Search Knowledge Base by Keyword

OneFunded Review: Pros & Cons Revealed

Prop firms have changed the type of opportunities open to retail traders in forex, futures, and equities. So instead of risking their own money, traders can now showcase their skills through structured evaluations. After these evaluations, they then gain access to funded accounts.

This evaluation has created successful traders, but it has also created a crowded prop firm industry. However, at the forefront of this industry is OneFunded, formerly known as PROP365. Recently, this company rebranded and positioned itself as a prop firm focused on transparency, fairness, and support for new and experienced traders.

This review talks about everything you need to know about OneFunded. Right from its evaluation models and account options down to its trading rules, user reputation, and industry comparisons. If you’re considering using prop firms, this OneFunded review will help you make an informed decision.

What is OneFunded?

OneFunded is a prop trading firm that offers traders virtual funded accounts through an evaluation process. The firm is dedicated to training and empowering traders by providing them with the resources and support to reach their potential and achieve success.

The firm rebranded from Prop365 to OneFunded. The rebranding was not just a fresh coat of paint. It was borne out of the company’s commitment to transparency, fairness, and unmatched support for its clients at every stage. They believe that every committed trader deserves a chance to trade without anxiety, but with utmost confidence.

According to their website, this firm tags itself as “the prop firm that backs the one who is ready.” OneFunded gives you the real opportunity to prove your trading skills through simulated challenges, virtual capital, and real-market trading conditions. As long as traders are ready to bring discipline and skill, OneFunded is ready to bring structure and confidence.

The rules, tools, and platform are built for you to trade like a pro. It is a straight path to earning a funded account without risking your funds. Traders have access to virtual assets, forex, and equities in an environment that mirrors the real market.

The firm follows the standard industry model where traders pay an initial challenge fee, show their skills during an evaluation period, and gain access to larger capital after a successful evaluation.

The company emphasizes flexibility and trader support, particularly through policies like no time limits on challenges and challenge fee refunds after the first payout, which helps reduce the financial risk for aspiring funded traders.

Is OneFunded Legit and Safe?

Based on information and testimonials for users, OneFunded appears to be a legitimate prop trading firm. The firm is also managed by Brynex Tech Limited, a UK-registered entity, under company number 15918986.

Although it appears to be relatively established due to its rebrand, it sort of lacks the extensive operational history that other established firms have. However, the company claims that it rebranded to strengthen its image as a transparent and reliable partner for traders. So in a way, the company is saying that clients have nothing to worry about.

The company’s mission is simple: offer clear and standard evaluation rules, no hidden fees, and quick support. However, the limited public information available about OneFunded’s regulatory status, backing broker relationships, and operational transparency might raise some flags. OneFunded’s website and public presence offer limited information.

But since the firm offers strictly educational and simulated trading without offering investment services or managing client funds, it is worth a shot. Traders have nothing to lose. All activities, including trading, are conducted in a virtual environment using simulated funds for educational purposes.

As with any prop firm, traders should:

- Read the terms and conditions

- Start with smaller account sizes

- Verify payout procedures

- Understand trading rules

How OneFunded Works

OneFunded functions like most modern prop firms; however, it adds a few twists to attract traders frustrated by restrictive rules.

Here is a step-by-step process of how OneFunded works:

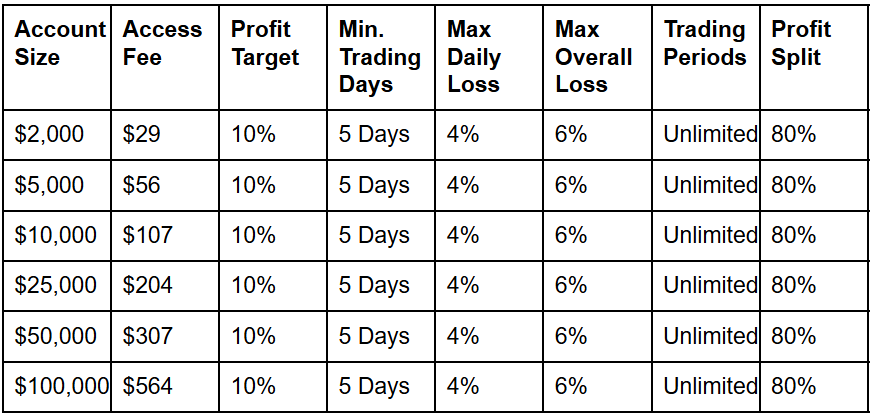

1. Choose A Challenge

Traders begin by selecting an account size. Each account ranges from $2,000 to $100,000. Each size has its own one-time access fee. The lowest access fee is $29, and the highest is $564. The access fee depends on the account size you choose.

2. Complete the Evaluation

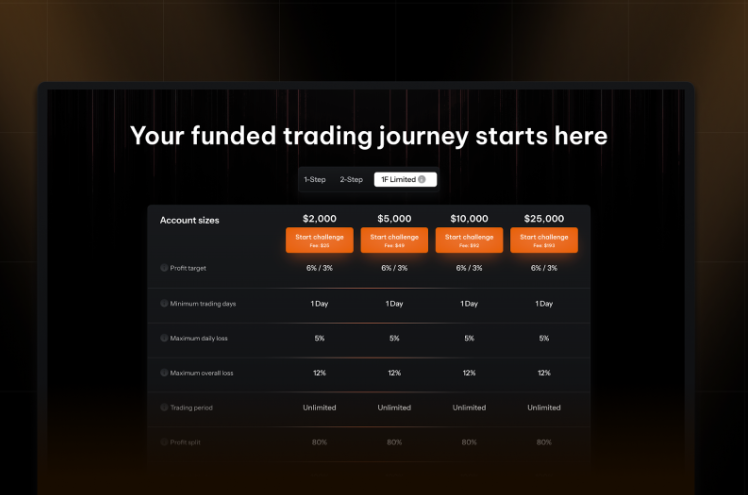

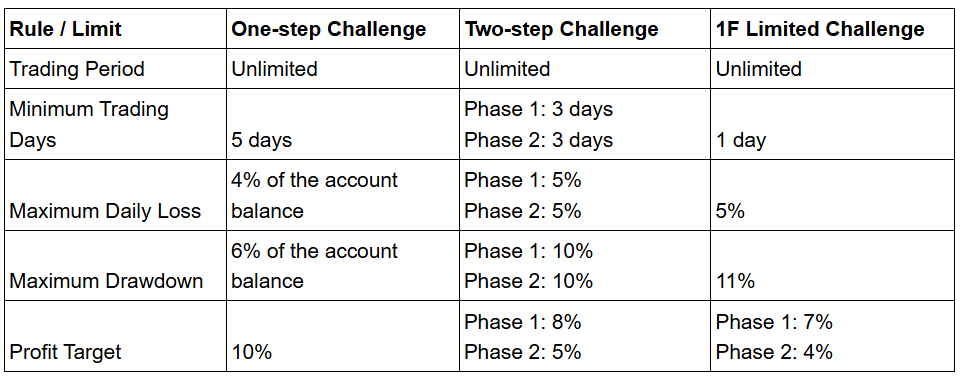

OneFunded offers two challenges: 1-Step and 2-Step challenges. There is also a 1F Limited challenge, which is only available for a limited period and promises better rules and a higher success rate. These challenges are designed to evaluate and enhance your trading skills.

Each challenge has its rules and aims to replicate real market conditions without the risk of losing actual money.

In the 1-Step model, traders only need to hit the profit target without breaching drawdown rules.

In the 2-Step model, traders must pass an initial profit target phase and then a verification phase.Traders must follow rules on daily loss limits, maximum drawdown, and profit targets. OneFunded emphasizes clear and transparent rules sets, with no hidden conditions.

3. Verification and Funding

Traders have to hit the profit target while staying within the rules. Once you pass, you undergo a quick KYC verification process and sign a funding agreement.Once your KYC documents are verified and the agreement is signed, your OneFunded Trader account credentials will be sent to you, ensuring you can start trading with full compliance and security.

4. Trade with Firm Capital

Once you have been verified, you will receive a funded account and begin trading simulated capital with zero personal investment needed.

5. Get Paid on Demand

OneFunded offers on-demand payouts, meaning traders don’t need to wait weeks for scheduled payments. This is a standout feature compared to firms that restrict payout windows.You can receive 80% of the profit made on your demo account as a real payout as long as you have a minimum of $100. After your first payout, you can request further payouts every 14 days.Another thing about this firm is that your evaluation fee is refundable once you pass the evaluation challenges and become a verified trader. The fee is usually reimbursed with your first payout. If you do not pass the evaluation process, that means no refund for you.

OneFunded Challenges

Challenges on OneFunded are created to evaluate and enhance your trading skills through simulated trading. They have strict rules and replicate real market conditions. You don’t have to worry about losing money with these challenges.

The firm offers challenges for 1-Step, 2-Step, and 1F Limited.

Here is a breakdown of both steps:

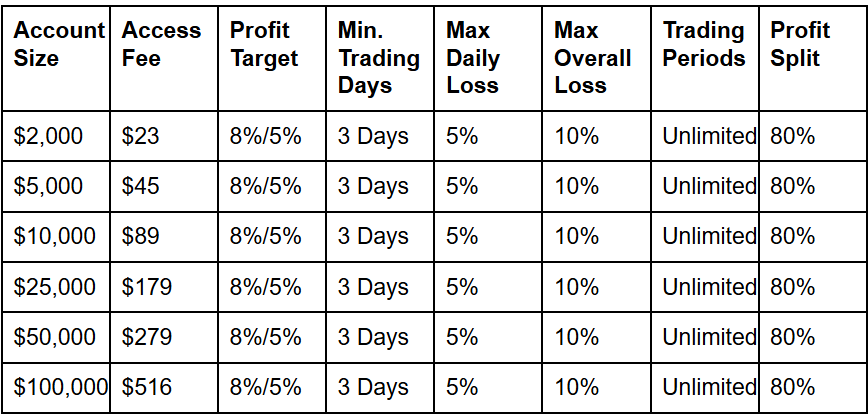

1-Step

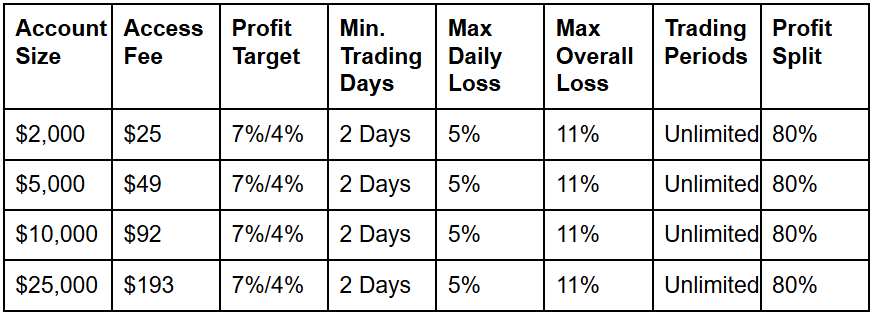

2-Step

1F Limited

The $2,000 to $100,000 range makes it accessible for beginners as well as professionals seeking larger capital allocations.

Unlike some firms, there are no strict time limits for completing challenges. This “trade at your own pace” policy is attractive for traders who dislike the pressure of 30-day evaluations.

Progress for OneFunded challenges can be tracked through your dashboard. The dashboard displays all relevant metrics and performance indicators in real-time.

Refunds are available for challenges. However, you have to successfully meet the Challenge criteria. Failure to do so would mean forfeiture of your access fee. It is taken as the cost of accessing the firm’s resources.

Passing the challenge you have chosen is a criterion for becoming a OneFunded Trader. It is also the start of your journey to earning real profit. Once verified, you will receive account credentials via email within 48 hours and be ready to begin trading with your upgraded status.

Pros and Cons of OneFunded

Here are the pros and cons of the platform:

Pros

- Transparent rules with no hidden charges

- Flexible challenges

- 80% profit split

- Multiple evaluation programs and account sizes

- News trading allowed

- 24/7 customer support

- Evaluation fee refunded with the first payout

- No dealing for evaluation

Cons

- Less established reputation compared to other prop firms like FTMO

- Expert Advisors (EAs) are not permitted

- Copy trading is not permitted

- No balance scaling options

- No instant funding (must pass evaluation)

Key Features of OneFunded and Trading Conditions

One thing this platform is particular about is creating a realistic trading environment for its users. Hence, the following features:

- Instruments: OneFunded allows its clients to engage in simulated trades of Forex, crypto, indices, commodities, and stocks. This wide access allows traders to stick to their preferred instruments rather than being forced into a narrow selection.

- Trading Conditions: The platform creates a real-life trading environment where you can play for zero funds. Trades are executed with tick-level market data, replicating live conditions.

- Platform Dashboard: To ensure ease, the platform has a clean, stable, easy-to-use interface. So anyone can navigate the platform with little or no experience.

- No Time Limits: Unlike other platforms that give traders time restrictions, OneFunded has no time limit, and this is done to remove trading pressure. Traders can pass the evaluation in a few days or take months if needed. This feature reduces psychological pressure.

- Support: OneFunded doesn’t just hand over accounts and expect you to figure it out on your own. It provides valuable educational resources for your development. This is a major benefit for beginners looking to build their skills and experts who want to improve their strategy.

- Payout System: You have access to on-demand withdrawals, a major advantage over firms with monthly or biweekly limits.

Trading Rules and Conditions

OneFunded does not have specific trading rules. However, standard prop firm rules apply to the platform. Here are the trading rules and conditions for OneFunded:

- Maximum daily loss limits are between 4% and 5% of account size, depending on the challenge you choose

- Maximum loss limits are usually 6% to 2% of account size

- Position sizing rule on the platform ensures that traders maintain a consistent risk level for each trade. The maximum risk for each trade is 2% of the initial account balance. Traders can still use the full daily drawdown limit, but it should be spread across different trades.

- The platform allows traders to hold trades overnight. However, these trades may increase swap fees.

- Traders have rules for profit targets, which are 5% to 10% of account size. There is also a minimum trading day requirement to meet this target.

- OneFunded requires consistent trading to prevent lottery-style trading.

- The platform has rules against expert advisors. Only you are permitted to manage your account. Sharing account management responsibilities or allowing another individual to trade on your behalf is strictly prohibited and may result in account termination.

In addition to these rules, certain trading strategies are prohibited on the platform. Failure to stay away from these strategies may result in losing access to the platform. These strategies include:

- Data freezing

- Gap billing

- Use of external, delayed, or slow data feeds

- Trading on delayed charts

- Latency arbitrage

- Reverse arbitrage

- Tick scalping strategies

- Any other strategies deemed prohibited by the Company

OneFunded’s Trading Platform

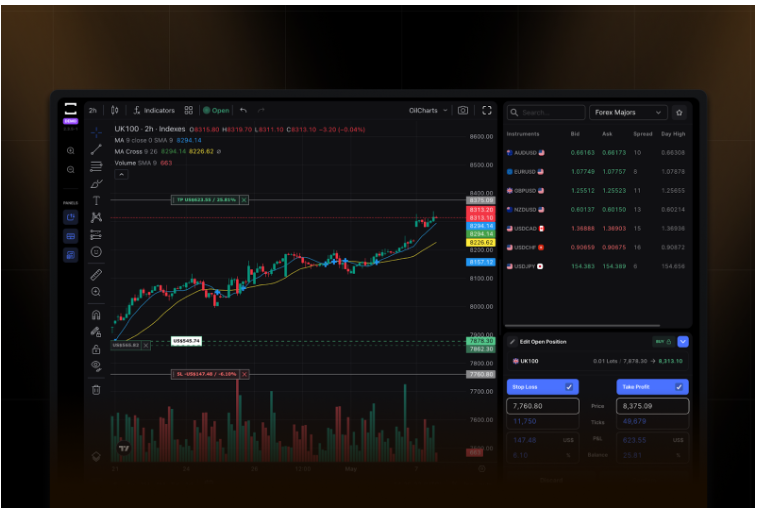

Like other prop trading firms, OneFunded has its own trading platform. The firm uses TradeLocker as its primary trading platform. TradeLocker provides live market data, analysis tools, and the ability to place orders.

Here is how TradeLocker works:

- OneFunded controls the instrument, fees, spread, and settings on TradeLocker.

- TradeLocker’s settings are controlled by OneFunded through a bridge that connects the platform via the FIX Protocol.

- Spreads, margins, leverage, and session times are all set by OneFunded.

Features of TradeLocker

Here are the features of OneFunded’s trading platform:

- Fast execution of trades without delay

- Interactive and intuitive design tools that you need.

- Stable performance for consistent trading

- User and beginner-friendly

- Professional features for experienced traders

On TradeLocker, you can easily navigate these 5 sections for the best experience. They include:

- Chart panel: This is where you can analyze the market and execute your trades. OneFunded integrates TradingView to help you analyze your instruments without switching between different apps.

- Markets panel: On this panel, you can find the full range of instruments you can trade via OneFunded. You also have the option of marking your favorite instruments for quick access.

- Order panel: This is where you execute your trades. You can place market orders and manage risk with stop loss and take profit settings.

- Trades panel: This gives you an overview of open, pending, and closed positions as well as trades and balance reports.

The good thing about TradeLocker is that once you have a OneFunded account, you automatically get access to TradeLocker. You can also use the SL&TP calculator in TradeLocker to enhance your trading experience with OneFunded.

With this calculator, you can maintain better control over your trades, automate SL&TP settings, and improve overall trading performance.

Profit Split Arrangements

OneFunded advertises profit splits of up to 80%. Their split is competitive within the prop trading industry.

Payout Process

OneFunded provides a good payout process. As a trader, you can receive 80% of the profit made on your demo account as a real payout.

The withdrawal process is also quite simple and quick. The firm has two payout methods such as:

- Crypto (USDT TRC20): You can process payouts below $1,000 through this method. OneFunded prefers this method due to faster processing times and lower fees.

- Bank Transfer: For payouts above $1,000, you can opt for payment to be processed via bank transfer.

The minimum amount you can withdraw is $100.

While the prop form is restricted to two withdrawal methods, it accepts a wide range of payment methods. You can pay your fees using major credit and debit cards, as well as other options available through their trusted payment partners. You can always select the most convenient option when signing up.

OneFunded’s Affiliate Program

The OneFunded Affiliate Program allows individuals and businesses to earn revenue by referring clients. As an affiliate, you can receive up to 30% commission on the first purchase and recurring commissions of 12–22% on repeat purchases.

The good part is that anyone can become an affiliate as long as they are aged 18 and above. There is no special experience to become an affiliate. The firm does not require you to pay any money to join its affiliate program. All you need to do is sign up, and you are in.

How OneFunded Compares to Competitors

When compared to other prop trading firms like FTMO, Onefunded has the following strengths:

- Competitive profit split up to 80%

- No time pressure during evaluations

- Challenge fee refund policy

- Flexible trading approach

- Responsive support

Here are areas that need improvement:

- Limited operational history

- Fewer publicly available trading platform options

- Smaller trader community

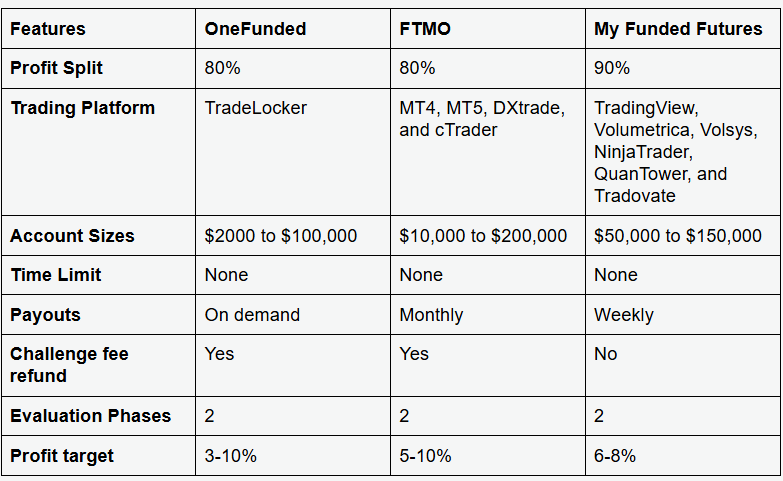

After comparison with FTMO and My Funded Futures, here is our verdict:

Is OneFunded Right For You?

OneFunded might be right for you if you need the following:

-

Flexible challenges without time pressure

-

Smaller account options starting at $2K

-

Fast, on-demand payouts

-

Capital access

-

Risk management

-

Comfortable evaluation timelines

-

No deadline pressure

-

High profit split

-

Low access fee

Stay away from OneFunded if you need:

-

A long-established prop firm with a global reputation

-

Futures-specific funding

-

Absolute security with no mixed reviews

Tips for Succeeding with OneFunded

If you want to enjoy the full benefit of the prop trading firm, here is what you need to do:

-

Master the rules: Don’t risk breaching drawdown.

-

Use proper risk management: Stick to 1–2% per trade

-

Take advantage of no deadlines: Trade patiently.

-

Engage in the community: Learn from other traders.

-

Treat the evaluation like real money: Build good habits early.

Final Verdict – Is OneFunded a Good Prop Trading Firm in 2025?

After careful evaluation and research, we can say OneFunded is a pretty decent prop trading firm. It is a good option for traders who want transparent rules, good profit split, fair pricing, and flexibility.

While OneFunded offers competitive terms, it faces the challenge of building trust and reputation in a crowded market dominated by more established firms with proven track records. It is not yet a top-tier firm when compared to FTMO or My Funded Futures. However, it is quickly carving a strong reputation.