Search Knowledge Base by Keyword

The Inverted Hammer Candlestick Pattern

TL;DR: The Inverted Hammer Pattern

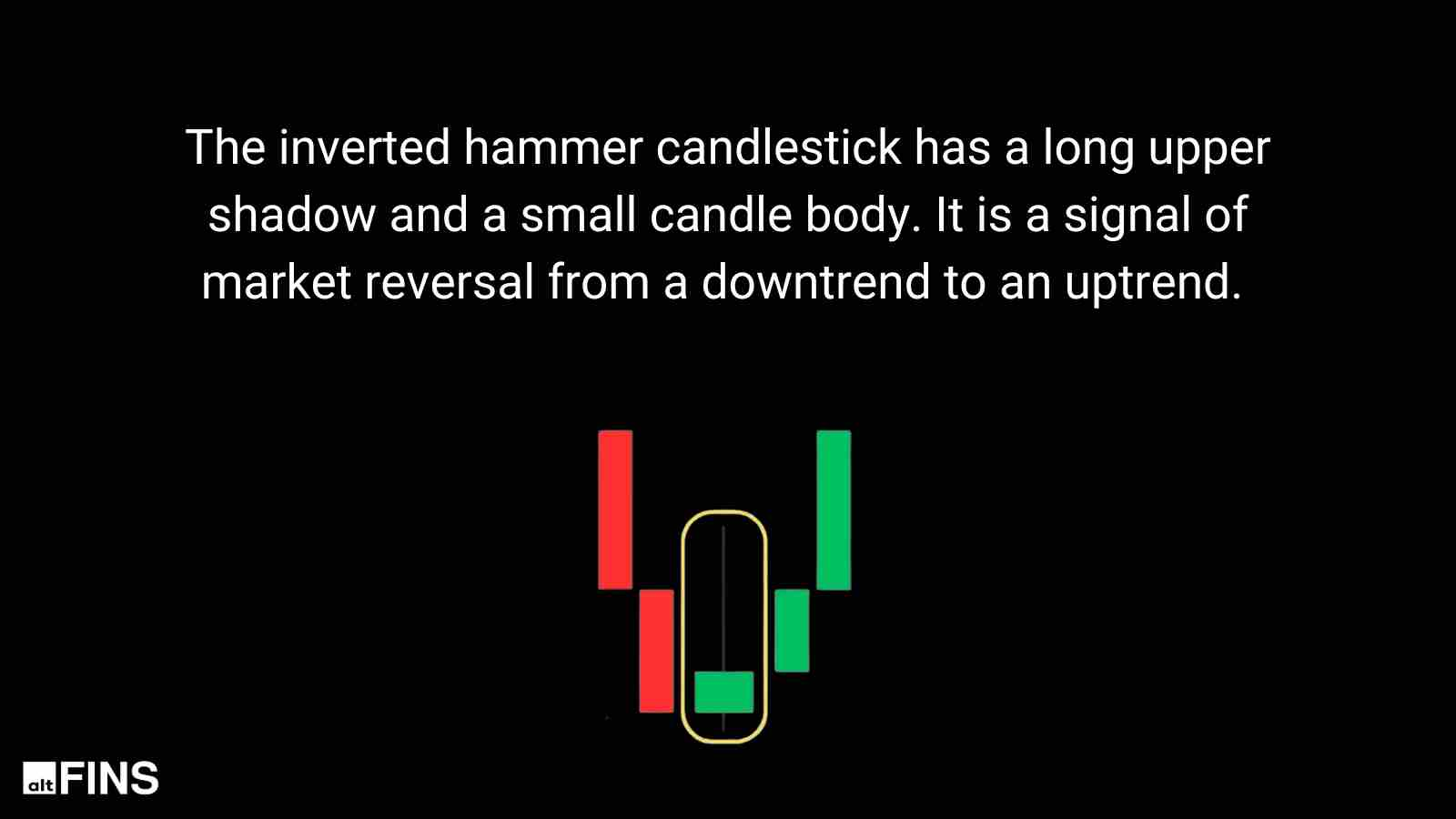

The Inverted Hammer is a bullish reversal signal that appears at the bottom of a downtrend. It features a small body at the lower end and a long upper shadow (at least twice the body’s length), showing that buyers attempted to push the price up and are starting to challenge the bears.

-

Market Psychology: It suggests that while sellers are still present, buying pressure is intensifying, and the downtrend may be exhausted.

-

Trading with altFINS: You can instantly find coins forming this pattern using altFINS’ Crypto Screener. Use Pre-set Filters for a quick 1-candle scan or Custom Filters to combine the Inverted Hammer with other indicators like RSI (oversold) or key support levels.

-

Best Practice: Always wait for confirmation. A bullish reversal is only “confirmed” if the next candle closes above the high of the Inverted Hammer.

Detailed Characteristics of the Inverted Hammer Pattern

The Inverted Hammer candlestick pattern is a crucial tool in technical analysis, heralding potential bullish reversals in bearish markets. Characterized by its distinctive shape, this pattern provides valuable insights into market sentiment and price action. This comprehensive guide explores the Inverted Hammer in depth, offering advanced strategies and insights for leveraging this pattern in various trading contexts.

Understanding the Inverted Hammer

The Inverted Hammer appears at the bottom of downtrends and is identified by its small body at the lower end and a long upper shadow. This configuration suggests that while sellers pushed the price down, buyers were able to regain some ground by the close, though not enough to reverse the trend on their own. For this reason, traders look for confirmation in the form of a subsequent bullish candle. See all altcoins with Inverted Hammer Pattern here.

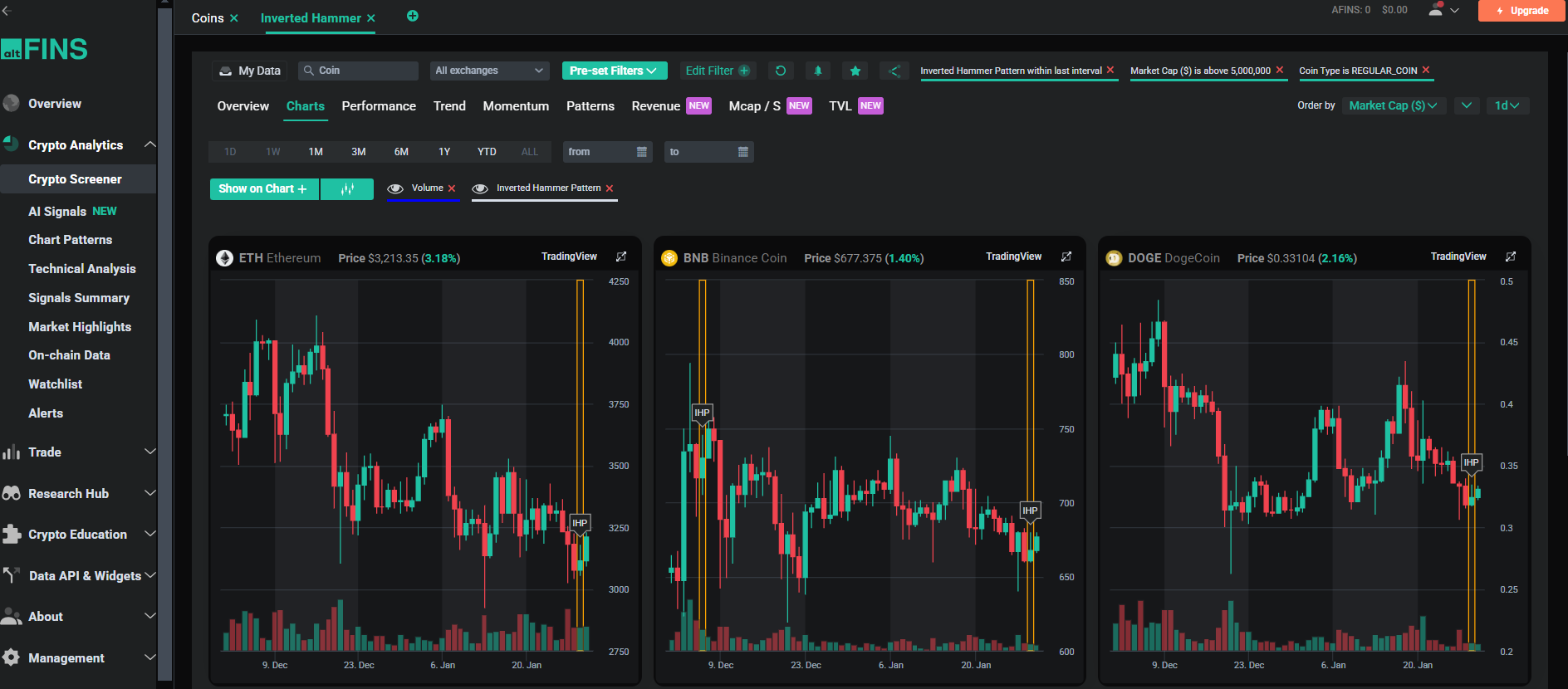

Example of Inverted Hammer Pattern

The Ethereum (ETH) chart shows an Inverted Hammer Pattern (IHP), a potential bullish reversal signal, suggesting a shift in momentum after a period of consolidation.

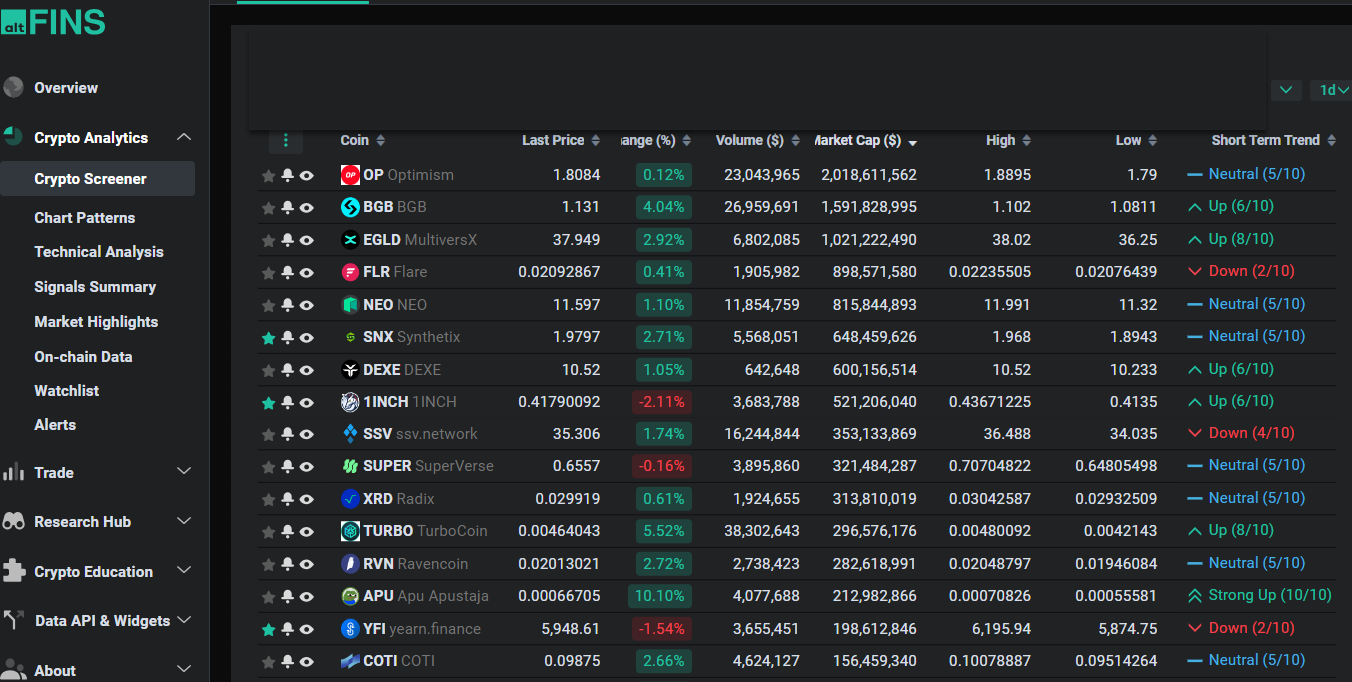

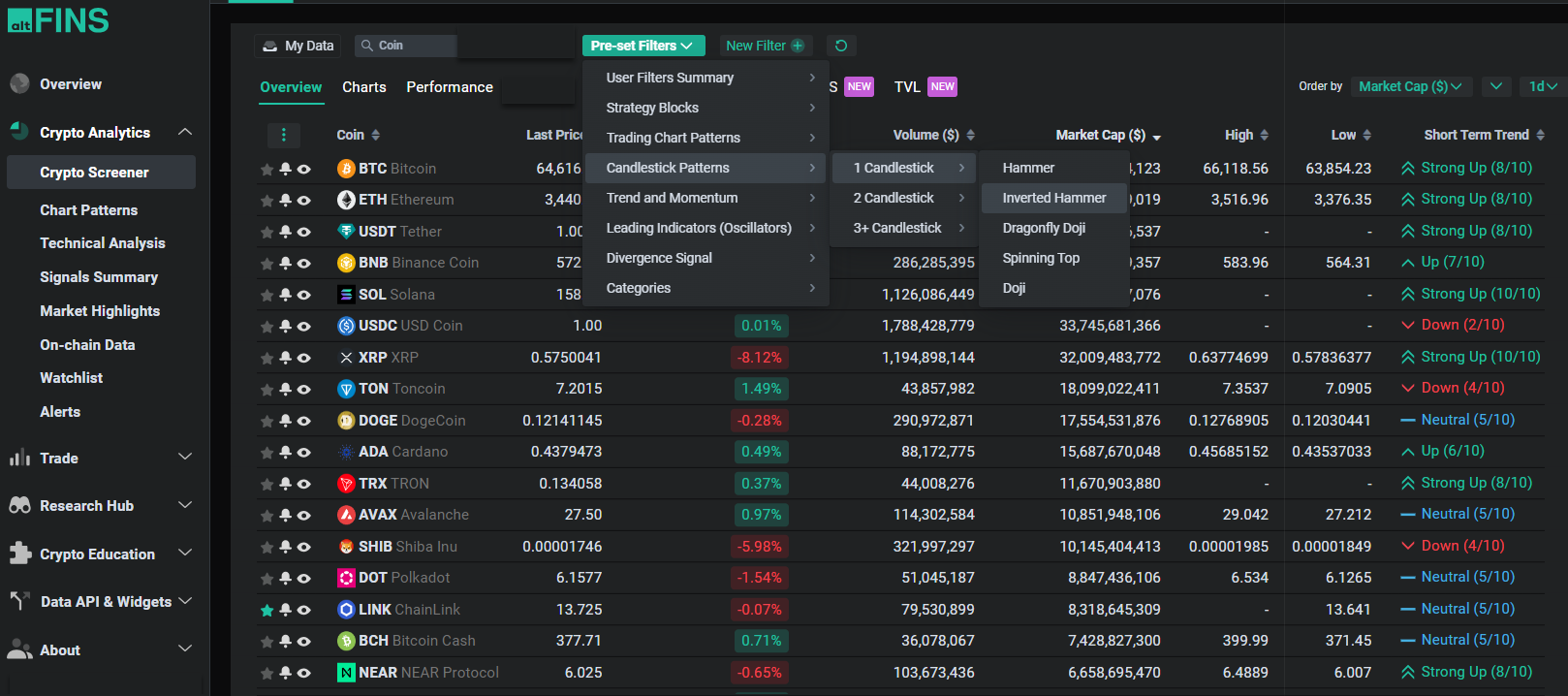

Inverted Hammer Candlestick Patterns on altFINS

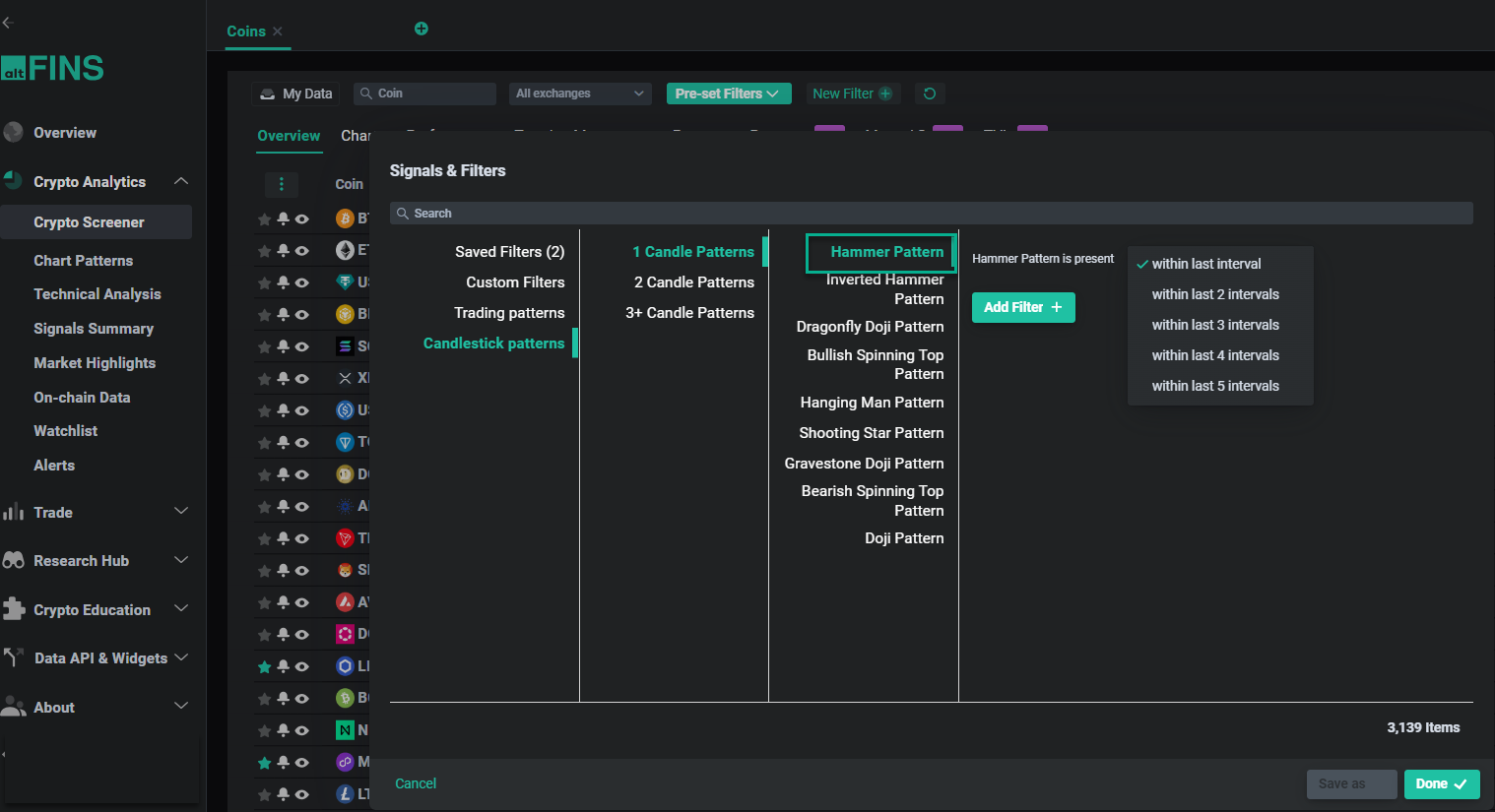

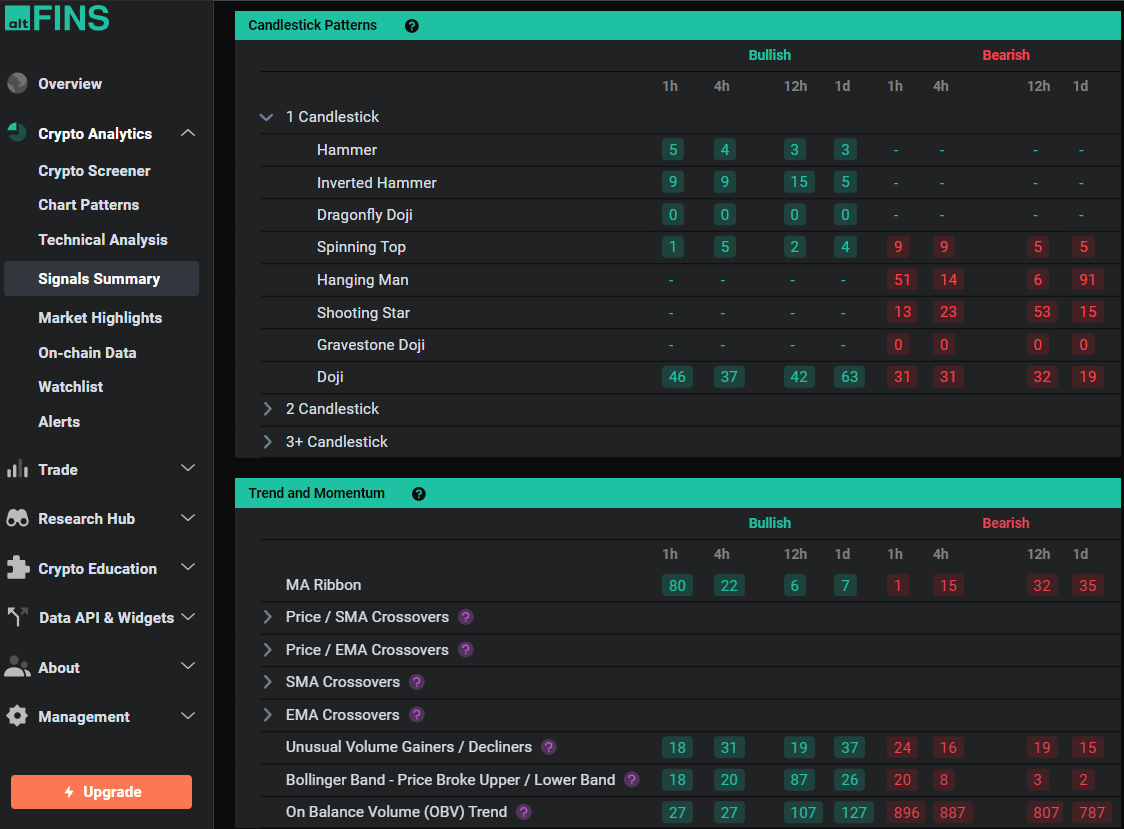

altFINS crypto screener allows traders to create custom filters based on Candlestick patterns. These patterns include 1-Candle Patterns, 2-Candle Patterns, and patterns involving 3 or more candles.

To access Candlestick patterns on altFINS, go to:

Crypto Screener – Preset Filters

altFINS provides a leading cryptocurrency screening tool capable of analyzing over 3,000 altcoins using 120 different indicators across five time frames. It includes Pre-set Filters, which are predefined and optimized strategies and patterns designed for quick access to the most popular filters, such as the Inverted Hammer Candlesticks pattern.

Crypto Screener Pre-set Filters

Select Pre-set Filters – Candlestick Patterns – 1 Candlestick – Inverted Hammer and you will get the results:

Screener Results

Examples: Inverted Hammer Candlestick Pattern in Charts

Crypto Screener Custom Filters

Select New Filter- Candlestick Patterns – 1 Candlestick – Inverted Hammer and select interval.

Signals Summary Custom Filters

Advanced Trading Strategies

Combining with Support Levels

Integrating the Inverted Hammer with existing support levels can greatly enhance the reliability of anticipating a bullish reversal. If an Inverted Hammer forms at a key support level, this convergence significantly bolsters the bullish signal.

Using with Trend Lines

An Inverted Hammer that materializes near a declining trend line may indicate a possible bullish breakout. Confirmation is typically sought with the price closing above this trend line following the appearance of the Inverted Hammer.

Tips and Tricks for Effective Use

Wait for Confirmation

A prevalent mistake is to react prematurely to an Inverted Hammer. Waiting for confirmation through additional bullish candlesticks or higher closing prices in subsequent sessions can help avoid false signals.

Check the Historical Context

Evaluating how an asset has previously responded to Inverted Hammers provides insights into its potential behavior, helping tailor strategies to specific market conditions.

Monitor Market Sentiment

The overall market mood and economic indicators should be considered. An Inverted Hammer during broadly bearish market conditions might be less effective.

Use Technical Indicators for Confirmation

- Stochastic Oscillator: This indicator can identify if the asset is oversold, enhancing the bullish signal when paired with an Inverted Hammer.

- Fibonacci Retracement Levels: An Inverted Hammer near significant Fibonacci levels, like the 61.8% retracement, can indicate a strong support and potential reversal zone. Learn more.

Psychological Insights

The Inverted Hammer symbolizes a period where bears lose their grip, allowing bulls to step in briefly before the close. This shift can indicate a diminishing bearish trend and the potential for bullish momentum.

Risk Management

Effective risk management is essential when trading based on the Inverted Hammer:

- Proper Position Sizing: Adapt your position size according to the asset’s volatility and your stop-loss setting.

- Dynamic Stop-Loss Adjustment: Move your stop-loss to break even or use a trailing stop as the trade progresses favorably.

Practical Examples

Illustrating real-life trading scenarios using the Inverted Hammer, both successful and unsuccessful, can provide deeper insights into recognizing optimal setups and common pitfalls.

Variations and Similar Patterns

- Shooting Star: This is a bearish variant of the Inverted Hammer, occurring during uptrends with a similar physical appearance but opposite implications.

- Hammer: The Hammer, a bullish signal like the Inverted Hammer, forms at the end of a downtrend but features a long lower shadow instead of an upper one. Read an article.

Understanding these variations helps traders differentiate between potentially bullish and bearish signals and apply them appropriately in trading scenarios.

Conclusion

The Inverted Hammer candlestick pattern offers a potent method for spotting potential bullish reversals in downtrends. By integrating advanced strategies, practical insights, and sound risk management, traders can enhance their market analysis and trading decisions, turning this pattern into a vital component of their technical analysis toolkit.

Read also an article:

Mastering Candlestick Patterns for Successful Crypto Trading

Essential Candlestick Patterns for Crypto Traders

The Dragonfly Doji Candlestick Pattern

The Hammer Candlestick Pattern

The Hammer Candlestick Pattern

The Gravestone and Perfect Gravestone Doji Candlestick Patterns

Bullish Engulfing Candlestick Pattern

The Spinning Top Candlestick Pattern

The Hanging Man Candlestick Pattern

What is Candlestick Pattern (source: Investopedia)