Search Knowledge Base by Keyword

Support and Resistance Crypto: The Complete 2026 Guide for Traders

In this article, we explain what support and resistance mean in crypto trading, why these price levels are critical for identifying breakouts, breakdowns, and reversals, and how they shape market structure. You’ll see real examples using Bitcoin, learn how support and resistance levels form, and understand how traders use them to plan entries, exits, and risk management.

We also show how altFINS automates support and resistance detection across 2,000+ cryptocurrencies, making it possible to scan the entire market and surface high-probability setups in seconds.

Key Takeaways

- Support is a price floor where buying pressure increases.

- Resistance is a price ceiling where selling pressure builds.

- Breakouts above resistance often start new uptrends.

- Breakdowns below support can accelerate selling.

- Strong levels repeat over time due to market psychology.

- Automated detection helps scale analysis across thousands of coins.

What Is Support and Resistance in Crypto?

Support and resistance in crypto are price levels where supply and demand repeatedly cause price reversals or breakouts. Support is a price floor where buying pressure increases, while resistance is a ceiling where selling pressure builds.

Support and resistance are core technical analysis concepts that help traders understand where crypto prices are likely to pause, reverse, or break out. Support acts like a safety net where buying interest increases and prevents further decline, while resistance functions as a ceiling where selling pressure limits upward movement. These levels reflect market psychology and often repeat over time, making them powerful tools for identifying entry points, profit targets, and risk management zones.

These levels help traders:

- Identify high-probability entry points

- Set stop-loss levels

- Define profit targets

- Anticipate breakouts and trend reversals

In volatile crypto markets, support and resistance levels often determine the next major move.

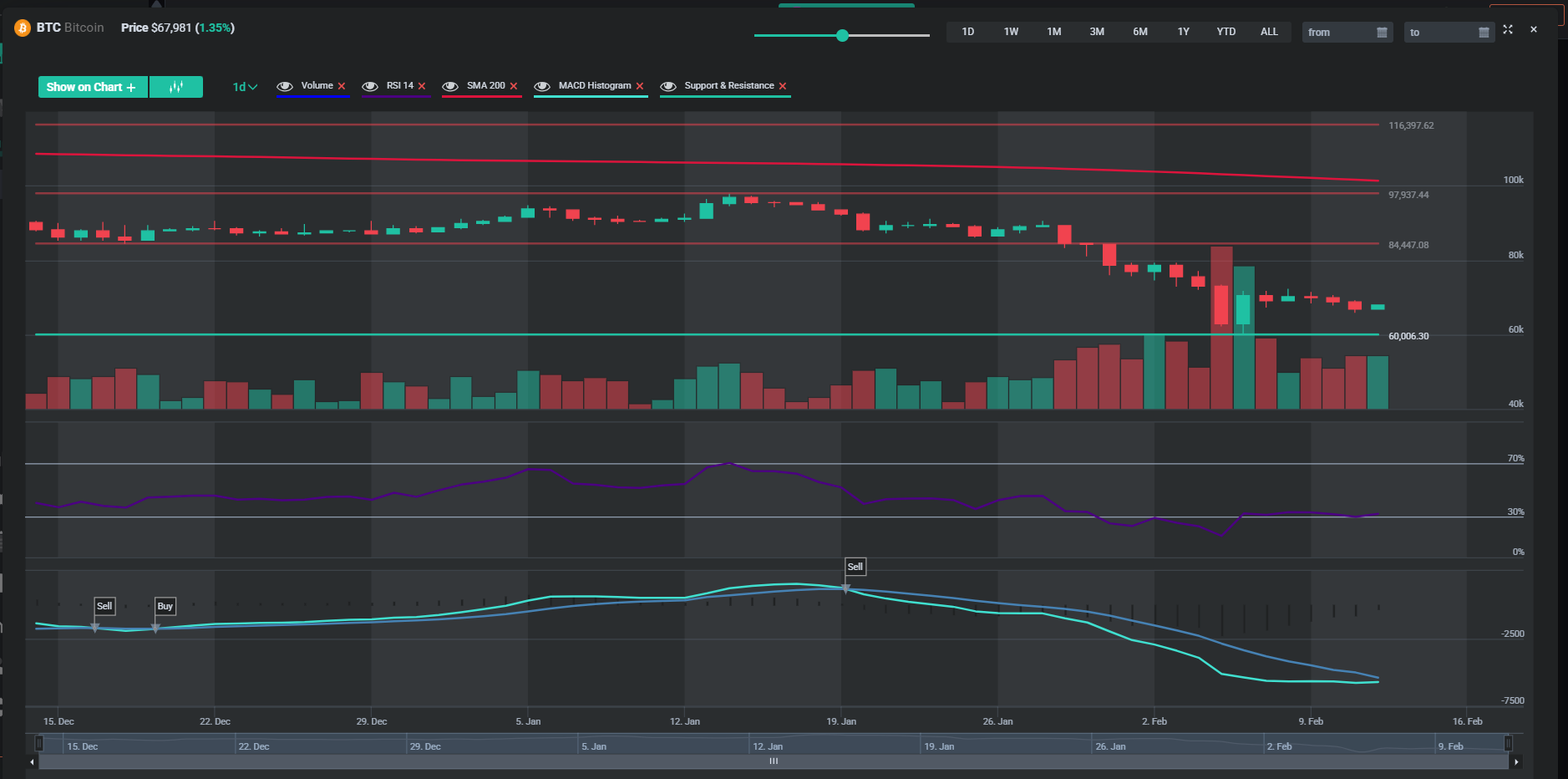

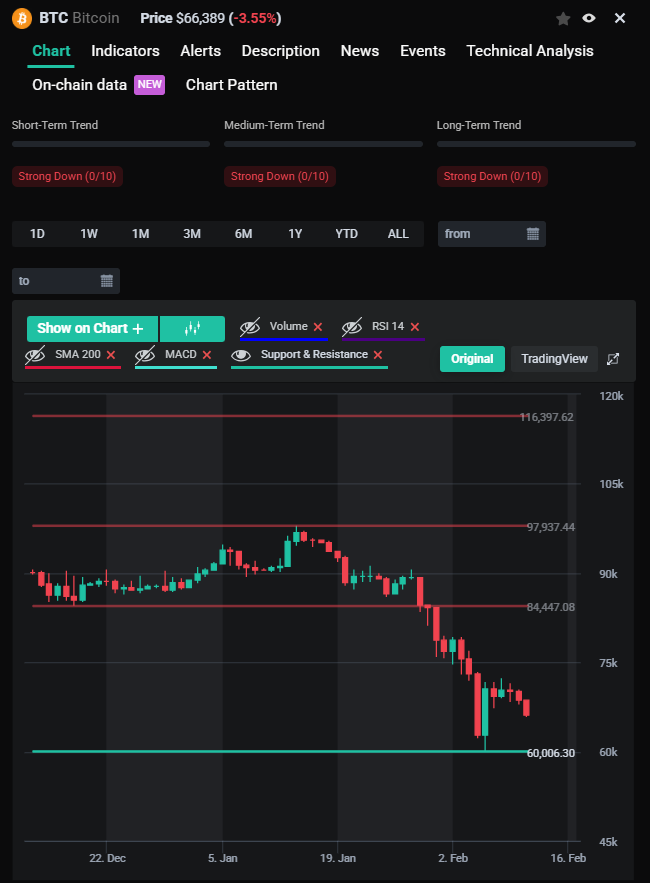

Example Support and Resistance Levels For Bitcoin

Source: altFINS

On this chart, Bitcoin has clear resistance around $84,400, $97,900, and higher near $116,400, which act like price ceilings where selling pressure previously stopped rallies, while strong support sits near $60,000, a key price floor where buyers have stepped in before.

In simple terms, support is where price tends to stop falling and bounce, and resistance is where it tends to stop rising and pull back. These levels matter because they help traders decide where to buy, sell, set stop-losses, and anticipate breakouts or breakdowns, if BTC breaks above resistance it can trigger a new upward move, and if it falls below support it can lead to faster downside momentum.

Why Support and Resistance Are Critical in Crypto Trading

Crypto markets differ from traditional markets because they:

- Trade 24/7

- Have higher volatility

- Include thousands of tradable assets

- Are driven heavily by retail psychology

- Because of this, crypto support levels and resistance levels act as liquidity zones where large buy and sell orders cluster.

When price reaches these zones, one of two things happens:

- Price rejects the level (bounce)

- Price breaks the level (breakout)

- Both scenarios create trading opportunities.

How Crypto Support Levels Form

Crypto support forms when:

- Price repeatedly bounces from a zone

- Large buyers defend a level

- Volume spikes at price lows

- Psychological round numbers attract orders (e.g., $60,000 BTC)

The more times price respects a support level, the stronger it becomes.

Example

If Bitcoin repeatedly bounces near $65,000, traders begin placing buy orders there, reinforcing the level.

How Crypto Resistance Levels Form

Resistance develops when:

- Price fails multiple times at a zone

- Sellers unload positions

- Early buyers take profits

- Overhead supply increases

Strong resistance zones often trigger sharp rejections, unless momentum breaks through.

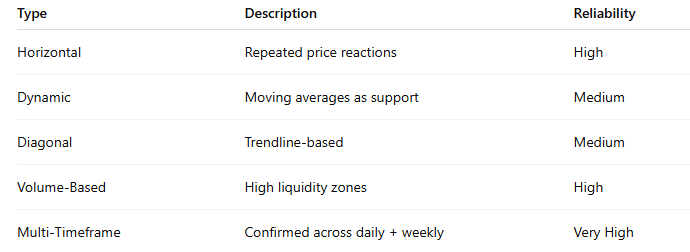

Types of Support and Resistance in Crypto

Multi-timeframe crypto support and resistance levels are significantly stronger than intraday levels alone.

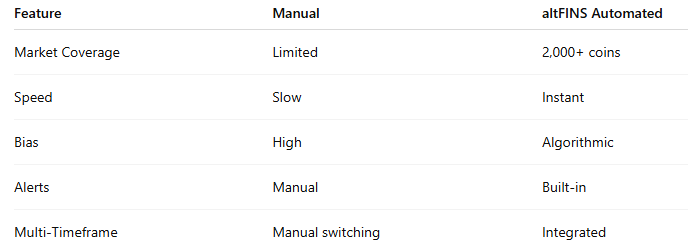

The Problem With Manual Support and Resistance Analysis

Most traders draw levels manually. This creates issues:

- Subjective bias

- Time-consuming chart scanning

- Inconsistent level strength

- Impossible to scale across 2,000+ coins

Manual methods work for a few charts — but not for full market coverage.

Why Automation Matters in 2026

Crypto markets trade 24/7 across thousands of assets. Manually drawing levels is time-consuming and subjective. Automated detection removes bias, scales across 2,000+ coins, and integrates alerts, helping traders react faster to breakout and breakdown setups. Learn more.

Automated Support and Resistance in Crypto (altFINS Solution)

To solve scalability and bias issues, altFINS introduced Automated Support & Resistance Detection for crypto markets.

How It Works

- Scans historical swing highs and lows

- Clusters price reactions

- Scores level strength

- Maps across multiple timeframes

Integrates into screeners and alerts

This allows traders to:

- Filter coins approaching resistance

- Detect breakout candidates instantly

- Monitor pullbacks efficiently

- Receive real-time alerts

Instead of manually drawing lines, traders can analyze the entire crypto market in seconds.

Manual vs Automated Crypto Support and Resistance

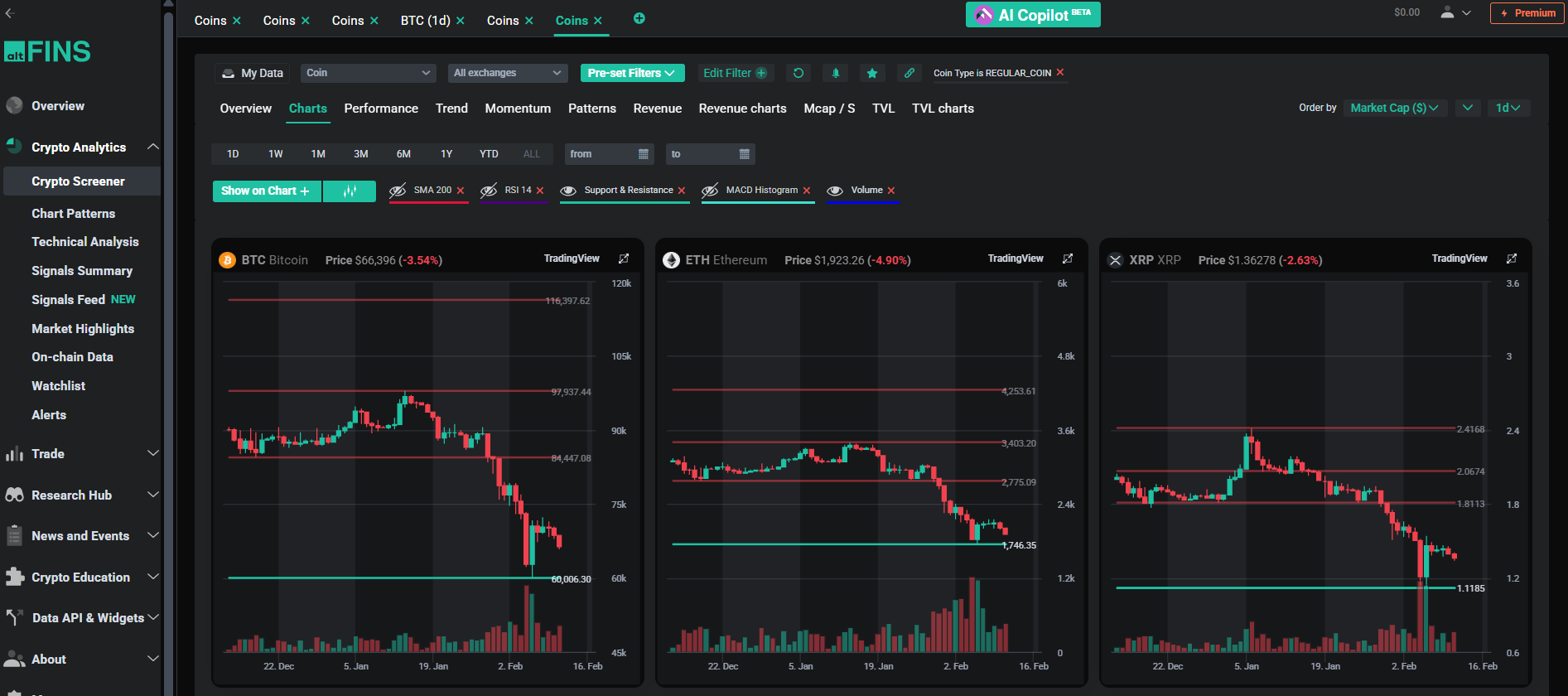

How to Find Support & Resistance on altFINS

altFINS provides Automated Support & Resistance detection across 2,000+ cryptocurrencies and 5 timeframes, fully integrated into charts, screeners, and alerts.

Instead of manually drawing lines, traders can instantly identify statistically significant support and resistance levels across the entire crypto market.

Watch Tutorial Video

You can access automated Support & Resistance levels in:

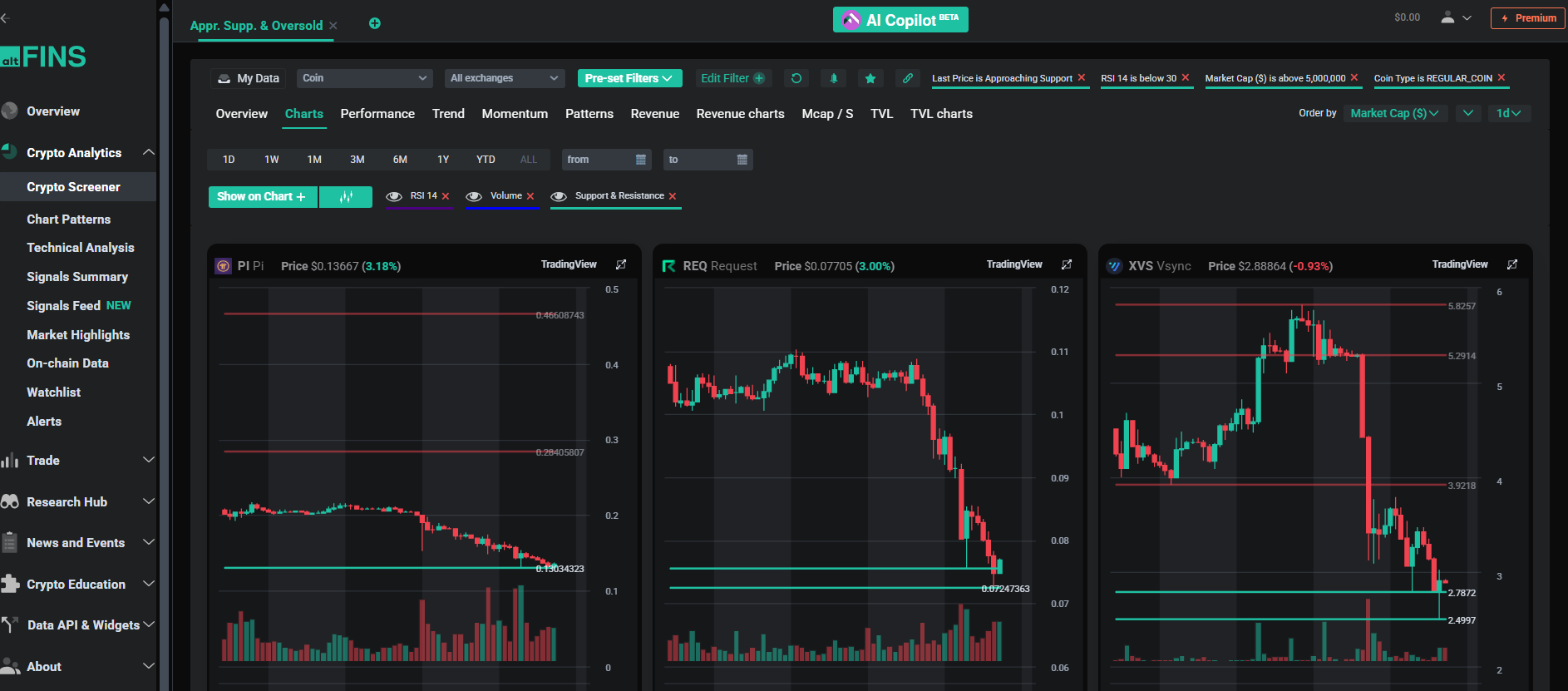

1️⃣ Crypto Screener → Charts Tab

View automatically plotted support and resistance levels directly on price charts.

2️⃣ Individual Coin Detail Pages

See key structural levels alongside trend ratings, RSI, MACD, and volume indicators.

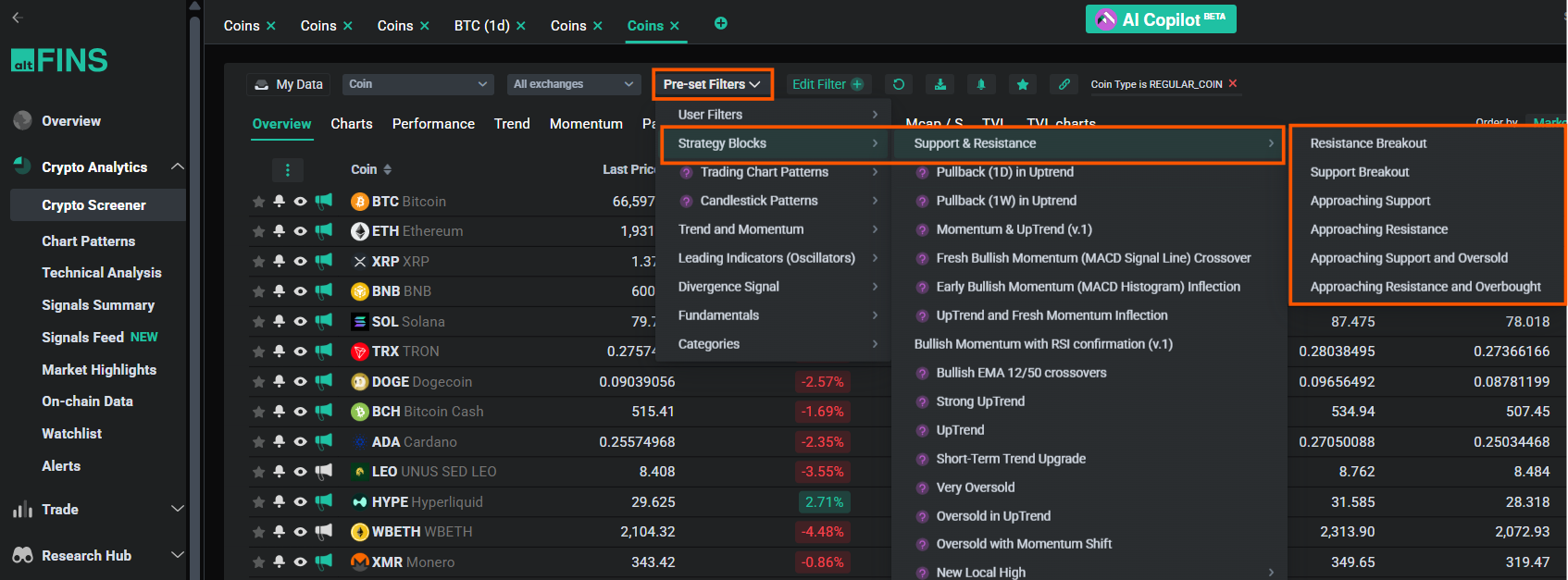

3️⃣ Crypto Screener → Pre-set Filters → Strategy Blocks → Support & Resistance

Use ready-made scans designed specifically around structural price levels.

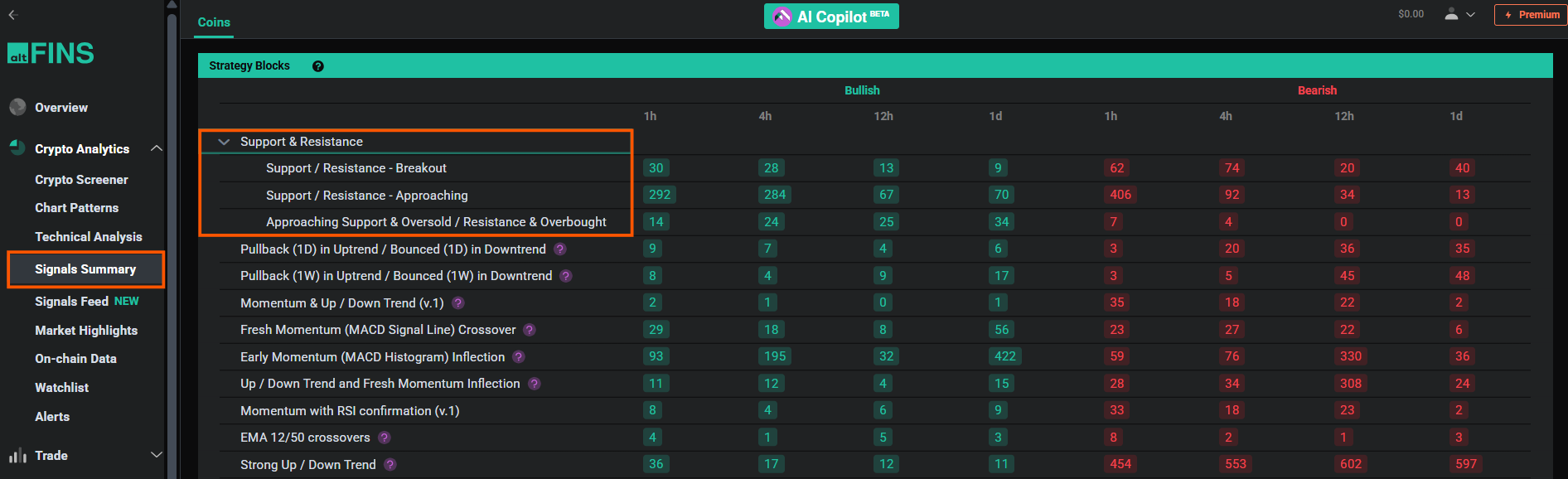

4️⃣ Signals Summary

Monitor breakout and breakdown activity across the market in real time.

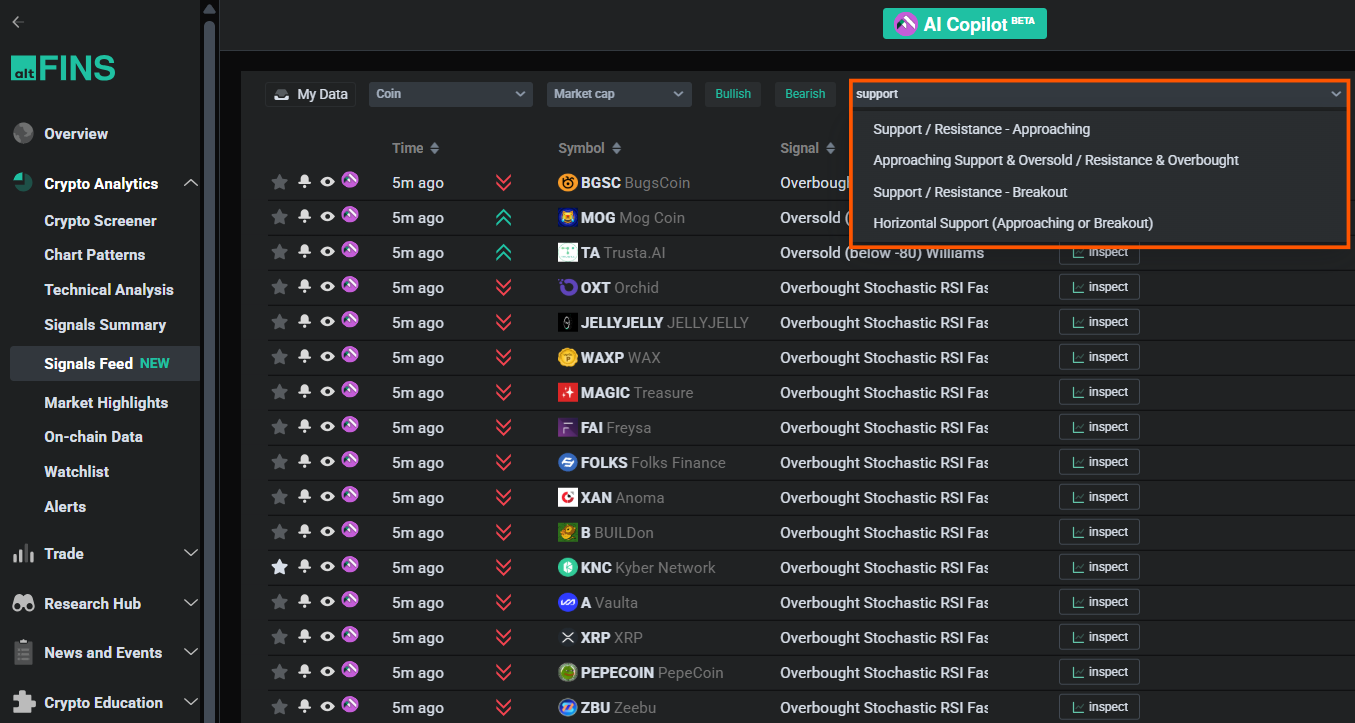

5️⃣ Signals Feed

Track newly triggered support and resistance events as they happen.

This allows traders to monitor structural price levels at scale — without manual chart scanning.

6 Preset Market Scans Based on Support & Resistance

To make support and resistance actionable, altFINS introduced six dedicated preset scans designed to surface high-probability setups instantly.

These scans eliminate guesswork and dramatically reduce research time.

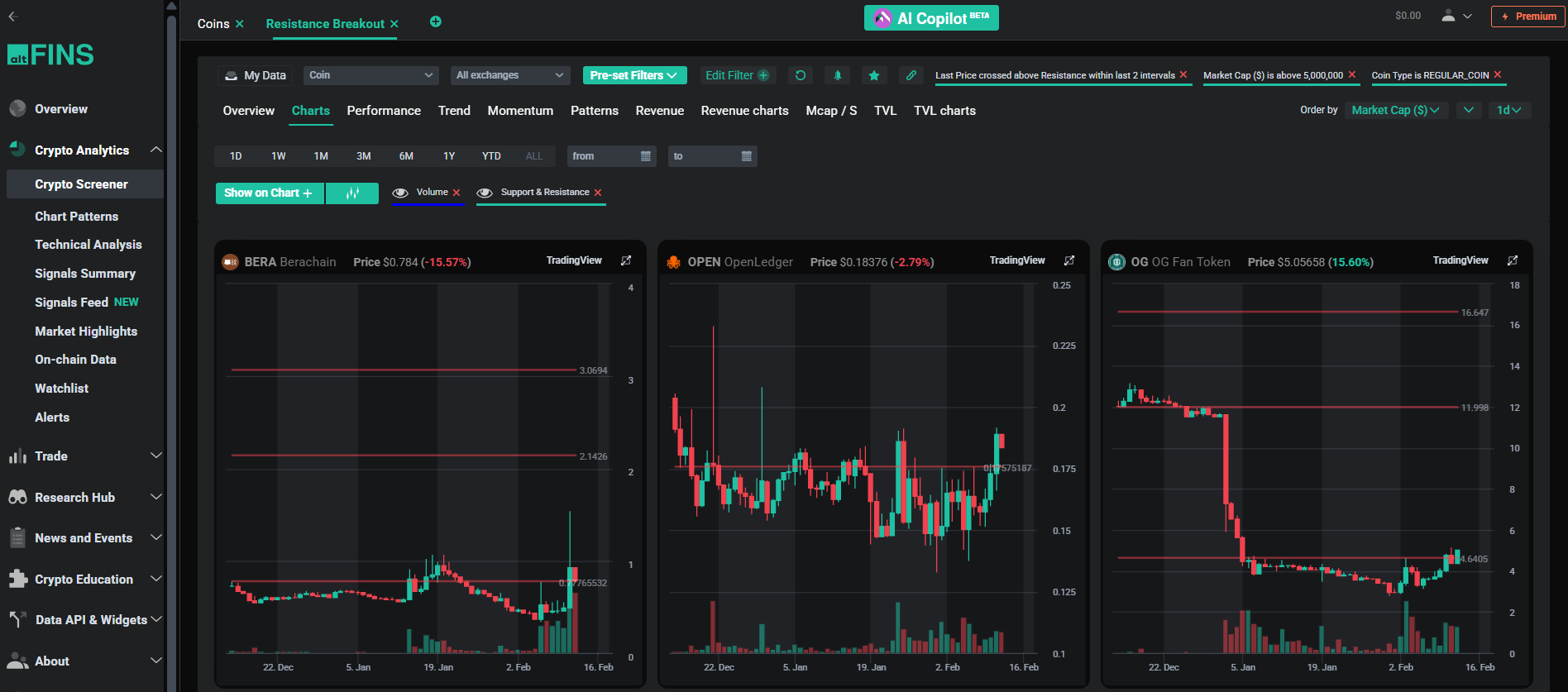

1️⃣ Resistance Breakout – Live Market Scan Results

What it finds:

Coins breaking above a key resistance level.

Why it matters:

A breakout above resistance often signals the beginning of a new upward trend, especially when confirmed by strong volume and momentum.

Best used with:

Trend Rating + Volume expansion

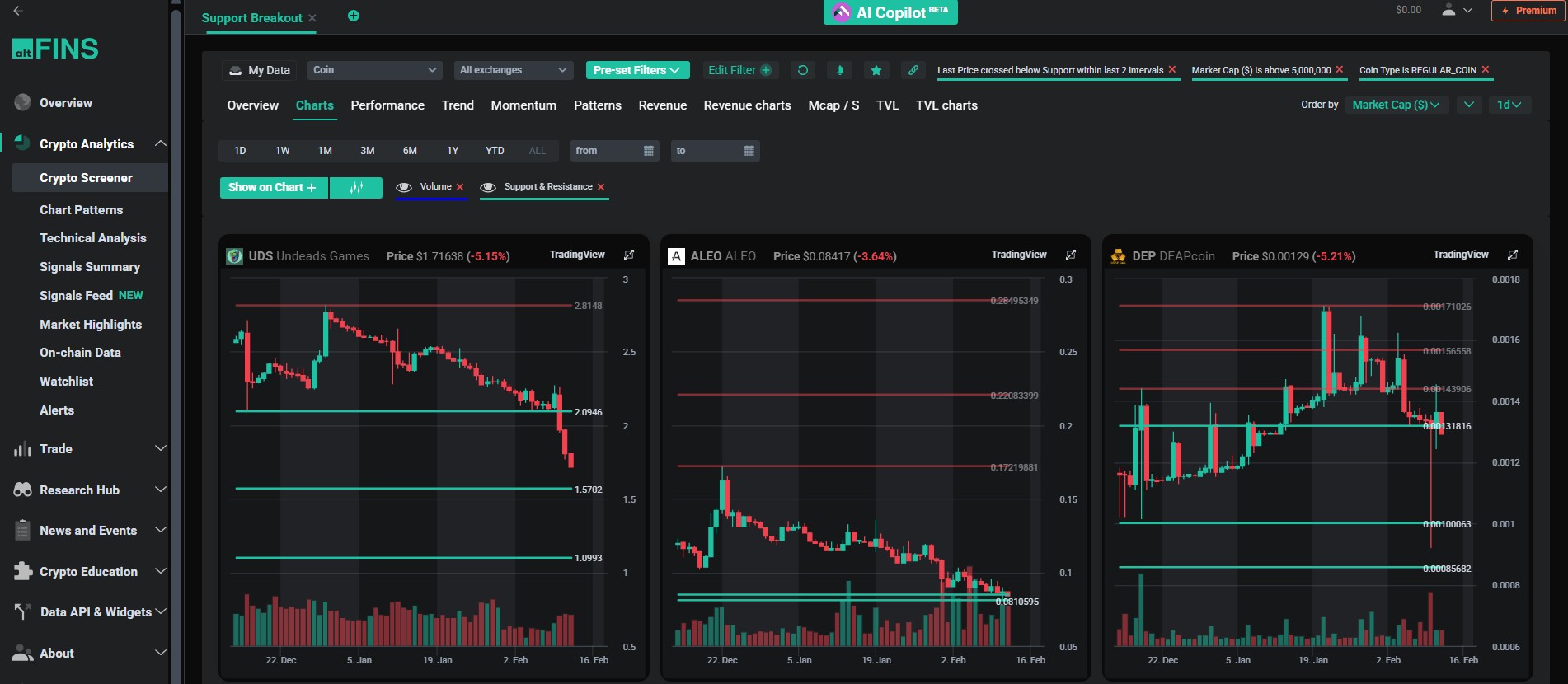

2️⃣ Support Breakout (Breakdown) – Live Market Scan Results

What it finds:

Coins breaking below a key support level.

Why it matters:

When support fails, selling pressure can accelerate quickly. This scan helps identify downside continuation risk or potential short setups.

Best used with:

Bearish MACD crossover + Weak trend rating

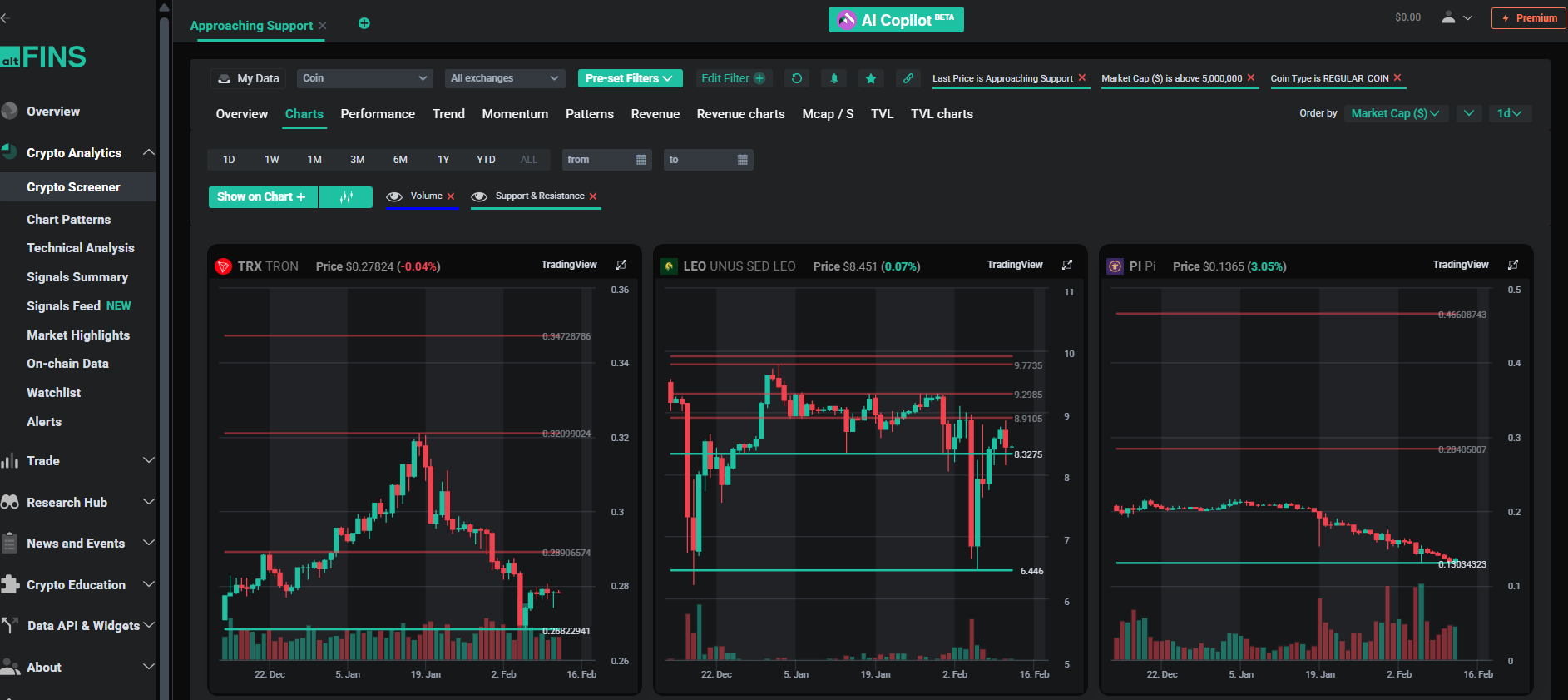

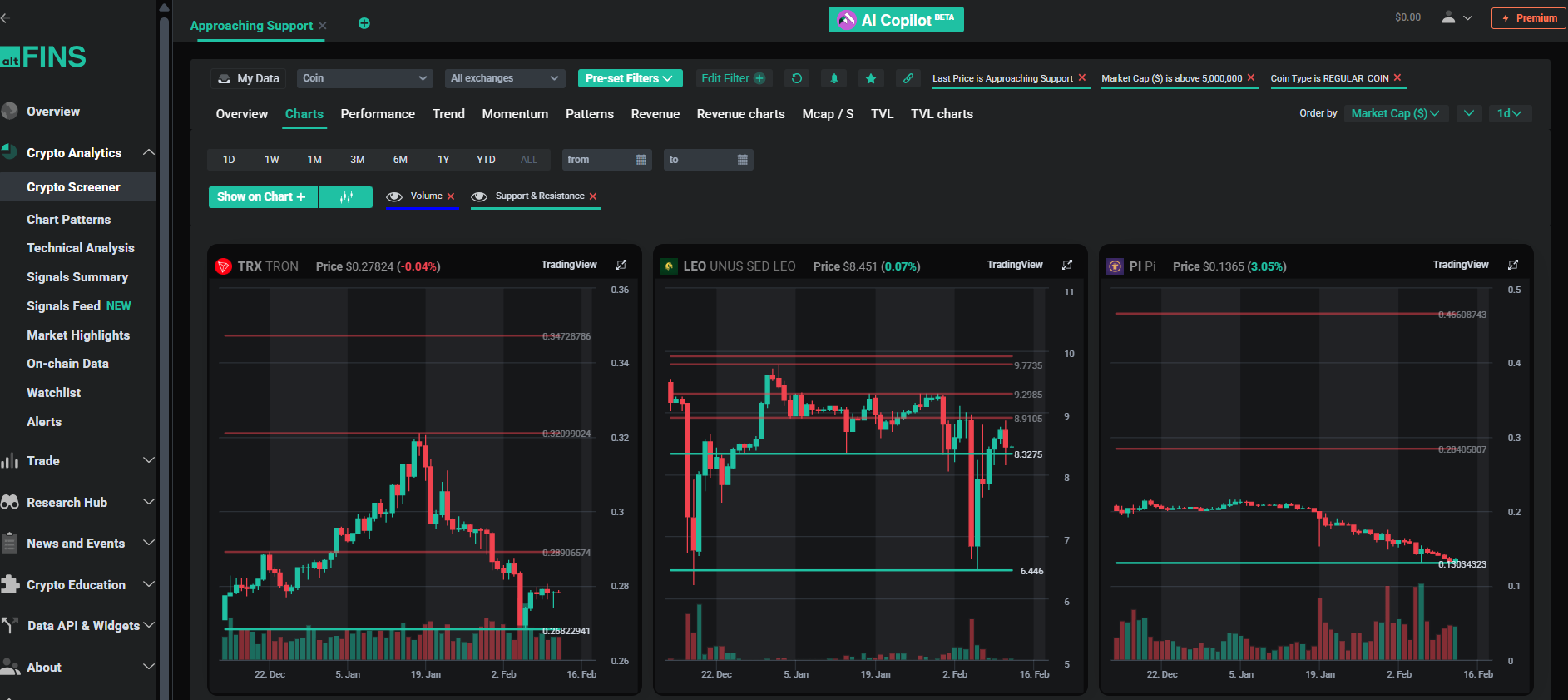

3️⃣ Approaching Support – Live Market Scan Results

What it finds:

Coins trading close to an identified support level.

Why it matters:

Support zones often act as bounce areas. Traders monitor these levels for potential reversal entries with defined risk.

Best used with:

Oversold RSI + Bullish divergence

4️⃣ Approaching Resistance – Live Market Scan Results

What it finds:

Coins trading near a key resistance level.

Why it matters:

Resistance can act as a price ceiling. Traders watch for either breakout confirmation or pullback setups.

Best used with:

Trend continuation + Increasing volume

5️⃣ Approaching Support + Oversold – Live Market Scan Results

What it finds:

Coins near structural support while momentum indicators (such as RSI) show oversold conditions.

Why it matters:

This dual confirmation increases the probability of a technical bounce, as both price structure and momentum align.

Best used for:

High-probability mean reversion setups

6️⃣ Approaching Resistance + Overbought – Live Market Scan Results

What it finds:

Coins near resistance while momentum indicators show overbought conditions.

Why it matters:

This setup highlights potential exhaustion near key resistance levels, signaling increased probability of pullback or rejection.

Best used for:

Fade trades or breakdown monitoring

Combining Support & Resistance With Momentum

Support and resistance levels are most powerful when combined with trend and momentum indicators.

Examples:

- Resistance breakout + strong Trend Rating → Potential continuation move

- Support hold + bullish RSI divergence → Possible reversal

- Breakdown below support + bearish MACD crossover → Confirmation of weakness

By combining structural price levels with momentum signals, traders filter out low-quality setups and focus on higher-probability opportunities.

Why This Matters for Crypto Traders

Crypto markets move fast. Breakouts and breakdowns often happen within hours.

Automated Support & Resistance allows traders to:

- Identify breakout candidates instantly

- Detect breakdown risks early

- Monitor pullback zones efficiently

- Set alerts before major volatility events

- Scale analysis across 2,000+ coins

Instead of manually scanning charts coin by coin, altFINS surfaces structural market opportunities in seconds.

Common Mistakes Traders Make

- Treating levels as exact lines instead of zones

- Ignoring higher timeframes

- Trading every touch without confirmation

- Ignoring volume and momentum

- Drawing too many levels

Additional Education Materials

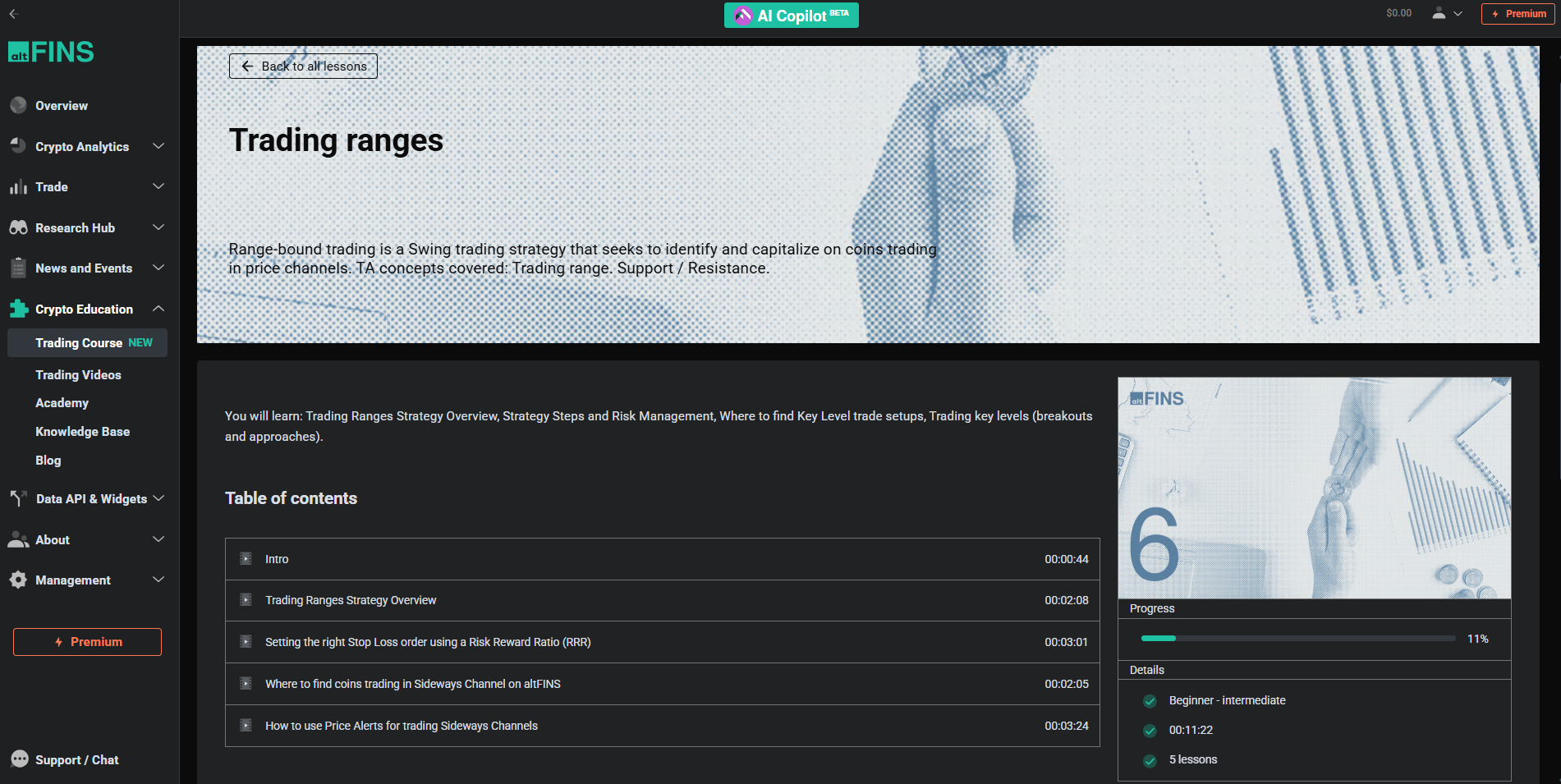

To deepen your understanding of support and resistance in crypto trading, explore the altFINS Trading Course, where you’ll learn step-by-step technical analysis strategies, breakout trading setups, and risk management principles.

Explore altFINS Blog and Knowledgebase articles.

Frequently Asked Questions (FAQ)

What is support in crypto trading?

Support is a price level or zone where buying pressure has historically been strong enough to stop the price from falling further. When price approaches support, it often slows down, stabilizes, or bounces upward.

What is resistance in crypto trading?

Resistance is a price level or zone where selling pressure has historically prevented the price from rising further. When price approaches resistance, it may stall, pull back, or reverse downward.

Do support and resistance levels work in crypto?

Yes. Crypto markets are heavily influenced by trader psychology and liquidity concentration, which causes prices to repeatedly react at key levels. Support and resistance help traders identify potential bounces, rejections, breakouts, and breakdowns.

What is a breakout in crypto?

A breakout occurs when price moves above a resistance level and holds, often with strong volume or momentum confirmation. Breakouts can signal the start or continuation of an upward trend.

What is a breakdown in crypto?

A breakdown happens when price falls below a support level and holds. This often signals increasing selling pressure and may lead to further downside movement.

Why are support and resistance important?

Support and resistance help traders identify entry and exit points, set stop-loss levels, define profit targets, and manage risk. They also provide insight into market structure and trend direction.

Questions About Support & Resistance on altFINS

How does altFINS detect support and resistance levels?

altFINS uses proprietary algorithms to identify statistically significant support and resistance zones by analyzing historical swing highs and lows, clustering repeated price reactions, and ranking level strength across multiple timeframes.

How many cryptocurrencies does altFINS cover?

Automated Support & Resistance detection is available across 2,000+ cryptocurrencies and multiple timeframes, allowing traders to scale their analysis beyond just a few charts.

Where can I find support and resistance levels on altFINS?

You can view automated levels directly on charts within the Crypto Screener, on individual coin pages, and through preset Strategy Blocks focused on support and resistance. These levels are also integrated into Signals Summary and Signals Feed.

Can I scan for breakout and breakdown setups on altFINS?

Yes. altFINS offers preset market scans such as Resistance Breakout, Support Breakdown, Approaching Support, and Approaching Resistance. These filters help traders instantly surface high-probability setups.

Can I set alerts for support and resistance events?

Yes. Traders can set alerts via the web platform, email, or mobile app to be notified when price approaches, tests, or breaks key support or resistance levels.

Why is automated support and resistance useful?

Automation removes subjectivity, saves time, and allows traders to monitor structural levels across the entire crypto market. Instead of manually drawing lines, traders can rely on objective, data-driven detection integrated with trend and momentum indicators.