Search Knowledge Base by Keyword

Altrady Review: How To Achieve Optimal Trade Execution

Successful (profitable) traders recognize the importance of optimal trade execution. Getting the right trade entry and exit makes a big difference in your profits.

In this article and video, we demonstrate how a tool like Altrady can increase your success rates and profitability, making it an indispensable tool for traders.

Let’s use an example trade setup for Solana (SOL):

Based on the above trade setup from altFINS, the ideal swing trade entry is in the Support Zone of $190-$210. Price target is $240 to $260 (ATH) and Stop Loss is $175.

Now that we have a trading plan, how do we execute it?

Using Altrady, it’s easy to execute this trading plan to perfection and to account for multiple scenarios.

The tool allowed us to create multiple entry levels and take profit levels, plus a trailing take profit order as well as a dynamic stop loss order that protects our profits.

This way, a trader can gradually scale into his position and also gradually exit the position with multiple take profit levels.

Altrady offers traders incredible control and flexibility over their trading execution.

Check out this video with an actual trading example:

Try Altrady for free, and if you enjoy it, use this link to get a 10% discount!

What is Altrady?

Altrady is a trading terminal that connects users to multiple cryptocurrency exchanges through a single platform. Designed for traders who need powerful tools, real-time data, and cross-exchange capabilities, Altrady brings together a variety of advanced trading features, portfolio management, and strategy tools. From executing smart trades to monitoring assets in real-time, Altrady strives to be an all-in-one solution for trading enthusiasts.

Key Features of Altrady

1. Smart Trading Tools

Altrady provides a range of smart trading features, enabling users to automate and enhance their trading strategies. You can set multiple Take Profit targets and Stop Loss strategies, which can be particularly helpful when working in volatile markets. Features such as “Risk-based size calculation” allow you to automate position sizing based on your risk appetite, helping you minimize losses and maximize gains.

Another helpful feature is “Stop Loss Cooldown,” which enables traders to avoid being stopped out unnecessarily during market fluctuations. Altrady also allows you to set trailing Stop Losses, meaning your Stop Loss will move up as the price increases, thereby locking in profits.

2. Real-Time Alerts and Watchlists

Altrady allows users to create customized watchlists to categorize assets and receive real-time alerts when critical levels are hit. This makes it easier to monitor different markets simultaneously and take timely action. For day traders who need to stay on top of the rapid changes in the crypto market, these real-time price alerts are invaluable. You can set alerts for price movements, specific levels, or even customized criteria that suit your trading style.

3. Integrated Trading and PnL Tracking

Altrady makes it easy to keep track of your positions, profit and loss (PnL), and trade history across different exchanges. The PnL tracking tool updates your metrics in real-time, so you always know where your portfolio stands. Altrady also offers built-in break-even calculations, which makes it easier for you to assess the point at which you can exit a trade profitably.

4. Grid Bot Trading

Altrady provides a Grid Bot for automated trading in sideways markets. The bot is simple to set up and effective at capitalizing on small price movements by buying low and selling high. Traders can specify price limits, number of orders, and trailing parameters, which allow the bot to adapt automatically to changing market conditions.

5. Paper Trading and Crypto Journal

If you want to practice trading without risking real money, Altrady offers a paper trading mode. This allows you to experiment with different strategies and understand market dynamics without any financial risk.

The platform also includes a trade journal that allows you to log your trading thoughts, strategies, and even screenshots of charts. This is useful for both reflection and strategy development as you progress in your trading journey.

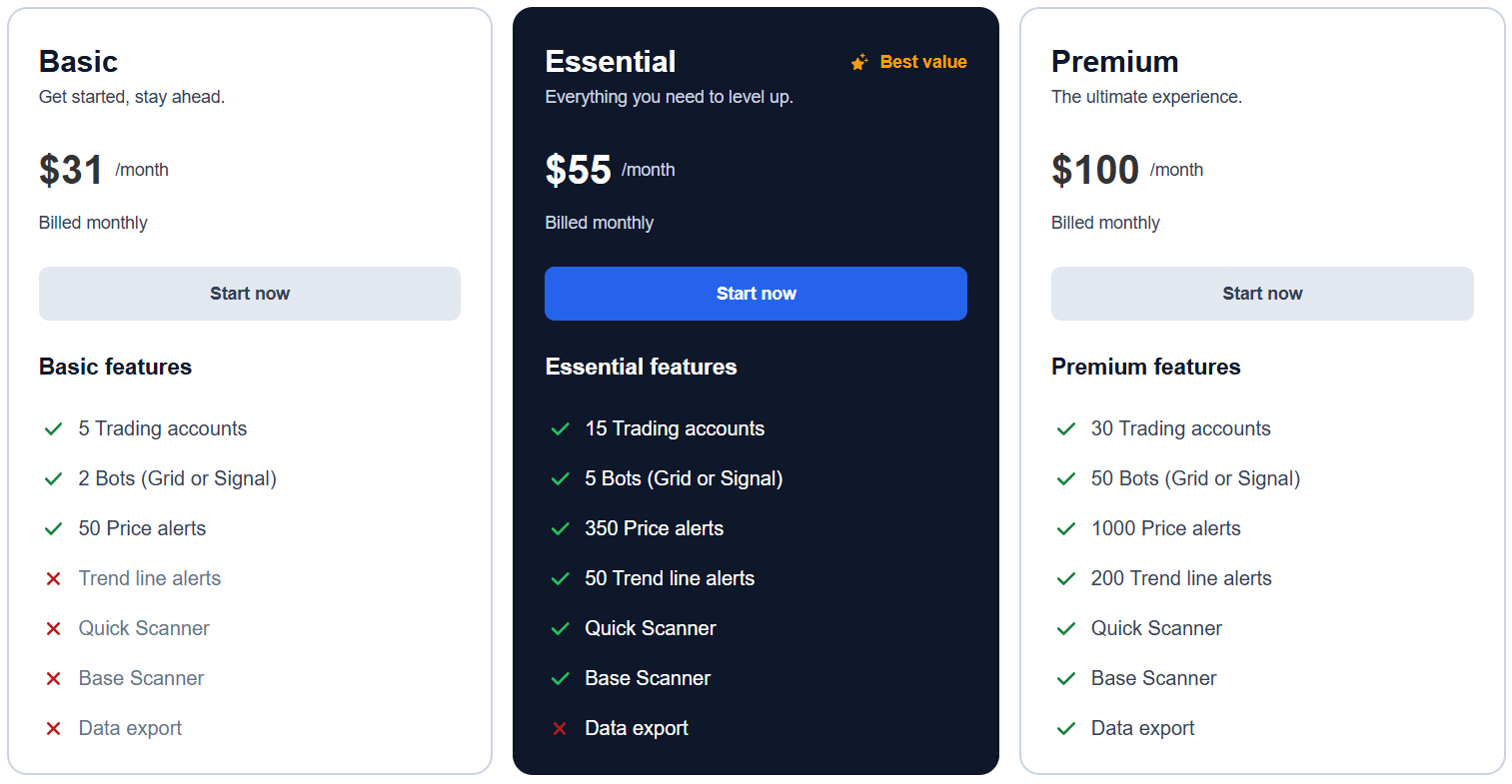

Altrady offers three pricing plans:

Basic Plan – Starting at $31 per month, this plan includes access to basic trading terminal features, charts, and signals.

Essential Plan – Costs between $55 per month. This plan offers additional charting options, order types, and analytics tools.

Premium Plan – The premium plan costs $100 per month. It provides access to the full suite of Altrady’s tools, including advanced scanning and screening tools.

These pricing plans offer flexible billing options, whether monthly or annually. However, it’s important to note that, in addition to Altrady’s subscription fees, users will still need to cover any trading fees associated with the specific exchanges they use.

Pros and Cons of Altrady

Pros

Smart Orders: This is by far the most valuable and differentiating aspect of Altrady. It offers many trade order types that crypto exchanges or brokers do not offer.

All-in-One Solution: Altrady provides a centralized interface that integrates multiple cryptocurrency exchanges, offering users a powerful toolkit that includes portfolio management, real-time alerts, advanced charting, and a wide variety of trading tools.

Cross-Platform Integration: The mobile app ensures that you can stay connected to the market anytime, anywhere, and even switch seamlessly between desktop and mobile versions.

Ease of Trade Management: Features like automated PnL tracking and break-even calculations make it easier for traders to manage their trades, eliminating manual errors and reducing time spent on tracking.

Paper Trading Mode: The availability of paper trading is a fantastic tool for newcomers to practice before risking their capital in the volatile cryptocurrency market.

Educational Resources: Altrady Academy and other educational resources make it accessible for users to learn about cryptocurrency trading, from basic to advanced levels.

Cons

Steep Learning Curve: The range of advanced features can make Altrady overwhelming for complete beginners. While the educational resources are helpful, there is still a learning curve for new users unfamiliar with advanced trading tools.

Who Should Use Altrady?

Altrady is ideal for:

Intermediate to Advanced Traders: Those who have some experience with cryptocurrency trading and are seeking powerful tools to streamline their process. Its smart trading, advanced alerts, and real-time PnL tracking features make it particularly attractive to experienced traders.

Traders Seeking Cross-Exchange Trading: Altrady’s ability to connect to multiple major exchanges makes it appealing for those looking to trade on a wide range of platforms without needing to manage multiple accounts manually.

Scalpers and Day Traders: Altrady’s features like Quick Scanner, real-time alerts, and automated PnL tracking are perfect for traders who need to make rapid decisions and execute multiple trades throughout the day.

Traders Who Want Automation: Features like the Grid Bot and advanced alert settings make Altrady a great choice for those who want to automate parts of their trading strategy.

On the other hand, Altrady might not be the best fit for absolute beginners who are unfamiliar with cryptocurrency trading, as the platform’s breadth of features can be overwhelming. However, for those willing to invest the time in learning, the educational tools provided by Altrady could be a helpful stepping stone.

Why Use Altrady?

Altrady is designed to save time, reduce errors, and make crypto trading more efficient and profitable. If you are tired of managing multiple exchange accounts, Altrady offers everything you need under one roof. The platform excels at automation, efficiency, and providing traders with key insights to enhance decision-making. Its advanced features cater to those who are serious about cryptocurrency trading, and its customizable platform is perfect for experienced traders looking to develop their unique trading strategy.

Final Verdict: Is Altrady Worth It?

Altrady is definitely worth considering if you are an active trader who wants optimal trade execution, values the ability to trade across different exchanges and monitor portfolio from a unified platform. The wide array of tools, combined with its educational resources, make it a powerful choice for traders looking to take their strategies to the next level. However, the learning curve can be steep for beginners, and the pricing may not be suitable for traders who are just getting started.

For traders who are looking for efficiency, automation, and an all-in-one solution Altrady is certainly worth a look. The platform makes it easier to find trading opportunities, manage risk, and gain insights into your trading performance—all of which can lead to improved profitability and a more streamlined trading experience.