Search Knowledge Base by Keyword

The Dragonfly Doji Candlestick Pattern

TL;DR: The Dragonfly Doji Pattern

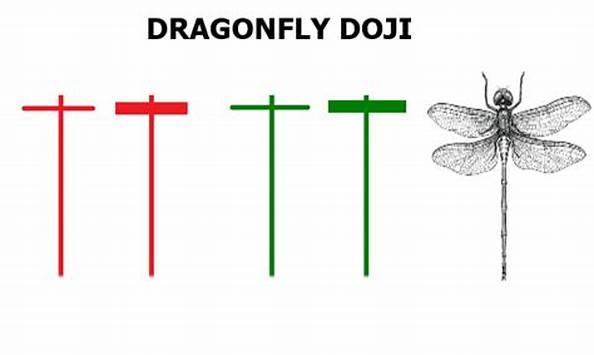

The Dragonfly Doji is a “T-shaped” candlestick that signals a potential bullish reversal, typically appearing at the bottom of a downtrend. It forms when the open, high, and close prices are virtually identical, leaving a long lower wick (shadow) that shows buyers rejected lower prices.

Key Characteristics

-

Appearance: Long lower tail, no upper tail, and a flat top.

-

Market Psychology: Sellers pushed the price down significantly, but buyers aggressively stepped back in to push it back to the opening price.

-

The “Perfect” Setup: For the strongest signal, the Doji should be preceded by at least two red candles and followed by a green confirmation candle.

Pro Strategies for Success

-

Confluence is King: The signal is much more reliable when it occurs at a key support level, a major moving average, or when the RSI is oversold.

-

Volume Matters: Look for above-average trading volume on the Doji day; this indicates seller exhaustion and strong new buying interest.

-

Confirmation: Never trade the Doji in isolation. Wait for the next candle to close higher to confirm the trend has actually shifted.

Risk Management

-

Stop-Loss: Place your stop-loss just below the bottom of the Dragonfly’s long lower wick.

-

Context: Be cautious if the overall market sentiment is overwhelmingly bearish, as individual patterns can fail in a crash.

Detailed Characteristics of the Dragonfly Doji Pattern

The Dragonfly Doji is a significant candlestick pattern in technical analysis, often signaling potential bullish market reversals. This unique pattern is easily recognizable by its singular visual characteristic: a long lower shadow with an absence of an upper shadow. But it’s important to take into consideration the context of where this candlestick appears!

This guide offers an in-depth exploration of the Dragonfly Doji, providing traders with advanced strategies and techniques for applying this pattern across different trading environments.

Understanding the Dragonfly Doji

A Dragonfly Doji appears when the open, high, and close prices are the same or very close, producing a T-shaped candlestick. This pattern typically emerges at the bottom of downtrends and represents a tug-of-war where neither bulls nor bears gain the upper hand, yet it signals that buyers are beginning to resist the prevailing downward pressure, potentially indicating a reversal.

Finding assets with Dragonfly Doji patterns is easy with altFINS Screener.

But that’s not enough. The signal is much stronger when Dragonfly Doji occurs during a pullback. Ideally, it is preceded by at least two red candles (two down days) and followed by a green candle (up day), which confirms the reversal.

Here’s a price chart for PEPE with such a ‘Perfect’ Dragonfly Doji pattern. After a Perfect Dragonfly Doji was detected in early May, price went on to double (+100%)!!

There were 5 red candles, followed by a DDP (Dragonfly Doji pattern) and another green candle.

All of this also happened at a $0.000008 support level.

Seeing a ‘Perfect’ Dragonfly Doji at a support level sends a strong signal that price has found support.

Dragonfly Doji can signal a bullish trend reversal.

The application of Dragonfly Doji is strengthened when we use in the right context.

Ideally, the Dragonfly Doji is preceded by two down (red) candles and followed by a up (green) candle.

The long downwick candle indicates that after sellers pushed down the price, buyers stepped up and bought it back up almost where it started the day. And that buying followed through the following day (green up candle).

It’s even better if Dragonfly Doji is accompanied by above average volumes. That’s another indication that sellers were exhausted and new buyers bought up of lot of volume.

The following are some examples of Dragonfly Doji candlestick patterns that worked very well.

Notice also that after the Dragonfly Doji appeared, the price still had a few bumps before it took off higher.

And that could be what’s ahead. A bounce, some retracements, but eventually a steady rise higher.

Crypto Screener – Preset Filters

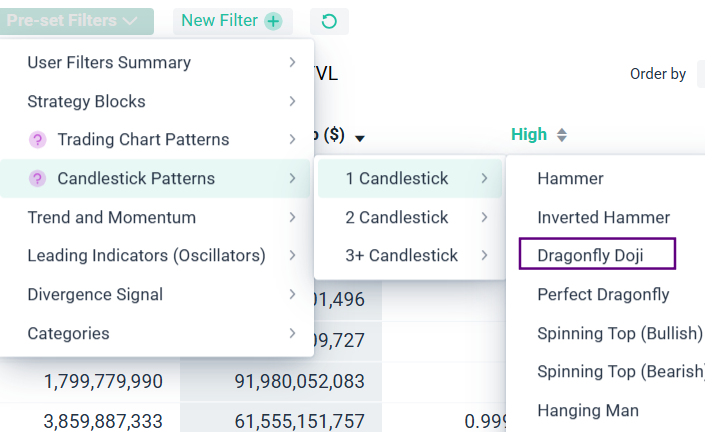

altFINS provides a leading cryptocurrency screening tool capable of analyzing over 3,000 altcoins using 120 different indicators across five time frames. It includes Pre-set Filters, which are predefined and optimized strategies and patterns designed for quick access to the most popular filters, such as the Dragonfly Doji Candlesticks pattern.

Crypto Screener Pre-set Filters

Select Pre-set Filters – Candlestick Patterns – 1 Candlestick – Dragonfly Doji Candlestick Pattern and you will get the results:

Source: altFINS

Crypto Screener Custom Filters

Select New Filter- Candlestick Patterns – 1 Candlestick – Dragonfly Doji Candlestick Pattern and select interval.

Source: altFINS

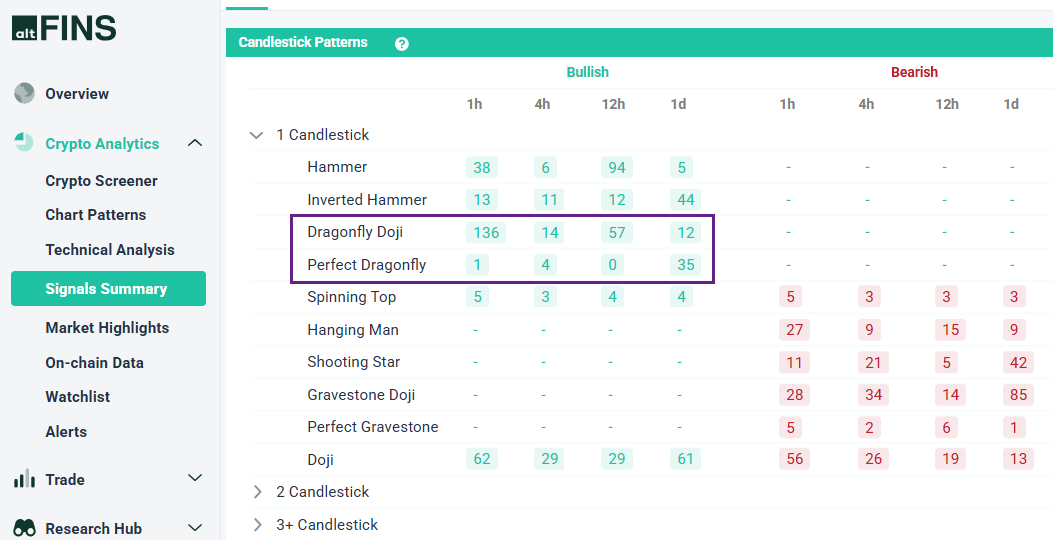

Signals Summary Custom Filters

Source: altFINS

Variations and Similar Patterns

- Gravestone Doji: This pattern is the bearish counterpart to the Dragonfly Doji, occurring at the peak of uptrends with a long upper shadow and similar implications for a potential reversal but in the opposite direction.

- Long-legged Doji: Features both a long upper and lower shadow, indicating significant indecision between buyers and sellers.

Understanding these variations allows traders to better gauge market sentiment and adjust their strategies accordingly.

Advanced Trading Strategies

Combining with Support Levels

When a Dragonfly Doji forms at a key support level, it reinforces the potential for a bullish reversal. This confluence of technical indicators serves as a stronger signal to traders than the pattern appearing in isolation.

Using with Trend Lines

The appearance of a Dragonfly Doji near critical trend lines, especially declining ones, can suggest a potential upward breakout. Traders often seek further confirmation through subsequent bullish patterns or a close above the trend line.

Tips and Tricks for Effective Use

Wait for Confirmation

As mentioned earlier, it is recommended that after a Dragonfly Doji appears, traders wait for a green candlestick during the following trading session as confirmation and to avoid false signals.

Check the Historical Context

Evaluating how the asset has historically reacted to Dragonfly Doji patterns can provide valuable insights into its potential future behavior and improve decision-making accuracy.

Monitor Market Sentiment

Considering the broader market sentiment and economic indicators is important, as a bullish Dragonfly Doji during overwhelmingly negative market conditions may be less effective.

Use Technical Indicators for Confirmation

- Relative Strength Index (RSI): An oversold reading on the RSI can complement the bullish signal provided by a Dragonfly Doji.

- Moving Averages: A Dragonfly Doji that appears near important moving averages can also indicate a significant support level, enhancing the reversal signal.

Psychological Insights

The Dragonfly Doji illustrates a session where sellers dominate early on but lose their advantage as buyers push prices back to the open, suggesting a shift towards bullish sentiment and potential upward momentum.

Risk Management

Prudent risk management strategies are key when trading with the Dragonfly Doji:

- Proper Position Sizing: Adjust position sizes based on asset volatility and proximity to your stop-loss. Learn Risk Management strategies in Lesson 9 of our Crypto Trading Course.

- Dynamic Stop-Loss Adjustment: As favorable movements develop, consider adjusting your stop-loss to either break even or a trailing stop to secure gains.

Practical Examples

Using historical chart data to demonstrate both successful and unsuccessful trades involving the Dragonfly Doji can offer practical insights. These examples help traders identify optimal conditions and understand common pitfalls.

Conclusion

The Dragonfly Doji candlestick pattern is a versatile tool in the arsenal of technical analysis. By employing advanced strategies, understanding market context, and practicing sound risk management, traders can significantly enhance their ability to spot and capitalize on potential market reversals, making the Dragonfly Doji a critical component of a comprehensive trading strategy.

Read also an article:

Mastering Candlestick Patterns for Successful Crypto Trading

Essential Candlestick Patterns for Crypto Traders

The Hammer Candlestick Pattern

The Inverted Hammer Candlestick Pattern

The Hammer Candlestick Pattern

The Gravestone and Perfect Gravestone Doji Candlestick Patterns

Bullish Engulfing Candlestick Pattern

The Spinning Top Candlestick Pattern

The Hanging Man Candlestick Pattern

What is Candlestick Pattern (source: Investopedia)