Search Knowledge Base by Keyword

The Best Crypto Prop Trading Firms

In cryptocurrency trading, having ample capital and a supportive environment can make all the difference.

This is precisely why crypto prop trading firms have become increasingly popular. They offer traders access to substantial funded accounts, favorable profit splits, and minimized personal risk.

In this article, we will examine some of the leading crypto prop trading firms available today. We will review their funding options, risk parameters, evaluation methods, and platforms.

By the end, you will clearly understand which firm aligns best with your individual trading style aspirations.

Key Factors to Consider in a Crypto Prop Trading Firm

Proprietary trading firms are not created equal. They have varying funding limits, fee structures, risk requirements, and technology. To navigate these waters effectively, concentrate on the following critical considerations. Each point can significantly impact your experience as a trader, so it is worth taking the time to evaluate them carefully.

Funding Opportunities

An essential factor in choosing a crypto prop firm is the size of the funded account you will receive. Some firms offer relatively modest starting amounts, while others allow scaling into six or seven figures.

A larger initial capital pool means the potential for bigger profits, but it also comes with the responsibility of managing higher risk. Pay attention to whether the firm enables you to scale your account after you have proven consistent profitability. This scalability can accelerate your earning potential and keep you motivated to grow with the firm.

Profit Split Structure

The profit split dictates how much of your trading gains you actually get to keep. Some firms are extremely generous, allowing traders to keep 80%, 90%, or even 100% of their profits, while others start at a lower rate and scale it up over time.

Additionally, the timing of these payouts matters. Is it monthly, weekly, or even daily? Do you receive your share in fiat currency, cryptocurrencies, or stablecoins?

Understanding these nuances will help you measure how lucrative a particular prop firm can be over the long run.

Risk Management and Evaluations

Every prop firm establishes its own risk rules. Typical examples include a daily drawdown limit (the maximum amount your account can lose in a single day) and a maximum overall drawdown or equity cap (the total allowable loss before the account is closed).

Additionally, many firms require traders to pass an evaluation or challenge phase, during which you aim to achieve a target profit without violating any drawdown rules. Some firms impose fixed time limits, while others permit unlimited time to meet the targets.

These conditions can significantly influence your stress levels, trading strategy, and overall success rate.

Trading Platforms and Tools

Prop firms differ in their approach to technology. Some integrate with well-known crypto exchanges, offering real-time market data and advanced order execution. Others rely on proprietary platforms that might have limited features but can be more streamlined.

Look for a firm that provides:

- Real-time data directly from trusted crypto exchanges

- Deep liquidity on the cryptocurrencies you want to trade

- Advanced order types (stop-limit, trailing stops, etc.)

- Technical analysis tools or the ability to connect to third-party platforms like TradingView

A robust platform can significantly enhance your trading performance, especially in a fast-moving and often volatile crypto market.

Payouts and Fees

The fee structure can significantly impact your profitability. Some firms charge a challenge fee for the evaluation phase, which may be refunded once you pass the challenge and begin earning profits. Others impose monthly subscription costs or additional platform fees.

Seek transparent fee models to avoid surprises later on. Additionally, consider how frequently you can request payouts and whether the withdrawal process is straightforward.

Some traders prefer stablecoins like USDT or USDC to maintain everything within the crypto ecosystem, while others require direct bank transfers.

Availability and Restrictions

Geographic restrictions are prevalent in the crypto space, particularly for traders in the United States. Not all prop firms accept U.S. residents due to regulatory nuances.

Ensure the firm you select has no issues operating in your region. This can help you avoid unexpected account closures or compliance challenges in the future.

Additionally, verify whether they permit your preferred trading strategies (such as scalping, algorithmic trading, etc.), as some firms restrict specific techniques.

Customer Support and Community

While it may seem secondary at first glance, customer support can significantly affect your overall experience with a prop firm. Quick responses, clear communication, and an engaged community of traders can help you resolve issues more efficiently.

Some firms, such as HyroTrader, often provide round-the-clock support via email or live chat and foster communities on platforms like Discord or Telegram, offering mentorship, trading ideas, and emotional support, which can be vital in the high-pressure world of crypto trading.

Leading Crypto Prop Firms at a Glance

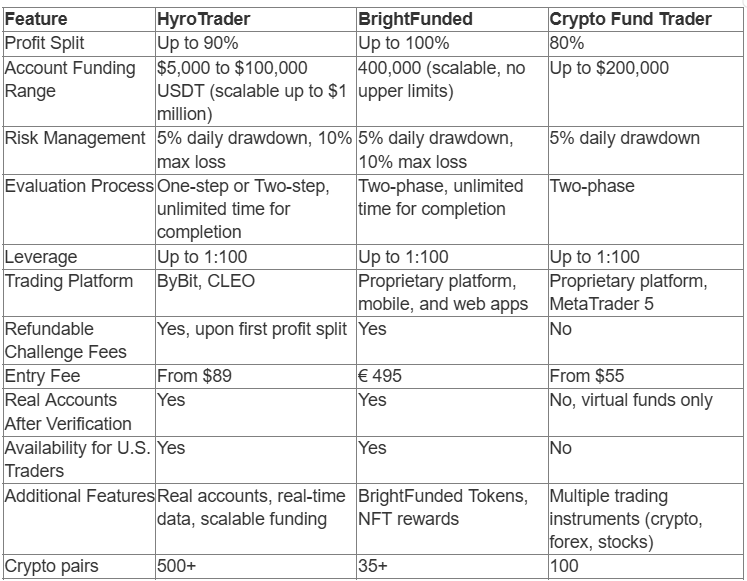

Before diving into detailed reviews, here is a quick look at three prominent crypto prop trading firms: HyroTrader, BrightFunded, and Crypto Fund Trader.

Each offers its own set of advantages and drawbacks. The comparison table below is designed to present their core features in a clear, concise way.

Quick Comparison

This table highlights the emphasis of each firm.

BrightFunded offers an impressively high profit split, possibly reaching 100%, while Crypto Fund Trader features a variety of instruments in crypto, forex, and stocks.

HyroTrader distinguishes itself with its flexible account scaling and direct access to live crypto trading environments, attracting those who intend to concentrate primarily on cryptocurrencies.

In-depth Review of the Top Crypto Prop Trading Firms

While the quick comparison table provides an initial sense of each firm’s offerings, the finer details often reveal why one firm may be more suitable for you than another. Below are deeper insights into HyroTrader, BrightFunded, and Crypto Fund Trader, focusing on essential factors such as account structure, evaluation processes, risk rules, and trading platforms.

HyroTrader: A Deep Dive

HyroTrader is a dedicated cryptocurrency prop trading firm designed to help crypto traders gain access to capital without risking their personal funds.

The firm offers a variety of account sizes ranging from $5,000 to $100,000. According to its official channels, successful traders can scale up to $1,000,000 in firm capital over time, making it an excellent choice for long-term growth.

Account Structure and Capital Scaling

Although initial accounts may seem smaller compared to some other prop firms, HyroTrader’s scaling approach can lead you to significant capital if you remain consistent. The progression model rewards traders for stable profitability, gradually increasing account sizes as they achieve performance milestones.

This ensures that traders aren’t rushed into managing more capital than they can handle responsibly.

Profit Splits, Payouts, and Refunds

HyroTrader’s standard profit split starts at around 70% and can increase to 80% or even 90% as you demonstrate profitability over multiple payout cycles.

In a world where some firms offer fixed shares, this variable structure can keep you motivated to trade effectively. The firm is also known for rapid payouts, often in less than 24 hours, which are issued in USDT or USDC stablecoins. This quick turnaround lets you lock in profits and utilize them almost immediately.

In addition, the challenge fee, the cost you pay to enter the evaluation phase, is fully refunded once you achieve your first profit split. This policy underscores the firm’s confidence in the trader’s ability to succeed.

Evaluation Process and Trading Rules

HyroTrader allows you to choose between a one-step or two-step evaluation, both of which have an unlimited time limit. This contrasts sharply with firms that require meeting a profit target within a short timeframe (e.g., 30 days).

The risk rules include a 5% daily drawdown and a 10% overall maximum loss, ensuring traders manage prudent money. For those who are not used to time pressure, HyroTrader’s open-ended timeline can feel like a breath of fresh air.

Leverage is extremely high, reaching up to 1:100, which is particularly useful for short-term, high-intensity trading strategies. Although caution is always advised with high leverage, having it available provides flexibility to act on short-lived market opportunities opportunities.

Trading Platform Options

HyroTrader integrates with ByBit, a top-tier crypto exchange, and it also features a CLEO platform that utilizes real-time data from Binance. This integration ensures minimal slippage and more accurate market reflections, even during periods of high volatility.

Since trades are executed on real exchange order books, users can utilize advanced order types and charting tools from ByBit or connect external services like TradingView.

One major benefit is that HyroTrader doesn’t artificially restrict trading styles like scalping, algorithmic trading, or weekend holding. This open environment is a boon for crypto specialists who want to explore diverse strategies strategies.

Key Benefits

- Rapid, on-demand payouts in stablecoins

- High leverage and real-time exchange connectivity

- Generous profit splits that scale with performance

- Challenge fee refunded upon your first withdrawal

- An open-minded approach to different trading strategies

Potential Drawbacks

- Smaller initial account sizes (though they do scale)

- Primarily focused on crypto (which is an advantage for crypto traders, but not for those who also want to trade stocks or forex)

Overall, HyroTrader prioritizes crypto traders, providing a transparent, real-market environment that fosters consistent profitability. Its quick payouts and unlimited evaluation timelines alleviate stress and promote long-term, responsible trading trading.

BrightFunded: A Critical Overview

BrightFunded is another contender in the crypto prop trading space, although it extends beyond cryptocurrencies into other assets. From the table, you can see BrightFunded advertises profit splits up to 100%, which is eye-catching. However, let’s look deeper into the specifics.

Funding Limits and Profit-Sharing

BrightFunded touts an impressive scaling model with “no upper limits.” That means you can theoretically keep growing your account indefinitely as you prove your skill.

Although a 100% profit split is possible, many traders begin at a lower rate and progress toward that upper tier based on performance milestones. The high potential split can motivate, but it is essential to understand the conditions under which it can be attained—specific volume or consistency requirements may exist.

Challenge Fees and Refunds

The entry fee for BrightFunded is €495, which is significantly higher than HyroTrader’s. However, the firm does provide refundable challenge fees, meaning you receive your money back upon passing the evaluation.

For some traders, the upfront cost might act as a barrier, especially if they are new to the prop trading scene or prefer smaller initial investments commitments.

Platform Capabilities and Additional Features

BrightFunded employs a proprietary trading platform, offering both mobile and web app versions. While some traders appreciate the diverse access options to their accounts, others may find proprietary platforms less versatile than mainstream alternatives.

Additionally, BrightFunded introduces creative features such as NFT rewards and BrightFunded Tokens, adding a gamification layer to the trading experience.

Strengths

- Potentially high profit splits (up to 100%)

- Scalable accounts with no stated upper limit

- Refundable challenge fee upon meeting profit goals

- Additional features like NFT rewards, tokens, and mobile access

Weaknesses

- Relatively high entry fee compared to some competitors

- A proprietary platform might not match the familiarity and depth of leading crypto exchanges

- Less specialized in crypto alone compared to a dedicated firm like HyroTrader

While BrightFunded may attract traders looking for maximum profit potential in a multi-asset environment, those deeply engaged in crypto markets might discover more specialized offerings elsewhere.

Nevertheless, it provides a strong set of tools and an unconventional approach with its token-based incentives.

Crypto Fund Trader: An Analysis

Crypto Fund Trader positions itself as a prop firm concentrating on the crypto space, while also engaging with other financial instruments such as forex and stocks. The table indicates that they can fund traders up to $200,000, making it a good option for intermediate-level traders seeking some diversification.

Funding Tiers and Profit-Split Approach

Compared to BrightFunded, the profit split is a flat 80%, which is quite respectable. However, it lacks the high-end potential that some traders might seek. If you are comfortable with an 80/20 arrangement, then Crypto Fund Trader’s simpler approach may suffice. But if you aim for 90% or even 100% shares, this may not be your top choice choice.

Evaluation Phases

Crypto Fund Trader requires a two-phase evaluation, similar to that of many other firms. Notably, these phases often have a time constraint, which can create pressure if market conditions are unfavorable.

Furthermore, the daily drawdown rule is set at 5%, so risk management remains essential.

Platform Aspects

They offer a proprietary platform alongside MetaTrader 5, a well-known solution for forex and CFDs, though it is less common in a purely crypto environment. This might be advantageous if you appreciate the familiarity of MT5 or engage in cross-trading between forex and crypto.

However, you may encounter limitations on the number of crypto pairs available or on the flexibility of using advanced exchange features.

Distinguishing Points

- Access to multiple asset classes: crypto, forex, and stocks

- Straightforward 80% profit split

- Mid-range funding amounts (up to $200k)

- Proprietary platform plus MT5 for multi-market strategies

Potential Limitations

- Lower top-end profit split than some other competitors

- No refund on the challenge fee

Emphasis on a two-phase evaluation with potential time constraints - Not specifically designed to be a crypto-first platform

Summary

In summary, Crypto Fund Trader can be a suitable option if you wish to trade various asset classes through a more traditional platform.

However, traders who concentrate exclusively on crypto and seek deeper exchange integration may prefer a more specialized firm like HyroTrader.

Why HyroTrader Stands Out

After closely analyzing the three firms, it is clear that HyroTrader provides a distinctive combination of flexibility, advanced technology, and crypto-centered support. Here’s why it frequently stands out as the preferred option:

Flexible Challenges and Unlimited Time

Most prop firms enforce strict timelines during their evaluation stages. In contrast, HyroTrader allows you as much time as you need, alleviating the pressure to execute trades under unfavorable market conditions merely to meet a deadline.

Instant Payouts in Stablecoins

The option to request payouts at any time is a significant benefit. You can secure your profits, reinvest in other crypto projects, or retain your funds in stablecoins.

Direct Integration with Live Crypto Exchanges

HyroTrader collaborates with ByBit or CLEO (using Binance data) to ensure price accuracy and order execution reliability. This accuracy is crucial when trading volatile crypto assets, where each second matters.

No Restrictions on Trading Styles

All trading styles are allowed, including scalping, news trading, algorithmic methods, and weekend trading. Since trades are made on actual markets, the firm has little reason to limit effective strategies.

High Leverage and Easy Scalability

With a maximum leverage of 1:100, HyroTrader offers opportunities that may not suit everyone but are available for those who know how to use them wisely. Additionally, scaling to $1 million in trading capital is straightforward once you build a positive track record.

Refundable Challenge Fee

The challenge fee is refunded on your initial profit split, which helps lower your long-term expenses. This approach demonstrates the firm’s commitment to supporting successful traders.

These unique characteristics provide HyroTrader with a genuine competitive advantage in a marketplace flooded with multiple prop trading options. The firm merges vital funding with a trader-friendly atmosphere, closely aligning its interests with those of its clients.

Choosing the Right Crypto Prop Firm

Selecting a prop firm is like choosing a business partner. You want a partner who aligns with your goals, respects your trading style, and helps you scale over time. Consider the following guidelines to make an informed decision decision:

- Match the Firm to Your Strategy: If you frequently scalp or trade highly volatile altcoins, you need real-time data and minimal restrictions. That points you toward a firm like HyroTrader. If you seek multi-asset exposure, perhaps a more traditional platform suits you.

- Weigh the Risk Parameters: Daily drawdown limits and max loss thresholds can either protect you or stifle your strategy. Choose a firm whose risk management rules align with your approach.

- Evaluate the Fee vs. Reward Trade-Off: A higher entry fee might be acceptable if the profit splits and scaling options are lucrative. On the other hand, a lower fee can be beneficial if it fits your budget and trading strategy. Just ensure you understand when and if fees are refundable.

- Check Community and Support: Fast, helpful support can save you from losing valuable time. Look for firms that offer 24/7 assistance, active chat channels, and transparent communication.

- Consider Regional and Regulatory Aspects: If you are a U.S. trader, confirm that the firm allows you to participate without future compliance issues.

- Understand the Payout Cycles: Daily or on-demand payouts can significantly improve your cash flow. If you need frequent liquidity, choose a firm known for prompt withdrawals.

Ultimately, your personal goals, style, and preferences will determine which firm feels like the best fit. Some traders thrive with a straightforward 80/20 structure, while others want every extra percentage of the profit split they can get. Consider how each element aligns with your objectives, and pick the strongest synergy option.