Search Knowledge Base by Keyword

Crypto Trend Changes

Introduction

altFINS automatically rates crypto trends across Short-, Medium-, and Long-term horizons using a 5-level system (Strong Up → Strong Down). Traders can spot opportunities by tracking trend upgrades/downgrades, such as assets recently improving from Neutral → Up. In Downtrends—when most coins trade below the 200-day MA—traders often short bounces, but altFINS also helps identify early trend reversals with Short-term trend improvements. Use pre-set scans, custom filters, alerts, and the AI Copilot to quickly find actionable trade setups.

Crypto Trend Upgrade / Downgrade

altFINS identifies and rates crypto trend from Strong Up, Up, Neutral, Down, to Strong Down, across three time horizons Short-term, Medium-term, and Long-term.

Identifying trends is a key pillar to successful trading strategies, especially trend trading.

As the old adage goes. Trend is your friend. Trade with the trend.

If you get the trend right, you dramatically improve your chances of winning.

With this analytic, traders can also find coins when their trend rating changes (i.e. upgrade or downgrade).

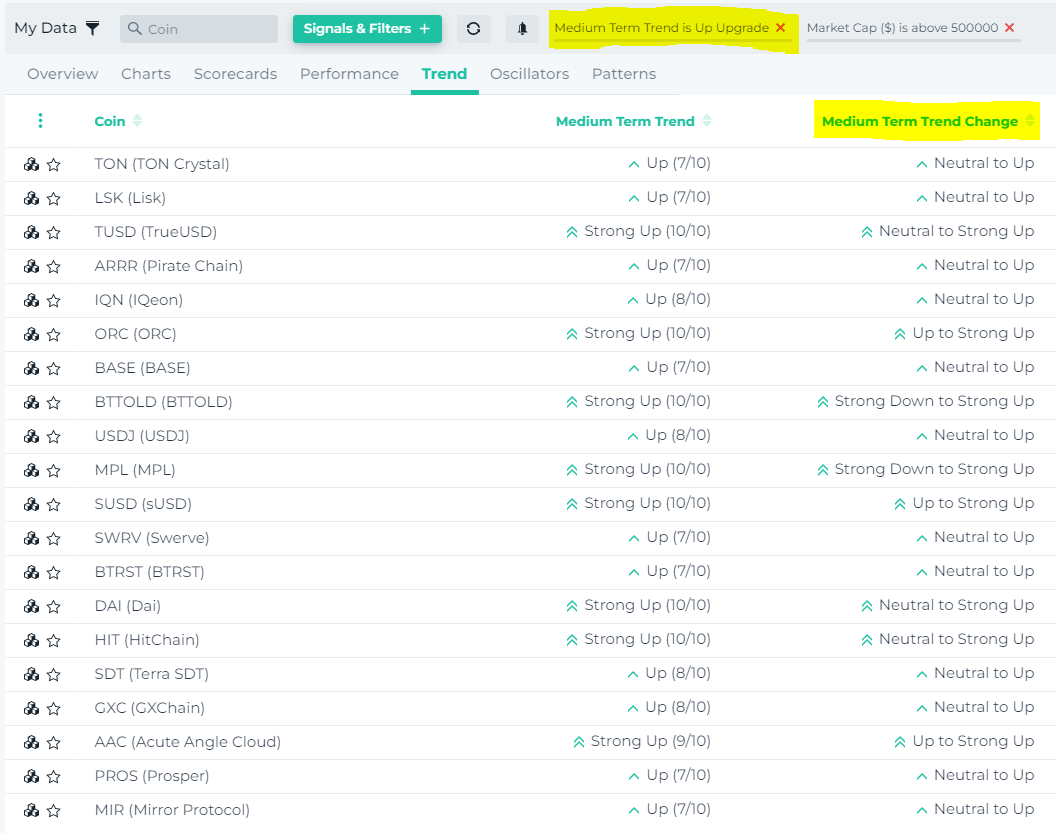

Let’s say you’re looking for coins that have had a recent (last 3 days) improvement (upgrade) in their Medium-Term trend specifically from Neutral to Up or from Up to Strong Up. Check out actual results.

Watch a 5 min tutorial video that demonstrates this new powerful capability, how to create and save this filter, and how to create an alert out of it so you don’t miss any trading opportunities.

How to Spot Trend Reversals

Crypto markets are firmly in a Downtrend, trading below their 200-day Moving Averages. (some exceptions here)

In downtrends, traders make money by Short Selling the bounces.

But naturally, we keep an eye on potential trend reversals. And there have been some early signs.

A simple way to spot early trend reversals is by using altFINS’ automated trend ratings and pre-set market scans.

Our systems scores trends for over 2,000 assets across Short- Medium- and Long-term horizonts.

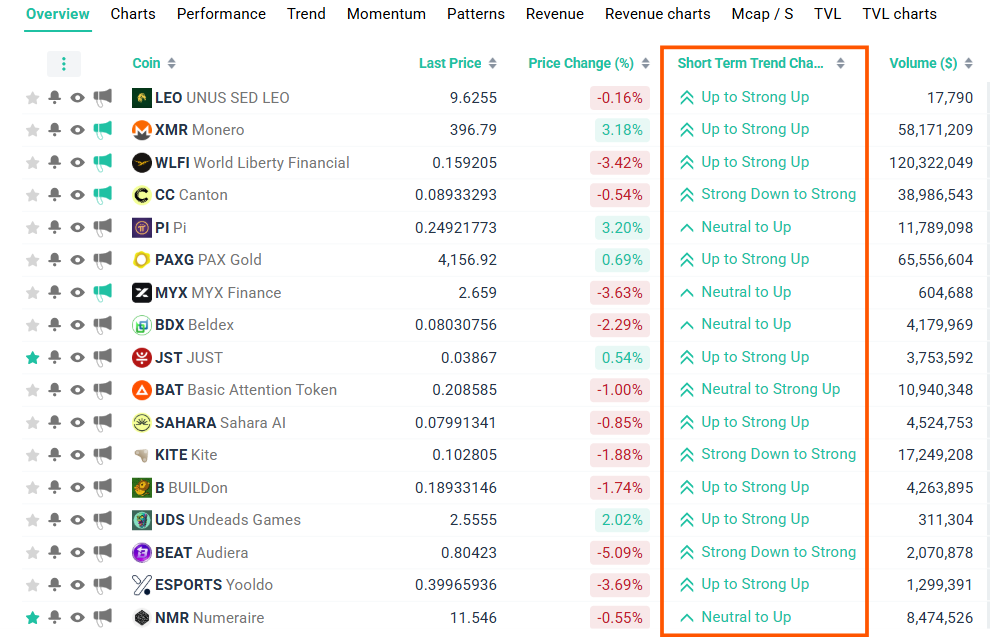

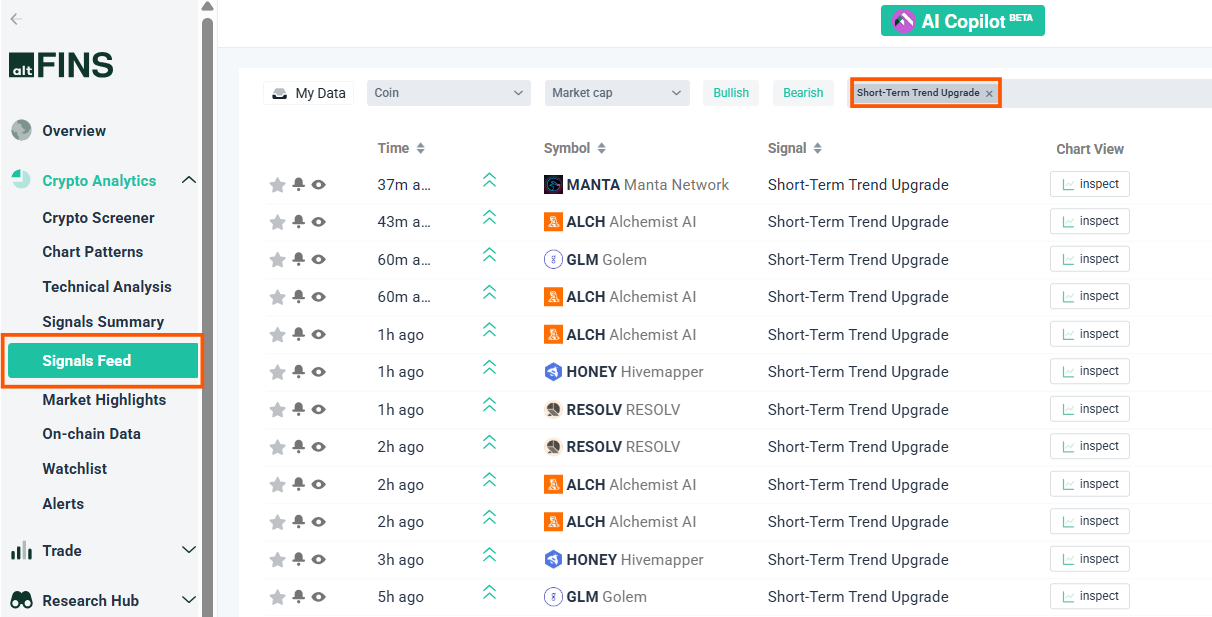

So let’s find assets where Short-Term trend has recently changed to Up or Strong Up (see live results here):

Crypto Screener: Short-Term Trend Upgrade

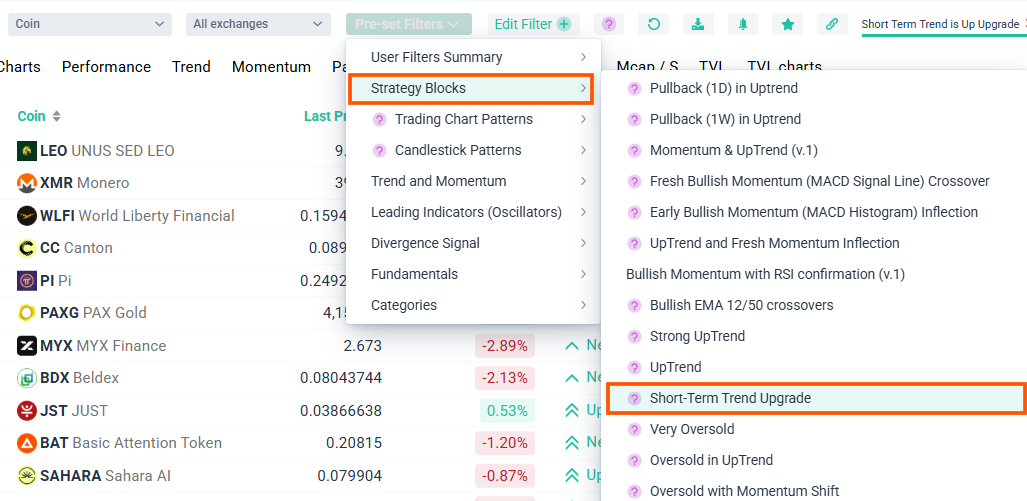

Crypto Screener: Pre-Set Filter

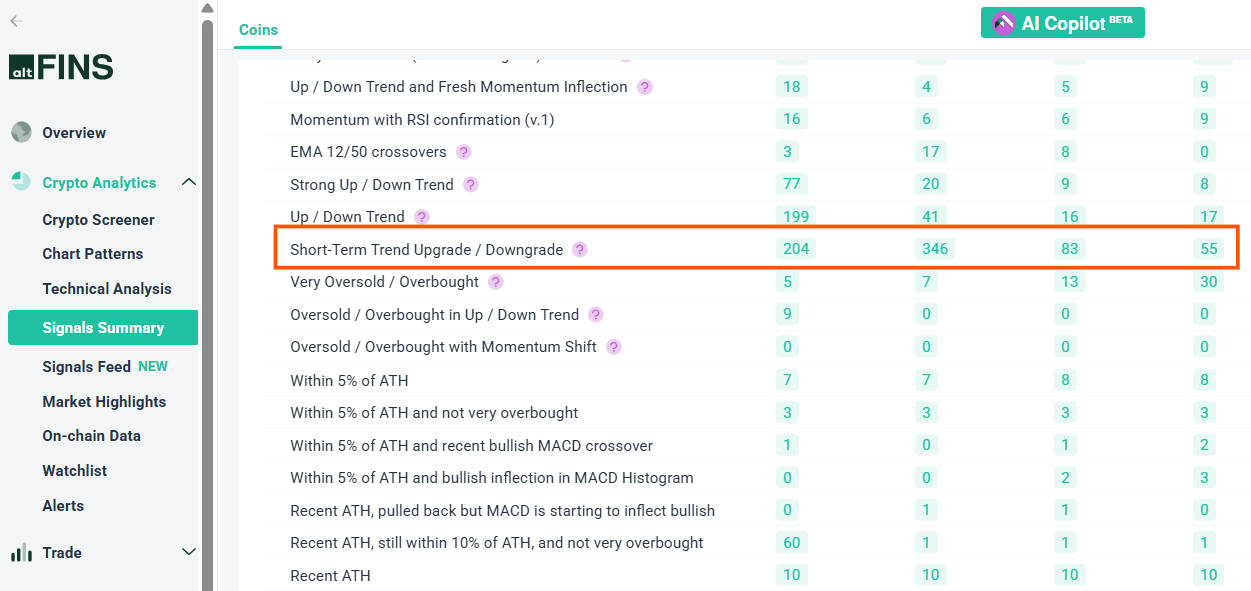

altFINS Signals Summary

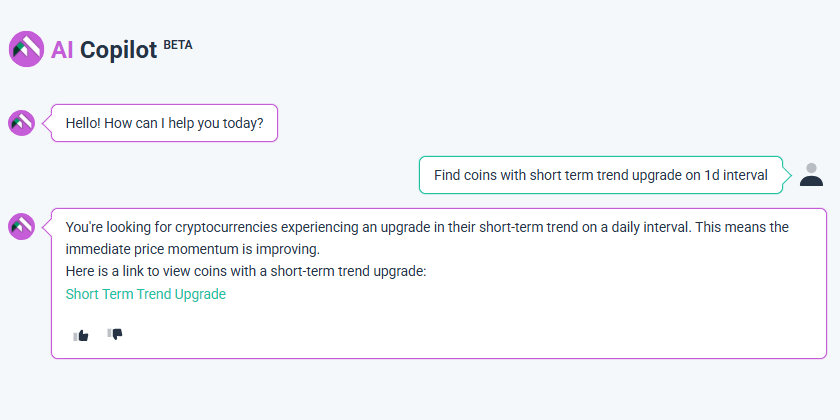

Ask altFINS AI Copilot

Crypto Signals Feed

Go ahead and try these pre-set market scans now:

FAQ

1. What are altFINS trend ratings?

Trend ratings classify assets into Strong Up, Up, Neutral, Down, or Strong Down across Short-, Medium-, and Long-term horizons.

2. Why are trend ratings important?

Trading with the trend increases your chance of success. Identifying upgrades/downgrades helps you catch early momentum shifts.

3. What is a trend upgrade or downgrade?

This is a change in an asset’s trend score—for example, Neutral → Up or Up → Strong Down. Upgrades may signal bullish momentum; downgrades may indicate weakness.

4. Can I filter for coins with recent trend upgrades?

Yes. You can create filters that detect upgrades within any time window (e.g., last 3 days) and across any timeframe (Short-, Medium-, Long-term).

5. How do I get alerts for trend changes?

Create a custom filter → Save it → Set an alert. altFINS will notify you when assets meet the criteria.

6. How does altFINS help identify trend reversals?

Monitor Short-term trend upgrades to Up or Strong Up. These often act as early reversal signals before Medium- or Long-term trends follow.

7. What if the market is in a Downtrend?

When assets trade below their 200-day MA, markets are typically bearish. Traders often short bounces but can still watch for early reversal signs using altFINS scans.

8. Where can I see pre-set scans?

You can access them directly through:

-

Crypto Screener

-

Signal Summary

-

Signals Feed

9. What does the AI Copilot do?

It helps you interpret signals, build filters, generate strategies, and find relevant market opportunities—instantly.