Search Knowledge Base by Keyword

Order Book & Trades in Crypto

A crypto order book is a real-time list of buy and sell orders for a specific cryptocurrency on an exchange. It shows where traders are willing to buy (bid prices) and sell (ask prices), giving a transparent view of market demand and supply.

Understanding how order books work helps traders identify liquidity, potential support and resistance levels, and short-term price direction.

Understanding the Order Book in Crypto Trading

An order book organizes buy and sell orders at different price levels.

- Bid prices (buy orders): what buyers are willing to pay.

- Ask prices (sell orders): what sellers are asking to receive.

These prices reflect real-time interest from all types of market participants — market makers, institutional traders, and retail investors.

Market Depth, Liquidity, and Order Imbalances

Each price level in the order book includes the volume available at that price. Together, these levels form the market depth, which shows how much liquidity exists in the market.

- A deep market (many orders at multiple prices) means high liquidity and efficient price discovery.

- A shallow market (few orders or large price gaps) indicates low liquidity and higher volatility.

Order Imbalances

Order imbalances occur when there are significantly more buy or sell orders at certain price levels. These can provide clues about short-term price direction:

- More buy orders than sell orders → possible buying pressure and upward movement.

- More sell orders than buy orders → potential selling pressure and downward movement.

Monitoring order imbalances can help traders anticipate near-term market shifts.

The order book crypto also shows order imbalances that may provide clues to a stock’s direction in the very short term. For example, a large imbalance of buy orders versus sell orders may indicate a move higher in the stock due to buying pressure. Traders can also use the crypto order book to help pinpoint an asset’s potential support and resistance levels. A cluster of large buy orders at a specific price may indicate a level of support, while an abundance of sell orders at or near one price may suggest an area of resistance.

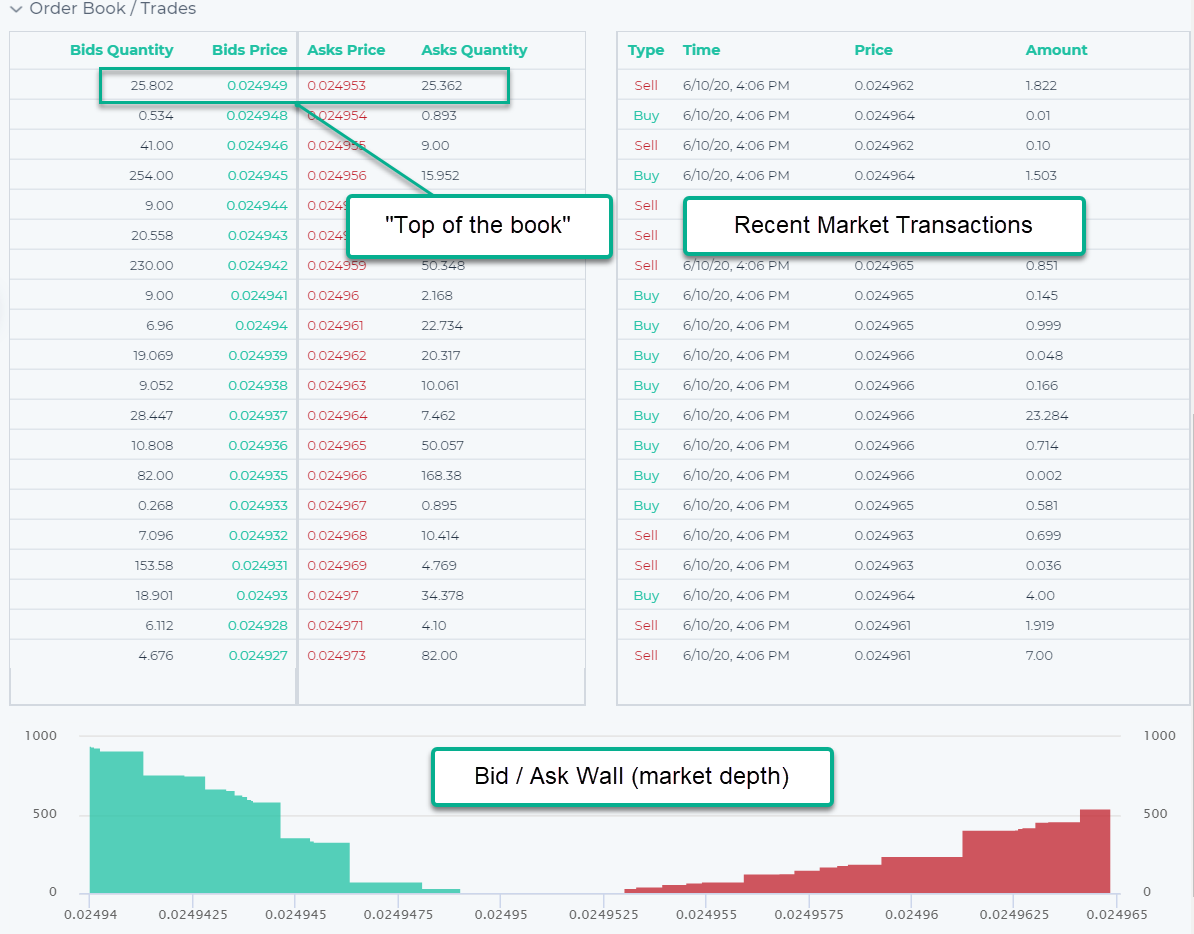

BUY orders get filled at Ask price, and SELL orders get filled at Bid price. The highest Bid and lowest Ask prices are also called the “top of the book”. Also, notice the spread between the Bid / Ask price (top of the book) – tight spread (small difference) is indicative of an efficient, liquid market, and vice versa. For assets with wide spreads (low liquidity), be sure to use Limit order types to minimize slippage (order execution at a poor price).

Each Bid / Ask price has a volume along with it, which forms the market depth. Traders should pay close attention to market depth if they’re going to trade large size order in a relatively illiquid asset.

The crypto order book is also accompanied by a recent history of completed trades in the market.

What Is an Order Book and How It Works

An order book in crypto is a real-time list of buy and sell orders for a specific asset on an exchange. It displays:

- Bid prices (buy orders) — what buyers are willing to pay

- Ask prices (sell orders) — what sellers are asking to receive

These prices reflect the current market interest from all types of participants—market makers, institutional traders, and retail traders.

Market Depth and Order Imbalances

Each price level in the order book also shows a volume (amount of the asset) available at that price. Collectively, this forms the market depth.

- A deep market (many orders at many prices) suggests high liquidity

- A shallow market (few orders or large gaps between prices) indicates lower liquidity

By analyzing the order book, traders can spot order imbalances that may hint at short-term price movements:

- If there are many more buy orders than sell orders, it may signal buying pressure and a potential upward move

- If there are many more sell orders, it may suggest selling pressure and a possible decline

Support, Resistance, and the “Top of the Book”

Clusters of large orders in the order book often mark support or resistance levels:

- Large buy orders at specific prices act as support, as demand may prevent prices from falling further.

- Large sell orders at or near certain prices act as resistance, as supply may prevent prices from rising higher.

- The highest bid and lowest ask prices are called the “top of the book.”

The difference between them is the bid-ask spread:

- Tight spread: indicates a liquid and efficient market.

- Wide spread: suggests low liquidity and higher trading costs.

For assets with wide spreads, traders should use limit orders to avoid slippage — when an order gets filled at a worse price than expected.

How Orders Get Filled

- Buy orders are filled at the ask price (from sellers)

- Sell orders are filled at the bid price (from buyers)

As trades happen, they are removed from the order book and recorded in the trade history, which shows the most recent completed transactions.

Order Book vs. Trade History

Order Book = pending buy/sell orders waiting to be matched

Trade History = list of completed trades (price, size, and time)

Together, they give traders a real-time snapshot of market activity.

Key Takeaways

- The order book shows real-time supply and demand for a crypto asset.

- Market depth reveals liquidity and potential support/resistance levels.

- Order imbalances may indicate short-term buying or selling pressure.

- The bid-ask spread is a key measure of market efficiency and liquidity.

- Use limit orders in illiquid markets to minimize slippage and protect trade execution quality.

- Monitoring both the order book and trade history gives a complete view of market behavior.

FAQ

What is a crypto order book used for?

It helps traders see real-time buy and sell interest, identify liquidity, and spot potential support or resistance levels.

What’s the difference between the order book and trade history?

The order book lists open orders that haven’t been executed yet, while the trade history shows completed transactions.

What is the bid-ask spread in crypto?

It’s the difference between the highest price buyers will pay (bid) and the lowest price sellers will accept (ask).

How can I avoid slippage in low-liquidity markets?

Use limit orders instead of market orders to control the price at which your trade executes.