Search Knowledge Base by Keyword

New Local High

What You’ll Learn in This Article

In this guide, you’ll discover how New Local High and New Local Low indicators help traders spot market strength, weakness, and breakout opportunities.

You’ll learn:

-

Definition & Purpose: What these indicators are and how they measure trend strength.

-

Practical Use: How to detect breakouts when prices move above resistance or below support.

-

Indicator Settings: How altFINS identifies new highs for multiple lookback periods (10–50).

-

Trading Strategy: A complete 4-step plan with entries, stop-losses, and exits.

-

Real Examples: Coins like SUI, SUP, and DMTR that gained up to 90%.

-

How to Use on altFINS: Simple steps to screen and set alerts for New Local Highs.

-

Pro Tips: Setting alerts and leveraging the VIP group for early signals.

📈 What Is a New Local High?

A New Local High occurs when an asset’s price reaches its highest level over a chosen period — for example, the last 10, 20, or 50 days.

This indicates buying strength and often signals the start of a bullish breakout.

-

Shorter periods (10–15) → Detect early momentum and generate frequent signals.

-

Longer periods (30–50) → Identify major breakout confirmations and sustained uptrends.

-

Traders use this indicator to spot assets breaking through resistance — a key moment when momentum can accelerate upward.

Example: If Bitcoin’s current price is higher than any closing price from the last 20 days, it forms a new local high, suggesting strong bullish momentum.

💬 Expert Insight

“It may seem sometimes like the market isn’t doing much, just brief swings up and down.

But the reality is, there’s always a massive bull market somewhere! You just have to know where to look and use the right tools (hint: altFINS).”

— Richard Fetyko, CEO and Founder of altFINS

Richard emphasizes that strength tends to lead to more strength — once a price breaks above resistance (new local high), it often continues higher.

Recent examples like SUP and DMTR show gains of 70–90% after confirming new local highs, proving the indicator’s power in spotting breakout opportunities.

SUP – New Local High

DMTR New Local High

New Local High and New Local Low are indicators that help traders identify assets with recent strength or weakness.

They can also help traders find assets breaking through resistance or support.

For example, when we filter assets to find those with a new local high in the last 50 periods, one of the assets is SUI. In the chart, we can see that the price has now broken above the prior swing high, which can often act as resistance.

So the price has now broken through the prior swing high, or resistance, and made a new high, which is a sign of strength and potential beginning of an uptrend.

Watch Tutorial Video on New Local High and New Local Low

New Local High is typically used in crypto technical analysis to detect when a new local high has been made in a time series, such as the price of a an asset, over a specified period. A “local high” refers to a point where the price is higher than the surrounding data points within a certain period or window of time.

Key Points:

- Shorter periods (e.g., 10 or 15): More sensitive to recent price movements, generating more frequent signals.

- Longer periods (e.g., 30 or 50): Less sensitive to short-term price fluctuations, signaling only significant upward trends.

How it’s used:

- Crypto traders might use the New Local High indicator to identify breakout patterns, where the price breaks above recent highs and potentially continues upward.

- The periods chosen depend on the crypto trader’s strategy. Shorter periods are typically used by day traders or swing traders, while longer periods may be used by position traders or investors.

- Shorter periods (10, 15) are often used to catch early breakouts, while longer periods (30, 50) might be used to confirm more substantial breakouts from major resistance levels.

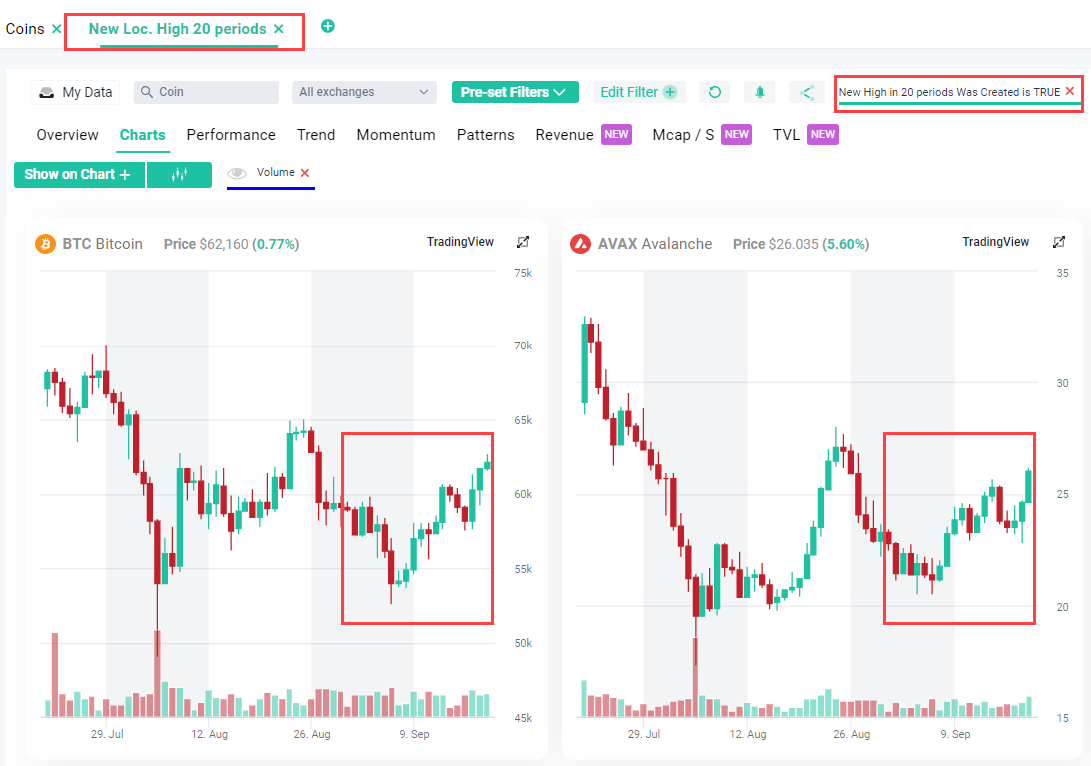

Example: these are coins reaching a new high over the last 20 periods. On a daily time frame, this represents a span of 20 days.

Trading Strategy Using New Local High

Here’s a practical 4-step trading plan for using the New Local High indicator:

Rule 1: Initial Breakout Entry

-

Condition: Enter when the price breaks above the highest level over the chosen period.

-

Action: Allocate 50% of your intended position at breakout confirmation.

Use a stop-loss slightly below the breakout level to manage risk.

Rule 2: Pullback and Re-Break Confirmation

-

Condition: If the price pulls back after the breakout and then re-breaks the level, it confirms strength.

-

Action: Enter the remaining 50% of the position.

Move your stop-loss below the pullback low.

Rule 3: No Pullback Strategy

-

Condition: If the price continues to surge with no pullback, avoid adding more.

-

Action: Use a trailing stop-loss (e.g., based on ATR) to lock in profits.

Rule 4: Exit Plan and Profit Targets

-

Condition: Set targets using Fibonacci extensions, prior resistance levels, or a fixed 2:1 or 3:1 reward-to-risk ratio.

-

Action: Take partial profits (e.g., sell 50% at the first target) and let the rest ride.

Exit fully if price drops below your trailing stop.

Bonus Tip:

Use altFINS alerts to be notified of breakouts, pullbacks, and re-breaks. This ensures timely reactions without constant chart-watching.

Example: EN Break Pullback Re-break

How to detect New Local Hight on altFINS

altFINS detects New Local High indicator for the periods of 10, 15, 20, 30, and 50. Here’s how the concept works for each of these periods:

Period 10:

- The indicator checks whether the current price is the highest price over the last 10 periods (e.g., 10 days, if using daily data).

- If the current price is higher than any of the prices over the last 10 periods, it would be marked as a new local high.

Period 15:

- The same logic applies, but over the last 15 periods. The indicator will signal a new local high if the current price is higher than any price from the previous 15 periods.

Period 20:

- The indicator checks if the current price is higher than any price from the last 20 periods, signaling a new local high if true.

Period 30:

- This indicator will look back over the last 30 periods. If the current price is the highest compared to any price in the last 30 periods, it will trigger a signal for a new local high.

Period 50:

- Finally, for a 50-period New Local High indicator, it checks whether the current price is the highest over the last 50 periods.

How to detect New Local High on altFINS?

If you are looking at daily price data for a coin and set the period to 20, the New Local High indicator would mark the current price as a new high if it’s higher than the highest price of the previous 20 days.

altFINS automatically detects New Local High and New Local Low across all supported coins and timeframes.

You can access it in several ways:

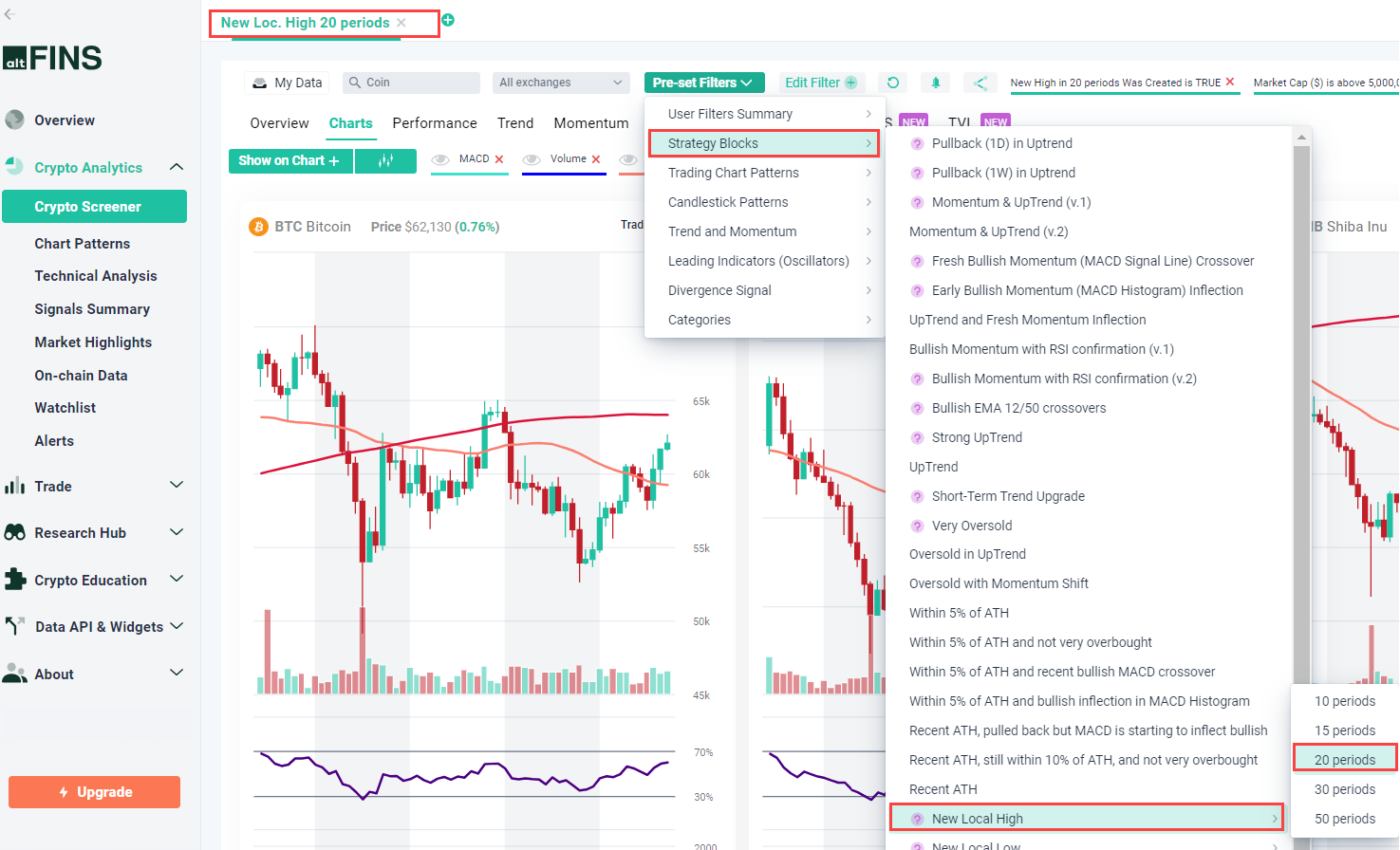

1. On the Crypto Screener

-

Pre-set Filters → Strategy Blocks → New Local High → Choose Period

-

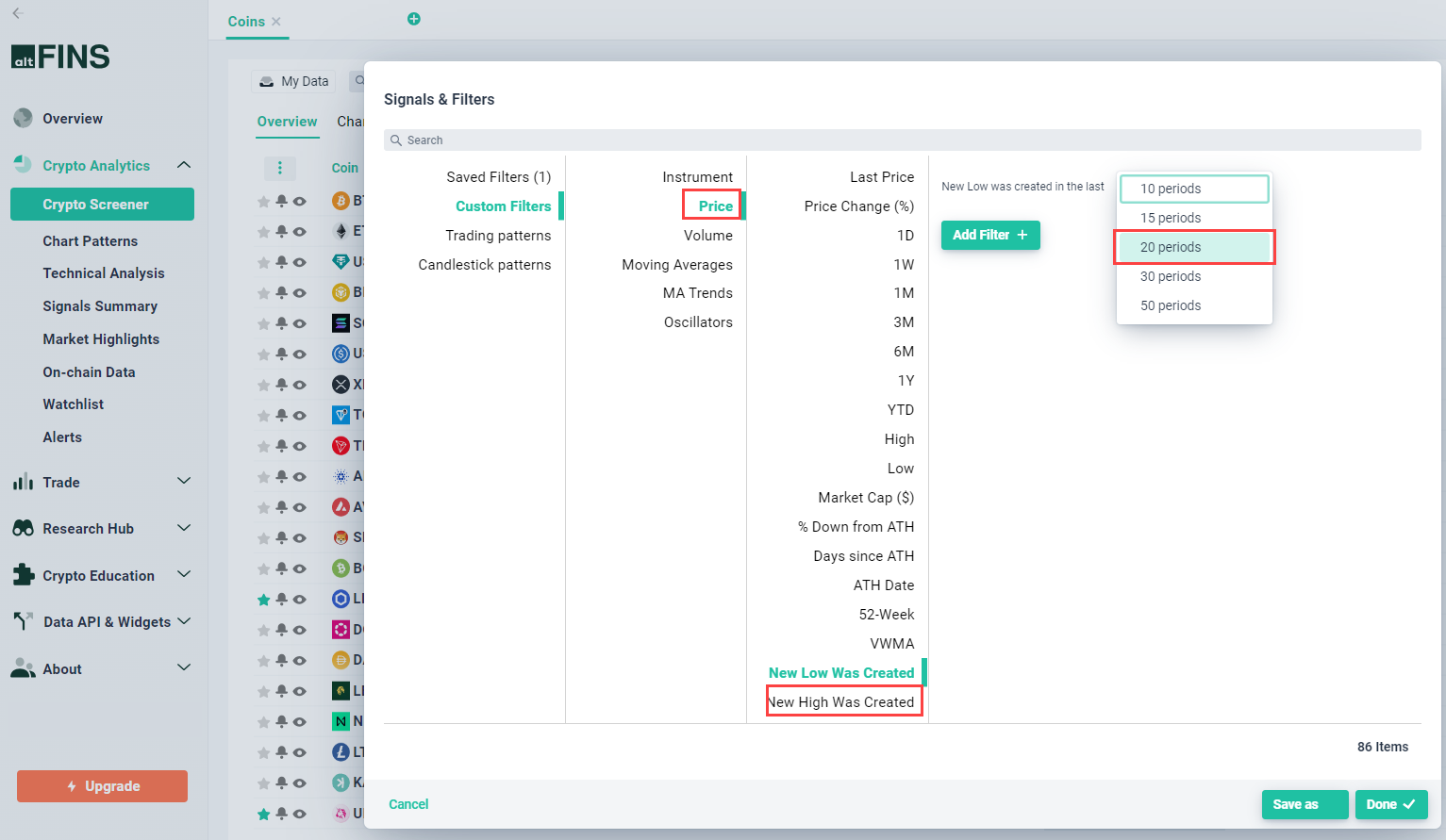

Or create a Custom Filter under Price → New High Was Created → Choose Period

- Custom Filters – Price- New Low Was Created – Choose Period

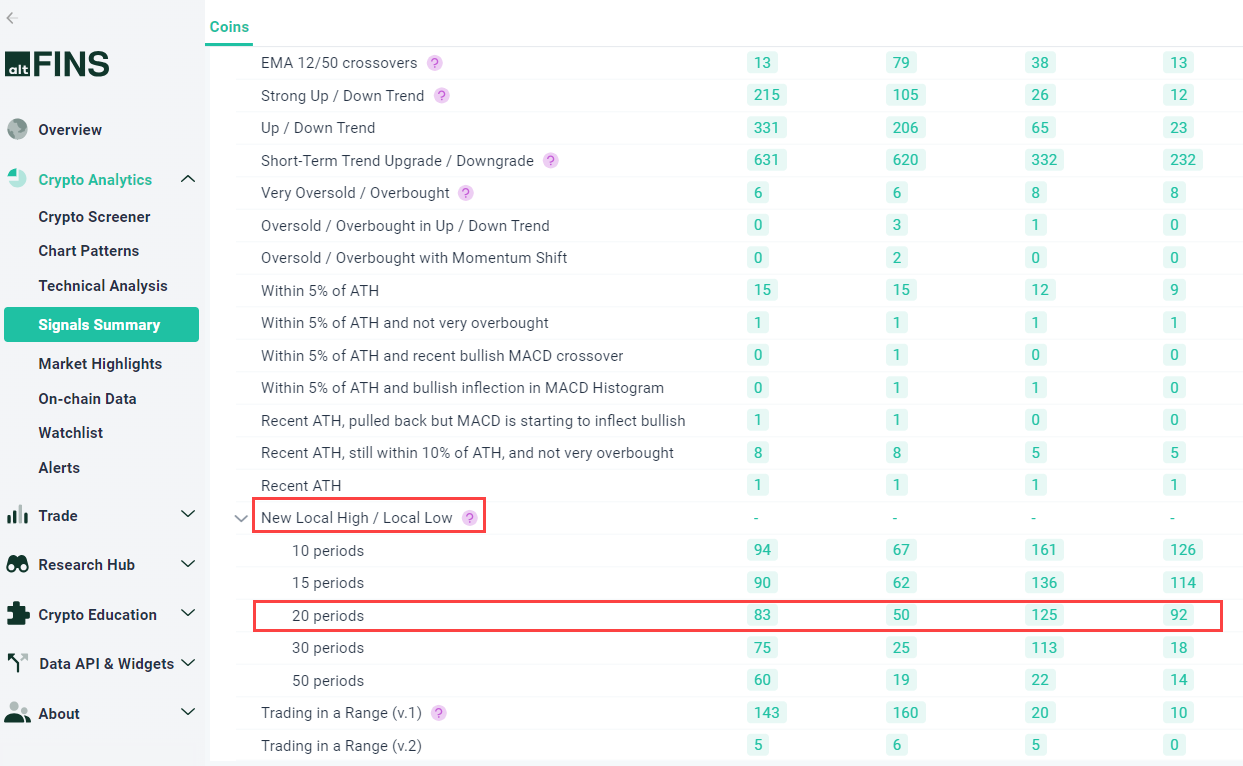

2. New Local High on Signals Summary

-

Strategy Blocks → New Local High → Choose Period

Set Alerts

Set alerts for new highs or lows to be notified instantly when breakouts occur — no need to monitor the screen constantly.

Summary

-

Purpose: Detect breakout points and measure market strength.

-

Indicator: Marks when price reaches a new high over a chosen period.

-

Usage: Great for identifying early momentum or confirming trend continuation.

-

Platform: Fully available in altFINS Screener, Signals Summary, and Alerts.

-

Outcome: Helps traders capture profitable uptrends before they go mainstream.

Ready to Catch the Next Breakout?

It only takes a few clicks to use this powerful indicator to your advantage.

👉 See Live Results: New Local High 20 Periods

👉 Watch Tutorial Video

👉 Join VIP Group for expert insights and trade ideas.

FAQ: New Local High and New Local Low Indicators

1. What is a New Local High?

A New Local High occurs when an asset’s price reaches its highest level over a chosen period — for example, the last 10, 20, 30, or 50 days. It signals buying strength and can indicate the beginning of an uptrend or bullish breakout.

2. What is a New Local Low?

A New Local Low is when an asset’s price drops to its lowest level over a specified lookback period. It often signals weakness or the start of a downtrend, as the price breaks below support.

3. How do traders use the New Local High indicator?

Traders use it to identify breakout points when prices move above recent highs, confirming strength and potential continuation. It helps spot early signs of momentum or confirm sustained uptrends.

4. What’s the difference between shorter and longer periods?

Shorter periods (10–15) are more sensitive to recent moves and help detect early breakouts, while longer periods (30–50) confirm major trends and filter out noise from short-term fluctuations.

5. How does altFINS detect a New Local High?

altFINS automatically checks whether the current price is higher than any price in the selected lookback period (10, 15, 20, 30, or 50). If it is, a New Local High signal is generated.

6. Can I use this indicator for different trading styles?

Yes. Day traders and swing traders often use shorter periods like 10 or 15 to catch early momentum, while position traders and investors prefer longer periods (30 or 50) to confirm stronger trends.

7. What is a good trading strategy for New Local High signals?

A typical plan includes entering 50% of your position on breakout confirmation, adding the remaining 50% on a pullback and re-break, using a stop-loss below support, and taking profits based on predefined targets or trailing stops.

8. What are some real examples of New Local High breakouts?

Recent examples include SUI, SUP, and DMTR, which broke above prior resistance and gained between 70% and 90% shortly after confirming new local highs.

9. Where can I find this indicator on altFINS?

You can find it under:

-

Crypto Screener → Strategy Blocks → New Local High → Choose Period

-

Signals Summary → Strategy Blocks → New Local High → Choose Period

You can also set alerts to be notified when new highs or lows occur.

10. Why is the New Local High indicator useful for crypto traders?

It helps traders identify coins showing early strength or entering strong uptrends, providing actionable insights for timely entries. It’s one of the most effective tools for catching breakout opportunities before they become widely noticed.