Search Knowledge Base by Keyword

The Gravestone and Perfect Gravestone Doji Candlestick Patterns

TL;DR: Gravestone Doji Pattern Guide

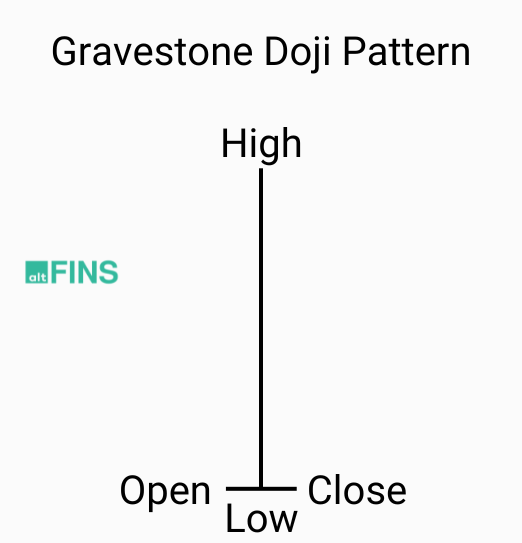

The Gravestone Doji is a bearish reversal candlestick pattern that looks like an inverted “T.” It signals that buyers pushed prices up, but sellers successfully drove them back down to the opening price by the end of the session.

Key Characteristics

-

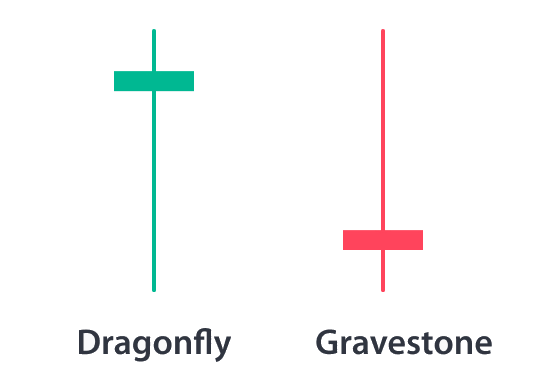

Visual: Long upper shadow (wick), little to no lower shadow, and identical open/close/low prices.

-

Context: Most effective at the peak of an uptrend or near resistance levels.

-

The “Perfect” Gravestone Doji: A specific high-probability setup consisting of two green candles (uptrend), the Doji, and a following red candle (confirmation).

How to Trade It

-

Wait for Confirmation: Do not trade the Doji alone. Wait for the next candle to close below the Doji’s low.

-

Volume: High volume during the Doji formation strengthens the bearish signal.

-

Confluence: Use indicators like RSI (check for overbought conditions) or Moving Averages to confirm resistance.

-

Invalidation: If the next candle closes above the Doji’s high, the bearish signal is void.

Tools for Identification

-

altFINS: Use the “Crypto Screener” or “Signals Summary” with pre-set filters to scan thousands of altcoins for this pattern across multiple timeframes.

What is Gravestone Doji Pattern?

The Gravestone Doji is a significant candlestick pattern in technical analysis, often signaling potential bearish market reversals. This distinctive pattern is characterized by its unique visual trait: a long upper shadow with little to no lower shadow.

This guide provides an in-depth exploration of the Gravestone and Perfect Gravestone Doji patterns, offering traders advanced strategies and techniques for applying these patterns across various trading environments.

Detailed Characteristics of the Gravestone Doji Pattern

Understanding the Gravestone Doji

A Gravestone Doji forms when the open, low, and close prices are the same or very close, creating an inverted T-shaped candlestick. This pattern typically emerges at the top of uptrends and represents a struggle between bulls and bears, indicating that buyers initially pushed the price higher, but sellers eventually overwhelmed them, bringing the price back down to its opening level. This often signals a potential reversal to the downside.

The Gravestone Doji can signal a bearish trend reversal. The effectiveness of the Gravestone Doji increases when it appears in the right market context.

Ideally, the Gravestone Doji is preceded by two up (green) candles and followed by a down (red) candle. This is called the Perfect Gravestone Doji pattern.

The long upper wick indicates that after buyers drove the price up, sellers pushed it back down to the opening level. A confirmation with a red down candle in the following session strengthens the signal.

Higher-than-average volume accompanying the Gravestone Doji can further confirm that buyers were exhausted and sellers took control.

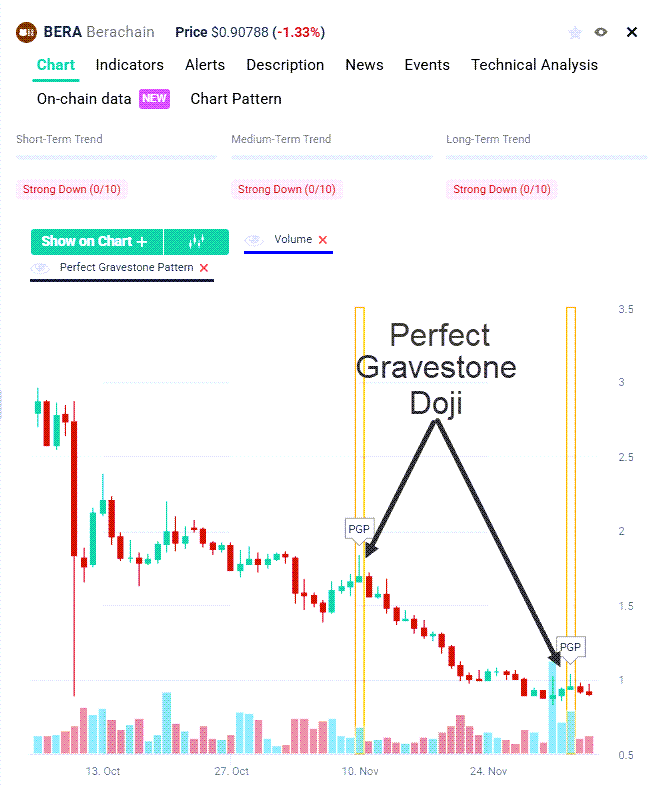

Examples of Gravestone Doji and Perfect Gravestone Doji Candlestick Patterns

Successful Gravestone Doji occurrences often show initial resistance after the pattern forms, followed by a series of downward movements. It is essential to consider possible retracements before the price trends lower consistently.

In the case of Perfect Gravestone Doji Patterns, they consist of two bullish candles and two bearish candles that follow the Gravestone Doji pattern.

It also helps to align the signal with the overall price trend. Notice in that in the below example (BERA), price is already in a Strong Down trend across Short- Medium- and Long-Term.

Trading with the trend (Buy in Uptrend, Sell in Downtrend) increases traders’ success rates. So it’s a good general rule to follow.

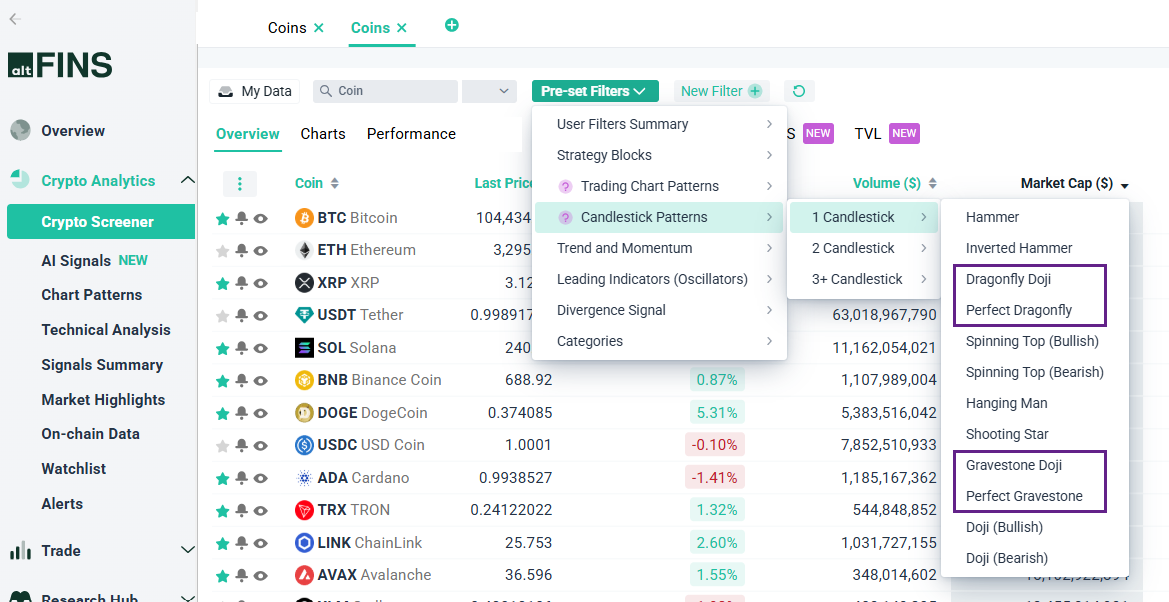

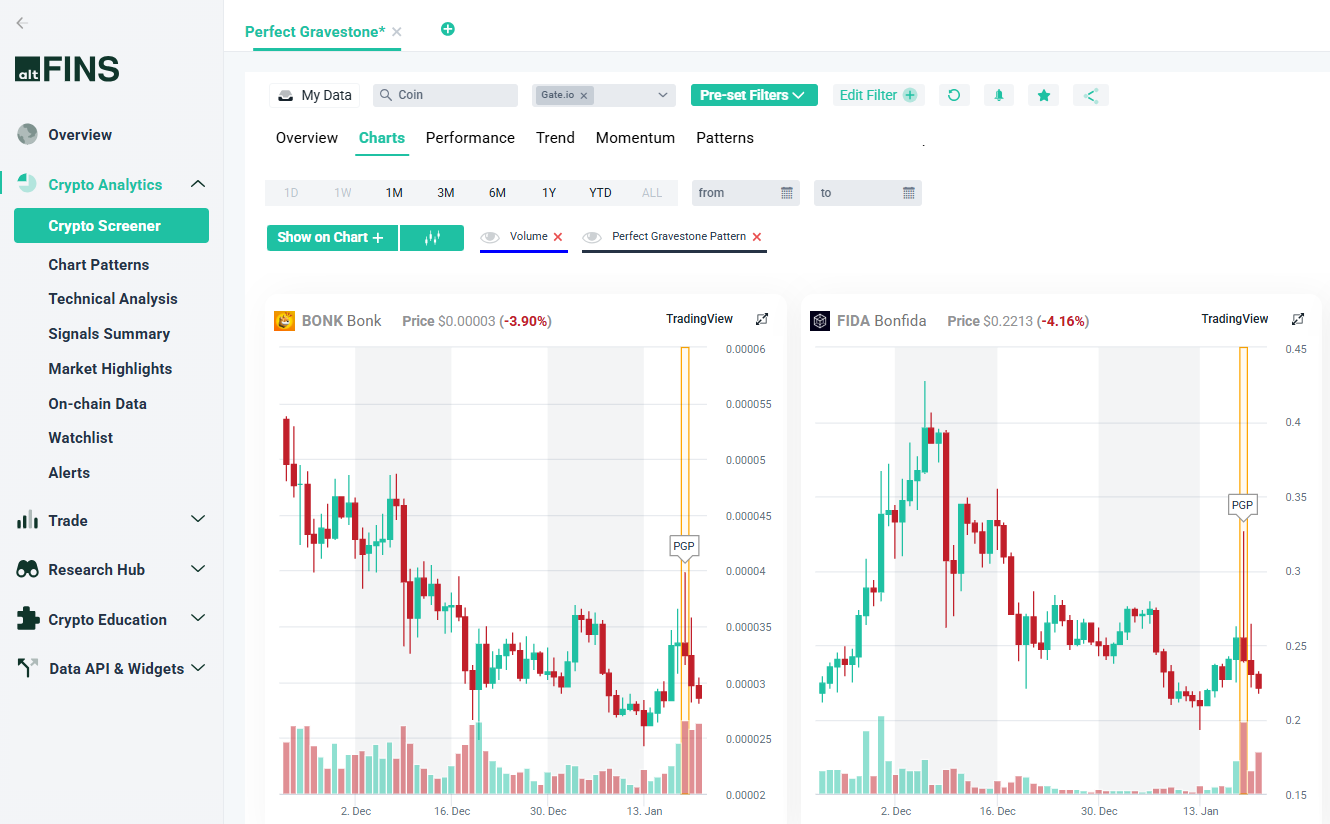

How to Identify Gravestone Doji and Perfect Gravestone Doji Patterns on altFINS?

altFINS provides a powerful cryptocurrency screening tool that analyzes over 3,000 altcoins using 120 different indicators across multiple time frames. The platform offers Pre-set Filters designed to quickly identify popular patterns, such as the Gravestone Doji Candlestick pattern.

Using the Crypto Screener

Pre-set Filters: Select “Candlestick Patterns – 1 Candlestick – Gravestone Doji” to generate results.

Source: altFINS

Custom Filters on Crypto Screener: Create a new filter by selecting “Candlestick Patterns – 1 Candlestick – Gravestone Doji” and choose the desired time interval.

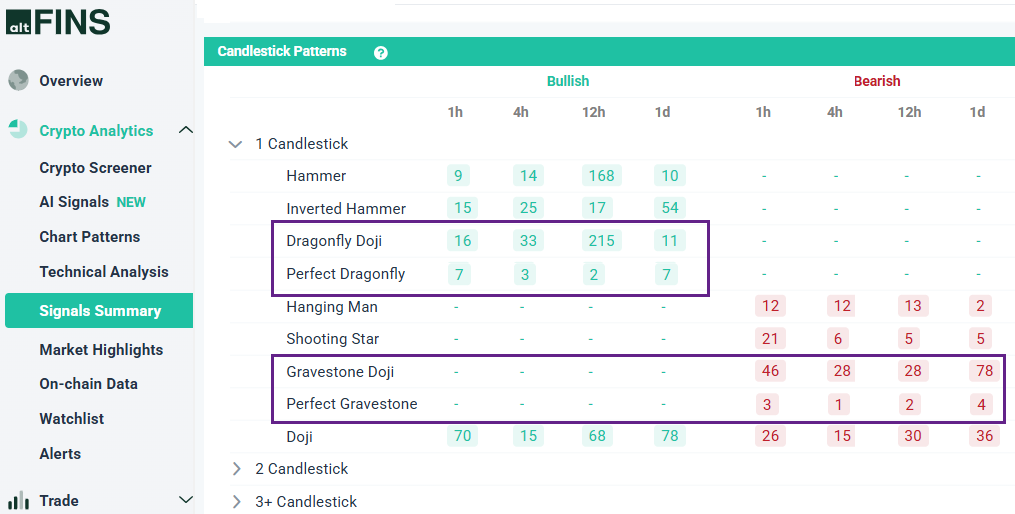

Using Signals Summary

Source: altFINS

Once you identify a coin with the Gravestone Doji pattern using the Scrypto screener or Signals Summary, proceed to the Chart Tab for a more detailed analysis of the findings.

Source: altFINS

Once the results of the pre-set filter appear in the Crypto Screener, it is essential to analyze Gravestone Doji patterns within the appropriate context.

Analyze the Preceding Trend:

- Uptrend: A Gravestone Doji at the top of an uptrend suggests a potential reversal, indicating that buyers tried to push prices higher but failed.

- Downtrend: If the pattern appears during a downtrend, it might indicate a continuation or short-term consolidation before further decline.

Volume Analysis:

- High volume: Strengthens the bearish signal, showing strong selling pressure.

- Low volume: Weakens the reliability of the pattern, indicating indecisiveness rather than strong bearish sentiment.

Confirmation with the Next Candles:

- A bearish confirmation requires follow-up candles closing below the Doji’s low, indicating seller dominance.

- A bullish confirmation (invalidating the pattern) happens if the next candle closes above the Doji’s high.

Variations and Similar Patterns

- Dragonfly Doji: The bullish counterpart of the Gravestone Doji, occurring at the bottom of downtrends with a long lower shadow. Read more details in this article.

- Long-legged Doji: Displays both long upper and lower shadows, indicating significant market indecision.

Recognizing these variations helps traders make informed decisions and refine their strategies.

Advanced Trading Strategies

Combining with Resistance Levels

When a Gravestone Doji forms at a key resistance level, it strengthens the likelihood of a bearish reversal. The confluence of technical indicators provides stronger confirmation than the pattern appearing alone.

Using with Trend Lines

If a Gravestone Doji appears near critical upward trend lines, it may suggest a potential downward breakout. Traders often look for further bearish confirmation with a close below the trend line.

Tips and Tricks for Effective Use

To effectively utilize the Gravestone Doji pattern in trading decisions, it is essential to wait for confirmation by observing a red candlestick in the next session to validate the bearish reversal signal and minimize false alarms. Use the Perfect Gravestone Doji Patterns from altFINS platform.

By creating candlestick patterns alerts on the altFINS platform, traders can take immediate action when their preferred alerts are triggered. Learn how to set up alerts in this article.

Evaluating historical occurrences of the pattern can offer valuable insights into potential outcomes and enhance decision-making.

Additionally, monitoring overall market sentiment is crucial, as the pattern’s significance may diminish in a strong bullish environment.

Traders should also incorporate technical indicators such as the Relative Strength Index (RSI), where an overbought reading can reinforce the bearish outlook, and moving averages, as a Gravestone Doji appearing near major moving averages can signal resistance and strengthen the likelihood of a reversal.

Read also an article:

Mastering Candlestick Patterns for Successful Crypto Trading

Essential Candlestick Patterns for Crypto Traders

The Dragonfly Doji Candlestick Pattern

The Hammer Candlestick Pattern

The Inverted Hammer Candlestick Pattern

The Hammer Candlestick Pattern

Bullish Engulfing Candlestick Pattern

The Spinning Top Candlestick Pattern

The Hanging Man Candlestick Pattern

What is Candlestick Pattern (source: Investopedia)