Search Knowledge Base by Keyword

What Is DEX Cryptocurrency Aggregator

Definiton: DEX aggregators are designed to help investors and traders fill trades at the best possible price by sourcing liquidity from different DEXs and thus offering users better token swap rates than they could get on any single DEX. DEX aggregators allow traders to benefit from different connected decentralized exchanges in a single interface. DEX aggregators also provide users with a secure, non-custodial trading experience, as trades are executed directly from the user’s wallet, without the need to deposit funds into the aggregator’s wallet.

DEX aggregator is a type of cryptocurrency exchange that enables users to access liquidity across multiple decentralized exchanges (DEXs) in a single platform. This means that users can swap or trade cryptocurrencies on different DEXs without having to navigate multiple platforms or conduct separate transactions.

Decentralized exchange aggregator can be considered a liquidity aggregator since it enables users to access liquidity from multiple decentralized exchanges (DEXs). By pooling together liquidity from different DEXs, a DEX aggregator can provide users with access to a larger pool of liquidity, which can help to address the issue of low liquidity often associated with individual DEXs.

History Of Decentralized Exchange Aggregator

The history of DEX aggregators can be traced back to the rise of decentralized exchanges, which use smart contracts and blockchain technology to enable peer-to-peer trading without relying on a central authority or intermediary. While DEXs offer several benefits, including enhanced security and privacy, they often suffer from low liquidity and poor user experience due to fragmentation across multiple platforms.

To address these issues, several DEX aggregators emerged in the market, starting with 1inch in 2019. Since then, several other DEX aggregators such as Matcha, altFINS, Paraswap, and DEX.AG have also entered the market. These aggregators use complex algorithms to search multiple DEXs for the best available rates and optimize transactions to minimize fees and slippage.

In addition to providing a seamless trading experience, DEX aggregators have also played a key role in driving the adoption of decentralized finance (DeFi) by providing users with a more accessible and efficient way to trade cryptocurrencies. As the DeFi ecosystem continues to grow and evolve, it is likely that DEX aggregators will continue to play an important role in shaping the future of decentralized finance. Overall, DEX aggregators have emerged as a solution to improve the liquidity, convenience, and efficiency of decentralized trading.

How Does DEX Work?

Users normally need to link their digital wallet to the platform in order to trade on a DEX, after which they may browse and make orders on the exchange’s automated market maker (AMM) matching engine. An order is broadcasted to the network and compared to any other order that matches it as soon as it is placed. If a match is discovered, the smart contract will immediately carry out the transaction, transferring the assets right between the users’ wallets.

Since users are not compelled to give personal information to the exchange, it may also provide better privacy. However, DEXs could potentially charge more money and have less liquidity than centralized exchanges (CEX).

The operation of a Decentralized exchange aggregator is described in more detail below:

- The user enters the specifics of the transaction they want to make, including the token they want to purchase or sell, the quantity they want to swap, and the price they want to pay.

- The algorithm used by the DEX aggregator examines the user’s trade request and checks several DEXs to find the best rates. The algorithm takes into account things like the current market pricing, the amount of liquidity, and trading commissions.

- The computer chooses the optimum route for carrying out the trade after identifying the best prices for the user’s trade. To get the greatest results, this may include dividing the trade across several DEXs.

- The DEX aggregator either sends the deal directly through the blockchain or through an intermediary layer to the chosen DEXs. Smart contracts may also be used by the aggregator to carry out trades automatically without requiring user input.

- The DEX aggregator optimizes the deal to reduce fees and slippage as it is executed across the user’s chosen DEXs.

- The DEX aggregator gives the user real-time updates on the status of their trades at all times, including the current market price, the anticipated time to execution, and any applicable fees.

Join altFINS Community

Types of DEX Aggregators

DEX aggregators with on-chain order books, everything takes place and is tracked on a blockchain. Because of this, these DEXs rely on nodes to maintain a record of the orders and on miners to verify transactions.

Off-chain order books are not completely decentralized because a centralized party hosts the transaction records. The off-chain order book DEXs that use relayers to handle the orders include the 0x protocol. According to this paradigm, all matching takes place off-chain, with transaction finalization being the only action carried out on-chain.

Aggregators for Smart Order Routing (SOR): In order to route orders to the best markets, SOR aggregators utilize algorithms that take into account variables including price, liquidity, and trading volume. To obtain the greatest results, SOR aggregators often distribute trades among numerous DEXs. They may also leverage cutting-edge features like limit orders to lower trading costs and slippage. Professional traders who need a lot of flexibility and customization in their trading techniques frequently prefer SOR aggregators.

Market Maker Aggregators: By serving as market makers on several DEXs, market maker aggregators create their own liquidity. Market maker aggregators can aid in lowering slippage and enhancing the overall trading experience by offering deeper liquidity pools. To cover the risk they assume as market makers, market maker aggregators frequently charge a spread or a trading fee. Retail traders that value simplicity and use tend to favor market maker aggregators.

Hybrid Aggregators: To give users a more flexible and personalized trading experience, hybrid aggregators combine the advantages of market maker aggregators and SOR. Hybrid aggregators may employ algorithms to direct trades to the best available markets, but in some circumstances they may also supply their own liquidity. In order to assist customers in optimizing their transactions, hybrid aggregators may additionally provide sophisticated features like limit orders, stop-loss orders, and other trading tools. Traders that prefer a balance between flexibility and ease of use frequently favor hybrid aggregators.

Liquidity Aggregators: These companies specialize in combining liquidity from several DEXs. Liquidity aggregators make it simpler for customers to identify and access the liquidity they require by giving them a single point of access to numerous DEXs, as opposed to optimizing trades. In order to assist customers in making educated trading decisions, liquidity aggregators may also include additional services including real-time market data, trading charts, and other tools. Retail traders and casual investors who emphasize simplicity and ease of use frequently favor liquidity aggregators.

DEX Aggregator Future Potential

DEX aggregators offer crypto traders and investors a simple and quick way to access decentralized trading, which could further encourage the usage of DEXs and promote the expansion of the decentralized finance (DeFi) ecosystem.

Users may increasingly turn to DEX aggregators as a means of gaining access to these advantages as DEXs continue to develop and offer more functionality and liquidity. DEX aggregators could gain from the advancement of new technologies like decentralized oracle networks and non-custodial aggregators, which might further enhance their security and usefulness.

The capacity of DEX aggregators to provide users with a quick and smooth trading experience while also resolving the issues that are now limiting the adoption of DEXs, such as poor liquidity and excessive fees, will likely determine how successful they are in the future.

DEX aggregators can completely change the way that trade is done in a decentralized environment. DEX aggregators could eventually replace DEXs as the preferred platform for traders and investors since they provide users with access to several DEXs and provide a safe, non-custodial trading environment.

Furthermore, DEX aggregator like altFINS offer features such as portfolio tracking and analytics, market screener, real-time news, advanced charting tools, which are typically not available on most DEXs. As the DeFi space continues to evolve and mature, DEX aggregators with aforementioned additional features will have a big potential and competitive edge to become major players in the decentralized trading space and DeFi ecosystem.

Benefits Of Trading On DEX Aggregators

- Best Price Execution: DEX aggregators give investors access to the most competitive pricing available across a number of decentralized exchanges. DEX aggregators assist investors in obtaining the best trade execution by searching numerous DEXs for the best rates.

- Provision of Liquidity: DEX aggregators assist in resolving the liquidity issue that frequently affects individual decentralized exchanges. Investors have access to larger liquidity pools through DEX aggregators, which let them execute transactions more quickly by combining liquidity from many DEXs.

- Reduced Slippage: DEX aggregators can assist investors in reducing slippage, which is the difference between the anticipated price of a trade and the actual price at which the trade is executed. Deep liquidity and best price execution are two features that DEX aggregators offer. Saving money and maximizing rewards are both possible thanks to this.

- Access to Multiple DEXs with Convenience: DEX aggregators give investors a simple method to access a number of decentralized exchanges from a single interface. Investors will save time and effort as a result of not having to manually navigate and keep an eye on numerous exchanges.

- Diversification of Portfolio: DEX aggregators frequently provide a selection of investment choices, such as liquidity pools, yield-generating protocols, and other DeFi chances. Investors can reduce risks and diversify their investments as a result.

- Lower Fees: Since DEX aggregators use smart contracts rather than middlemen to execute trades, they often charge lower fees than traditional centralized exchanges.

The Problem With DEX Aggregators

- Price Oracle Risks: To calculate the price of assets on the underlying exchanges, DEX aggregators rely on price oracles. Incorrect pricing information may be utilized for trades if the price oracle is tampered with or corrupted.

- Risks Associated With Liquidity: DEX aggregators are dependent on the liquidity of the underlying decentralized exchanges. Low liquidity on any of the exchanges may make it more difficult for the aggregator to carry out trades successfully.

- Regulatory Risks: DEX aggregators operate in a gray area of regulation, and their immediate surroundings is unpredictable. Risks for the aggregator and its investors as well as heightened regulatory scrutiny are possible outcomes of this.

- Complexity: Casual investors who may not be familiar with the underlying protocols and methods that power them may find DEX aggregators to be complicated and challenging to grasp.

The Best Decentralized Exchange Aggregators!

altFINS DEX Aggregator benefits from its ability to break down liquidity by connecting to market makers, seeking trades with the lowest transaction costs across multiple liquidity sources. When the DEX’s transaction cost is relatively high, altFINS Aggregator can connect the order to external market maker network and find cheaper option. The diversified liquidity network distiguishes altFINS from other DEX aggregators and gives altFINS a competitive advantage on the market.

Futhermore, users benefit from an unified portfolio view for both DEX and CEX trading, which makes altFINS special among other DEX Aggregators. Althought users can connect their favourite CEX via an API and execute trade directly from the altFINS platform, it is also possible to use a more efficient DEX Aggregator. The altFINS DEX aggregator provides users with best execution by scanning across 70+ DEXs and external market makers, achieving faster response times and lower revert rates than any other DEX Aggregator available on the crypto market.

altFINS is a cloud-based platform for retail and institutional investors to conduct technical and fundamental investment analysis, trade and track digital assets across exchanges and wallets. altFINS was launched in 2020. The platform offers extensive crypto analytics as it ingests over 500M price and volume data records per day and calculates 120 analytics across different time intervals. It offers a leading market scanner with access to over 3,000 different digital assets and it automatically recognizes certain trading chart patterns like for example Wedges, Triangles, Channels, Head and Shoulders that users can use to predict future price trajectory.

The 1inch Network is a DEX Aggregator which offers users better prices than any single exchange by searching deals across many decentralized exchanges. 1inch Network was founded in 2019 and benefits by being adopted across different chains like Ethereum, BNB Chain, Polygon, Avalanche, Optimistic Ethereum, Aurora, Arbitrum, Fantom, and Gnosis Chain. The 1inch DEX aggregator has crossed $150B in total volume on the Ethereum network alone and attracted 1M users in a little more than two years.

1inch has the highest market share in terms of volume traded on Ethereum. It has acquired an average of 10% of the total Ethereum DEX trading volume since May 2020. The goal of 1inch is to provi

DeFi users with the simplest execution at the lowest cost. 1inch has successfully maintained its market dominance by concentrating mostly on DEX aggregation.

As a result, the 1inch v5 smart contract, which conducts runtime verification of transaction execution, is the central component of the DEX Aggregator. 1inch can find the best trading paths across multiple chains in seconds, taking transaction costs into account and enabling users to save up to 40% on total fees.

1inch DEX Aggregator also counteracts slippage. Slippage happens when there is inadequate trade activity, causing a digital asset being purchased for more than it was planned or sold for less than intended.

Paraswap is another DEX aggregator, launched in 2019. It helps exchange owners with their liquidity problems as well as end-users to get access to best execution across numerous liquidity sources. It lowers transaction costs for users and increases the level of security for decentralized exchanges.

Paraswap was deployed on 7 active blockchains, including Ethereum, Binance Smart Chain, Avalanche, Polygon, Fantom, Arbitrum and Optimism. It allows users to access multiple DEXes through a single interface, making it easier for users to compare prices and trade on different DEXs with the best prices for a particular asset. Paraswap also offers users advanced charting tools and complements open liquidity with exclusive pricing from the best market makers, which is a non-standard feature for a typical DEX Aggregator.

Like other DEX aggregators, Paraswap only requires users to connect non-custodial wallet with it. That implies that users are in full control of their digital assets at all times. In addition to the trading features, Paraswap has a very user-friendly interface that is similar to the Web2 programs that many users are accustomed to. This makes using the platform and exchanging coins even more straightforward, greatly improving users’ DeFi experience.

The CoW Protocol stands out among other DEX Aggregators in that it protects users from MEV (Miner Extractable Value) like frontrunning and sandwich attacks, for example, and that it acts as a DEX Aggregator of the DEX Aggregators. It searches the lowest price for a trade across all DEXs as well as all other DEX Aggregators on the market. It was first launched in 2021 and officially deployed on Ethereum protocol.

Trades can be settled either via on-chain AMMs at DEXs or via DEX Aggregators, depending on which liquidity source offers the best price. However, even before finding the best price for a trade from available on-chain liquidity, CoW Protocol first seeks a Coincidence of Wants (CoWs) within an internal Batch Auction to offer an even better price than any external liquidity pool can.

The protocol allows these batch auctions to maximize liquidity through Coincidence of Wants (CoWs), an economic phenomenon where two parties each hold an item the other wants and that are settled directly without using an AMM, therefore without incurring slippage and transaction costs. Because the parties responsible for determining the batch’s most optimum settlement are actively competing for the best price, the protocol constantly runs batch auctions. The successful solution will be able to maximize traders’ surplus by having the best CoW, identifying the greatest sources of liquidity across different sources.

In addition, there batch auctions help reduce frontrunning and sandwich attacks by matching orders together and settling a maximum amount of order internally instead of via external markets like the AMMs. Therefore, CoW Protocol removes the need for an extrenal market maker, or liquidity provider, which in turn allows users to save on transaction costs, avoid slippage and even provide protection against MEV.

How to use altFINS DEX aggregator for trading?

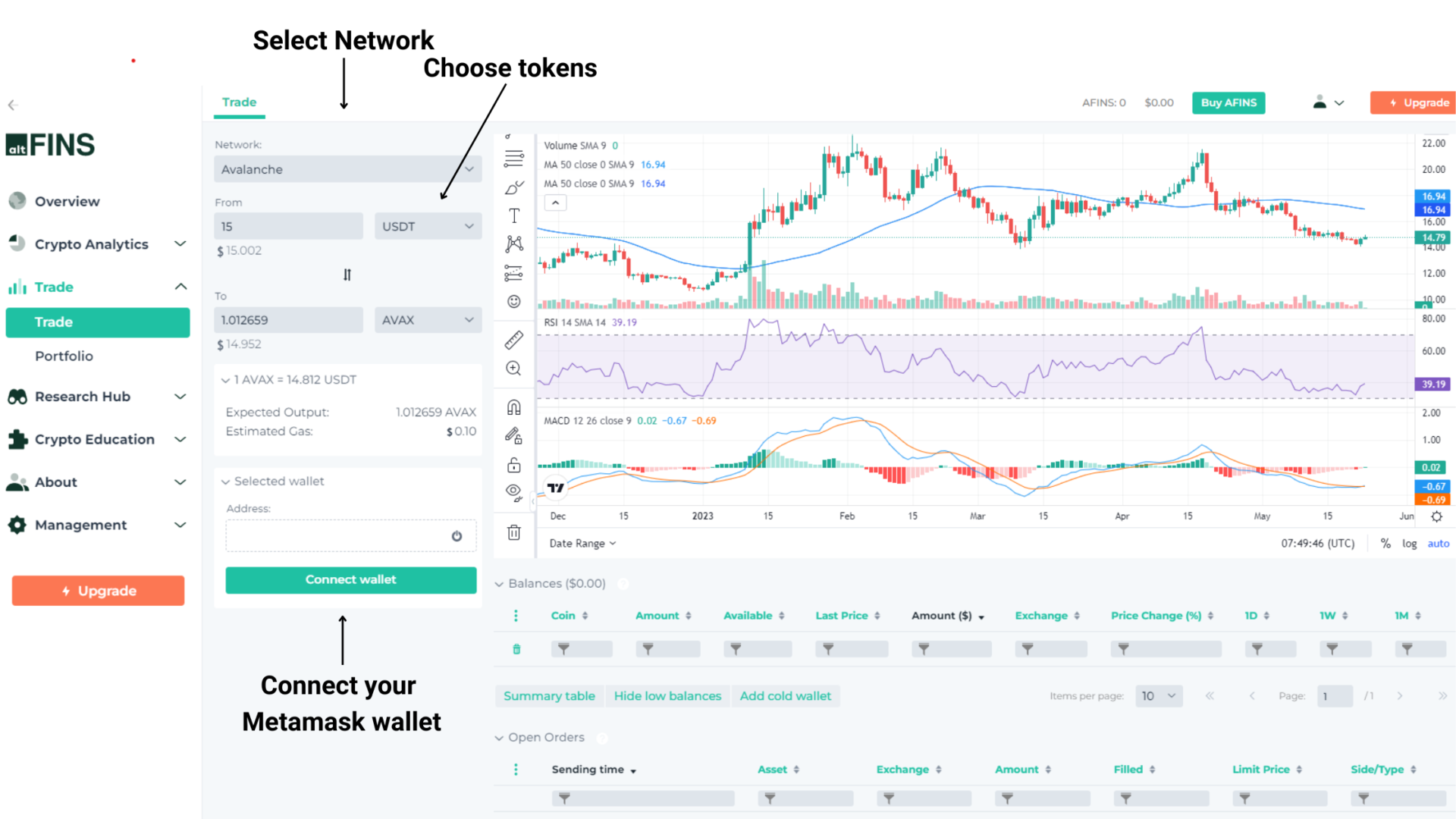

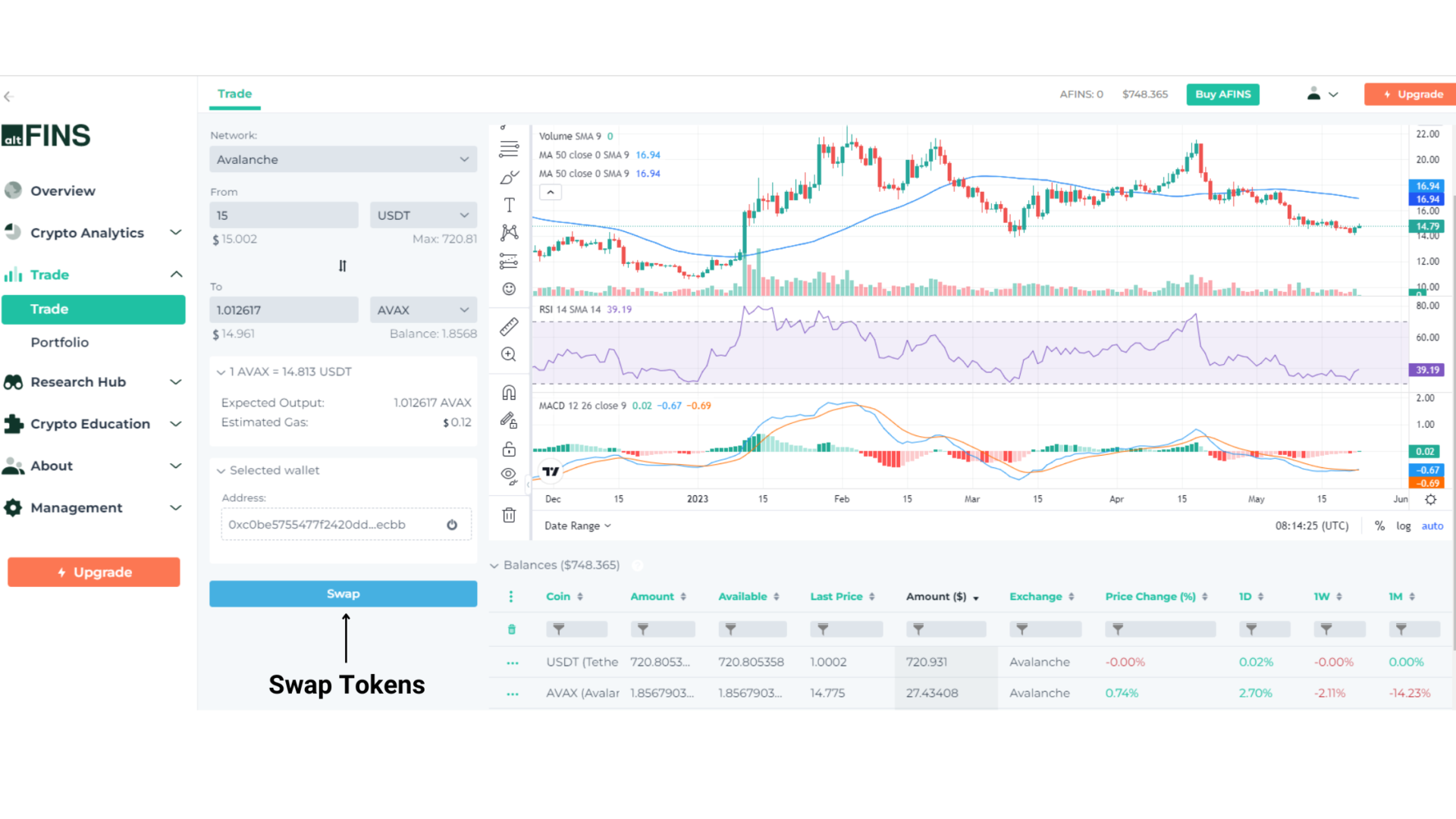

To use altFINS DEX Aggregator, follow the steps below to connect your MetaMask Wallet:

- Go to Trade section on altFINS.

- Choose Network among: Ethereum, BSC, Polygon, Fantom, Arbitrum, Avalanche

- Select tokens you want to swap.

- Connect your MetaMask Wallet.

6. Swap tokens

What are the benefits of using altFINS DEX aggregator?

altFINS’ DEX aggregator stands alone in its ability to provide a unique combination of advanced charting and analytics for 3000 altcoins, seamless integration with CEXs, and a robust swapping platform. The platform offers the best price execution and provides access to trading across 70+ decentralized exchanges and 6 networks.

Summary

• DEX aggregators are designed to access liquidity from multiple decentralized exchanges (DEXs) in a single interface, and provide users with better token swap rates.

• Decentralized exchange aggregators emerged in 2019, providing a secure and non-custodial trading experience.

• Users link their digital wallet to the platform to make trades on a DEX using an automated market maker (AMM) matching engine.

• Types of DEX aggregators include on-chain order books, off-chain order books utilizing relayers, smart order routing (SOR) aggregators, market maker aggregators, hybrid aggregators, and liquidity aggregators.

• DEX aggregators offer users greater liquidity, convenience and efficiency when trading cryptocurrencies.

• Potential benefits of trading using a DEX Aggregator include best price execution; provision of liquidity; reduced slippage; access to multiple DEXs with convenience; diversification of portfolio; lower fees.

DEX Aggregator FAQ

How does a dex aggregator handle price slippage and ensure traders receive the best possible prices?

Download altFINS Mobile app