Polygon (POL) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance. Explore Polygon (POL) Analysis.

Polygon (POL) Trends

Polygon (POL) Performance

Polygon (POL) RSI & MACD

Polygon (POL) technical analysis:

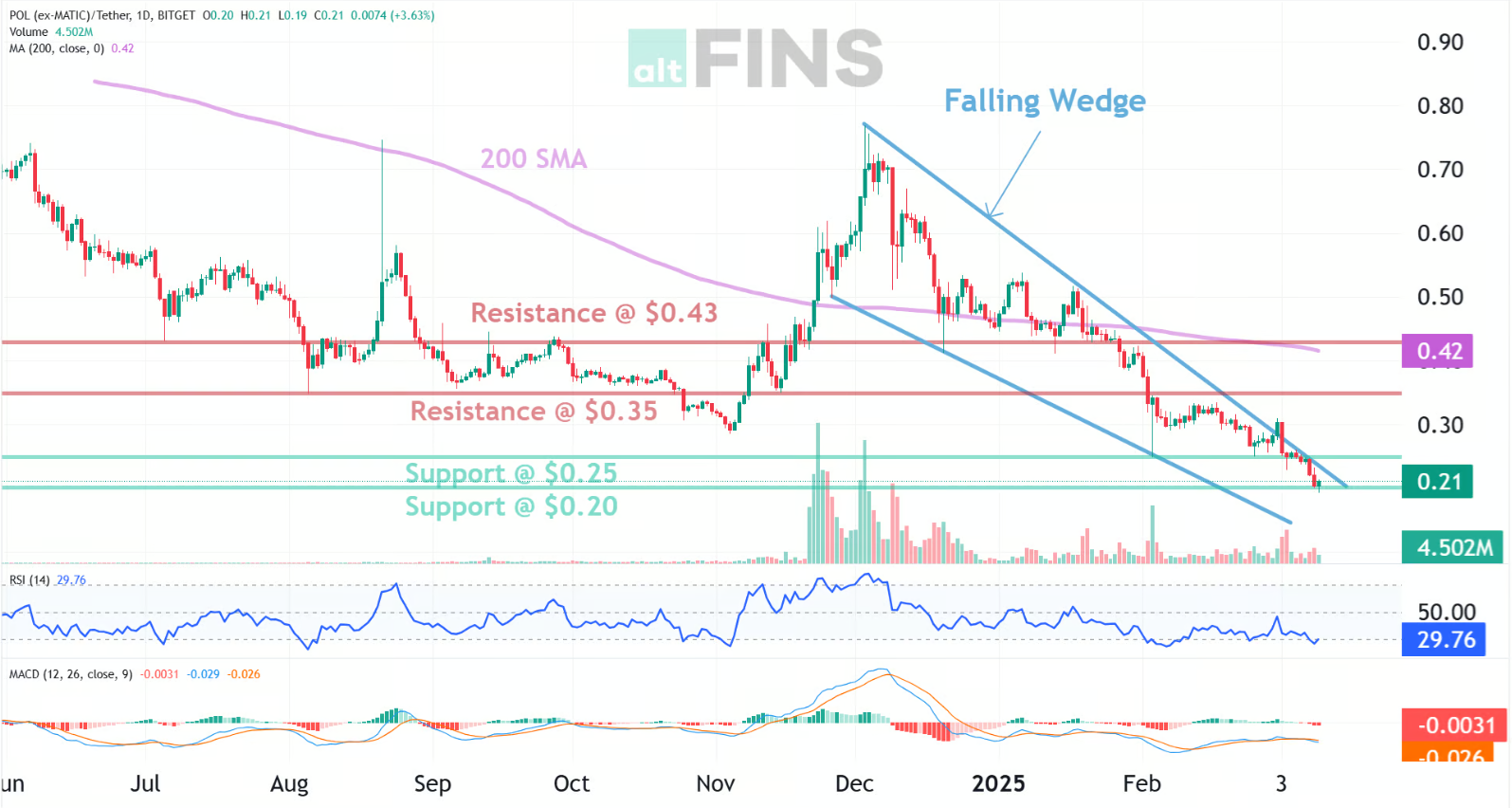

Trade setup: Price is in a Downtrend, making new 52-week lows. However, it is trading in a Falling Wedge pattern, which typically resolves in a bullish breakout. We wait for such breakout, which could signal at least a temporary trend reversal. (Set a price alert) Learn to trade breakouts in Lesson 7 and Risk Management in Lesson 9.

Patterns: Falling Wedge usually results in a bullish breakout. When price breaks the upper trend line the price is expected to trend higher. Emerging patterns (before a breakout occurs) can be traded by swing traders between the convergence lines; however, most traders should wait for a completed pattern with a breakout and then place a BUY order. Learn to trade chart patterns in Lesson 8.

Trend: Short-term trend is Strong Down, Medium-term trend is Strong Down, Long-term trend is Strong Down.

Momentum is Bearish but inflecting. MACD Line is still below MACD Signal Line but momentum may have bottomed since MACD Histogram bars are rising, which suggests that momentum could be nearing an upswing. Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance: Nearest Support Zone is $0.20.

Nearest Resistance Zone is $0.35, then $0.43.

See more curated charts for top 60+altcoins.

Recent news and research:

Polygon nears $100B volume mark – Factors that will help POL

Polygon Launches AggLayer v0.2 Testnet to Enhance Blockchain Interactions

Polygon (MATIC) Teases Major Announcement

Binance NFT ends Sandbox staking and drops Polygon network support

MATIC Drops 6% as Polygon Labs Slashes Headcount by 20%

Polygon to Deliver Zero-Knowledge Powered Rollup

Polygon Working to Become ‘True Layer 2’

Polygon Raises $450M From Sequoia Capital India, Galaxy, SoftBank to Support Web 3 Plans

Sunflower Game Throws Wrench in Polygon’s Gears

Polygon leads NFT gaming growth while Axie Infinity, Decentraland retain “powerhouse” status

Polygon’s MATIC Primed to Revisit All-Time Highs

Kyber Partners with Polygon to Enhance DeFi Liquidity

As market slumps, Ren bolsters DeFi liquidity via Fantom, Polygon integrations

3 reasons why Polygon (MATIC) outperformed Bitcoin and major cryptos this week

ERC20 versions of Bitcoin, Dogecoin, and others get a ‘bridge’ to Polygon

Here’s What Billionaire Mark Cuban Checks Before Investing In A Blockchain Project

Find more real-time news here.

What is Polygon (POL)?

Find full description and news on altFINS platform.

Overview

A platform called Polygon was created to aid in the growth of Ethereum’s infrastructure and scale. Its main component is a modular, adaptable framework (Polygon SDK) that enables programmers to create and link Layer-2 infrastructures like Plasma, Optimistic Rollups, zkRollups, and Validium as well as independent sidechains like the project’s flagship product, Matic POS (Proof-of-Stake). In February 2021, Polygon, formerly known as PO Network, changed its name and shifted its focus to supporting various Layer-2 infrastructure. The Matic POS sidechain and Plasma-based payment system, which is presently home to over 90 apps, will still be supported.

History

In 2017, Polygon debuted as Matic Network. To address challenges with blockchain scale and usability, Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun co-founded it. High transaction fees and latency for traditional blockchains might impede their adoption, technological efficiency, and user experience. For networks that can’t automatically grow as user activity rises, load-balancing can be performed through layer-2 scaling solutions or external networks. Matic included a plasma-driven scaling strategy and Proof-of-Stake (PoS) sidechains to help Ethereum as user demand for the network rose. In 2017, Plasma was at the vanguard of blockchain scaling. Matic POS evolved as a well-known scalable choice for several applications. In February 2021, Matic changed its name to Polygon to position itself as a Swiss Army knife for scaling solutions. Rollup and Validium functionality will be added by Polygon to its already functional Plasma/POS chain. The team is aware that a single solution by itself might not be able to grow Ethereum. Polygon aspires to play a key role in providing the infrastructure required to establish any of these systems. It is possible that several solutions may co-exist and help expand Ethereum collectively.

Supply Curve Details

After the sale, IEO (initial exchange offering) tokens became unlocked. At the moment of launching, half of all private sale tokens were unlocked, while the remaining tokens vested after six months (October 2019). Here you may find information about the remaining token release timetable.

Token Usage Details

POL ex.MATIC is Polygon’s native token. These are the functions of this token: Fees: The main purpose of the POLtoken is to cover network transaction fees. The token is intended to be a utility token that serves as the medium of exchange for payments and settlements among users interacting with the Polygon ecosystem. Staking: The Proof-of-Stake (PoS) layer used by POL sidechains to guarantee consensus requires that network users stake POL in order to act as validators and get staking incentives. Several operations on the Polygon Network, like verifying blocks and posting proofs, call on computational resources. POL inflation encourages these resource providers to bootstrap security and uphold network integrity by rewarding them.

About altFINS

altFINS is the best crypto analytics platform. The platform will help you find the right crypto trading opportunities. You can search for coin in Uptrend, with Momentum or Breakouts. It’s is great for advanced traders but also for beginners to learn basics of technical analysis in Crypto trading Course or in Curated charts or Chart pattern sections. But also more advanced traders can create their own Screens and Alerts of coins with different trading strategies.