly signaling retail hype.

🔹 Traders should be cautious with tokens experiencing declining smart money interest, while PEPE may offer stronger long-term confidence.