Search Knowledge Base by Keyword

The Ultimate Guide to Cryptocurrency ETFs in 2025

What is an ETF?

An Exchange-Traded Fund (ETF) is a financial instrument that allows investors to buy and sell shares that track the price of an underlying asset or basket of assets. ETFs trade on traditional stock exchanges, making them a popular choice for investors looking for diversified exposure to stocks, commodities, or sectors without directly owning individual assets. Discover more about Crypto ETFs later in this article.

Key Characteristics of ETFs:

- Liquidity: ETFs trade like stocks, offering high liquidity.

- Diversification: Many ETFs track multiple assets, reducing risk.

- Low Costs: Passive ETFs often have lower fees than actively managed mutual funds.

- Transparency: Most ETFs disclose their holdings daily.

What is a Crypto ETF?

A Cryptocurrency ETF is a type of exchange-traded fund that tracks the price of one or more digital assets, such as Bitcoin (BTC) or Ethereum (ETH). Crypto ETFs offer an alternative to directly owning cryptocurrencies by allowing investors to gain exposure through regulated stock exchanges.

How Do Crypto ETFs Work?

Crypto ETFs work in two primary ways:

- Spot Crypto ETFs: These ETFs directly hold cryptocurrencies, such as Bitcoin or Ethereum, and their share price reflects the real-time value of the digital asset.

- Futures-Based Crypto ETFs: These ETFs invest in cryptocurrency futures contracts rather than the assets themselves. They track the expected future price of cryptocurrencies rather than their spot price.

Why Invest in Crypto ETFs?

Benefits of Crypto ETFs

- Ease of Access: Investors can gain exposure to crypto without the complexities of wallets, private keys, or exchanges.

- Regulation & Security: Crypto ETFs operate within regulated financial markets, reducing fraud risks.

- Portfolio Diversification: Investing in a crypto ETF allows traditional investors to include digital assets in their portfolios.

- Tax Efficiency: ETFs may offer more favorable tax treatment compared to direct crypto holdings.

Risks of Crypto ETFs

- Volatility: Cryptocurrencies are highly volatile, impacting ETF performance.

- Tracking Errors: The ETF price may not always perfectly track the price of its underlying assets.

- Regulatory Risks: Crypto regulations are still evolving, potentially affecting ETFs.

Existing Crypto ETFs

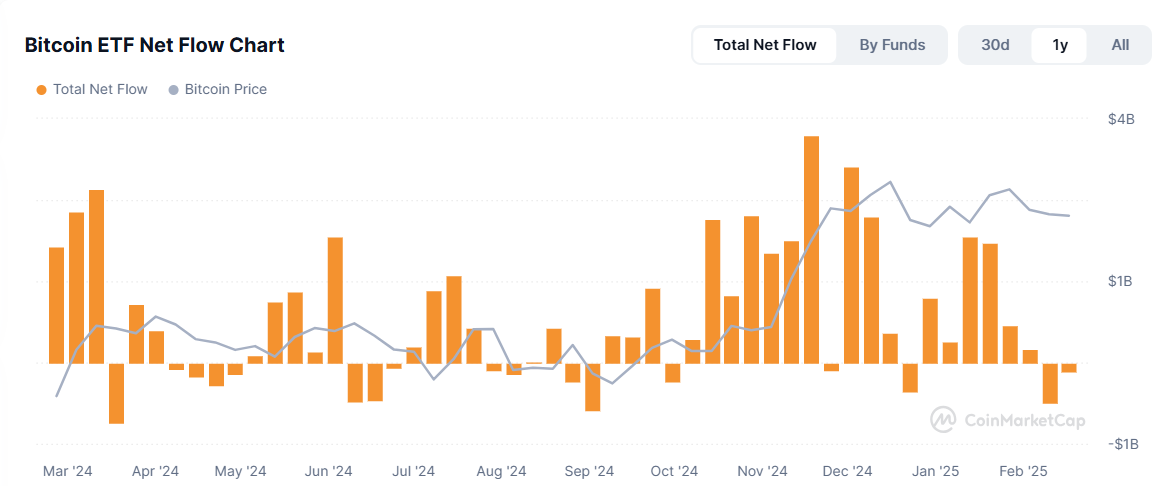

Bitcoin ETF Inflows and Market Impact

Bitcoin ETFs have been a major driver of institutional investment in digital assets. However, recent trends show a shift in inflows and outflows, reflecting broader market sentiment.

- As of February 14, 2025, Bitcoin ETFs ended a six-week inflow streak, with $651.83 million in weekly outflows.

- Prior to this decline, Bitcoin ETFs had accumulated over $5 billion in net inflows.

- The Fidelity Wise Origin Bitcoin Fund (FBTC) recorded an inflow of $94.04 million, reversing previous outflows.

- BlackRock’s iShares Bitcoin Trust (IBIT) remains the leading BTC ETF, with $57.46 billion in net assets and $40.9 billion in cumulative net inflows.

- Meanwhile, the Grayscale Bitcoin Trust (GBTC) continues to struggle, with $46.95 million in exits, bringing its total outflows to $22.01 billion.

Despite recent outflows, Bitcoin ETFs rebounded slightly with a $66.19 million inflow on February 17, 2025, led by Fidelity’s FBTC.

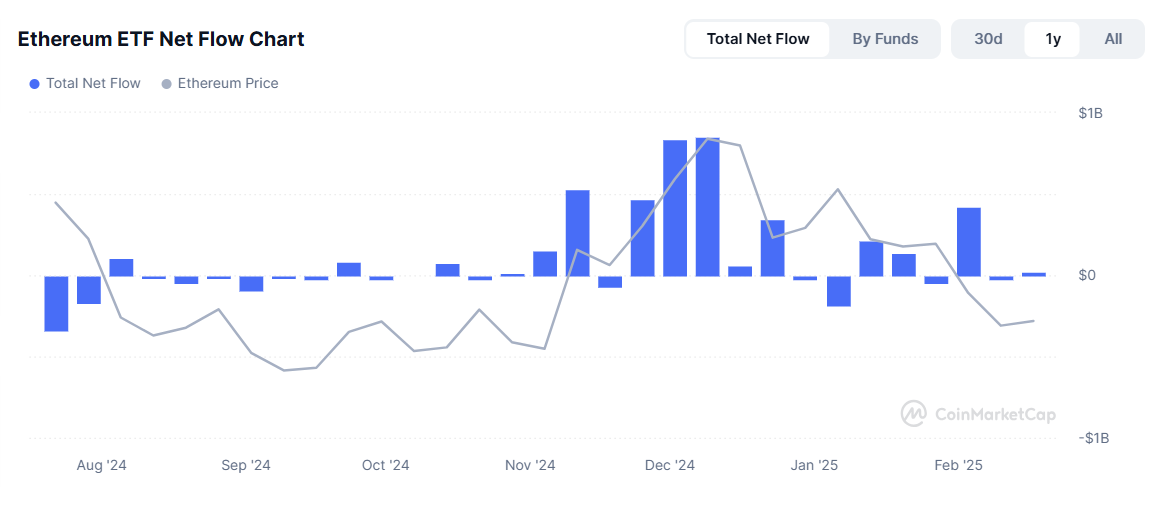

Ethereum ETF Inflows and Market Sentiment

Ethereum ETFs have also been gaining traction but face similar market headwinds as Bitcoin.

- U.S. spot Ethereum ETFs hold $10.35 billion in net assets, representing 3.15% of ETH’s market cap.

- ETH ETFs recorded $26.26 million in outflows for the week ending February 14, 2025, reflecting investor caution.

- Despite this, ETH ETFs ended the week on a positive note, with $11.65 million in net inflows, primarily driven by Fidelity’s FETH.

- The total inflows for Ethereum spot ETFs have now surpassed $3.17 billion, boosting investor confidence.

Ethereum’s price, however, remains under pressure, having declined 14.38% in the past 30 days.

ETF Inflows Charts

Source: CoinMarketCap

Bitcoin ETF Net Inflows

Source: CoinMarketCap

Ethereum ETF Net Inflows

Source: CoinmarketCap

Solana ETFs: The Next Big Move?

The U.S. Securities and Exchange Commission (SEC) has recently entered multiple Solana ETF filings into the Federal Register, marking a crucial step in the potential approval process for Solana-based ETFs.

Key Developments:

- Several asset managers, including Grayscale, Canary Capital, VanEck, 21Shares, and Bitwise, have submitted applications for Spot Solana ETFs.

- The public has 21 days from the Federal Register entry date to submit comments on the filings.

- The SEC now has up to 240 days (until October 16, 2025) to approve or deny these ETF applications.

Potential Challenges for Solana ETFs

Despite the excitement around a Solana ETF, regulatory concerns remain:

- Security Classification: The SEC previously classified Solana as a security in its lawsuits against Binance and Coinbase.

- Pending Litigation: The SEC’s decision on Solana ETFs may be influenced by ongoing legal battles and regulatory shifts.

- Political Factors: The approval process for Ethereum ETFs was potentially accelerated by political pressures; similar factors may influence Solana’s case.

Why Solana ETFs Make Sense

Solana’s rapid growth and unique features make it a strong candidate for an ETF product:

- High-Speed Transactions: Solana can process thousands of transactions per second with low fees, making it an efficient blockchain.

- DeFi and NFT Growth: Solana is a leading platform for decentralized finance (DeFi) and NFTs, driving increased adoption.

- Institutional Interest: Solana has seen rising institutional adoption, reinforcing its legitimacy as an ETF candidate.

10 COINS TO SURGE WITH SPOT SOLANA ETF APPROVALS

If approved, this ETF could boost institutional confidence and drive capital into the Solana ecosystem. altFINS research team prepared a research report introducing 10 projects which could benefit from Solana ETF. Read the report.

Future Outlook for Crypto ETFs

Expanding Beyond Bitcoin and Ethereum and maybe Solana

The approval of Bitcoin and Ethereum ETFs has paved the way for additional digital assets to be considered for ETF listings. If Solana ETFs receive approval, it could encourage applications for other prominent cryptocurrencies such as:

- Ripple (XRP) – Gaining regulatory clarity post-SEC lawsuit.

- Cardano (ADA) – Known for its strong staking ecosystem.

- Polkadot (DOT) – A leader in blockchain interoperability.

- Avalanche (AVAX) – Increasing adoption in DeFi applications.

- Chainlink (LINK) – A key player in blockchain-based data services.

Institutional Adoption and Market Growth

As institutional demand for cryptocurrency exposure grows, more asset managers are likely to launch additional ETFs. The ability of ETFs to provide regulated, accessible exposure to cryptocurrencies makes them an attractive investment vehicle for traditional investors looking to diversify their portfolios.

Regulatory Landscape and Future Challenges

While crypto ETFs provide a bridge between traditional finance and the digital asset market, regulatory uncertainty remains a key factor influencing their growth. Changes in financial regulations, tax policies, and SEC rulings will continue to shape the future of the crypto ETF market.

Conclusion

Cryptocurrency ETFs have revolutionized access to digital assets, providing investors with a regulated and convenient way to gain exposure to cryptocurrencies without directly holding them. With Bitcoin and Ethereum ETFs already established and Solana ETFs potentially on the horizon, the future looks promising for crypto ETFs.

Investors should continue to monitor developments in the ETF landscape, as further approvals and market dynamics could create new opportunities for both retail and institutional investors.

Read also Which Coins would benefit from ETFs approvals?