Search Knowledge Base by Keyword

-

Overview

-

- altFINS Platform Features - Your All-in-One Crypto Trading Tool

- Why use altFINS?

- Registered user benefits

- What kind of trader are you?

- How to trade cryptocurrencies?

- How to Trend Trade Crypto

- Trading Risk Management

- What Makes altFINS One of the Best Crypto Screeners in 2025?

- What Kind Of Crypto Trading Signals Are on altFINS?

-

-

Crypto Analytics

-

- Why use it?

- Overview > Charts > Scorecards > Performance > Trend > Oscillators

- Add table columns

- Detail view

- Charts

- Create a Trading Signal or Filter

- Find SMA crossover signals

- Crypto Time Intervals

- Create an alert

- Extreme Overbought coins Due for a Pullback

- Early momentum detection

- Crypto Trend Changes

- Why And How Use altFINS Crypto Screener

- Mastering Candlestick Patterns for Successful Crypto Trading

- What Are Fibonacci Retracement Levels?

- Essential Candlestick Patterns for Crypto Traders

- Using Local High to Spot Breakouts

- Oversold in Uptrend

- Strong Uptrend

- The Hammer Candlestick Pattern

- The Inverted Hammer Candlestick Pattern

- The Hanging Man Candlestick Pattern

- The Spinning Top Candlestick Pattern

- The Dragonfly Doji Candlestick Pattern

- What is "My Data" Option on altFINS?

- The Relative Volume (RVOL) Indicator

- New Local High

- New Local Low

- Buying Coins at an All-Time-High (ATH)

- Bullish Engulfing Candlestick Pattern: A Comprehensive Guide

- The Gravestone and Perfect Gravestone Doji Candlestick Patterns

- Support and Resistance Crypto: The Complete 2026 Guide for Traders

- What Makes altFINS One of the Best Crypto Screeners in 2025?

- Crypto Volume Tracker: Spot Unusual Volume and Momentum with altFINS

- Crypto Fundamental Data On altFINS: Identifying Projects with Real Traction

- What is ATR Indicator and How to Find It on altFINS?

- Combining fundamentals with TA

- Trading RSI and RSI Divergence

- What Is the 200-Day Simple Moving Average and How to Find It on altFINS

- Show all articles ( 24 ) Collapse Articles

-

- Overview

- Emerging v. Complete

- Mastering Key Levels in Crypto Trading: The Ultimate Guide

- Consecutive Candles

- Big Movement in Trading: Understanding and Trading the Volatility

- Fibonacci Patterns

- 10 steps for how to trade crypto using Crypto Chart Patterns

- How to trade Channel Down? | Crypto Chart Pattern

- Tutorial: Using Custom Chart Pattern Filters

- How To Set Up Chart Patterns Alerts?

- How To Trade Channel Up Pattern? | Crypto Chart Pattern

- How To Trade Ascending Triangles? | Crypto Chart Pattern

- How To Trade Bullish Flag Pattern? | Crypto Chart Pattern

- How To Trade Sideways Channel pattern? | Crypto Chart Pattern

- How To Trade Rising Wedge pattern? | Crypto Chart Pattern

- How To Trade Falling Wedge pattern? | Crypto Chart Pattern

- How To Trade Descending Triangle pattern? | Crypto Chart Pattern

- How To Trade Inverse Head and Shoulders pattern? | Crypto Chart Pattern

- What is "My Data" Option on altFINS?

- How To Trade Symmetrical Triangle Pattern? | Crypto Chart Pattern

- Crypto Chart Patterns Cheat Sheet

- How Does AI Help with Crypto Trading?

- Crypto Chart Patterns

- Show all articles ( 8 ) Collapse Articles

-

- Signals Summary Overview

- How To Find And Trade Crypto Pullbacks In Uptrend (Buying Dips)?

- Momentum & Up / Down Trend

- Range in Up/Down Trend

- Momentum

- How to trade EMA 12 / 50 crossovers?

- Moving Average Ribbons

- Strong Up / Down Trend

- Strong Up / Down Trend (Short Term)

- Strong Up / Down Trend (Medium Term)

- Strong Up / Down Trend (Long Term)

- Price / SMA Crossovers In Crypto

- What are Price / EMA Crossovers in crypto?

- SMA Crossovers

- EMA Crossovers

- Crypto Unusual Volume Gainers / Decliners

- New Up/Down trend (ADX)

- Bollinger Band - Price Broke Upper / Lower Band

- Strong Up / Down Trend and Oversold / Overbought

- Strong Up / Down Trend and Strong / Weak Ultimate Oscillator

- MACD (12,27,9) Signal Line cross

- MACD (12,27,9) Center Line cross

- Commodity Channel Index cross

- Overall Score of Oscillators (Oversold / Overbought)

- Relative Strength Index (9)

- Relative Strength Index (14)

- Relative Strength Index (25)

- Stochastic RSI (3, 3, 14, 14)

- Williams Percent Range (14)

- Bull Power

- MACD line

- Relative Strength Index (RSI) Divergence: Explained

- How to Trend Trade Crypto

- Early momentum detection

- Short-Medium-Long-Term Trend

- Relative Strength Index

- Uptrend and Fresh Bullish Momentum Inflection

- Using Local High to Spot Breakouts

- Oversold in Uptrend

- Strong Uptrend

- The Hammer Candlestick Pattern

- The Inverted Hammer Candlestick Pattern

- The Hanging Man Candlestick Pattern

- The Spinning Top Candlestick Pattern

- The Dragonfly Doji Candlestick Pattern

- What is "My Data" Option on altFINS?

- The Relative Volume (RVOL) Indicator

- New Local High

- New Local Low

- Bullish Engulfing Candlestick Pattern: A Comprehensive Guide

- The Gravestone and Perfect Gravestone Doji Candlestick Patterns

- Three White Soldiers Candlestick Pattern: A Comprehensive Guide

- How Does AI Help with Crypto Trading?

- What Kind Of Crypto Trading Signals Are on altFINS?

- Trading RSI and RSI Divergence

- Show all articles ( 40 ) Collapse Articles

-

- Volume

- OBV Divergence Indicator

- SMA vs. EMA

- Trading RSI and RSI Divergence

- Stochastic (14, 3, 3) (STOCH)

- What is CCI 20? (Commodity Channel Index 20)

- ADX

- MACD Line and MACD Signal Line

- Williams %R

- Stochastic RSI Fast

- Bull / Bear Power

- What is the UO: Ultimate Oscillator (7, 14, 28)

- Short Term Trend

- Medium Term Trend

- Long Term Trend

- Oscillator Rating

- Trading Multiple Time Frames

- Support and Resistance Crypto: The Complete 2026 Guide for Traders

- Polarity principle

- Early momentum detection

- Crypto Trend Changes

- MACD Histogram (H1, H2)

- What Are Fibonacci Retracement Levels?

- Using Local High to Spot Breakouts

- Oversold in Uptrend

- Strong Uptrend

- The Relative Volume (RVOL) Indicator

- New Local High

- Buying Coins at an All-Time-High (ATH)

- Crypto Volume Tracker: Spot Unusual Volume and Momentum with altFINS

- What is ATR Indicator and How to Find It on altFINS?

- Combining fundamentals with TA

- What Is the 200-Day Simple Moving Average and How to Find It on altFINS

- Show all articles ( 18 ) Collapse Articles

- How To Trade Symmetrical Triangle Pattern? | Crypto Chart Pattern

- New Local High

- New Local Low

- Three White Soldiers Candlestick Pattern: A Comprehensive Guide

- Crypto Volume Tracker: Spot Unusual Volume and Momentum with altFINS

- What is ATR Indicator and How to Find It on altFINS?

- What Is the 200-Day Simple Moving Average and How to Find It on altFINS

- Crypto Breakouts Explained: How to Spot Winning Trades with altFINS

- Getting Started with altFINS! Your Complete Step-by-Step Guide to Crypto Trading Success

-

-

Trade Crypto

-

- Initiating a trade

- Market vs. Limit order

- Refreshing tables

- Are derivatives such as futures, options and perpetual swaps supported?

- Does altFINS charge trading fees?

- Balances

- Open Orders

- Transaction History

- Order Book & Trades in Crypto

- Connecting to exchanges

- How to trade cryptocurrencies?

- Trading Risk Management

- Crypto Portfolio Tracker

- Connect To Bitget

- Connect to Coinbase

-

-

Research Hub

-

Crypto Education

-

- Where To Buy And Sell Cryptocurrency?

- When Is The Best Time To Buy And Sell Cryptocurrency?

- Crypto Profits: Full Guide How to Take Profits In Cryptocurrency

- What Is Crypto Copy Trading?

- What Is Leverage Trading Cryptocurrency?

- Crypto Arbitrage Trading: Meaning, Signals And Opportunities

- Crypto Hot Wallet vs. Cold Wallet: What is the Difference

- Crypto Trading Strategies

- Difference Between Crypto Fundamental and Technical Analysis

- List of TOP Decentralized Exchanges 2025

- What is a Crypto Prop Trading? A Complete Guide to Crypto Proprietary Trading Firms

- The Best Crypto Prop Trading Firms

- Altrady Review: How To Achieve Optimal Trade Execution

- Crypto AI Agents Explained: Top 10 AI Agent Cryptos by Market Cap to Watch in 2025

- The Ultimate Guide to Smart Money Whales in Crypto

- The Ultimate Guide to Cryptocurrency ETFs in 2025

- How to Control Your Emotions While Trading Crypto (and How altFINS Can Help)

- HyroTrader Review: A Comprehensive Analysis

- Best Crypto Trading Bots in 2025: Coinrule vs Cryptohopper vs 3Commas

- How to Automate Your Crypto Trading with Coinrule

- OneFunded Review: Pros & Cons Revealed

- Show all articles ( 6 ) Collapse Articles

-

-

About

-

AI Features

-

altFINS API

- What Is the altFINS Analytics Data API?

- Who Is the altFINS Data API For?

- Real-World Use Cases of the altFINS API

- altFINS Crypto Market & Analytical Data API

- How to Create an altFINS API Key (Step-by-Step Guide)

- The Ultimate Guide to Cryptocurrency MCP Servers in 2026: Complete Comparison for Traders, Developers & Trading Platforms

How to find undervalued tokens

In the traditional stock market, investors often look for undervalued stocks.

Undervalued typically means:

- Low Market Capitalization relative to Revenue (Sales)

- and High Revenue Growth

Intuitively, companies or blockchain-based projects with high revenue growth indicates that their products have found good market fit and are in demand by customers.

Market Capitalization refers to the total value of a company or project based on the token price and fully dilluted tokens.

But wait, do blockchain projects generate revenues?

Right. Good question. Most don’t, buy many do!

And some generate a lot of revenue. Such revenue-generating projects offer investors some underlying fundamentals to base our valuation on.

MEME tokens don’t have any revenues, their prices are purely sentiment driven.

But many DeFi, DePIN, and L1/L2 projects do generate fees, often substantial fees.

That brings us to another important point: revenue scale.

While revenue growth is important, investors need to pay attention to the size of revenue. If it’s just in a few tens or hundreds of thousands (annualized), that’s not meaningful.

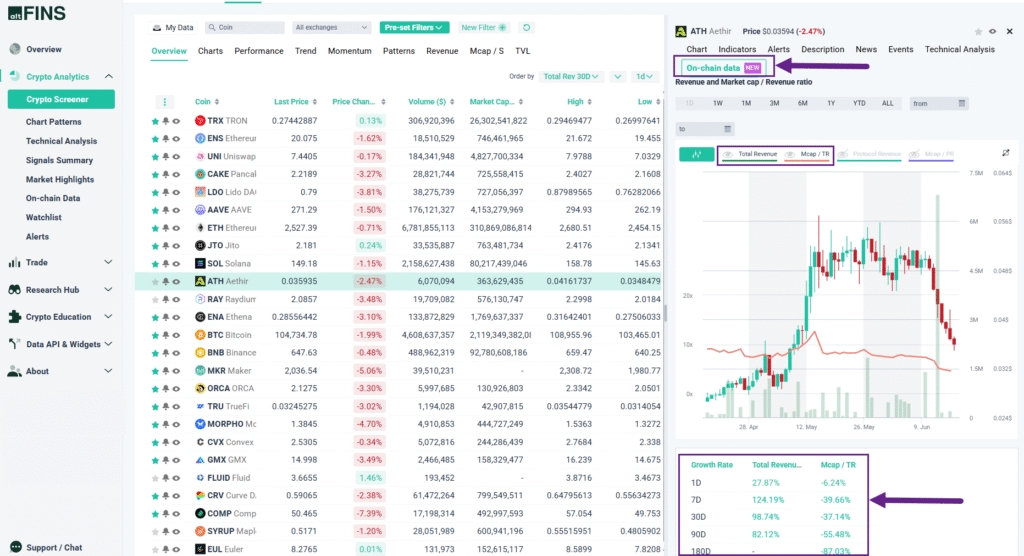

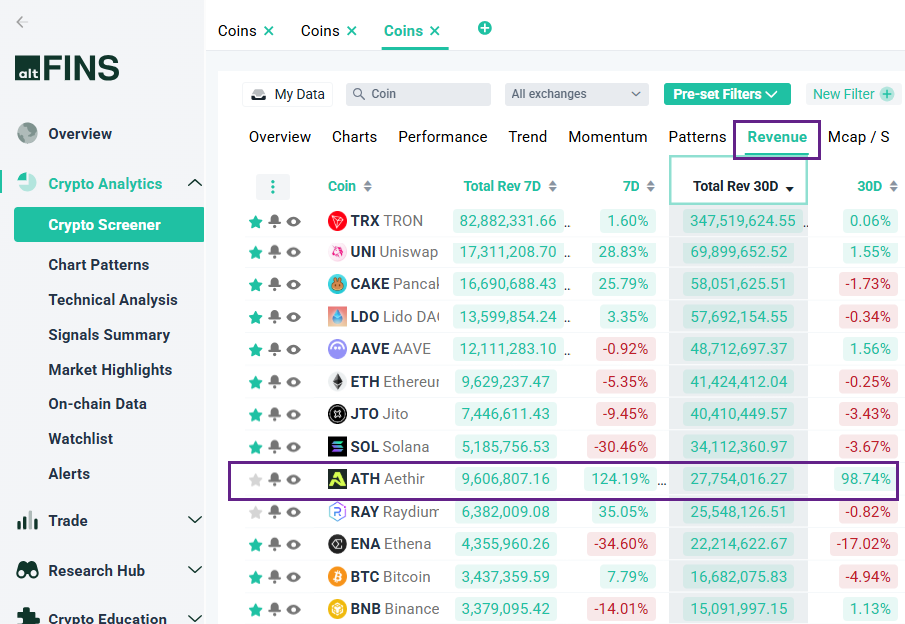

But Aethir (ATH) generate $9.6M in last 7D (days) and $27.7M in last 30D, which grew 98.7%. That’s sizeable.

In fact, that places Aethir in the top 10 list by revenues generated in the last 30D.

Top Blockchain Projects Based on 30D Revenue

Using altFINS’ On-Chain data, investors can find such revenue-generating projects, their revenue growth, and valuation (market cap versus revenue).

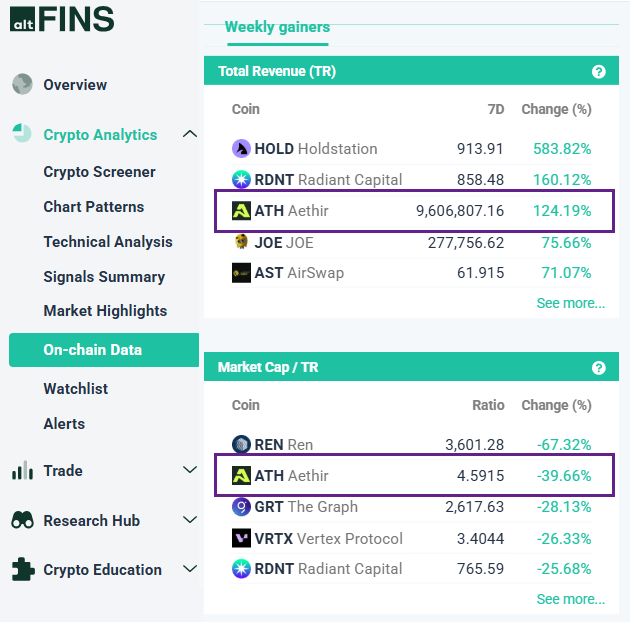

Good starting point is altFINS’ On-Chain data section which provides quick insights into the biggest gainers and losers in terms of revenue, Market cap / revenue valuation ratio, and TVL (Total Value Locked):

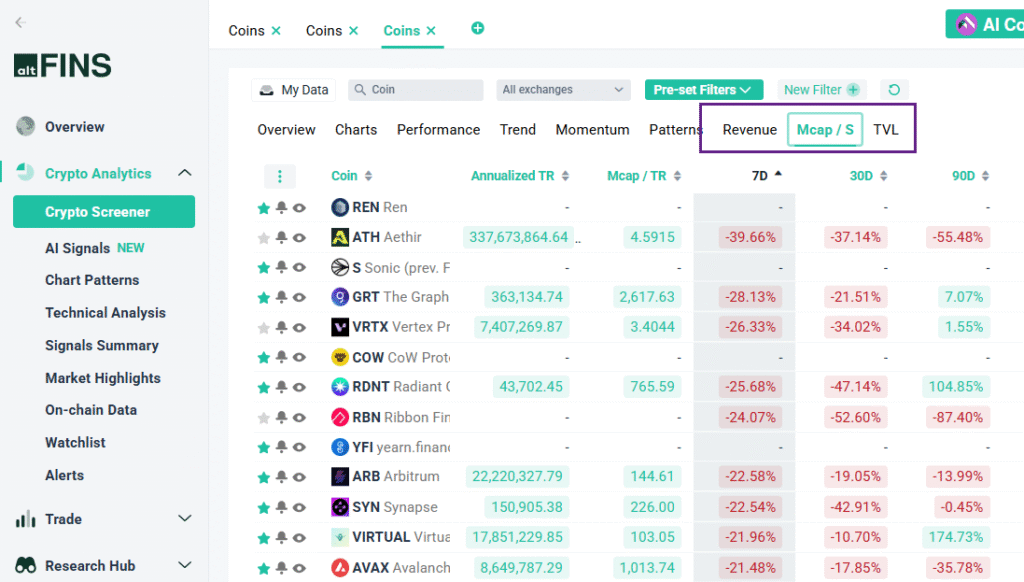

Notice that ATH (Aethir) is not only among the faster revenue growing projects in the last 7D (days), up 124%, its valuation multiple (Market cap / Total Revenue ratio) declined by 37%!

So while revenues are growing, the valuation is declining!? It’s cheaper now than it was a week ago, all the while revenues grew 124%.

That’s worth exploring further.

Market Cap / Total Revenue

Also, notice that the Market Cap / Total Revenue multiple is only 4.6x.

Most fast growing technology stocks on NASDAQ trade at 10x multiple or higher.

For comparison, Nvidia (NVDA), the most valuable company in the world (publicly trading at $3.5 trillion), is valued at 24x Market cap / Revenue (TTM – trailing twelve months revenue).

That implies that 4.6x for Aethir (ATH) is cheap!

Especially when we consider the high double- or triple-digit growth.

In fact, we could argue that Aethir (ATH) could be valued at 10-20x ratio of market cap / revenue, which implies 100-300% potential upside to Aethir token price (currently trading at $0.0357).

What is Aethir? It’s a distributed enterprise-grade GPU compute infrastructure tailored for AI and gaming. Aethir aims to serve enterprise AI clients who need the world’s most powerful AI chips such as NVIDIA H100s and support hundreds of thousands of cloud gaming players.

How To Find Such Coins On altFINS?

To find token projects with actual revenues and growth rates, investors can use the following three tabs on altFINS’ Screener:

- Revenue

- Market Cap / Sales (Mcap/S)

- TVL

You can also find a token’s revenue, growth and valuation (Mcap/S ratio) under each token’s details: