Search Knowledge Base by Keyword

Strong Uptrend

TL;DR: Profit from Crypto Uptrends

Trading with the trend (“The Trend is Your Friend”) significantly increases win rates. A Strong Uptrend is defined by consistent higher highs and higher lows, supported by rising volume and positive momentum.

How to Identify & Trade It

-

Technical Signs: Price stays above the 50/200-day Moving Averages; RSI stays above 50.

-

Confirmation: Increasing volume during price pumps and bounces off trend-line support.

-

Top Strategy: Use Trailing Stop-Losses to protect profits while letting winners run.

How altFINS Helps

-

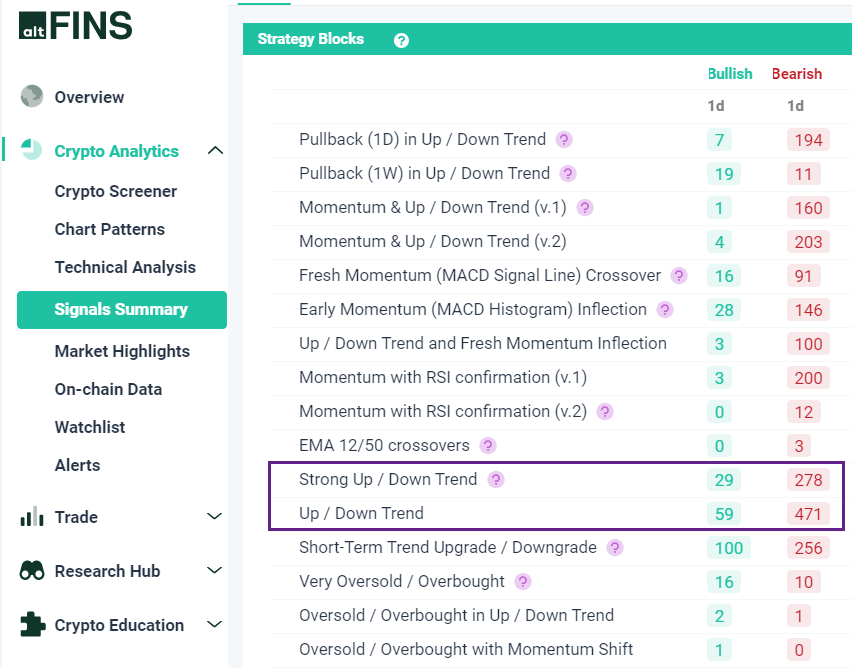

Automated Scans: Instantly filters 3,000+ assets for “Strong Uptrends” or “Recent Upgrades.”

-

Alerts & Education: Provides custom alerts and a dedicated course (Lesson 3) on trend trading.

What Is Strong Uptrend in Crypto Trading?

A strong uptrend in crypto trading indicates a sustained increase in the price of a cryptocurrency over a period of time. Understanding and identifying a strong uptrend can help traders make informed decisions.

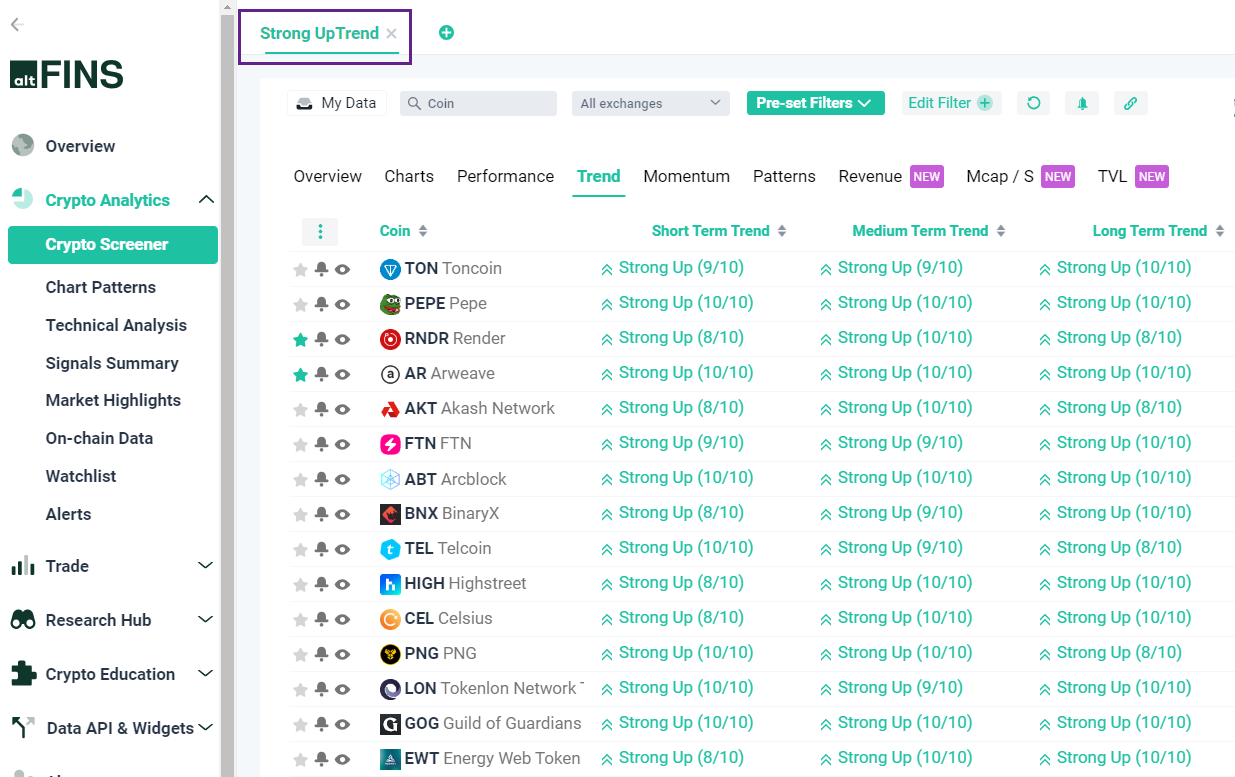

altFINS helps traders easily identify assets that are still in a Strong Uptrend:

Watch a tutorial video where our CEO explains how to find assets in a Strong Uptrend or those that were recently upgraded to an Uptrend.

He also demonstrates how to create customer filters and alerts.

Identifying and trading with the trend significantly increases winning rates for traders, especially beginners.

As the old adage goes “trade with the trend” or “trend is your friend“.

That means, find an uptrend, and ride it for potentially big gains. Trend trading works because price trends have a tendency to continue. Identifying a trend is half the battle. It greatly increases your winning probabilities.

altFINS constantly monitors and updates trend ratings for over 3,000 assets, saving you a ton of time when looking for trades!!

Here are three market scans you can use and save!

1. Assets in Strong Uptrend (see live scan results)

2. Assets in Uptrend (see live scan results)

3. Assets with recent upgrade to Uptrend (see live scan results)

Learn to trade for profit with altFINS!

We teach this trading strategy in Lesson 3 of our Crypto Trading Education Course.. We teach 7 trend and swing trading strategies, as well as Short Selling, Marging Trading and Risk Management techniques in our new Crypto Trading Course.

We share the best trading ideas in our VIP telegram channel.

Characteristics of a Strong Uptrend

- Higher Highs and Higher Lows: The most basic definition of an uptrend is when the price consistently forms higher highs and higher lows. This pattern indicates that the buying pressure is greater than the selling pressure.

- Increasing Volume: Volume often increases as the trend strengthens. High trading volume during an uptrend indicates strong investor confidence and support for the price increase.

- Positive Market Sentiment: Sentiment in the crypto community, as well as news and events, can heavily influence the strength of an uptrend. Positive news such as regulatory approvals, partnerships, or technological advancements can drive prices higher.

Technical Indicators:

- Moving Averages: The price typically remains above key moving averages (e.g., 50-day, 200-day) during a strong uptrend.

- Relative Strength Index (RSI): An RSI above 50 often confirms the strength of the uptrend, though levels above 70 might indicate overbought conditions.

- MACD (Moving Average Convergence Divergence): A positive MACD, where the MACD line is above the signal line, supports the presence of an uptrend.

- Trend Lines: Drawing trend lines connecting the lows in an uptrend can help identify support levels. If the price consistently bounces off this line, the uptrend is considered strong.

Strategies for Trading in a Strong Uptrend

- Trailing Stop-Loss: Use trailing stop-loss orders to protect profits. As the price rises, the stop-loss order adjusts, allowing traders to lock in gains while still participating in the uptrend.

- Leverage Positional Trading: Traders might use margin or leverage to amplify gains in a strong uptrend. However, this strategy carries higher risk and requires careful management.

- Monitor Market Sentiment: Stay updated on news, social media trends, and other factors that might impact market sentiment and the strength of the uptrend.

- Overbought Conditions: If technical indicators like RSI show overbought conditions, it may signal a potential correction or consolidation period before the uptrend continues.