Search Knowledge Base by Keyword

How to Trend Trade Crypto

Trends interrupted. Two weeks ago, altcoins were making new highs….then they flash crashed. Too far too fast? Many charts were flashing extreme overbought levels (RSI > 90!), so yes, some froth was evident but it’s hard to time a correction. Plus, it happened in a flash, as is custom for crypto. (btw you can scan the market for such extreme RSI levels – see 2 min video here)

So what’s next? Even in uptrends, prices go up in stages of 2 steps forward, 1 step back (correction, consolidation). We have likely entered a period of consolidation when market participants find equilibrium.

So what is a Trend Trader to do? Stay the course, stick to your strategy. Trend traders can still find coins in a Strong Up- or Down-trend. There is always a bull market somewhere! Just look at ETH, UNI, LEO, WAVES, COMP and SOL….breaking new all-time-highs (ATH).

Trend traders can search for coins in a Strong Uptrend (or Downtrend if short-selling) and either:

1) wait for new breakouts of ATHs (resistance levels), or

2) buy the dips at support levels

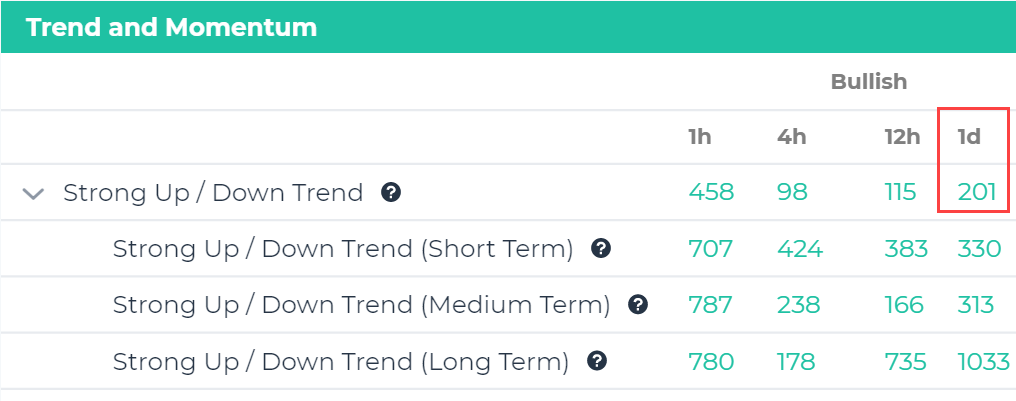

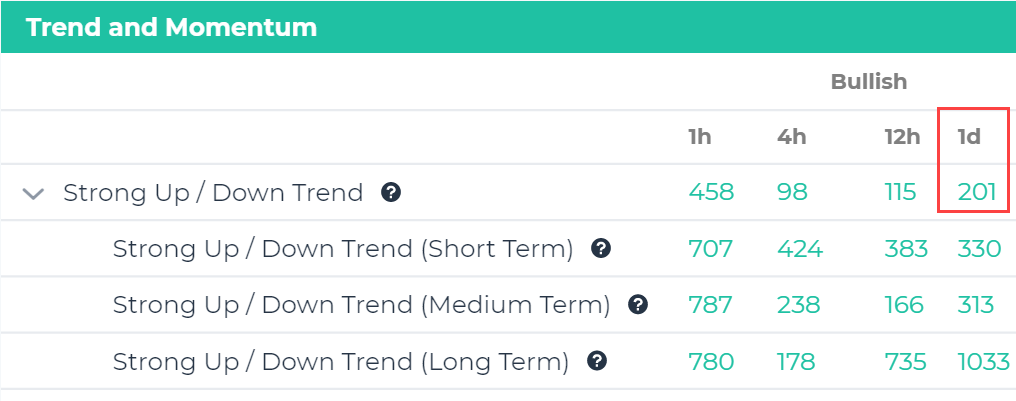

altFINS’ Signal Summary page currently shows that there are 201 coins in a Strong Uptrend (daily interval). These are good candidates for Trend Traders to examine further:

The next step is to review the charts in our charts grid view and identify the resistance and support levels. Resistance levels are often the ATHs. Traders can set price alerts for such levels to be notified when a breakout occurs.

Here’s ETH (Ethereum) example, also highlighted in our Curated Charts:

Alternatively, Trend Traders can look for pullbacks in Strong Uptrend. Our Signals Summary currently shows 57 coins in an Uptrend but experiencing a pullback.

Traders could examine these to find situations where price has pulled back close to a Support area. Most of the time, during an uptrend, price will bounce and head in the direction of the overall trend. Trend is your friend, after all. Cliché but true.

Here’s an example of a coin in an Uptrend with a pullback: COMP (Compound). After reaching a new ATH (~$700), the price has pulled back. If it retreats to $600 support level, it could be an attractive entry for this uptrend.

As with any trading strategy, risk management and discipline are key ingredients for success.

Basic risk management includes 1) proper position sizing, 2) use of stop loss orders, and 3) risk-reward-ratio.

Proper position sizing. Typically, a trader should not risk more than 2% of his entire portfolio. That does not mean his positions should be 2% of his portfolio. There’s an important difference.

If a trader determines that a new trade has a 20% max downside, his portfolio is $100K (equity not using leverage or margin), and wants to use 2% max loss rule then his position size should be $10K.

Because if he loses 20% of $10K, that’s $2K, which represents 2% of his entire portfolio’s equity ($100K). Expressed in a formula: Position = (Max Loss (i.e. 2%) * Portfolio Equity (i.e. $100K)) / Max Downside (i.e. 20%).

Stop Loss orders. Traders should place a Stop Loss at such price level so as to allow for normal movement within a trend, giving it room to breathe and bounce back, yet not too far. One common technique is to set a Stop Loss to below the low of the most recent trough for an uptrend. In the case of COMP (Compound) in the above chart, the most recent trough was around $550.

Target an RRR. Using the aforementioned Stop Loss strategy, if a trader were to Buy COMP on a pullback around $600, the downside would be $550 ($50 or 9%) and his upside would be $700+ ($100+ or 17%+) for a decent risk-reward-ratio (RRR) of 1:2 or better (50 / 100+). Many traders target a 1:3 ratio.