Search Knowledge Base by Keyword

What Are Fibonacci Retracement Levels?

Practical Application of Fibonacci Retracement

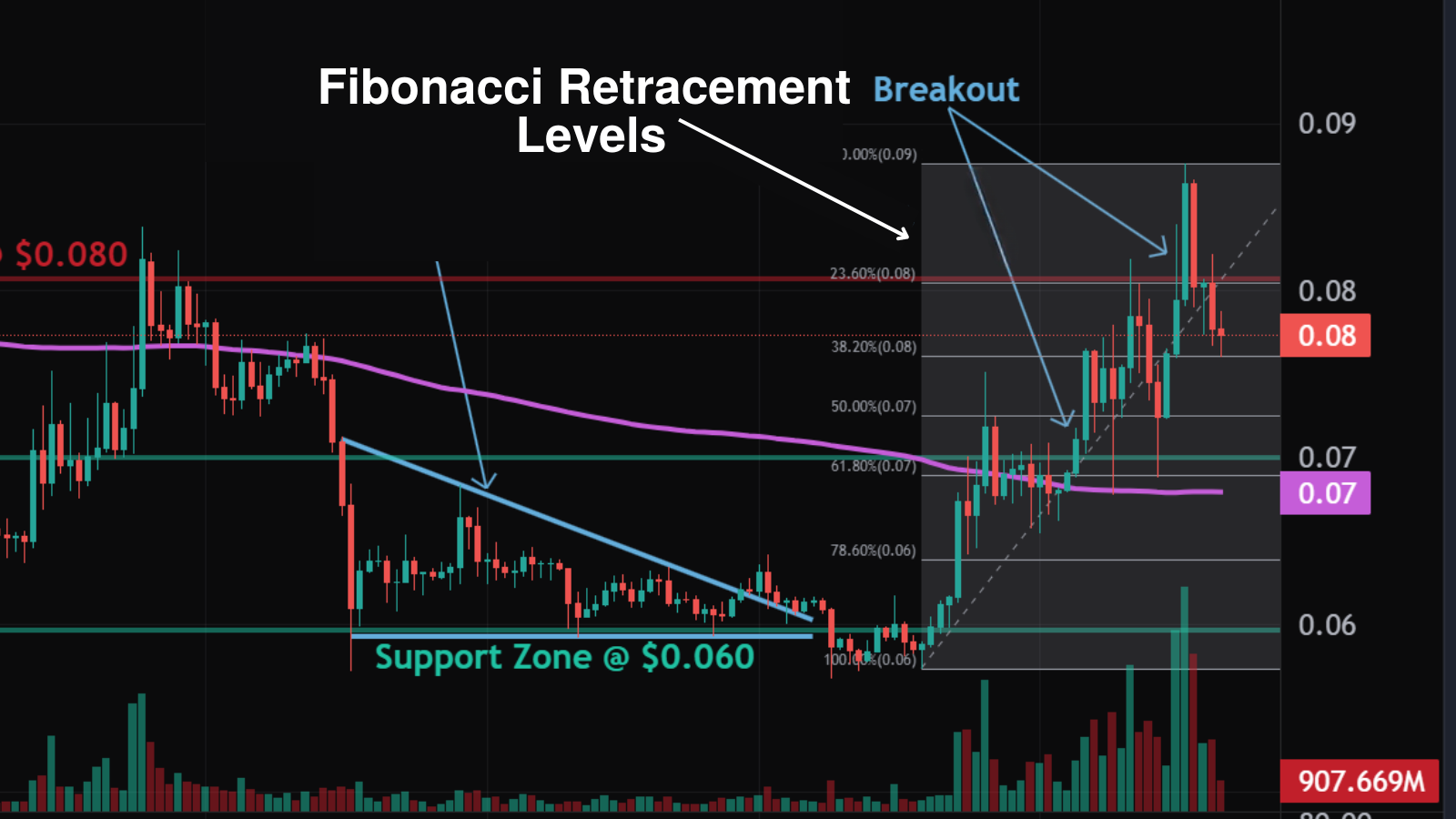

In practical terms, Fibonacci Retracement Levels are potential support levels. Particularly after a big rise in price, there’s typically a pullback as traders take profits, before the price resumes it’s Uptrend. Fibonacci Retracement Levels can help traders identify those support levels where the price pullback to and rebound.

It is commonly observed that pullbacks in Uptrend typically reverse at the following retracement levels: 23.6%, 38.2%, 50%, 61.8%, and 78.6%. What does that mean? If price rises from $10 to $20 over the course of two weeks, for example, and then it pulls back, we measure how much of the price increase could it retrace.

So the price increase was $20 – $10 = $10. Hence, a 23.6% retracement would be 0.236 * $10 = $2.36 retracement from the High level of $20. Therefore, the 23.6% retracement level would be $20 – $2.36 = $17.64. And so on with the other levels (38.2%, 50%, 61.8%, and 78.6%).

Ideally, a trader finds horizontal support levels that line up with the Fibonacci Retracement Levels, which then forms for a more robust support area where price is likely to stop declining and resumes its Uptrend.

What Is Fibonacci Retracement?

Fibonacci Retracement is a powerful tool used by traders in various financial markets, including cryptocurrencies, to identify potential reversal levels in the price of an asset. Named after the Italian mathematician Leonardo Fibonacci, this tool is based on the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones.

In cryptocurrency trading, Fibonacci Retracement is particularly valuable for analyzing price movements and determining potential support and resistance levels. Traders use this technical analysis tool to make informed decisions about entry and exit points.

Watch Tutorial Video

Limitations of Utilizing Fibonacci Retracement Levels

While Fibonacci retracement levels offer insights into potential support or resistance areas, it’s crucial to acknowledge that their indication doesn’t guarantee a definitive price reversal. Traders commonly seek additional confirmation signals, such as observing the price bouncing off a specific level, to enhance the reliability of their analysis.

Another argument against relying solely on Fibonacci retracement levels is the sheer abundance of these levels. Given the multitude of possible retracement points, the challenge arises in determining which one will be influential at any given time. The uncertainty surrounding the selection of the most relevant retracement level can lead to ambiguity and make it challenging for traders to pinpoint the exact level for their analysis. Consequently, when a trade doesn’t unfold as expected, it becomes a point of contention as traders may argue that a different Fibonacci retracement level should have been considered.

Understanding the Fibonacci Sequence

Before delving into Fibonacci Retracement, it’s essential to grasp the basics of the Fibonacci sequence. The sequence begins with 0 and 1, and each subsequent number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, 21, and so on). The key ratios derived from this sequence are 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

Fibonacci Retracement Levels

Fibonacci Retracement levels are horizontal lines that indicate potential support or resistance areas. These levels are drawn on a price chart between a significant low and high. The main retracement levels are:

- 23.6%: Often considered the shallowest retracement level, it represents a minor pullback in the price.

- 38.2%: This level is deeper and is considered a moderate retracement.

- 50%: While not a Fibonacci number, the 50% retracement level is widely used in trading and can act as a strong support or resistance.

- 61.8%: Known as the “golden ratio,” this level is a significant retracement level and is closely watched by traders.

- 78.6%: This level is a deep retracement and is sometimes considered the last line of defense before a trend is deemed invalid.

Applying Fibonacci Retracement in Cryptocurrency Trading

Step 1: Identify a Trend

Before applying Fibonacci Retracement, identify the prevailing trend. The tool is most effective when applied to established trends.

Step 2: Identify Swing Highs and Lows

Locate the most recent swing high and swing low in the price movement. The swing high is the highest point reached before a significant pullback, while the swing low is the lowest point before a rebound.

Step 3: Draw Fibonacci Retracement Levels

Use a charting platform to draw Fibonacci Retracement levels between the identified swing high and low. Most trading platforms have tools that make this process simple and intuitive.

Step 4: Analyze Potential Reversal Zones

Pay close attention to price action around the Fibonacci Retracement levels. If the price approaches a retracement level and shows signs of slowing down, it may indicate a potential reversal.

Practical Tips for Crypto Traders

- Combine with Other Indicators: While powerful on its own, Fibonacci Retracement is most effective when used in conjunction with other technical analysis tools and indicators.

Use on Multiple Timeframes: Confirm retracement levels by checking them on different timeframes. This helps validate the significance of a retracement level. - Risk Management is Key: Always implement risk management strategies, such as setting stop-loss orders, to mitigate potential losses.

- Stay Informed About Market Fundamentals: Understand the broader market trends and news that may impact cryptocurrency prices.

Fibonacci Retracement Example on altFINS Technical Analyses Charts

altFINS team of analysts use Fibonacci Retracement in their technical analysis. Find more examples on Technical Analysis section.

Fibonacci Retracement is a valuable tool for cryptotraders seeking to make well-informed decisions in a dynamic market. By understanding and applying the principles of Fibonacci retracement, traders can identify potential reversal zones, set realistic price targets, and enhance their overall trading strategy. As with any technical analysis tool, it’s crucial to combine Fibonacci retracement with other methods and exercise prudent risk management for consistent success in cryptocurrency trading.

Fibonacci Extensions

In addition to retracement levels, traders also use Fibonacci Extensions to identify potential price targets in the direction of the prevailing trend. Common extension levels include 127.2%, 161.8%, and 261.8%.

Fibonacci Extensions are a technical analysis tool that complements the well-known Fibonacci Retracement. While retracement levels identify potential reversal points within an existing trend, Fibonacci Extensions project possible future price levels in the direction of the prevailing trend.

Key Components:

- Application of Ratios: Similar to Fibonacci Retracement, Extensions use key Fibonacci ratios (e.g., 127.2%, 161.8%, 261.8%) to forecast where a price trend might extend.

- Beyond 100% Level: Unlike retracement levels that stay within 100%, extension levels go beyond, indicating how far the price might travel in the direction of the trend.

How to Use Fibonacci Extensions:

- Identify the Trend: Extensions are most effective when the market trend is clear. Ascertain whether it’s an upward (bullish) or downward (bearish) trend.

- Locate Swing Points: Similar to retracement, identify significant swing highs and lows to establish the trend’s direction.

- Apply Fibonacci Ratios: Using these swing points, apply Fibonacci ratios to project potential future price levels. Common extension levels include 127.2%, 161.8%, and 261.8%.

- Set Realistic Targets: Extensions provide traders with potential price targets, aiding in decision-making for profit-taking or anticipating the continuation of a trend.

Example Scenario:

- If a cryptocurrency is in an upward trend and experiences a pullback, a trader might use Fibonacci Extensions to project where the price could reach in the next leg of the uptrend.

Fibonacci Extensions offer traders a valuable tool for setting realistic price targets in the direction of a prevailing trend. By combining both retracement and extension levels, traders can create a more comprehensive strategy for navigating the complexities of the financial markets.

FAQ